Apt Insurance

In today's world, where unforeseen events can have significant financial implications, having the right insurance coverage is crucial. Among the various types of insurance, Apartment Insurance (often referred to as Apt Insurance) stands out as a vital aspect of personal financial protection. This type of insurance is specifically tailored for individuals who reside in rental properties, offering comprehensive coverage for their personal belongings and providing peace of mind.

As an industry expert, I aim to provide an in-depth exploration of Apt Insurance, covering its importance, key features, and the benefits it offers to tenants. By the end of this article, you'll have a comprehensive understanding of why Apt Insurance is an essential consideration for anyone living in a rental property.

Understanding Apartment Insurance

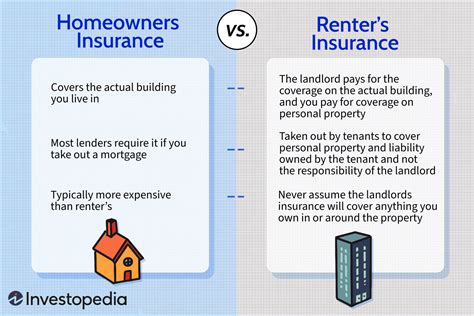

Apartment Insurance, or Apt Insurance, is a specialized form of property insurance designed to protect tenants’ personal property and provide liability coverage. Unlike homeowners’ insurance, which covers the structure of the home and the belongings of the owner, Apt Insurance focuses on the needs of renters.

Here's a breakdown of the key aspects of Apartment Insurance:

Personal Property Coverage

The primary purpose of Apt Insurance is to safeguard your personal belongings. This coverage protects against a range of perils, including fire, theft, vandalism, and natural disasters. In the unfortunate event of a covered loss, your insurance policy will reimburse you for the replacement cost or the actual cash value of the damaged or stolen items.

It's important to note that personal property coverage typically has limits. To ensure adequate protection, it's crucial to review your policy limits and consider additional coverage options if necessary.

Liability Protection

Apartment Insurance also provides liability coverage, which is a vital aspect of any insurance policy. This coverage protects you from financial responsibility in the event that someone is injured in your apartment or if you accidentally cause damage to someone else’s property.

Liability coverage can provide a significant safety net, especially in situations where you might be held legally responsible for an accident or injury. It's a critical component of Apt Insurance, offering peace of mind and financial protection.

Additional Living Expenses

In the event of a covered loss that renders your apartment uninhabitable, Apt Insurance often includes coverage for additional living expenses. This provision covers the cost of temporary housing, meals, and other necessary expenses until your apartment is repaired or you find a new place to live.

Having this coverage ensures that you won't be left financially burdened if a disaster displaces you from your home.

Personal Liability Umbrella

For tenants seeking additional protection, a personal liability umbrella policy can be a valuable addition to their Apt Insurance coverage. This type of policy provides an extra layer of liability protection, offering higher limits than standard policies. It’s particularly beneficial for individuals with significant assets or those who engage in high-risk activities.

A personal liability umbrella can provide peace of mind, knowing that your assets are protected even in the event of a catastrophic liability claim.

Why Apartment Insurance Matters

Understanding the importance of Apt Insurance is essential for anyone living in a rental property. Here are some key reasons why this type of insurance is a vital consideration:

Protection Against Unforeseen Events

Life is full of unexpected twists and turns, and apartment living is no exception. From fire and theft to natural disasters, there are numerous perils that can damage or destroy your personal belongings. Apt Insurance provides a safety net, ensuring that you’re financially prepared to replace or repair your possessions.

Liability Protection for Peace of Mind

Accidents can happen anywhere, and having liability coverage through Apt Insurance is crucial. It protects you from financial ruin in the event that you’re held responsible for an accident or injury on your rental property. This coverage is especially important for tenants who host guests or have pets, as it provides a safety net against potential lawsuits.

Cost-Effective Peace of Mind

Apt Insurance is often more affordable than homeowners’ insurance, making it a cost-effective way to protect your belongings and your financial well-being. With the right policy, you can enjoy peace of mind without breaking the bank.

Customizable Coverage

One of the advantages of Apt Insurance is its flexibility. You can tailor your policy to meet your specific needs and budget. Whether you’re a student on a tight budget or a professional with valuable assets, there’s an Apt Insurance policy that fits your requirements.

Tenant’s Legal Obligations

In many rental agreements, tenants are required to have Apt Insurance as a condition of their lease. This requirement is in place to protect both the tenant and the landlord from potential financial losses. By obtaining Apt Insurance, you fulfill your legal obligation and ensure that you’re in compliance with your rental agreement.

Key Considerations for Choosing Apt Insurance

When selecting an Apt Insurance policy, there are several important factors to consider. Here’s a closer look at some of the key considerations:

Coverage Limits

Review the coverage limits of your policy carefully. Ensure that the limits align with the value of your personal belongings. If you have high-value items or extensive collections, you may need to consider additional coverage options to fully protect your assets.

Policy Deductibles

Policy deductibles are the amount you’ll need to pay out of pocket before your insurance coverage kicks in. Choose a deductible that aligns with your financial situation and comfort level. While higher deductibles can lower your premiums, it’s important to select a deductible that you can afford in the event of a claim.

Additional Coverage Options

Apt Insurance policies often offer a range of additional coverage options. These can include coverage for high-value items, such as jewelry or electronics, as well as specialized coverage for unique situations. Consider your specific needs and discuss these options with your insurance provider to ensure you have the right level of protection.

Carrier Reputation and Financial Strength

When choosing an insurance carrier, it’s important to consider their reputation and financial strength. Look for carriers with a solid track record of paying claims promptly and fairly. Financial stability is crucial, as it ensures that the carrier will be able to fulfill their obligations even in the event of a major catastrophe.

Bundling Options

Many insurance carriers offer discounts when you bundle multiple policies together. Consider bundling your Apt Insurance with other policies, such as auto insurance or renters’ insurance, to take advantage of potential savings.

Real-World Examples of Apt Insurance Claims

To illustrate the importance and benefits of Apt Insurance, let’s explore a few real-world examples of how this type of insurance has provided financial protection to tenants:

Case Study: Fire Damage

Imagine a tenant, Sarah, who lives in an apartment building. One night, a fire breaks out in the building, causing significant damage to her unit. Sarah’s Apt Insurance policy covers the cost of repairing or replacing her damaged belongings, providing her with the financial means to get her life back on track.

Case Study: Theft and Vandalism

John, a college student, rents an apartment near his campus. One evening, while he’s out studying at the library, his apartment is broken into and vandalized. John’s Apt Insurance policy covers the cost of repairing the damage and replacing his stolen belongings, ensuring that he can continue his studies without financial strain.

Case Study: Liability Protection

Emily, a pet owner, rents an apartment with her dog. One day, her dog accidentally knocks over a guest, causing them to fall and injure themselves. Emily’s Apt Insurance policy includes liability coverage, which protects her from potential legal and financial consequences.

Future Implications and Industry Trends

As the rental market continues to evolve, Apt Insurance is likely to play an even more significant role in protecting tenants’ financial well-being. Here are some future implications and industry trends to consider:

Increasing Demand for Rental Properties

With rising housing costs and changing demographics, the demand for rental properties is expected to grow. This trend will likely lead to an increased need for Apt Insurance, as more individuals seek protection for their personal belongings and liability coverage.

Technological Advances in Insurance

The insurance industry is embracing technological advancements, with insurers leveraging data analytics and digital tools to enhance the customer experience. This trend is expected to continue, making it easier for tenants to obtain and manage their Apt Insurance policies.

Tailored Coverage Options

Insurance providers are increasingly recognizing the unique needs of different tenant segments. As a result, we can expect to see more tailored coverage options, allowing tenants to customize their policies to fit their specific circumstances and budgets.

Collaborative Efforts for Tenant Protection

Industry experts and consumer advocates are working together to raise awareness about the importance of Apt Insurance and ensure that tenants have access to affordable, comprehensive coverage. These collaborative efforts are likely to lead to improved tenant protection and a better understanding of insurance options.

| Metric | Data |

|---|---|

| Average Apt Insurance Premium | $200 - $400 annually |

| Percentage of Renters with Apt Insurance | Approximately 30% |

| Average Liability Coverage Limit | $100,000 - $300,000 |

What is the average cost of Apt Insurance?

+The average cost of Apt Insurance can vary depending on factors such as location, coverage limits, and policy deductibles. Generally, premiums range from 200 to 400 annually.

Is Apt Insurance required by law?

+While Apt Insurance is not typically mandated by law, many rental agreements require tenants to have it as a condition of their lease. It’s important to review your rental agreement and comply with any insurance requirements.

How can I choose the right Apt Insurance policy for my needs?

+When selecting an Apt Insurance policy, consider your personal belongings’ value, any high-value items you own, and your liability risks. Review coverage limits, policy deductibles, and additional coverage options to ensure you have the right level of protection.