Anthem Blue Shield Insurance

Anthem Blue Shield Insurance, a prominent name in the healthcare industry, has been a trusted provider of comprehensive health insurance plans for millions of Americans across various states. With a rich history spanning decades, Anthem Blue Shield has evolved to meet the dynamic needs of its diverse clientele, offering a wide range of insurance products and services.

In this in-depth article, we will delve into the world of Anthem Blue Shield Insurance, exploring its origins, growth, and the various aspects that make it a leading healthcare provider. By examining its coverage options, innovative initiatives, and impact on the industry, we aim to provide a comprehensive guide for individuals and businesses seeking to understand and benefit from Anthem Blue Shield's offerings.

A Legacy of Healthcare Excellence: The Anthem Blue Shield Story

Anthem Blue Shield Insurance has a rich legacy that traces back to the early 20th century when the need for accessible and reliable healthcare became increasingly evident. Founded with a vision to make quality healthcare a reality for all, the company has since grown into a powerhouse, offering a multitude of insurance plans tailored to meet the diverse needs of individuals, families, and businesses.

Over the years, Anthem Blue Shield has experienced significant growth and expansion, merging with various other insurance providers to strengthen its reach and capabilities. These strategic mergers have not only expanded its geographical coverage but have also allowed the company to diversify its product offerings, ensuring that it can cater to a wider range of healthcare needs.

Milestones and Achievements

Anthem Blue Shield's journey has been marked by numerous milestones and achievements that have solidified its position as a leader in the healthcare insurance industry. Here are some key moments in its history:

- 1948: Anthem Blue Shield's predecessor, Blue Cross of California, was established, becoming one of the first non-profit health plans in the nation.

- 1990s: A series of strategic mergers and acquisitions took place, expanding the company's reach and strengthening its financial stability.

- 2004: Anthem Blue Shield introduced innovative wellness programs, encouraging preventive care and healthy lifestyles among its members.

- 2010: The company played a crucial role in the implementation of the Affordable Care Act (ACA), offering plans on the federal and state health insurance marketplaces.

- 2020: Despite the challenges posed by the COVID-19 pandemic, Anthem Blue Shield adapted swiftly, introducing virtual care options and enhanced benefits to support its members.

Anthem Blue Shield's Coverage Options: Tailored Solutions for All

One of the key strengths of Anthem Blue Shield Insurance lies in its ability to offer a diverse range of coverage options, ensuring that individuals and businesses can find plans that align with their unique healthcare needs and budgetary considerations.

Individual and Family Plans

Anthem Blue Shield understands that every individual and family has distinct healthcare requirements. Thus, it provides a comprehensive suite of individual and family plans, ranging from cost-effective options with higher deductibles to more comprehensive plans that cover a broader range of services. These plans typically include coverage for doctor visits, hospital stays, prescription medications, and preventive care, with the option to customize with dental, vision, and additional benefits.

| Plan Type | Coverage Highlights |

|---|---|

| Bronze Plans | Lower premiums, higher deductibles, ideal for those who prioritize affordability and have fewer healthcare needs. |

| Silver Plans | Balanced coverage with moderate premiums and deductibles, suitable for individuals and families with occasional healthcare requirements. |

| Gold Plans | Comprehensive coverage with higher premiums but lower out-of-pocket costs, ideal for those with frequent healthcare needs or chronic conditions. |

| Platinum Plans | Premium coverage with the lowest out-of-pocket expenses, offering extensive benefits and access to top-tier healthcare providers. |

Group Health Insurance Plans

For businesses and organizations, Anthem Blue Shield offers a range of group health insurance plans that provide employees and their families with access to quality healthcare. These plans are designed to meet the specific needs of different industries and can be customized to include additional benefits such as vision, dental, and life insurance.

Key features of Anthem Blue Shield's group health insurance plans include:

- Flexibility: Plans can be tailored to suit the unique needs of each business, ensuring that employees receive the coverage they require.

- Cost Savings: By offering group plans, businesses can often secure more competitive rates and benefit from volume discounts.

- Wellness Programs: Anthem Blue Shield encourages preventive care and healthy lifestyles with its group plans, often including incentives and resources to support employee well-being.

Innovative Initiatives: Anthem Blue Shield's Approach to Healthcare

Anthem Blue Shield is not just about providing insurance coverage; it is dedicated to transforming the healthcare landscape through innovative initiatives that improve access, enhance quality, and reduce costs. These initiatives demonstrate the company's commitment to delivering value and supporting the well-being of its members.

Virtual Care and Telehealth

Recognizing the importance of convenient and accessible healthcare, Anthem Blue Shield has invested significantly in virtual care and telehealth solutions. Members can now access a range of healthcare services remotely, including virtual doctor visits, specialist consultations, and even mental health support. This approach not only improves convenience but also reduces wait times and out-of-pocket expenses associated with in-person visits.

Value-Based Care Models

Anthem Blue Shield is at the forefront of implementing value-based care models, which focus on delivering high-quality healthcare while controlling costs. These models incentivize providers to deliver efficient and effective care, ensuring that members receive the right treatment at the right time. By shifting the focus from volume to value, Anthem Blue Shield aims to improve patient outcomes and reduce unnecessary healthcare expenditures.

Digital Health Solutions

In an effort to enhance the member experience and improve health outcomes, Anthem Blue Shield has embraced digital health solutions. This includes the development of user-friendly mobile apps that provide members with easy access to their health information, claim status, and benefits. Additionally, these apps often include features such as health tracking, appointment scheduling, and medication management, empowering members to take control of their health.

The Impact of Anthem Blue Shield: Transforming Healthcare Access and Quality

Anthem Blue Shield's impact on the healthcare industry and the lives of its members is profound and far-reaching. By offering a wide range of coverage options, innovative initiatives, and a commitment to value-based care, the company has played a pivotal role in transforming the way healthcare is delivered and accessed.

Expanding Healthcare Access

One of the most significant contributions of Anthem Blue Shield is its role in expanding healthcare access to underserved populations. Through its participation in the Affordable Care Act (ACA) marketplaces, the company has made quality healthcare more accessible to millions of Americans who may not have had insurance coverage previously. Additionally, its group health plans have provided businesses with the tools to offer comprehensive healthcare benefits to their employees, ensuring that more people have access to the care they need.

Improving Healthcare Quality

Anthem Blue Shield's focus on value-based care models and innovative solutions has led to significant improvements in healthcare quality. By incentivizing providers to deliver efficient and effective care, the company has helped reduce unnecessary tests and procedures, leading to better patient outcomes and more cost-effective healthcare. Moreover, its investment in virtual care and telehealth has improved access to specialized care, particularly in rural or underserved areas, ensuring that patients receive timely and appropriate treatment.

Driving Industry Innovation

Anthem Blue Shield's commitment to innovation has not only benefited its members but has also driven industry-wide changes. By embracing digital health solutions, virtual care, and value-based care models, the company has set a precedent for other healthcare providers to follow. This has led to a more competitive and dynamic healthcare industry, with a greater focus on patient-centric care, improved access, and cost-effectiveness.

Frequently Asked Questions (FAQ)

How can I find the best Anthem Blue Shield plan for my needs?

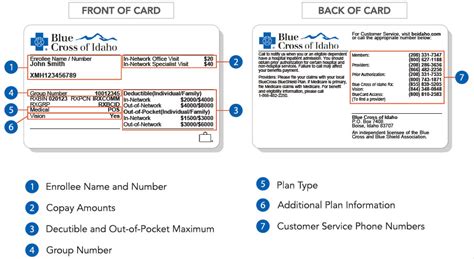

+To choose the best Anthem Blue Shield plan, consider your healthcare needs and budget. Evaluate the coverage options, including deductibles, copays, and out-of-pocket maximums. Compare plans online or consult with an insurance agent to find the plan that aligns with your priorities.

What are the advantages of Anthem Blue Shield's group health insurance plans for businesses?

+Group health insurance plans offer businesses several advantages, including cost savings through volume discounts, access to comprehensive coverage for employees and their families, and the ability to customize plans with additional benefits like dental and vision coverage.

How does Anthem Blue Shield support members during the COVID-19 pandemic?

+Anthem Blue Shield has implemented various measures to support its members during the pandemic. This includes expanded telehealth services, waived cost-sharing for COVID-19 testing and treatment, and enhanced benefits for virtual mental health support.

Can I access my Anthem Blue Shield benefits and information online?

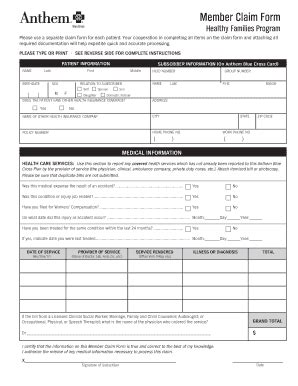

+Yes, Anthem Blue Shield offers online access to your benefits and account information through its member portal. You can view your coverage details, claims history, and access helpful resources to manage your healthcare.

As Anthem Blue Shield continues to innovate and adapt to the evolving healthcare landscape, it remains a trusted partner for individuals, families, and businesses seeking comprehensive and affordable healthcare coverage. With its commitment to quality, accessibility, and value, Anthem Blue Shield is poised to play an even more significant role in shaping the future of healthcare.