Cheap Insurance For Motorcycle

For motorcycle enthusiasts, finding affordable insurance is often a top priority. The cost of insuring a motorcycle can vary significantly, and riders are always on the lookout for ways to reduce their premiums without compromising on coverage. This comprehensive guide will delve into the world of motorcycle insurance, offering insights into how to secure the best coverage at the most competitive rates.

Understanding Motorcycle Insurance

Motorcycle insurance is designed to protect riders and their bikes from financial losses resulting from accidents, theft, or other unforeseen events. Much like auto insurance, it provides coverage for medical expenses, property damage, and liability claims. However, the cost and specific coverage options can vary widely depending on several factors.

Factors Influencing Motorcycle Insurance Rates

The cost of motorcycle insurance is influenced by a multitude of factors, including the rider’s age, driving history, and location. Additionally, the type of motorcycle, its age, and the coverage options chosen can significantly impact the premium.

| Factor | Impact on Rates |

|---|---|

| Rider's Age | Younger riders (under 25) often pay higher premiums due to their perceived higher risk of accidents. |

| Driving History | A clean driving record can lead to lower rates, while violations and accidents may increase premiums. |

| Location | Insurance rates can vary based on the state and even the specific area within a state. Factors like crime rates and accident frequency play a role. |

| Motorcycle Type | The make, model, and power of the motorcycle can affect insurance costs. Sports bikes, for instance, are often more expensive to insure. |

| Coverage Options | The level of coverage chosen, such as liability-only or comprehensive coverage, will impact the premium. |

Strategies to Secure Cheap Motorcycle Insurance

While several factors beyond your control influence insurance rates, there are still strategies you can employ to reduce your premiums and find affordable coverage.

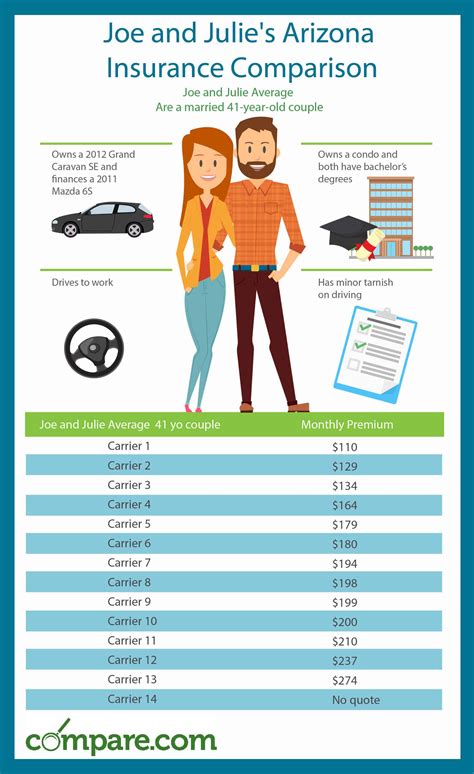

Shop Around and Compare Quotes

Insurance rates can vary significantly between providers, so it’s crucial to shop around and compare quotes. Online comparison tools can be a great starting point, but don’t hesitate to contact individual insurers directly for quotes tailored to your specific needs.

Choose the Right Coverage

While comprehensive coverage offers the most protection, it’s also the most expensive. Consider your needs and budget when choosing coverage. If your bike is older or has a lower resale value, you might opt for liability-only coverage to keep costs down.

Utilize Discounts

Many insurance providers offer discounts that can significantly reduce your premium. Common discounts include:

- Safe Rider Discount: Completing a recognized safe riding course can lead to discounts, especially if you're a new rider.

- Multi-Policy Discount: Insuring your home and motorcycle with the same provider can result in savings.

- Multi-Vehicle Discount: If you have multiple motorcycles or other vehicles insured with the same company, you might qualify for a discount.

- Loyalty Discount: Some insurers offer discounts for long-term customers.

- Payment Method Discount: Paying your premium annually rather than monthly can sometimes lead to savings.

Consider High Deductibles

Opting for a higher deductible can lower your premium. However, this means you’ll have to pay more out-of-pocket if you make a claim, so it’s a trade-off between saving on insurance costs and managing potential repair expenses.

Maintain a Clean Driving Record

A clean driving record is not only essential for your safety but also for keeping your insurance costs down. Avoid violations and accidents, as they can significantly increase your premiums.

Store Your Bike Securely

If you have a garage or a secure storage area for your motorcycle, inform your insurer. Secure storage can sometimes lead to lower premiums, as it reduces the risk of theft or damage.

The Future of Motorcycle Insurance

The insurance industry is continually evolving, and new technologies and data insights are shaping the future of motorcycle insurance.

Telematics and Usage-Based Insurance

Telematics devices can monitor a rider’s driving behavior, such as speed, acceleration, and braking. Usage-based insurance, also known as pay-as-you-ride or pay-how-you-drive insurance, uses telematics data to offer customized premiums based on an individual’s actual driving habits. This technology could lead to more accurate pricing and potentially lower rates for safe riders.

Artificial Intelligence and Data Analytics

Insurance providers are increasingly using advanced analytics and artificial intelligence to better understand risk factors and tailor insurance offerings. This includes predicting repair costs, identifying high-risk areas, and even using social media data to assess rider behavior and potential risks.

Digital Transformation

The insurance industry is undergoing a digital transformation, with many providers offering online quotes, digital policies, and even apps for policy management and claims filing. This shift towards digital services can make it easier and faster for riders to access insurance, potentially leading to more competitive pricing.

Insurtech Innovations

Insurtech companies are disrupting the traditional insurance model with innovative technologies and business models. From peer-to-peer insurance platforms to blockchain-based insurance solutions, these startups are offering new ways to access affordable insurance, often with a focus on transparency and customization.

FAQ

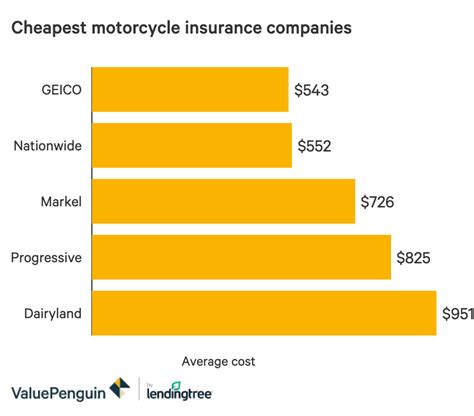

What is the average cost of motorcycle insurance?

+

The average cost of motorcycle insurance can vary widely depending on several factors, including the rider’s age, driving history, location, and the type of coverage chosen. As a general guide, liability-only coverage might cost around 200 to 500 annually, while comprehensive coverage could range from 500 to 1,500 or more.

How can I lower my motorcycle insurance premium if I’m a high-risk rider (e.g., young, with a history of accidents)?

+

If you’re considered a high-risk rider, you can take steps to reduce your premium. This includes maintaining a clean driving record going forward, taking a safe riding course to improve your skills, and shopping around for quotes from various insurers. Some providers specialize in insuring high-risk riders and may offer more competitive rates.

Are there any states with particularly affordable motorcycle insurance rates?

+

Insurance rates can vary significantly by state. Generally, states with lower population densities and lower accident rates tend to have more affordable insurance. However, it’s important to note that individual circumstances and the specific coverage chosen can also greatly impact the premium.

Can I get insurance for a custom-built motorcycle?

+

Yes, you can insure a custom-built motorcycle. However, due to the unique nature of these bikes, the process might be more complex. You’ll likely need to provide detailed specifications and photos of the bike to the insurer. The cost of insurance for a custom bike can vary widely depending on factors like the value of the bike, the components used, and the level of customization.

What is the process for making a claim on my motorcycle insurance policy?

+

The process for making a claim can vary slightly between insurers, but generally, you’ll need to report the incident to your insurer as soon as possible. This can often be done online, over the phone, or via an insurer’s app. You’ll then need to provide details about the accident or incident, including any relevant photos or documentation. The insurer will assess the claim and, if approved, arrange for repairs or provide a payout.