Country Company Insurance

In today's complex and ever-changing world, insurance has become an essential tool for managing risks and ensuring financial security. Country Company Insurance is a renowned name in the industry, offering a comprehensive range of insurance solutions tailored to meet the diverse needs of individuals and businesses alike. With a rich history spanning decades, Country Company has established itself as a trusted partner, providing coverage and peace of mind to millions of policyholders.

A Legacy of Trust and Innovation

Country Company Insurance was founded in [Founding Year] with a vision to revolutionize the insurance sector by introducing innovative products and exceptional customer service. Over the years, the company has remained committed to its core values, earning the loyalty and trust of its customers. Through its dedication to continuous improvement and adaptation to the evolving insurance landscape, Country Company has solidified its position as a leading provider in the industry.

Headquartered in [Headquarters City, State], Country Company Insurance operates across the United States, offering a diverse range of insurance products and services. From auto and home insurance to life and health coverage, the company's comprehensive portfolio caters to a wide array of insurance needs. With a focus on delivering exceptional value and personalized experiences, Country Company has become a preferred choice for individuals and businesses seeking reliable protection.

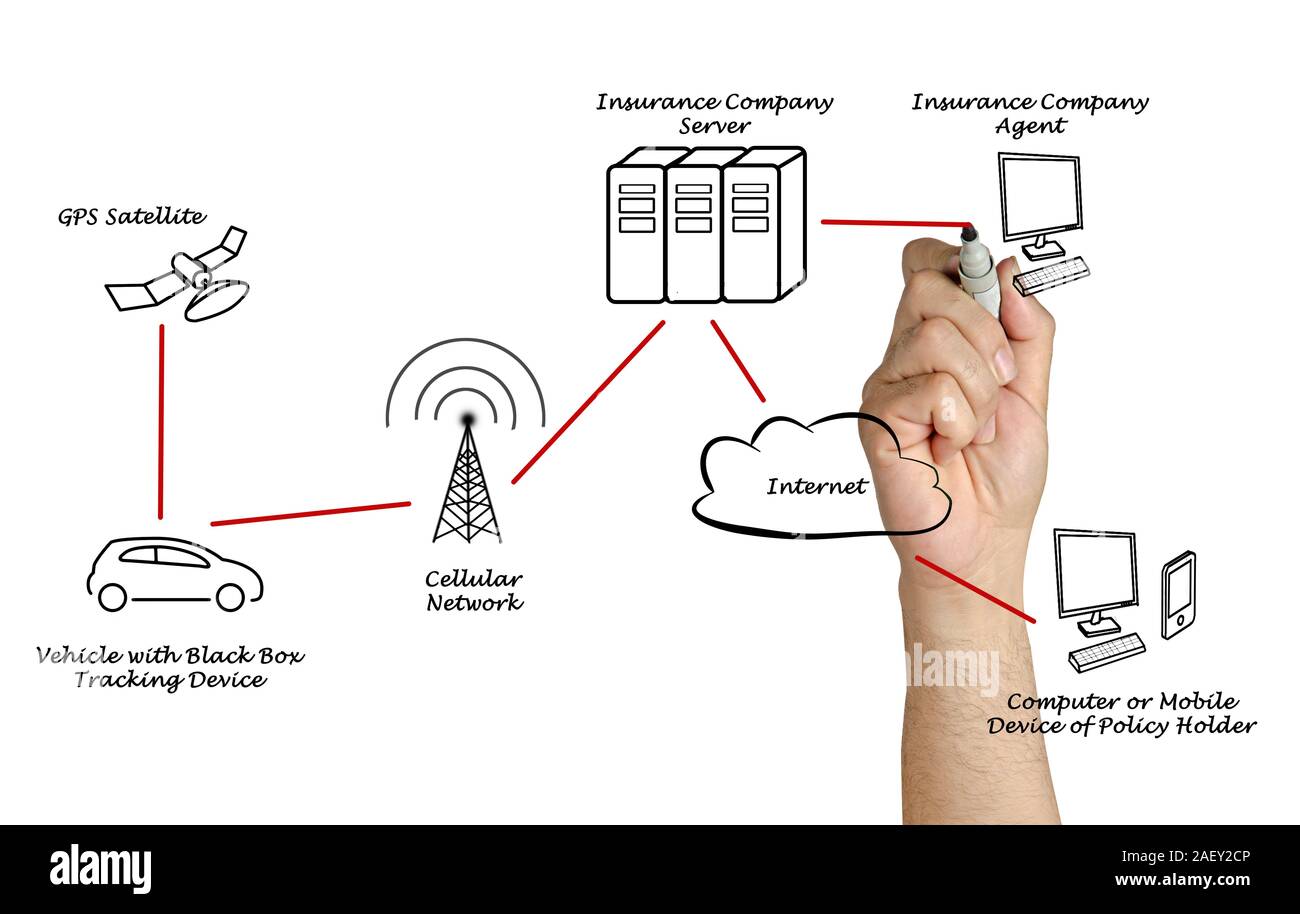

Auto Insurance: Protecting Your Journey

When it comes to auto insurance, Country Company understands the unique challenges and requirements of drivers across the nation. The company offers a comprehensive suite of auto insurance policies designed to provide comprehensive protection at competitive rates. Whether you’re a daily commuter or an occasional driver, Country Company’s auto insurance plans offer the coverage you need to navigate the roads with confidence.

Key features of Country Company's auto insurance include:

- Comprehensive coverage options: From liability protection to collision and comprehensive coverage, Country Company offers a range of options to suit your specific needs.

- Customizable policies: Tailor your auto insurance policy to fit your unique circumstances. Choose from a variety of deductibles, coverage limits, and additional endorsements to create a policy that aligns with your budget and requirements.

- Discounts and savings: Take advantage of Country Company's generous discounts, including multi-policy discounts, good student discounts, and safe driver incentives. These savings can help reduce your premium costs significantly.

- Roadside assistance: In the event of a breakdown or emergency, Country Company's roadside assistance program provides timely support, ensuring you're never stranded. From towing services to battery jumps, their team is ready to assist.

- Digital tools and resources: Country Company leverages technology to enhance the customer experience. Their online platform offers convenient policy management, allowing you to view and update your coverage, make payments, and access important documents anytime, anywhere.

With Country Company's auto insurance, you can drive with confidence, knowing you're protected against a wide range of risks. From accidents and theft to natural disasters, their comprehensive coverage ensures you're prepared for any eventuality. Additionally, their dedicated claims team is committed to providing efficient and fair resolution, ensuring a seamless and stress-free claims process.

Real-Life Example: A Satisfied Customer’s Story

“I’ve been a loyal customer of Country Company for over a decade, and their auto insurance has been a reliable companion throughout my driving journey. Recently, I was involved in an unfortunate accident that left my car severely damaged. However, the claims process with Country Company was a breeze. Their responsive team guided me through every step, ensuring I received the necessary repairs and compensation without any hassle. Their prompt and efficient service not only helped me get back on the road quickly but also reaffirmed my trust in their commitment to customer satisfaction. I highly recommend Country Company’s auto insurance to anyone seeking comprehensive protection and exceptional service.”

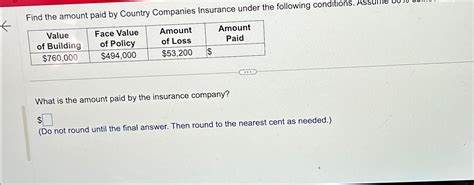

Home Insurance: Securing Your Sanctuary

Your home is more than just a physical structure; it’s a sanctuary where memories are made and cherished. Country Company recognizes the value and importance of your home, which is why they offer a robust home insurance program designed to protect your investment and provide you with the peace of mind you deserve.

Country Company's home insurance policies offer:

- Comprehensive coverage: Protect your home and its contents against a wide range of perils, including fire, theft, vandalism, and natural disasters such as hurricanes, tornadoes, and earthquakes (subject to policy terms and conditions).

- Personalized policies: Work with Country Company's experienced agents to create a home insurance policy that aligns with your specific needs and budget. Customize your coverage limits, deductibles, and optional endorsements to ensure you're adequately protected.

- Replacement cost coverage: In the event of a covered loss, Country Company's replacement cost coverage ensures you receive the full cost of repairing or rebuilding your home, without any depreciation adjustments.

- Liability protection: Extend your coverage to include liability protection, safeguarding you against legal claims and expenses arising from accidents or injuries that occur on your property.

- Additional living expenses: If your home becomes uninhabitable due to a covered loss, Country Company's additional living expenses coverage provides financial assistance to cover temporary housing and other related costs until you can return home.

By choosing Country Company's home insurance, you gain the assurance that your home and its contents are protected against unforeseen events. Their knowledgeable agents are dedicated to helping you understand your coverage options and ensuring you have the right protection in place. Additionally, their claims process is streamlined and efficient, ensuring a swift and hassle-free resolution in the event of a claim.

Success Story: A Homeowner’s Peace of Mind

“As a homeowner, I understand the importance of having reliable insurance coverage. Country Company’s home insurance has given me the peace of mind I need to fully enjoy my home without worrying about unexpected expenses. Recently, a severe storm caused significant damage to my roof and several windows. I was impressed by the speed and efficiency of Country Company’s claims team. They promptly dispatched an adjuster to assess the damage and approved the necessary repairs without delay. Their professionalism and commitment to customer satisfaction made the entire process seamless and stress-free. I’m grateful to have Country Company as my insurance partner, and I highly recommend their home insurance to anyone seeking comprehensive protection and exceptional service.”

Life Insurance: Securing Your Legacy

Life insurance is an essential component of financial planning, providing security and stability for your loved ones in the event of your passing. Country Company understands the importance of this protection and offers a comprehensive range of life insurance policies tailored to meet the unique needs of individuals and families.

Country Company's life insurance options include:

- Term Life Insurance: This type of policy provides coverage for a specified term, typically ranging from 10 to 30 years. It offers affordable protection during key life stages, such as raising a family or paying off a mortgage. Term life insurance is ideal for those seeking temporary coverage at a fixed premium.

- Whole Life Insurance: A permanent insurance policy that provides lifelong coverage and accumulates cash value over time. Whole life insurance offers guaranteed death benefits, fixed premiums, and the potential for tax-advantaged savings.

- Universal Life Insurance: This flexible policy combines permanent life insurance coverage with an investment component. It allows you to adjust your coverage and premiums over time, providing the ability to customize your policy to changing needs and financial goals.

- Final Expense Insurance: Designed to cover the costs associated with end-of-life expenses, such as funeral and burial costs. Final expense insurance provides a lump-sum payment to your beneficiaries, ensuring they have the financial support they need during a difficult time.

Country Company's life insurance policies are designed to provide financial security and peace of mind. Their experienced agents work closely with you to understand your goals and needs, helping you choose the right policy and coverage amount. Additionally, their comprehensive underwriting process ensures that you receive a policy that meets your specific requirements.

Expert Tip: Maximizing Life Insurance Benefits

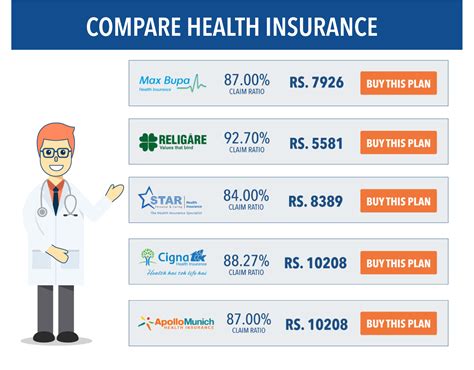

Health Insurance: Your Wellbeing, Their Priority

Country Company recognizes the importance of good health and the impact it has on your overall well-being. That’s why they offer a comprehensive range of health insurance plans designed to provide access to quality healthcare services and protect you from unexpected medical expenses.

Key features of Country Company's health insurance include:

- Comprehensive coverage: Their health insurance plans offer a wide range of benefits, including coverage for doctor visits, hospital stays, prescription medications, and specialty care. Whether you have a pre-existing condition or require ongoing medical treatment, Country Company's plans are designed to meet your unique healthcare needs.

- Network of providers: Country Company has established relationships with a network of trusted healthcare providers, including hospitals, clinics, and specialists. By utilizing their network, you can access quality care at preferred rates, ensuring you receive the best possible treatment without breaking the bank.

- Preventive care: Preventive care is a cornerstone of Country Company's health insurance philosophy. Their plans encourage and support regular check-ups, screenings, and vaccinations to help identify and address health concerns early on. By prioritizing preventive care, you can maintain your health and potentially avoid more serious and costly medical issues down the line.

- Flexible plan options: Country Company understands that every individual has unique healthcare needs and preferences. That's why they offer a variety of plan options, including HMO, PPO, and EPO plans, each with its own network of providers and cost-sharing arrangements. Whether you prefer a more cost-effective plan with a limited network or a plan that offers greater flexibility and broader access, Country Company has a plan that suits your needs.

With Country Company's health insurance, you can rest assured knowing that you have access to the care you need when you need it. Their dedicated team of healthcare professionals is committed to providing exceptional service and support, ensuring you receive the highest quality of care. Additionally, their user-friendly online platform makes it easy to manage your policy, access important documents, and stay informed about your coverage and benefits.

Patient Story: A Journey to Better Health

“As someone with a chronic health condition, finding the right health insurance coverage was crucial for me. Country Company’s health insurance plan has been a true lifeline. Their network of providers includes specialists who have helped me manage my condition effectively. The plan’s coverage for prescription medications has also been a huge relief, as it ensures I can access the medications I need without straining my budget. With Country Company’s support, I’ve been able to focus on my health and well-being, knowing that I have a reliable partner by my side. Their compassionate and responsive approach has made all the difference in my journey to better health.”

Conclusion: A Trusted Partner for Life’s Journey

Country Company Insurance stands as a testament to the power of innovation, trust, and dedication in the insurance industry. With a rich legacy spanning decades, the company has solidified its position as a leader, offering a comprehensive range of insurance solutions tailored to meet the diverse needs of individuals and businesses. From auto and home insurance to life and health coverage, Country Company provides the protection and peace of mind necessary to navigate life’s challenges and pursue your dreams with confidence.

As you embark on your insurance journey, consider the expertise and commitment of Country Company. Their dedicated team of professionals is ready to guide you through the process, ensuring you receive the coverage and support you deserve. With Country Company by your side, you can rest assured knowing that you have a trusted partner committed to safeguarding your future and protecting what matters most.

FAQ

How do I choose the right auto insurance policy for my needs?

+Choosing the right auto insurance policy involves considering several factors, such as your driving history, the type of vehicle you own, and your budget. Country Company offers customizable policies with various coverage options, allowing you to tailor your plan to your specific needs. Consult with their experienced agents to determine the best coverage limits, deductibles, and endorsements for your situation.

What sets Country Company’s home insurance apart from other providers?

+Country Company’s home insurance stands out for its comprehensive coverage options, including replacement cost coverage and additional living expenses. Their experienced agents work closely with you to understand your specific needs and create a personalized policy. Additionally, their efficient claims process ensures a swift and hassle-free resolution in the event of a covered loss.

How can I maximize the benefits of my life insurance policy with Country Company?

+To maximize the benefits of your life insurance policy, it’s essential to choose a policy that aligns with your long-term financial goals and the needs of your loved ones. Country Company’s agents can provide valuable guidance and help you select the right coverage amount and policy type. Regularly review and update your policy as your life circumstances change to ensure your loved ones are adequately protected.

What are the key advantages of Country Company’s health insurance plans?

+Country Company’s health insurance plans offer several key advantages, including a comprehensive network of trusted healthcare providers, flexible plan options to suit individual needs, and a strong focus on preventive care. Their plans provide access to quality healthcare services while helping you manage costs effectively. Additionally, their user-friendly online platform makes it easy to manage your policy and stay informed about your coverage.