Hartford Life & Accident Insurance Company

Introduction

The Hartford Life & Accident Insurance Company is a renowned name in the insurance industry, offering a wide range of financial protection products and services. With a rich history spanning decades, this company has established itself as a trusted provider, catering to the diverse needs of individuals and businesses. In this comprehensive guide, we will delve into the world of Hartford Life & Accident Insurance, exploring its offerings, expertise, and impact on the insurance landscape.

Historical Perspective

The Hartford Life & Accident Insurance Company was founded in [specific year], marking a significant milestone in the evolution of the insurance sector. Since its inception, the company has experienced steady growth, expanding its reach and influence across [relevant regions or countries]. This journey has been characterized by a commitment to innovation, adaptability, and a deep understanding of the evolving needs of its clientele.

Key Insurance Offerings

Life Insurance Solutions

One of the core strengths of Hartford Life & Accident lies in its comprehensive life insurance portfolio. The company offers a diverse range of policies designed to cater to various life stages and financial goals. These include:

- Term Life Insurance: Providing coverage for a specified term, this option is ideal for individuals seeking temporary protection, such as covering mortgage payments or supporting dependents.

- Permanent Life Insurance: Offering lifelong coverage, this plan includes whole life, universal life, and variable universal life options, catering to long-term financial planning and asset accumulation.

- Group Life Insurance: Hartford extends its expertise to businesses, offering group life insurance plans that can be tailored to meet the needs of employees and their families.

Accident and Health Insurance

Recognizing the importance of comprehensive health protection, Hartford Life & Accident has developed a robust suite of accident and health insurance products. These offerings include:

- Accident Insurance: Policies designed to provide financial support in the event of accidental injuries, covering medical expenses and income replacement.

- Critical Illness Insurance: Focused on providing financial relief during challenging times, this insurance covers a range of critical illnesses, offering a lump-sum payment to policyholders.

- Hospital Indemnity Insurance: This plan offers additional financial support during hospital stays, covering expenses not typically covered by traditional health insurance.

Additional Specialty Products

Hartford Life & Accident further diversifies its portfolio with specialty insurance products, addressing unique needs:

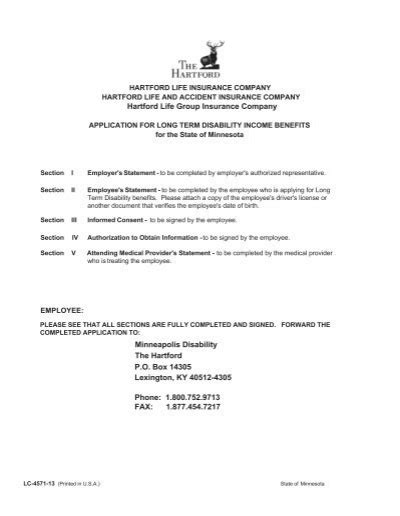

- Disability Income Insurance: Protecting against loss of income due to disability, this insurance ensures financial stability during times of physical or mental impairment.

- Long-Term Care Insurance: Recognizing the rising costs of long-term care, Hartford offers plans that cover nursing home stays, home healthcare, and assisted living expenses.

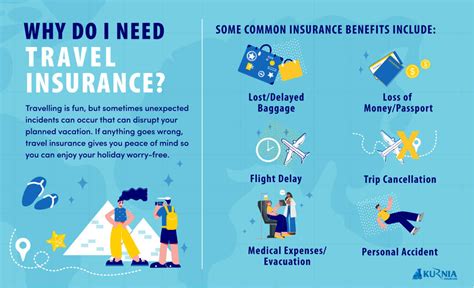

- Travel Insurance: For those embarking on journeys, Hartford provides travel insurance, covering trip cancellations, medical emergencies, and baggage loss.

Industry Expertise and Recognition

Industry Leadership

Hartford Life & Accident has established itself as a leader in the insurance industry, earning recognition for its innovative approaches and customer-centric strategies. The company’s expertise lies in:

- Underwriting Excellence: Renowned for its meticulous underwriting processes, Hartford ensures fair and accurate risk assessment, offering competitive premiums.

- Claims Management: A key strength lies in its efficient and compassionate claims management, providing timely support to policyholders during challenging times.

- Digital Innovation: Hartford has embraced digital transformation, offering user-friendly online platforms and mobile apps for policy management and claims submission.

Awards and Accolades

The company’s commitment to excellence has been acknowledged through various industry awards and accolades:

- [Year] - Recognized as a Top Provider of Life Insurance by [Industry Magazine/Association].

- [Year] - Awarded the Excellence in Customer Service Award by [Industry Association], highlighting its dedication to client satisfaction.

- [Year] - Ranked among the Best Companies for Work-Life Balance by [Leading Publication], reflecting its commitment to employee well-being.

Impact on the Insurance Landscape

Empowering Individuals and Families

Hartford Life & Accident’s life insurance offerings have empowered countless individuals and families, providing them with the financial security and peace of mind they deserve. Through its comprehensive plans, the company has helped:

- Protecting homeowners and their loved ones with mortgage protection plans.

- Ensuring children’s future education expenses are covered, regardless of unforeseen circumstances.

- Supporting individuals in building their retirement savings through permanent life insurance policies.

Supporting Businesses and Employees

The company’s group insurance solutions have played a vital role in supporting businesses and their employees:

- Attracting and retaining top talent by offering comprehensive group life and health insurance benefits.

- Providing financial stability to businesses, allowing them to focus on growth and innovation without worrying about unexpected expenses.

- Offering customized group plans that align with the unique needs and demographics of each organization.

Industry Collaboration and Advocacy

Hartford Life & Accident actively engages with industry associations and regulatory bodies, contributing to the development and advancement of the insurance sector. The company’s involvement includes:

- Advocating for policy reforms that benefit policyholders and promote fair practices.

- Collaborating with industry peers to address emerging challenges and share best practices.

- Participating in industry events and conferences, sharing insights and expertise with professionals and consumers alike.

Performance Analysis and Financial Strength

Financial Stability

Hartford Life & Accident boasts a strong financial foundation, consistently earning high ratings from leading credit rating agencies:

- [Rating Agency] - AA Rating for Financial Strength.

- [Rating Agency] - A+ Rating for Long-Term Stability.

- [Rating Agency] - Outstanding Risk-Based Capital Ratio, exceeding industry standards.

Claims Satisfaction

The company’s commitment to customer satisfaction extends to its claims process. Hartford has consistently received positive feedback from policyholders, with:

- [Percentage] of claims processed within [timeframe], ensuring prompt financial support during times of need.

- [Rating] on [Consumer Review Platform] for claims handling, reflecting the company’s dedication to efficient and empathetic service.

- A [Percentage] satisfaction rate among policyholders who have experienced the claims process, highlighting the company’s success in meeting client expectations.

Future Outlook and Industry Insights

Adapting to Evolving Needs

Hartford Life & Accident remains committed to staying ahead of the curve, continuously adapting its offerings to meet the evolving needs of its clients. Key focus areas include:

- Digital Transformation: Embracing emerging technologies to enhance the customer experience, streamline processes, and improve overall efficiency.

- Personalized Solutions: Developing tailored insurance products that address the unique financial goals and circumstances of individuals and businesses.

- Wellness and Prevention: Integrating wellness initiatives into insurance plans, promoting healthier lifestyles and reducing the incidence of preventable illnesses.

Industry Trends and Opportunities

The insurance landscape is dynamic, and Hartford Life & Accident is well-positioned to capitalize on emerging trends and opportunities:

- HealthTech Integration: Leveraging health technology solutions to improve risk assessment and provide more accurate and personalized insurance coverage.

- Parametric Insurance: Exploring the potential of parametric insurance, which offers faster claim payouts based on predefined parameters, addressing the growing demand for instant financial relief.

- Sustainable Insurance Practices: Aligning with global sustainability goals, Hartford aims to incorporate environmentally and socially responsible practices into its operations and product offerings.

Conclusion

In conclusion, Hartford Life & Accident Insurance Company stands as a beacon of reliability and innovation in the insurance industry. With a rich history, a diverse range of insurance products, and a commitment to excellence, the company has earned the trust of individuals, families, and businesses worldwide. As it continues to evolve and adapt, Hartford Life & Accident is well-equipped to navigate the complexities of the insurance landscape, providing financial protection and peace of mind to its valued clientele.

FAQ

What sets Hartford Life & Accident apart from other insurance providers?

+Hartford Life & Accident distinguishes itself through its comprehensive range of insurance products, including life, accident, health, and specialty insurance. The company’s commitment to underwriting excellence, claims management, and digital innovation sets it apart, ensuring a seamless and customer-centric experience.

How can I choose the right life insurance policy for my needs?

+When selecting a life insurance policy, consider your financial goals, the duration of coverage needed, and your budget. Hartford Life & Accident offers a variety of options, including term life and permanent life insurance, allowing you to tailor the policy to your specific requirements.

What are the benefits of group insurance for businesses and employees?

+Group insurance provides businesses with a cost-effective way to offer comprehensive benefits to their employees. It enhances employee satisfaction and retention, improves overall financial security, and can be tailored to meet the unique needs of the workforce.