Cheapest Best Car Insurance

Finding the cheapest car insurance that also offers the best coverage can be a challenging task, but it's certainly possible with the right knowledge and strategy. Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind. However, with numerous insurance providers and varying coverage options, it's easy to get overwhelmed. This comprehensive guide aims to navigate you through the process, ensuring you secure the best value for your money while maintaining quality coverage.

Understanding Car Insurance Basics

Car insurance is a contract between you and the insurance provider. In exchange for your premium payments, the insurer agrees to cover certain costs associated with vehicle-related incidents, such as accidents, theft, or natural disasters. The coverage options and premiums vary widely, influenced by factors like your driving history, the make and model of your vehicle, and the location where you primarily drive.

Types of Car Insurance Coverage

Understanding the different types of car insurance coverage is crucial. Here’s a breakdown of the most common ones:

- Liability Coverage: This is the most basic form of car insurance, covering damages you cause to others’ property or injuries you cause to others. It’s required by law in most states.

- Collision Coverage: This option covers damage to your vehicle in the event of a collision, regardless of fault. It’s particularly beneficial if you have a newer or more valuable car.

- Comprehensive Coverage: This coverage protects against non-collision incidents like theft, vandalism, fire, or natural disasters. It’s often required if you have a loan or lease on your vehicle.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for medical expenses for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This provides protection if you’re involved in an accident with a driver who doesn’t have enough insurance to cover the damages.

Factors Affecting Insurance Rates

Several factors influence the cost of your car insurance premiums. These include:

- Driver Profile: Your age, gender, driving record, and years of driving experience all play a role. Younger drivers, especially males, often pay higher premiums due to their higher risk profile.

- Vehicle Details: The make, model, year, and safety features of your car can impact rates. Sports cars and luxury vehicles, for instance, may have higher premiums.

- Location: Where you live and primarily drive affects your rates. Urban areas often have higher rates due to increased traffic and the risk of accidents or theft.

- Coverage Options: The more coverage you choose, the higher your premiums will likely be. However, it’s important to strike a balance between cost and adequate protection.

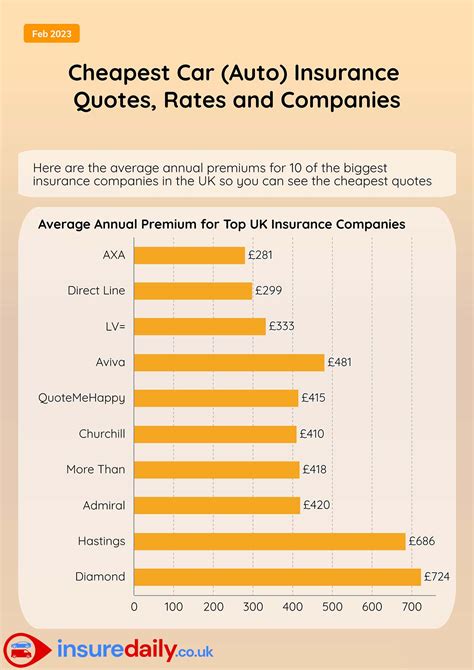

Researching and Comparing Insurance Providers

With a solid understanding of car insurance basics, it’s time to research and compare different providers. This step is crucial to finding the best value for your money.

Online Comparison Tools

Utilize online comparison tools and websites that aggregate insurance quotes from multiple providers. These tools allow you to input your details once and receive multiple quotes, making it easier to compare rates and coverage options. However, keep in mind that these tools often provide estimates, and the actual quote may vary slightly.

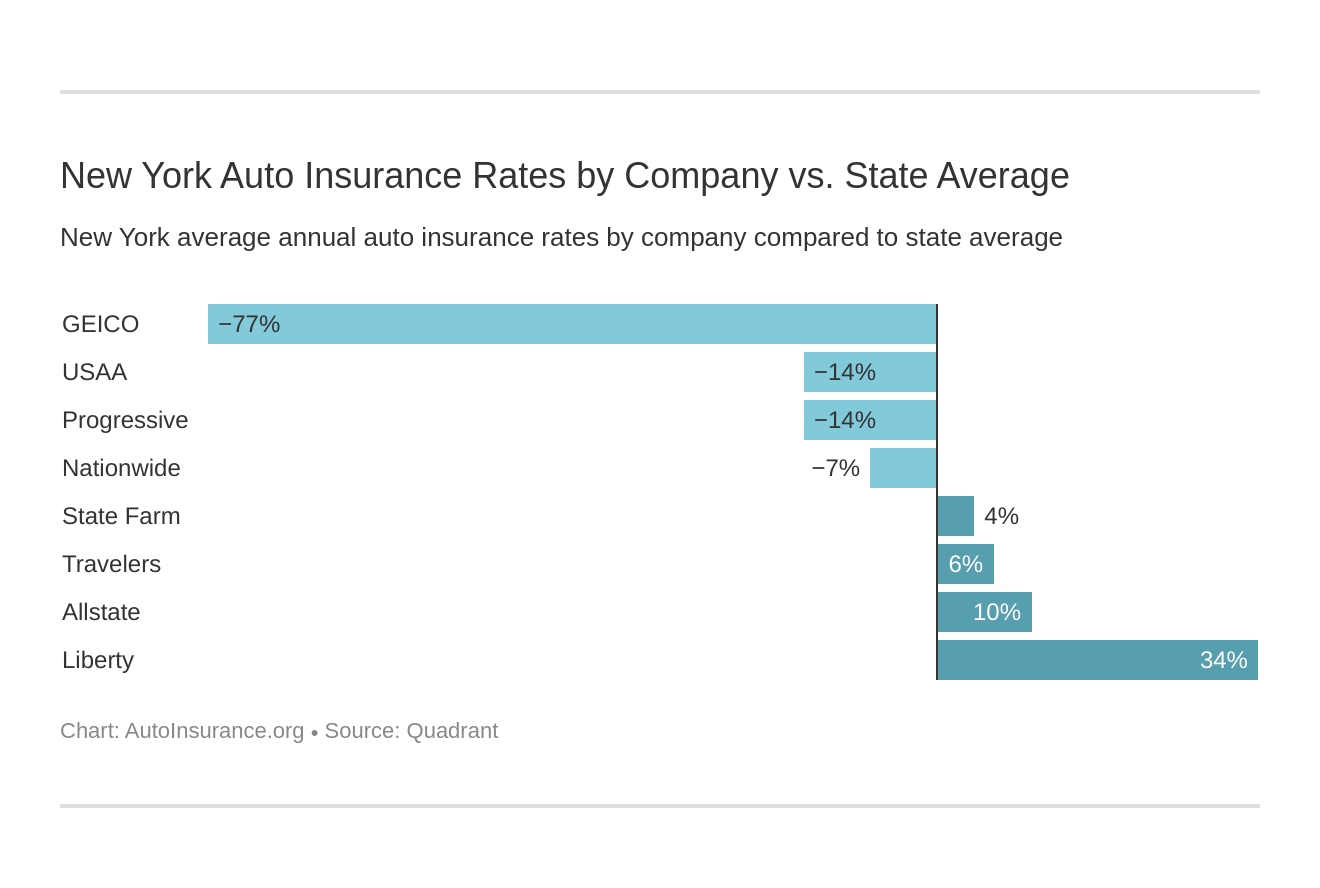

Direct vs. Broker Insurance

Consider whether you prefer to purchase insurance directly from a specific provider or through a broker. Direct insurance companies, like Geico or Progressive, offer their own policies and often have competitive rates. Brokers, on the other hand, work with multiple insurance companies and can shop around for the best deal on your behalf. They may charge a fee for their services, but they can save you time and provide personalized advice.

Reading Insurance Reviews

Take the time to read reviews and customer feedback about insurance providers. This can give you insights into their claim handling process, customer service, and overall satisfaction levels. While a single negative review shouldn’t necessarily deter you, consistent patterns of poor service or claim issues should raise red flags.

Negotiating and Customizing Your Policy

Once you’ve narrowed down your options, it’s time to negotiate and customize your policy to ensure you’re getting the best deal.

Bundling Policies

Consider bundling your car insurance with other types of insurance, such as home or renters insurance. Many providers offer discounts when you have multiple policies with them. This can be a great way to save money while simplifying your insurance needs.

Adjusting Coverage Levels

Review your coverage levels and consider whether you can reduce them to save money. For instance, if you have an older car with a low resale value, you might consider dropping collision and comprehensive coverage and opting for liability-only insurance. However, be cautious not to reduce your coverage too much, as this could leave you vulnerable in the event of an accident.

Discounts and Savings

Inquire about potential discounts and savings. Many insurance providers offer discounts for safe driving records, low mileage, anti-theft devices, and even certain professions or affiliations. Additionally, some providers offer discounts for paying your premium annually instead of monthly.

Understanding Policy Exclusions and Limitations

While it’s important to focus on finding the cheapest insurance, it’s equally crucial to understand the exclusions and limitations of your policy. This ensures you’re not caught off guard in the event of a claim.

Common Policy Exclusions

Most car insurance policies exclude certain types of incidents or situations. For instance, standard policies typically don’t cover wear and tear, mechanical breakdowns, or damages incurred during off-road driving. Understanding these exclusions can help you determine if you need additional coverage.

Policy Limitations

Policy limitations refer to the maximum amount your insurance provider will pay for a covered incident. For example, liability coverage has limits for bodily injury and property damage. It’s important to ensure these limits are adequate for your needs, especially if you have significant assets to protect.

The Claims Process and Customer Service

When choosing car insurance, it’s crucial to consider the claims process and the level of customer service provided by the insurer. After all, the true value of your insurance policy is revealed when you need to make a claim.

Claims Handling Efficiency

Research the insurer’s claims handling process and reputation. Look for reviews and ratings that specifically mention the claims process. A good insurer should have a streamlined process, with clear communication and efficient resolution of claims.

Customer Service Availability

Consider the availability of customer service and support. Are they easily reachable via phone, email, or live chat? Do they offer extended hours or 24⁄7 support in case of emergencies? Responsive and helpful customer service can make a significant difference, especially during stressful situations.

Future Considerations and Policy Adjustments

Finding the cheapest best car insurance isn’t a one-time task. It requires ongoing evaluation and adjustments to ensure you maintain the best coverage at the most affordable price.

Regular Policy Reviews

Review your insurance policy annually or whenever your circumstances change significantly. This could include a new vehicle purchase, a change in your driving habits or location, or major life events like marriage or having a child. These changes can impact your insurance needs and potential savings.

Monitoring Market Changes

Keep an eye on the insurance market. Insurance rates and coverage options can change over time, influenced by various factors like economic conditions, regulatory changes, or industry trends. Regularly comparing quotes and staying informed about market changes can help you identify opportunities to save.

Utilizing Telematics and Usage-Based Insurance

Consider insurance providers that offer telematics or usage-based insurance programs. These programs use data from your driving behavior, such as mileage, driving speed, and braking habits, to determine your insurance rate. If you’re a safe and cautious driver, you could potentially save money with these programs.

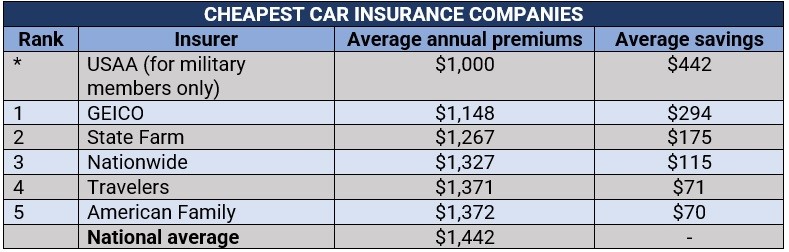

| Insurance Provider | Average Annual Premium | Key Features |

|---|---|---|

| Geico | $1,200 | Known for their extensive discounts, including military and federal employee discounts, and a user-friendly digital experience. |

| Progressive | $1,350 | Offers usage-based insurance with Snapshot, providing personalized rates based on your driving behavior. Also provides online tools for easy policy management. |

| State Farm | $1,420 | Provides a range of discounts and has a strong network of local agents for personalized service. Offers accident forgiveness and rental car coverage. |

| Allstate | $1,500 | Features a range of coverage options and add-ons, including roadside assistance and rental car reimbursement. Offers discounts for safe driving and bundling policies. |

| Esurance | $1,380 | Known for their digital-first approach, offering a seamless online experience for policy management and claims. Provides various discounts and has flexible payment options. |

Can I get car insurance without a license or a car?

+Yes, it is possible to get car insurance without a license or a car. Some insurance providers offer non-owner car insurance policies, which can be beneficial if you frequently borrow or rent vehicles. However, the availability and cost of such policies may vary, and you should check with different providers to find the best option for your needs.

How can I lower my car insurance rates if I have a poor driving record?

+Improving your driving record over time can lead to lower insurance rates. You can also consider taking a defensive driving course, which may qualify you for a discount. Additionally, shopping around and comparing quotes from different insurers can help you find a better rate, as prices can vary significantly between providers.

Are there any alternatives to traditional car insurance?

+Yes, there are alternatives to traditional car insurance, such as peer-to-peer insurance and subscription-based models. Peer-to-peer insurance allows you to pool resources with other drivers to cover each other’s claims, while subscription-based models offer flexible coverage options, often with monthly payments. These alternatives may suit certain drivers better, but it’s important to research and understand the specifics before making a decision.