Non Owner Car Insurance Progressive

Non-owner car insurance is a unique and often overlooked type of coverage that provides an essential safety net for many individuals. In a world where mobility and access to vehicles are crucial, understanding the intricacies of non-owner car insurance becomes imperative. This article delves deep into the specifics of this insurance, focusing on the offerings from one of the industry's leading providers, Progressive.

Understanding Non-Owner Car Insurance

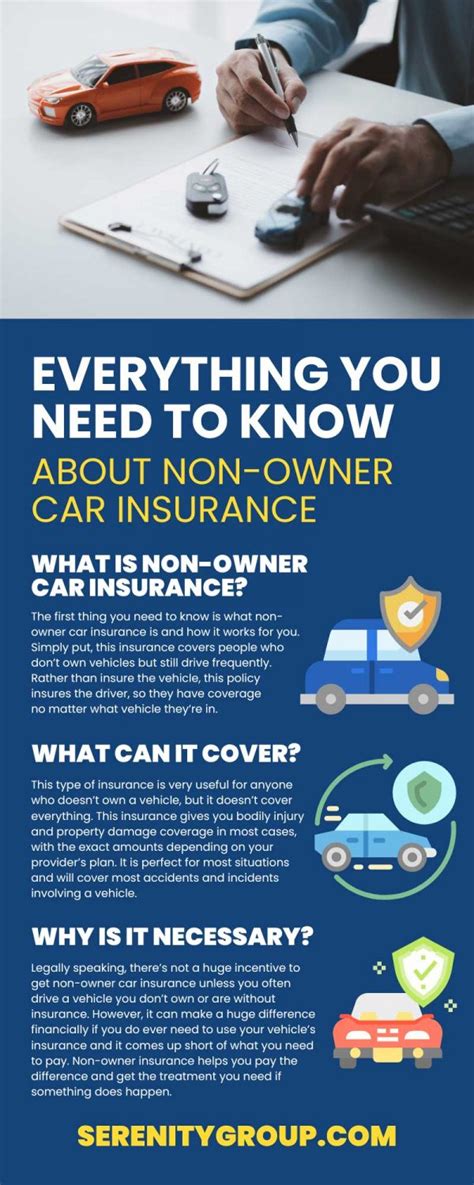

Non-owner car insurance, as the name suggests, is a policy designed for individuals who do not own a vehicle but still require insurance coverage for various reasons. This could include frequent renters, rideshare drivers, or even those who borrow vehicles regularly. It’s a specialized type of coverage that fills a crucial gap in the traditional auto insurance market.

This type of insurance is distinct from standard auto insurance policies, which are typically tied to a specific vehicle. Non-owner car insurance, on the other hand, follows the individual, offering protection regardless of the vehicle they're driving. This flexibility makes it an attractive option for a diverse range of individuals.

Key Features of Non-Owner Car Insurance

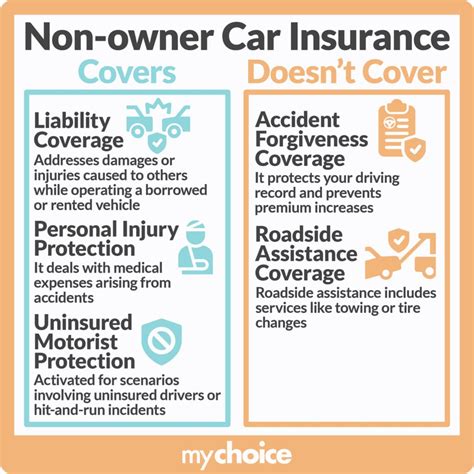

Non-owner car insurance typically includes liability coverage, which protects the insured against bodily injury and property damage claims resulting from accidents they cause while driving someone else’s vehicle. This coverage is especially crucial for rideshare drivers or those who frequently borrow cars.

Additionally, some policies may offer medical payments coverage, which can help cover the medical expenses of the insured and their passengers in the event of an accident, regardless of fault. This adds an extra layer of protection and peace of mind for the policyholder.

Another notable feature is the potential for uninsured/underinsured motorist coverage. This protection steps in when the at-fault driver in an accident either lacks insurance or doesn't have sufficient coverage to pay for the damages caused. It's a vital component for ensuring financial security in the event of such incidents.

Progressive’s Non-Owner Car Insurance: A Comprehensive Overview

Progressive, a renowned name in the insurance industry, offers a robust non-owner car insurance policy, tailored to meet the diverse needs of its customers. With a focus on innovation and customer satisfaction, Progressive’s non-owner policy has become a go-to choice for many.

Coverage Options and Customization

Progressive’s non-owner car insurance policy allows for a high degree of customization. Policyholders can choose from a range of coverage limits to tailor their policy to their specific needs and budget. This flexibility ensures that individuals can select the level of protection that aligns with their unique circumstances.

The liability coverage offered by Progressive is particularly robust, with limits that can be adjusted to provide adequate protection in various situations. This includes coverage for bodily injury, property damage, and even legal defense costs in the event of a lawsuit.

Additionally, Progressive's policy includes options for medical payments coverage, which can help cover expenses for the policyholder and their passengers, as well as uninsured/underinsured motorist coverage, ensuring comprehensive protection against a range of potential risks.

| Coverage Type | Limits |

|---|---|

| Liability Coverage | Customizable, up to $1 million |

| Medical Payments | Up to $10,000 per person |

| Uninsured/Underinsured Motorist | Up to $1 million |

Progressive’s Advantages and Unique Offerings

One of the standout features of Progressive's policy is its focus on convenience. Policyholders can easily manage their insurance online, making adjustments and payments with just a few clicks. This digital-first approach ensures a seamless experience, catering to the modern consumer's needs.

Furthermore, Progressive offers a range of discounts to make their non-owner car insurance even more affordable. These discounts can be applied based on various factors, such as the policyholder's driving history, educational qualifications, or even their membership in certain organizations. This ensures that policyholders can access competitive rates tailored to their specific circumstances.

Real-World Benefits and Use Cases

Non-owner car insurance from Progressive finds its utility in a multitude of real-world scenarios. For instance, consider a professional rideshare driver who relies on their vehicle to earn a living. With Progressive’s non-owner policy, they can ensure they’re protected, even if they’re involved in an accident while on the job.

Another example could be a frequent traveler who rents cars regularly. With non-owner car insurance, they can rest assured that they're covered, regardless of which rental car they're driving. This adds a layer of financial security and peace of mind to their travels.

For individuals who borrow cars from friends or family members, non-owner car insurance can be a lifesaver. It ensures that they're protected in the event of an accident, without having to rely on the vehicle owner's insurance. This shared responsibility model is a unique benefit of non-owner policies.

Performance and Customer Satisfaction

Progressive’s non-owner car insurance has consistently received high marks for performance and customer satisfaction. Policyholders appreciate the comprehensive coverage and the flexibility to customize their policies. The digital tools and resources offered by Progressive further enhance the overall experience, making it easy to manage and understand their insurance.

In the event of a claim, Progressive's efficient and responsive claims process is a key differentiator. Policyholders can rest assured that their claims will be handled promptly and fairly, minimizing the stress and inconvenience associated with accidents or incidents.

Future Outlook and Innovations

As the mobility landscape continues to evolve, with ridesharing and car-sharing services becoming increasingly popular, the demand for non-owner car insurance is expected to grow. Progressive, with its focus on innovation, is well-positioned to meet these changing needs.

Looking ahead, Progressive may explore further customization options, allowing policyholders to tailor their coverage even more precisely. This could include adding additional coverages or adjusting limits based on specific activities, such as participating in ridesharing services or engaging in certain types of driving.

Additionally, with the rise of autonomous vehicles, Progressive may need to adapt its non-owner car insurance policies to account for the unique risks and liabilities associated with this new technology. This could involve developing new coverage types or adjusting existing policies to ensure policyholders are adequately protected in this evolving landscape.

Conclusion

Non-owner car insurance from Progressive offers a comprehensive and flexible solution for individuals who don’t own a vehicle but still require insurance coverage. With its customizable coverage options, competitive pricing, and focus on convenience, Progressive’s policy stands out in the market. As the mobility landscape continues to evolve, Progressive’s commitment to innovation ensures that its non-owner car insurance remains a relevant and essential offering for its customers.

What is the average cost of Progressive’s non-owner car insurance?

+The cost of Progressive’s non-owner car insurance can vary significantly based on individual circumstances and the chosen coverage limits. On average, policyholders can expect to pay around $300 annually for a basic liability policy. However, the cost can increase or decrease based on factors like the policyholder’s driving history, the chosen coverage limits, and any applicable discounts.

Does Progressive’s non-owner policy cover rental cars?

+Yes, Progressive’s non-owner car insurance policy does cover rental cars. This means that policyholders can drive rental vehicles with the same peace of mind and protection they would have if they were driving their own car.

Can I add additional coverages to my non-owner policy with Progressive?

+Absolutely! Progressive offers a range of additional coverages that can be added to your non-owner car insurance policy. These include medical payments coverage, comprehensive coverage for non-collision incidents, and uninsured/underinsured motorist coverage. By customizing your policy with these additional coverages, you can ensure you’re protected against a wider range of potential risks.