Irs What Is You Don't Have Insurance

For many individuals, understanding the complexities of the Internal Revenue Service (IRS) and its regulations can be daunting, especially when it comes to tax obligations and penalties. One particular area that often raises questions is the relationship between tax compliance and health insurance coverage. In this comprehensive guide, we will delve into the world of the IRS and explore the implications of not having health insurance, shedding light on the potential consequences and offering valuable insights for taxpayers.

The IRS and the Health Insurance Mandate

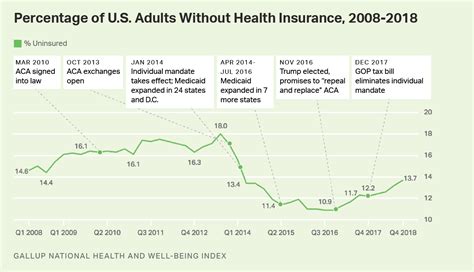

In the United States, the Internal Revenue Service plays a crucial role in enforcing tax laws, including those related to health insurance. The Affordable Care Act (ACA), often referred to as Obamacare, introduced a key provision known as the Individual Mandate, which required most individuals to have qualifying health insurance coverage or face a penalty. This mandate aimed to ensure that a significant portion of the population was insured, reducing the financial burden on the healthcare system.

However, with the enactment of the Tax Cuts and Jobs Act in 2017, a significant change occurred. The law eliminated the penalty associated with the Individual Mandate, effectively removing the financial incentive for individuals to maintain health insurance coverage. This shift has led to a complex landscape where the IRS still collects information about health insurance status but does not impose a direct penalty for non-compliance.

Understanding the Impact of No Insurance

While the penalty for lacking health insurance has been removed, the implications of not having coverage can still be significant. Here’s a closer look at the potential consequences:

Medical Expenses

Without health insurance, individuals are responsible for paying all medical expenses out of pocket. This can include costly procedures, medications, and treatments. Even a minor injury or illness can lead to substantial financial burdens, especially for those without emergency savings.

| Example Scenario | Potential Cost |

|---|---|

| Broken Arm | $3,000 - $5,000 |

| Appendicitis Surgery | $15,000 - $30,000 |

| Cancer Treatment | $100,000 - $500,000 or more |

Limited Access to Care

Individuals without insurance may face challenges in accessing healthcare services. Many healthcare providers require proof of insurance or upfront payment, which can be a barrier for those without financial resources. This can lead to delayed or inadequate medical care, potentially exacerbating health issues.

Financial Stress and Debt

The financial strain of unexpected medical expenses can be overwhelming. Individuals may find themselves burdened with substantial debt, impacting their overall financial well-being and creditworthiness. This can lead to long-term financial struggles and a cycle of debt.

Tax Reporting and Potential Audits

Despite the removal of the penalty, the IRS still requires individuals to report their health insurance status on their tax returns. Failure to do so can raise red flags and potentially trigger an audit. It’s crucial to understand the reporting requirements and ensure accurate documentation.

Navigating Health Insurance Options

For those facing the decision of whether to obtain health insurance, it’s essential to explore the available options and understand the potential benefits. Here are some key considerations:

Affordable Care Act (ACA) Marketplaces

The ACA established Health Insurance Marketplaces, often referred to as Exchanges, where individuals can shop for and compare health insurance plans. These marketplaces offer a range of options, including subsidized plans for those with lower incomes. It’s worth exploring these options to find affordable coverage that meets individual needs.

Employer-Sponsored Insurance

Many employers offer health insurance as a benefit to their employees. These plans can provide comprehensive coverage at a reduced cost, as employers often contribute to the premiums. It’s beneficial to inquire about available options and understand the enrollment process.

Short-Term Plans and Alternative Coverage

For those seeking temporary coverage or unable to afford traditional plans, short-term health insurance plans or alternative options like medical cost-sharing programs may be considered. However, it’s crucial to thoroughly research and understand the limitations and potential risks associated with these alternatives.

Conclusion: A Balanced Approach

The landscape of health insurance and its relationship with the IRS is intricate. While the removal of the penalty for lacking insurance provides flexibility, it also underscores the importance of careful consideration and personal responsibility. Understanding the potential financial and health-related consequences of going without insurance is crucial for making informed decisions.

As we navigate the complexities of healthcare and tax regulations, staying informed and exploring available options is key. Whether opting for insurance coverage or facing the challenges of managing healthcare costs without it, knowledge and proactive planning can make a significant difference in one's financial and overall well-being.

What happens if I don’t report my health insurance status on my tax return?

+

Failing to report your health insurance status can lead to potential IRS audits and penalties. It’s crucial to accurately report your coverage to avoid unnecessary complications.

Are there any exceptions to the requirement of having health insurance?

+

Yes, certain individuals may qualify for exemptions from the health insurance requirement. These include individuals with religious objections, those who are incarcerated, and those who experience hardship situations. It’s important to review the IRS guidelines for exemptions.

Can I be denied healthcare services if I don’t have insurance?

+

Healthcare providers may have different policies regarding uninsured patients. Some may require upfront payment or proof of insurance, while others may offer discounted rates or sliding-scale fees. It’s best to inquire with specific providers about their policies.