Cost For Small Business Insurance

For small business owners, understanding the financial aspects of running a venture is crucial. One of the essential considerations is insurance coverage, which can protect businesses from various risks and potential liabilities. The cost of insurance is a significant factor that influences the financial health and stability of small businesses. In this comprehensive guide, we will delve into the world of small business insurance, exploring the various factors that impact its cost, providing real-world examples, and offering insights to help entrepreneurs make informed decisions.

Understanding the Basics: Types of Small Business Insurance

Before diving into the costs, it's essential to grasp the different types of insurance that small businesses typically require. Here's a breakdown of some common insurance policies:

- General Liability Insurance: Covers bodily injury, property damage, and personal and advertising injury claims. It is a fundamental policy for most businesses.

- Professional Liability Insurance (aka Errors and Omissions Insurance): Essential for professionals like consultants, accountants, and designers, providing protection against negligence claims.

- Product Liability Insurance: Crucial for businesses manufacturing or selling products, safeguarding against claims of injury or property damage caused by a product.

- Workers' Compensation Insurance: Mandated in most states, it covers medical care and a portion of lost wages for employees injured on the job.

- Commercial Property Insurance: Protects physical assets like buildings, equipment, and inventory from damage or loss due to fire, theft, or natural disasters.

- Business Interruption Insurance: Replaces lost income and covers ongoing expenses if a business is forced to shut down due to a covered event.

Factors Influencing Insurance Costs for Small Businesses

The cost of insurance for small businesses is influenced by a multitude of factors. Understanding these factors can help business owners anticipate and manage their insurance expenses effectively. Here's an in-depth look at the key considerations:

Industry and Business Type

The nature of your business and the industry you operate in play a significant role in determining insurance costs. High-risk industries like construction or manufacturing typically incur higher insurance premiums due to the increased likelihood of accidents and property damage.

| Industry | Average Premium |

|---|---|

| Construction | $3,500 - $7,000 |

| Retail | $1,500 - $3,000 |

| Professional Services | $1,000 - $2,500 |

Within each industry, the specific type of business can also impact costs. For instance, a retail store with a high-value inventory may pay more for property insurance compared to a similar-sized store with lower-value goods.

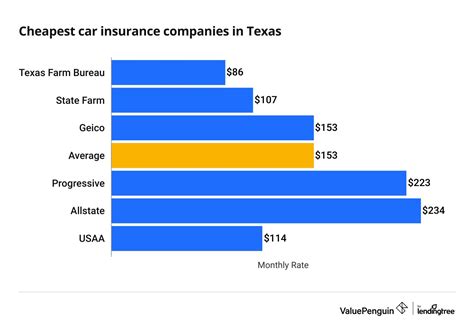

Location and Risk Factors

The geographical location of your business can significantly affect insurance rates. Areas prone to natural disasters like hurricanes, floods, or earthquakes may have higher premiums for property and liability insurance.

Additionally, the crime rate and traffic density in your area can influence the cost of commercial auto insurance and the likelihood of theft or vandalism, impacting property insurance rates.

Business Size and Revenue

The size of your business, often measured by annual revenue or the number of employees, is a critical factor in insurance pricing. Larger businesses with higher revenues or more employees typically face higher insurance costs due to the increased potential for claims.

| Annual Revenue | Average Premium |

|---|---|

| $100,000 - $500,000 | $2,000 - $4,000 |

| $500,000 - $1,000,000 | $4,000 - $8,000 |

| $1,000,000 - $5,000,000 | $8,000 - $20,000 |

Claims History and Risk Management

Insurance providers assess a business's claims history to determine its risk profile. A history of frequent or large claims can lead to higher premiums, as it indicates a higher likelihood of future claims. On the other hand, a clean claims record can result in more favorable rates.

Implementing robust risk management strategies, such as employee safety training, security measures, and regular equipment maintenance, can help reduce the likelihood of claims and potentially lower insurance costs.

Coverage Limits and Deductibles

The level of coverage you choose directly impacts the cost of your insurance policy. Higher coverage limits typically result in higher premiums, while lower limits can reduce costs. Similarly, opting for a higher deductible (the amount you pay out of pocket before insurance coverage kicks in) can lower your premium.

It's crucial to strike a balance between coverage limits and deductibles to ensure you have adequate protection without overpaying for insurance.

Insurance Provider and Policy Terms

Different insurance providers offer varying rates and policy terms. Shopping around and comparing quotes from multiple insurers can help you find the most cost-effective coverage for your small business. Additionally, the policy terms, such as the length of the policy period and the specific exclusions and inclusions, can impact the overall cost.

Real-World Examples: Insurance Costs for Small Businesses

To illustrate the variability in insurance costs, let's explore some real-world examples of small businesses and their insurance expenses:

Example 1: Retail Store

A small retail store in a suburban area sells clothing and accessories. The business has an annual revenue of $300,000 and employs 5 staff members. The owner purchases the following insurance policies:

- General Liability Insurance: $2,200

- Workers' Compensation Insurance: $800

- Commercial Property Insurance: $1,500

- Business Interruption Insurance: $500

Total Annual Insurance Cost: $4,000

Example 2: Consulting Firm

A consulting firm specializing in marketing and business strategy operates out of a rented office space. The firm has an annual revenue of $750,000 and a team of 10 consultants. Their insurance coverage includes:

- Professional Liability Insurance: $3,500

- General Liability Insurance: $1,800

- Cyber Liability Insurance: $1,200

- Commercial Property Insurance: $2,000

Total Annual Insurance Cost: $8,500

Example 3: Construction Company

A small construction company based in a coastal region frequently experiences hurricanes. The company has an annual revenue of $1,200,000 and employs 15 workers. Their insurance coverage consists of:

- General Liability Insurance: $6,500

- Workers' Compensation Insurance: $3,200

- Commercial Property Insurance: $7,000

- Builder's Risk Insurance: $2,500

Total Annual Insurance Cost: $19,200

Strategies to Lower Insurance Costs for Small Businesses

While insurance is a necessary expense for small businesses, there are strategies to potentially reduce costs without compromising coverage. Here are some effective approaches:

Bundle Policies

Consider purchasing multiple insurance policies from the same provider. Many insurers offer discounts when you bundle policies, such as combining general liability and commercial property insurance.

Raise Deductibles

Increasing your deductible can lower your insurance premiums. However, it's crucial to ensure that you can afford the higher out-of-pocket expense if a claim occurs.

Implement Risk Management Measures

Invest in proactive risk management strategies to reduce the likelihood of claims. This could include employee safety training, regular equipment maintenance, and implementing security measures to deter theft or vandalism.

Shop Around for Quotes

Don't settle for the first insurance quote you receive. Compare rates from multiple providers to find the most competitive pricing for your business's specific needs.

Review Coverage Regularly

As your business grows and changes, your insurance needs may evolve. Regularly review your coverage to ensure it aligns with your current operations and consider adjusting coverage limits or policies to optimize costs.

The Future of Insurance for Small Businesses

The insurance landscape for small businesses is continually evolving, driven by technological advancements and changing market dynamics. Here are some insights into the future of insurance for small enterprises:

Digital Transformation

The insurance industry is embracing digital technologies, offering online platforms and mobile apps for policy management and claims processing. This digital transformation enhances convenience and efficiency for small business owners, making insurance more accessible and user-friendly.

Data-Driven Underwriting

Advanced analytics and data science are revolutionizing insurance underwriting. Insurers can now use sophisticated algorithms to assess risk more accurately, leading to fairer and more precise pricing for small businesses.

Customized Coverage

With the advent of parametric insurance and on-demand coverage, small businesses can access more flexible and tailored insurance solutions. These innovative products allow businesses to choose coverage based on their specific needs and operational requirements.

Enhanced Risk Management Tools

Insurance providers are developing risk management tools and resources specifically for small businesses. These tools can help entrepreneurs identify and mitigate risks, potentially reducing insurance costs and improving overall business resilience.

Conclusion

Understanding the cost of insurance for small businesses is crucial for financial planning and long-term success. By considering the various factors that influence insurance rates and implementing cost-saving strategies, small business owners can navigate the insurance landscape with confidence. As the insurance industry continues to evolve, staying informed about emerging trends and leveraging digital tools can further enhance the efficiency and effectiveness of insurance coverage for small enterprises.

What is the average cost of insurance for a small business?

+

The average cost of insurance for a small business can vary widely based on factors like industry, location, and revenue. However, as a general guideline, small businesses can expect to pay between 1,000 and 5,000 annually for a comprehensive insurance package.

How often should I review my insurance coverage?

+

It’s recommended to review your insurance coverage annually or whenever there are significant changes to your business, such as expansion, relocation, or new products or services.

Can I negotiate insurance rates with providers?

+

While insurance rates are largely based on calculated risk assessments, it doesn’t hurt to negotiate with providers. You can highlight your business’s strong risk management practices or request a review of your coverage to potentially secure a better rate.

Are there government programs or subsidies available to help small businesses with insurance costs?

+

Some governments offer programs or subsidies to support small businesses with insurance costs, especially in high-risk industries or regions. It’s worth researching local and national initiatives to see if your business qualifies for any assistance.

What should I do if I’m unsure about the insurance coverage my business needs?

+

Consulting with an insurance broker or agent who specializes in small business insurance can be extremely helpful. They can assess your business’s unique risks and recommend appropriate coverage to ensure you’re adequately protected without overspending.