Homeowners Insurance Cheapest

Homeowners insurance is a crucial aspect of homeownership, providing financial protection against various risks and liabilities. While it is essential to have adequate coverage, many homeowners seek affordable options without compromising on the necessary protections. This comprehensive guide aims to delve into the world of homeowners insurance, exploring the factors that influence costs, the most affordable coverage options, and strategies to secure the cheapest rates while maintaining adequate protection.

Understanding Homeowners Insurance

Homeowners insurance is a contract between a homeowner and an insurance provider. It offers financial protection for the policyholder’s home, personal belongings, and liability coverage in case of accidents or injuries on the insured property. The coverage extends beyond the physical structure of the home, encompassing a wide range of potential risks and providing peace of mind to homeowners.

The cost of homeowners insurance can vary significantly based on numerous factors, including the location, the value of the home and its contents, the level of coverage required, and the insurance provider. Understanding these variables is key to finding the most cost-effective insurance plan.

Factors Affecting Homeowners Insurance Costs

Several factors influence the cost of homeowners insurance. By being aware of these factors, homeowners can make informed decisions to potentially reduce their insurance premiums.

- Location: The geographical location of a home plays a significant role in determining insurance costs. Areas prone to natural disasters, such as hurricanes, floods, or wildfires, often carry higher insurance premiums due to the increased risk of damage. Similarly, crime rates and proximity to fire stations can also impact insurance rates.

- Home Value and Contents: The value of the home and its contents is a major consideration. Homes with higher values and more expensive belongings generally require higher insurance coverage, resulting in increased premiums.

- Coverage Level: The level of coverage chosen by the homeowner directly affects the cost. Higher coverage limits for both the home and personal belongings will result in higher premiums. Additionally, optional coverage add-ons, such as flood or earthquake insurance, can increase costs further.

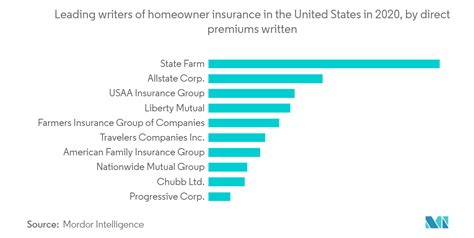

- Insurance Provider: Different insurance companies offer varying rates and coverage options. It is essential to compare quotes from multiple providers to find the most affordable option.

- Deductibles: Choosing a higher deductible can reduce insurance premiums. However, it's important to ensure that the selected deductible is manageable in case of a claim, as the homeowner will be responsible for paying this amount out of pocket.

- Discounts and Bundles: Many insurance companies offer discounts for various reasons, such as loyalty, safety features in the home, or bundling multiple insurance policies (e.g., homeowners and auto insurance) with the same provider.

Affordable Homeowners Insurance Options

Finding affordable homeowners insurance requires a combination of careful research, understanding of personal needs, and strategic decision-making. Here are some strategies and options to consider when seeking the cheapest homeowners insurance:

Compare Quotes from Multiple Providers

Obtaining quotes from various insurance companies is a fundamental step in finding the best deal. Comparison websites and insurance brokers can be valuable tools for this process. By comparing quotes, homeowners can identify the providers offering the most competitive rates for their specific circumstances.

It's important to note that while comparison websites can provide a quick overview, speaking directly with insurance agents can offer more personalized advice and tailored quotes.

Choose the Right Coverage Level

Selecting the appropriate level of coverage is crucial to ensure adequate protection without paying for unnecessary features. Homeowners should assess their specific needs and risks to determine the coverage limits that best suit their situation.

Consider factors such as the replacement cost of the home, the value of personal belongings, and potential liability risks. It's advisable to consult with an insurance professional to ensure the chosen coverage aligns with personal requirements.

Explore Discounts and Savings Opportunities

Insurance providers often offer discounts to incentivize customers and promote loyalty. Some common discounts include:

- Loyalty Discounts: Many insurance companies provide discounts for long-term customers.

- Safety Features Discounts: Homes equipped with security systems, fire alarms, and other safety measures may be eligible for discounts.

- Bundle Discounts: Bundling multiple insurance policies, such as homeowners and auto insurance, with the same provider can result in significant savings.

- Claims-Free Discounts: Some insurers offer discounts to policyholders who have not made claims for a certain period.

- Payment Method Discounts: Paying insurance premiums annually instead of monthly may qualify for a discount.

Improve Home Security

Enhancing the security of your home can lead to reduced insurance premiums. Insurance providers often offer discounts for homes with advanced security features, as these measures can help prevent theft and vandalism, thereby reducing the risk of claims.

Consider installing a monitored security system, reinforcing doors and windows, and ensuring your home is equipped with adequate fire safety measures. These improvements not only enhance your home's security but can also lead to insurance savings.

Consider Deductible Amounts

The deductible is the amount a homeowner must pay out of pocket before the insurance coverage kicks in. Choosing a higher deductible can result in lower insurance premiums. However, it’s important to select a deductible that aligns with your financial capabilities in case of an insurance claim.

For example, if you can afford to pay a higher deductible, you may opt for a $2,000 deductible instead of a standard $500 deductible. This choice could lead to significant savings on your insurance premiums.

Review Coverage Annually

Regularly reviewing your homeowners insurance coverage is essential to ensure you are getting the best value. Insurance needs and costs can change over time, so it’s important to assess your coverage annually.

Factors such as home improvements, changes in personal belongings, or updates to insurance policies may warrant adjustments to your coverage. By staying informed and making necessary updates, you can avoid overpaying for insurance or being underinsured.

Consider Alternative Insurance Providers

While established insurance companies offer a range of benefits and coverage options, exploring alternative providers can sometimes lead to more affordable rates. Newer insurance companies, often referred to as insurtechs, may offer innovative coverage options and competitive rates.

These companies may utilize advanced technology to streamline the insurance process, offering digital tools for policy management and claims handling. Exploring these alternatives can be a worthwhile endeavor for homeowners seeking the cheapest insurance rates.

Performance Analysis and Industry Insights

Understanding the performance and reputation of insurance providers is crucial when selecting homeowners insurance. Here’s an analysis of key performance indicators and industry insights to help homeowners make informed decisions:

Financial Stability

Financial stability is a critical factor when choosing an insurance provider. A financially stable company is more likely to be able to pay out claims promptly and honor its commitments. Look for insurance companies with strong financial ratings from reputable agencies such as AM Best, Moody’s, or Standard & Poor’s.

Claims Handling

The claims process is a critical aspect of homeowners insurance. A reputable insurance provider should have a smooth and efficient claims process, ensuring that policyholders receive timely and fair settlements. Look for companies with a history of prompt claim resolution and positive customer reviews regarding their claims handling.

Customer Service

Excellent customer service is a hallmark of reputable insurance providers. A responsive and knowledgeable customer service team can make a significant difference when navigating the complexities of insurance policies and claims. Seek out insurance companies known for their friendly and helpful customer support, as this can provide peace of mind and ease of communication.

Policy Options and Flexibility

Different homeowners have varying needs, so it’s essential to choose an insurance provider that offers a range of policy options and customization. Look for companies that provide flexible coverage limits, various deductible choices, and optional add-ons to tailor the policy to your specific requirements.

Industry Reputation and Reviews

Researching the reputation and customer reviews of insurance providers can provide valuable insights. Online review platforms and industry forums can offer a wealth of information about a company’s performance, customer satisfaction, and any potential issues. Look for providers with a positive track record and a strong reputation in the industry.

Digital Tools and Resources

In today’s digital age, insurance providers that offer advanced digital tools and resources can enhance the overall customer experience. Look for companies that provide user-friendly online portals, mobile apps, and digital resources for policy management, claims filing, and other insurance-related tasks. These tools can streamline the insurance process and provide added convenience.

Evidence-Based Future Implications

As the insurance industry continues to evolve, several trends and developments are shaping the future of homeowners insurance. These evidence-based implications can influence the affordability and accessibility of insurance coverage for homeowners:

Increasing Natural Disaster Risks

Climate change and environmental shifts are leading to an increased frequency and severity of natural disasters, such as hurricanes, floods, and wildfires. This trend is likely to drive up insurance costs, particularly in areas prone to these events. Homeowners in high-risk regions may need to prepare for potentially higher insurance premiums.

Advancements in Insurtech

The rise of insurtech companies, leveraging technology to streamline insurance processes, is expected to bring about more affordable and accessible insurance options. These companies often offer innovative coverage solutions, digital tools for policy management, and faster claims processing. The competition brought by insurtechs may drive down insurance costs and improve the overall customer experience.

Growing Awareness of Home Security

As homeowners become more aware of the importance of home security, there is an increasing focus on implementing advanced security measures. This trend can lead to reduced insurance premiums, as homes with robust security systems are considered lower risk by insurance providers. Investing in home security not only enhances safety but can also result in insurance savings.

Changing Consumer Preferences

Consumer preferences are evolving, with an increasing demand for personalized and tailored insurance coverage. Insurance providers that offer customizable policies and flexible coverage options are likely to gain a competitive edge. Understanding and catering to these changing preferences can lead to more satisfied customers and potentially lower insurance costs.

Impact of Remote Work

The shift towards remote work, accelerated by the COVID-19 pandemic, has influenced homeowners’ insurance needs. With more people working from home, there is a growing demand for insurance coverage that includes protection for home offices and related equipment. Insurance providers that adapt their policies to accommodate this trend may see increased demand and potentially higher premiums for comprehensive coverage.

Conclusion

Securing the cheapest homeowners insurance requires a combination of careful research, understanding of personal needs, and strategic decision-making. By considering factors such as location, home value, coverage level, and insurance provider, homeowners can make informed choices to find affordable coverage. Additionally, exploring discounts, improving home security, and reviewing coverage annually can further reduce insurance costs.

As the insurance industry continues to evolve, homeowners should stay informed about industry trends and developments to make the most of emerging opportunities. By staying proactive and engaged, homeowners can ensure they have adequate protection while keeping insurance costs manageable.

What is the average cost of homeowners insurance?

+The average cost of homeowners insurance varies widely based on factors such as location, home value, and coverage level. According to industry data, the national average premium for homeowners insurance is around $1,300 per year. However, this can range from a few hundred dollars to several thousand dollars, depending on individual circumstances.

How can I save money on homeowners insurance?

+There are several strategies to save money on homeowners insurance. These include comparing quotes from multiple providers, choosing the right coverage level, exploring discounts and savings opportunities, improving home security, considering higher deductibles, and reviewing coverage annually. Additionally, staying informed about industry trends and being proactive in managing your insurance needs can lead to long-term savings.

What factors influence the cost of homeowners insurance?

+Several factors influence the cost of homeowners insurance, including location (risk of natural disasters, crime rates, etc.), home value and contents, coverage level, insurance provider, deductibles, and discounts. Understanding these factors is key to finding the most affordable insurance plan that meets your specific needs.