Insurance Policy

In today's complex world, insurance has become an essential financial tool, providing individuals and businesses with a crucial safety net. The insurance industry, with its intricate policies and vast array of options, can be a daunting landscape to navigate. This article aims to demystify the concept of an insurance policy, shedding light on its intricacies, benefits, and the critical role it plays in modern life.

Understanding the Insurance Policy: A Comprehensive Overview

An insurance policy is a legal contract between an insurer (insurance company) and an insured (policyholder). This contract outlines the terms, conditions, and benefits of the insurance coverage purchased by the policyholder. It serves as a comprehensive guide, detailing the rights and responsibilities of both parties, and forms the basis for any insurance claim made.

The insurance policy is a detailed document, covering various aspects of the insured's needs. It specifies the type of coverage, the amount of coverage, the duration of the policy, and the premium payments. It also outlines the process for making claims, the exclusions, and any additional benefits or add-ons.

Types of Insurance Policies

Insurance policies are diverse, catering to a wide range of needs. Some common types include:

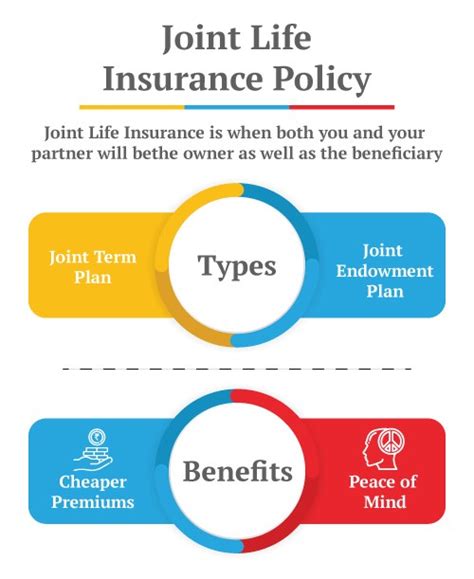

- Life Insurance: This policy provides financial protection to the policyholder’s beneficiaries upon their death. It can offer a lump-sum payment or regular income, ensuring financial security for loved ones.

- Health Insurance: Designed to cover medical expenses, health insurance is crucial in today’s healthcare landscape. It can include coverage for hospital stays, surgeries, medications, and sometimes even preventive care.

- Auto Insurance: With auto insurance, policyholders are protected against financial losses resulting from accidents or theft involving their vehicles. It often includes liability coverage, collision coverage, and comprehensive coverage.

- Homeowners Insurance: This policy provides coverage for the structure of a home and its contents. It protects against damages caused by natural disasters, theft, or other covered perils.

- Business Insurance: Businesses require specialized insurance to protect against various risks. This can include property insurance, liability insurance, workers’ compensation, and more.

Each type of insurance policy comes with its own set of terms, conditions, and exclusions, making it vital for policyholders to thoroughly understand their coverage.

The Insurance Policy Application Process

Obtaining an insurance policy involves a thorough application process. This process typically includes:

- Assessment: The insurer evaluates the risk associated with the policyholder. For life insurance, this may involve a health assessment. For property insurance, it might involve an assessment of the property’s location and value.

- Quote Generation: Based on the assessment, the insurer provides a quote, detailing the premium and coverage offered.

- Policy Selection: The policyholder reviews the quote and selects the policy that best suits their needs and budget.

- Policy Issuance: Once the policy is selected, the insurer issues the policy document, outlining the terms and conditions of the coverage.

- Premium Payment: The policyholder pays the agreed-upon premium, either in full or in installments, as specified in the policy.

Making an Insurance Claim

When an insured event occurs, policyholders can make a claim to receive the benefits outlined in their insurance policy. The claims process typically involves the following steps:

- Notification: The policyholder informs the insurer about the incident or loss.

- Claim Submission: The policyholder provides the necessary documentation to support their claim, such as police reports, medical records, or repair estimates.

- Claim Assessment: The insurer reviews the claim and assesses the extent of the loss or damage.

- Decision: The insurer decides whether to approve or deny the claim, based on the policy’s terms and conditions.

- Payout: If the claim is approved, the insurer pays out the agreed-upon amount to the policyholder or their designated beneficiaries.

| Insurance Type | Claim Process Key Steps |

|---|---|

| Life Insurance | Beneficiary notification, claim form submission, proof of death, claim assessment, payout to beneficiaries |

| Health Insurance | Submit claim form with medical records, assess claim, approve or deny, reimburse policyholder or pay healthcare provider directly |

| Auto Insurance | Report accident, submit claim form with police report and repair estimates, assess claim, approve or deny, arrange repairs or provide reimbursement |

The Benefits and Importance of Insurance Policies

Insurance policies offer a range of benefits that are vital to modern life and business:

- Financial Protection: Insurance policies provide a financial safety net, protecting policyholders from unexpected losses or expenses. Whether it’s a car accident, a medical emergency, or a natural disaster, insurance can help cover the costs, ensuring financial stability.

- Peace of Mind: Knowing that you are covered by an insurance policy can provide immense peace of mind. It allows individuals and businesses to focus on their daily lives and operations without the constant worry of potential risks and their financial consequences.

- Risk Management: Insurance policies are a powerful tool for risk management. By identifying and assessing risks, insurers can help policyholders understand and manage their vulnerabilities. This proactive approach can lead to better decision-making and enhanced risk mitigation strategies.

- Legal Compliance: Certain types of insurance, such as auto insurance and workers’ compensation, are legally required in many jurisdictions. Having the necessary insurance coverage ensures compliance with the law and protects policyholders from legal penalties and liabilities.

- Access to Expertise: Insurance companies often have vast resources and expertise in risk management and loss mitigation. Policyholders can leverage this knowledge to make informed decisions and take proactive measures to reduce their risks.

The Future of Insurance Policies

The insurance industry is evolving rapidly, driven by technological advancements and changing consumer needs. Here are some key trends and predictions for the future of insurance policies:

- Digital Transformation: The insurance industry is increasingly adopting digital technologies, from online policy applications and claims submissions to the use of artificial intelligence for risk assessment and fraud detection. This digital transformation is expected to continue, making insurance services more accessible and efficient.

- Personalized Insurance: With the availability of big data and advanced analytics, insurance companies are moving towards more personalized insurance products. These policies can be tailored to an individual’s unique needs and circumstances, offering more accurate pricing and coverage.

- Parametric Insurance: This innovative type of insurance pays out based on the occurrence of a specific event or parameter, rather than the actual loss or damage. Parametric insurance is particularly useful for natural disasters, as it can provide rapid payouts, helping policyholders recover more quickly.

- Collaborative Insurance Models: The rise of collaborative consumption, such as ride-sharing and co-working spaces, is driving the development of new insurance models. These models often involve sharing risks and resources among a community of users, offering more flexible and affordable coverage.

Conclusion

Insurance policies are an indispensable part of modern life, providing financial protection, peace of mind, and risk management for individuals and businesses. By understanding the intricacies of insurance policies, policyholders can make informed decisions, ensuring they have the right coverage for their needs. As the insurance industry continues to evolve, staying updated with the latest trends and innovations will be crucial for maximizing the benefits of insurance policies.

What is the difference between an insurance policy and an insurance contract?

+An insurance policy is a specific type of insurance contract. While all insurance policies are contracts, not all insurance contracts are policies. An insurance policy is a detailed document that outlines the coverage, terms, and conditions of a particular insurance product, such as life insurance or auto insurance. On the other hand, an insurance contract is a broader term that refers to any legally binding agreement between an insurer and an insured, which can include various types of insurance coverage.

How often should I review my insurance policies?

+It is generally recommended to review your insurance policies annually or whenever there is a significant life change, such as getting married, buying a home, starting a business, or having children. Regular reviews ensure that your coverage remains adequate and up-to-date with your evolving needs and circumstances.

Can I customize my insurance policy?

+Yes, many insurance policies offer customization options. You can often choose the level of coverage, add additional riders or endorsements to tailor the policy to your specific needs, and select optional add-ons, such as rental car coverage or roadside assistance. It’s important to work with your insurance agent or broker to understand the available customization options and ensure you have the right coverage for your situation.