Cheap Car Insurance Down Payment

Finding affordable car insurance can be a challenge, especially when it comes to the initial down payment. The down payment, or the upfront cost, is an essential part of securing car insurance coverage, and it can vary significantly between insurance providers and policies. In this comprehensive guide, we will explore the world of cheap car insurance down payments, offering valuable insights, tips, and strategies to help you secure the best deal while keeping costs low.

Understanding the Importance of Down Payments

A down payment is the first installment you pay when purchasing an insurance policy. It is a crucial step in the insurance process as it demonstrates your commitment and financial responsibility. Insurance companies often require a down payment to initiate coverage, ensuring that policyholders have some skin in the game and are less likely to default on future premiums.

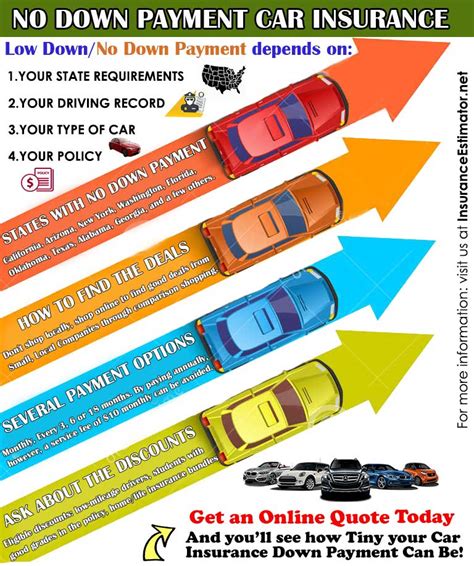

The amount of the down payment can vary depending on several factors, including your driving record, the type of vehicle you own, and the insurance company's policies. It's essential to understand that a lower down payment doesn't always equate to a better deal. While it might be tempting to choose the option with the lowest upfront cost, it's crucial to consider the overall cost of the policy, including monthly premiums and any additional fees.

Tips for Securing a Cheap Car Insurance Down Payment

Securing a cheap car insurance down payment requires a combination of research, comparison, and understanding of your own circumstances. Here are some expert tips to help you navigate the process:

1. Shop Around and Compare Quotes

The insurance market is highly competitive, and prices can vary significantly between providers. Take the time to shop around and compare quotes from multiple insurance companies. Online comparison tools can be a great starting point, allowing you to quickly assess a range of options and identify the most affordable down payments.

When comparing quotes, pay attention to the coverage limits, deductibles, and any additional features or discounts offered. Ensure that you're comparing apples to apples by considering policies with similar coverage levels. Don't solely focus on the down payment; evaluate the overall cost and value of the policy.

2. Understand Your Risk Profile

Insurance companies assess your risk profile when determining your down payment and premium costs. Factors such as your age, gender, driving history, and the type of vehicle you drive all play a role in assessing your risk. Understanding your risk profile can help you identify areas where you might be able to negotiate a lower down payment.

For example, if you have a clean driving record with no accidents or traffic violations, you may have more leverage to negotiate a lower down payment. Similarly, if you own a vehicle with excellent safety ratings and a low risk of theft, insurance companies might be more inclined to offer favorable terms.

3. Explore Payment Plans and Financing Options

Some insurance companies offer flexible payment plans or financing options to make the down payment more manageable. These plans can allow you to spread the cost of the down payment over several months, reducing the initial financial burden. While this might increase the overall cost of the policy due to interest charges, it can be a viable option for those with limited upfront funds.

When considering payment plans, be sure to understand the terms and conditions, including any interest rates or additional fees. Compare different financing options to find the most cost-effective solution for your situation.

4. Bundle Policies for Discounts

Bundling multiple insurance policies with the same provider can often lead to significant savings. Many insurance companies offer multi-policy discounts, allowing you to combine your car insurance with other policies like home, renters, or life insurance. By bundling your policies, you may be able to negotiate a lower down payment and overall premium costs.

When exploring bundling options, consider the long-term benefits. While the initial down payment might be higher, you could save a substantial amount over the policy's lifetime by taking advantage of multi-policy discounts.

5. Utilize Online Discounts and Promotions

Insurance companies frequently offer online discounts and promotions to attract new customers. Keep an eye out for special offers that can reduce your down payment or provide other benefits. These discounts might be time-limited, so it’s essential to stay informed and act promptly when such opportunities arise.

Additionally, some insurance providers offer loyalty discounts to existing customers who renew their policies. If you've been with the same provider for a while, it's worth inquiring about any loyalty programs or discounts that could lower your down payment costs.

The Impact of Credit Score on Down Payments

Your credit score can play a significant role in determining your car insurance down payment. Insurance companies often use credit-based insurance scores to assess your financial responsibility and predict the likelihood of future claims. A higher credit score can lead to more favorable terms, including lower down payments and premiums.

If you're concerned about your credit score impacting your insurance costs, consider taking steps to improve your credit. This might include paying off debts, reducing your credit utilization ratio, or disputing any inaccurate information on your credit report. A better credit score can not only lead to lower insurance costs but also provide benefits in other areas of your financial life.

Choosing the Right Coverage for Your Needs

When seeking a cheap car insurance down payment, it’s essential to strike a balance between cost and coverage. While a lower down payment might be appealing, it’s crucial to ensure that the policy provides adequate protection for your vehicle and liabilities.

Evaluate your specific needs and circumstances to determine the appropriate level of coverage. Consider factors such as the value of your vehicle, your driving habits, and any state-mandated minimum coverage requirements. By tailoring your coverage to your needs, you can avoid paying for unnecessary features while still maintaining adequate protection.

State-Mandated Minimum Coverage

Every state has its own set of minimum coverage requirements for car insurance. These mandatory coverage levels ensure that all drivers have a basic level of protection in the event of an accident. It’s essential to understand your state’s specific requirements to ensure you meet the legal obligations.

While the minimum coverage might be tempting due to its lower cost, it's important to assess whether it provides sufficient protection for your needs. In many cases, the minimum coverage might not be enough to cover the full cost of repairs or liabilities in the event of an accident. Consider upgrading your coverage to a higher level to ensure you're adequately protected.

Tailoring Coverage to Your Vehicle

The type of vehicle you drive can also impact the cost of your car insurance down payment. High-performance sports cars or luxury vehicles often come with higher insurance costs due to their increased risk of theft, accidents, and repair expenses. On the other hand, older, more affordable vehicles might require less comprehensive coverage, leading to lower down payment costs.

Evaluate the value of your vehicle and its potential risks. If you own an older car with a lower resale value, you might consider opting for liability-only coverage, which provides protection for damage you cause to others but not for your own vehicle. This type of coverage can significantly reduce your down payment and monthly premiums.

The Role of Deductibles in Down Payment Costs

Deductibles are an essential component of car insurance policies, and they can have a direct impact on your down payment costs. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you can often reduce your down payment and monthly premiums.

For example, if you opt for a policy with a $1,000 deductible, you'll be responsible for paying the first $1,000 of any covered claim. This means that in the event of an accident, you'll need to pay the first $1,000 of repair costs before your insurance coverage takes effect. While this might seem like a risky proposition, it can lead to significant savings on your down payment and overall policy costs.

However, it's crucial to carefully consider your financial situation and ability to cover a higher deductible. If an accident occurs and you're unable to pay the deductible, you might be left with substantial out-of-pocket expenses. Assess your financial stability and risk tolerance before deciding on a deductible amount.

Real-Life Examples and Case Studies

To illustrate the impact of these strategies, let’s explore a few real-life examples and case studies:

Case Study 1: John’s Successful Negotiation

John, a 35-year-old with a clean driving record, was looking to purchase car insurance for his newly acquired used car. He began by comparing quotes from multiple insurance providers, paying close attention to down payment costs and overall policy coverage. He found that by bundling his car insurance with his home insurance policy, he was able to negotiate a 10% discount on his down payment.

Additionally, John's excellent credit score allowed him to secure a further 5% discount on his down payment. By leveraging his good financial standing and taking advantage of multi-policy discounts, John was able to reduce his initial down payment by a significant margin, making his insurance more affordable from the start.

Case Study 2: Sarah’s Strategic Deductible Choice

Sarah, a 28-year-old with a safe driving history, was shopping for car insurance for her first vehicle. She wanted to keep costs low but also ensure adequate coverage. After comparing quotes, she noticed that by opting for a higher deductible, she could significantly reduce her down payment.

Sarah decided to choose a $1,500 deductible, which lowered her down payment by $200 compared to a policy with a $500 deductible. While the higher deductible meant she would need to pay more out of pocket in the event of a claim, Sarah felt confident in her ability to cover that expense. By making this strategic choice, Sarah was able to save on her initial down payment while still maintaining a comprehensive insurance policy.

Expert Insights and Future Implications

Securing a cheap car insurance down payment requires a combination of research, negotiation, and understanding of your own financial situation and risk profile. By shopping around, comparing quotes, and exploring various payment options, you can find the most affordable down payment while still obtaining the coverage you need.

As the insurance landscape continues to evolve, staying informed about industry trends and changes in regulations can also impact your ability to secure affordable coverage. Keep an eye on emerging technologies and innovations in the insurance sector, as they might offer new opportunities for cost-effective policies and down payments.

In conclusion, finding a cheap car insurance down payment is achievable with the right approach and knowledge. By implementing the strategies outlined in this guide and staying proactive in your insurance decisions, you can secure the coverage you need without breaking the bank.

How do I know if I’m eligible for a lower down payment?

+Eligibility for a lower down payment can depend on various factors, including your driving record, credit score, and the insurance company’s policies. Generally, a clean driving record and a good credit score can increase your chances of negotiating a lower down payment. It’s always worth inquiring with insurance providers to understand their specific criteria and potential discounts.

Can I negotiate the down payment amount with insurance companies?

+Absolutely! Negotiating the down payment amount is a common practice, and many insurance companies are open to discussions. By highlighting your good driving record, financial stability, or loyalty to the provider, you may be able to secure a lower down payment. It’s always worth asking and exploring your options.

Are there any hidden fees associated with low down payment policies?

+It’s essential to carefully review the terms and conditions of any policy, especially those with low down payments. Some insurance providers may charge additional fees or have specific conditions attached to low down payment policies. Be sure to understand any potential hidden costs or restrictions before committing to a policy.