Peril Insurance Definition

Peril insurance is a specialized type of coverage that protects policyholders against specific perils or risks. It is an essential component of the insurance industry, providing financial security and peace of mind to individuals and businesses facing potential losses due to unforeseen events. In this comprehensive guide, we will delve into the world of peril insurance, exploring its definition, key characteristics, different types, and its importance in managing risk effectively.

Understanding Peril Insurance

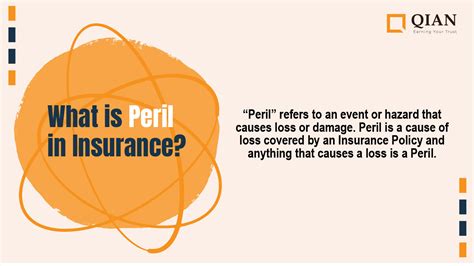

Peril insurance, often referred to as specific peril insurance, is a tailored insurance policy that offers protection against specific events or perils. Unlike general insurance policies that provide broad coverage, peril insurance focuses on distinct risks that may cause significant financial harm. These perils can vary widely and are typically identified and defined within the insurance contract.

The concept of peril insurance stems from the recognition that not all risks are created equal. Some perils, such as natural disasters or specific types of accidents, carry higher probabilities of occurrence and can result in substantial losses. By offering targeted coverage for these specific risks, peril insurance allows individuals and businesses to safeguard their assets and mitigate potential financial burdens.

Key Characteristics of Peril Insurance

- Specific Coverage: Peril insurance policies are designed to cover specific perils or events. These perils are clearly defined in the policy document, ensuring that policyholders understand the scope of their coverage.

- Risk Assessment: Before issuing a peril insurance policy, insurance providers conduct thorough risk assessments. They evaluate the likelihood and potential impact of the identified perils, allowing them to determine appropriate premiums and coverage limits.

- Targeted Protection: By focusing on specific perils, peril insurance provides targeted protection. This approach ensures that policyholders receive coverage tailored to their unique needs and circumstances, making it a highly personalized form of insurance.

- Exclusion Clauses: While peril insurance offers coverage for specific risks, it may also contain exclusion clauses. These clauses outline situations or events that are not covered by the policy, providing clarity and preventing misunderstandings.

Types of Peril Insurance

Peril insurance comes in various forms, each designed to address specific risks. Here are some common types of peril insurance policies:

Natural Disaster Insurance

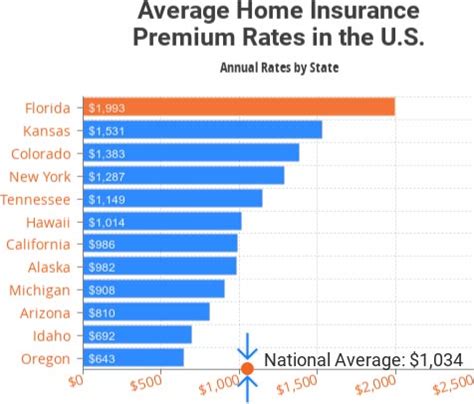

Natural disaster insurance provides coverage against losses caused by natural events such as earthquakes, hurricanes, floods, tornadoes, and wildfires. These policies are crucial for individuals and businesses located in regions prone to such disasters, as they can offer financial protection for property damage, loss of income, and even personal injuries.

| Natural Disaster | Coverage |

|---|---|

| Earthquakes | Structural damage, personal belongings, business interruption |

| Hurricanes | Wind damage, flooding, debris removal |

| Floods | Water damage, flood protection measures |

| Tornadoes | Wind damage, debris removal, temporary housing |

| Wildfires | Fire damage, smoke damage, evacuation expenses |

Fire Insurance

Fire insurance is a type of peril insurance that specifically covers losses resulting from fires. It provides protection for residential, commercial, and industrial properties against damage caused by fires, including structure repairs, replacement of personal belongings, and business recovery costs.

Theft and Burglary Insurance

Theft and burglary insurance policies protect policyholders against losses arising from theft, robbery, or burglary. These policies cover a range of valuables, including jewelry, electronics, and cash, providing financial compensation for the stolen items and any related damage.

Liability Insurance

Liability insurance is a broad category of peril insurance that covers legal liabilities arising from various situations. It can include public liability insurance, which protects against injuries or damages caused to third parties, as well as professional liability insurance, which safeguards against legal claims related to professional services.

Flood Insurance

Flood insurance is designed to provide coverage for losses caused by flooding, which is often excluded from standard property insurance policies. It covers damage to structures, personal belongings, and even vehicles that are affected by floodwaters.

Importance of Peril Insurance

Peril insurance plays a crucial role in managing risk and ensuring financial stability for individuals and businesses. Here are some key reasons why peril insurance is of utmost importance:

Financial Protection

Peril insurance offers financial protection against unforeseen events that can result in significant losses. By having the right peril insurance coverage, policyholders can mitigate the financial impact of disasters, accidents, or other specified perils, ensuring they have the resources to rebuild and recover.

Peace of Mind

Knowing that you have specific peril insurance coverage provides peace of mind. Policyholders can rest assured that they are protected against the risks they face, allowing them to focus on their daily lives and businesses without constant worry about potential financial setbacks.

Risk Management

Peril insurance is a vital tool for effective risk management. By identifying and addressing specific perils, individuals and businesses can proactively assess their vulnerabilities and take necessary precautions. This proactive approach to risk management can help prevent losses and minimize the impact of unforeseen events.

Business Continuity

For businesses, peril insurance is essential for ensuring continuity. In the event of a covered peril, such as a natural disaster or fire, having the right insurance coverage can help businesses quickly recover and resume operations, minimizing downtime and potential long-term impacts on their reputation and financial health.

FAQ

Can I customize my peril insurance policy to include specific perils that are not typically covered?

+Yes, many insurance providers offer customization options for peril insurance policies. You can work with your insurer to tailor the coverage to your specific needs and include additional perils that are not typically covered. This allows you to create a policy that aligns with your unique circumstances and provides comprehensive protection.

Are there any common exclusions in peril insurance policies that I should be aware of?

+Yes, it’s important to carefully review the exclusion clauses in your peril insurance policy. Common exclusions may include acts of war, nuclear incidents, intentional damage, and certain types of water damage. It’s crucial to understand these exclusions to ensure you have adequate coverage for your specific risks.

How can I determine the appropriate level of coverage for my peril insurance policy?

+Determining the appropriate level of coverage involves assessing your specific risks and the potential financial impact of a covered peril. Consider factors such as the value of your assets, the likelihood of certain perils occurring in your area, and the cost of potential repairs or replacements. Consulting with an insurance professional can help you tailor your coverage to your needs.