United Healthcare Private Insurance

In the realm of healthcare, United Healthcare stands as a prominent name, offering a comprehensive range of insurance plans to cater to diverse needs. This article delves into the intricacies of United Healthcare's private insurance options, exploring the features, benefits, and key considerations that make it a compelling choice for individuals and families seeking personalized healthcare coverage.

Overview of United Healthcare’s Private Insurance Plans

United Healthcare’s private insurance portfolio encompasses a wide array of plans tailored to meet the varying requirements of different individuals and demographics. These plans are designed to provide comprehensive medical coverage, ensuring access to quality healthcare services while offering flexibility and customization.

Key Features and Benefits

Customizable Coverage Options

United Healthcare’s private insurance plans allow policyholders to tailor their coverage to suit their specific needs. From selecting preferred healthcare providers to choosing the level of coverage for various medical services, the customization options provide a sense of control and assurance.

Nationwide Provider Networks

United Healthcare boasts an extensive network of healthcare providers across the United States, ensuring policyholders have access to a wide range of medical professionals and facilities. This network includes primary care physicians, specialists, hospitals, and urgent care centers, making it convenient for individuals to receive the care they need without compromising on quality or proximity.

Preventive Care Focus

One of the standout features of United Healthcare’s private insurance plans is their emphasis on preventive care. These plans typically cover a range of preventive services, such as annual physical exams, immunizations, screenings for various health conditions, and wellness programs. By encouraging and facilitating preventive care, United Healthcare aims to promote overall health and well-being while potentially reducing the need for more extensive and costly medical interventions in the future.

Innovative Technology Integration

United Healthcare is known for its forward-thinking approach, leveraging technology to enhance the overall insurance experience. Policyholders can access their insurance information, view coverage details, and manage their healthcare needs through user-friendly online platforms and mobile apps. Additionally, United Healthcare’s digital tools often include features like telemedicine options, allowing policyholders to consult with healthcare professionals remotely, which can be particularly beneficial for those with limited mobility or residing in remote areas.

Policyholder Experiences and Case Studies

To gain a deeper understanding of United Healthcare’s private insurance offerings, let’s explore a few real-life scenarios and testimonials:

Family Coverage: The Johnson Family’s Experience

The Johnson family, consisting of two parents and three children, opted for United Healthcare’s private insurance plan due to its comprehensive family coverage. With the plan, they were able to choose their preferred pediatricians and specialists, ensuring continuity of care for their children’s various medical needs. The plan’s coverage for annual check-ups, immunizations, and vision and dental care provided the Johnsons with peace of mind, knowing their family’s health was well-protected.

Individual Coverage: Mr. Williams’ Story

Mr. Williams, a self-employed professional, chose United Healthcare’s private insurance plan for its flexibility and customization options. As a frequent traveler, he appreciated the plan’s nationwide network, ensuring he could receive medical care regardless of his location. The plan’s coverage for mental health services was particularly beneficial, as Mr. Williams utilized telemedicine options to access therapy sessions while on the road.

Senior Coverage: Mrs. Smith’s Journey

Mrs. Smith, a retired senior citizen, selected United Healthcare’s Medicare supplement plan to enhance her existing Medicare coverage. The plan’s focus on preventive care aligned with her desire to maintain her health and well-being. With the plan’s coverage for annual wellness visits and screenings, Mrs. Smith was able to proactively manage her health, catching potential issues early on and receiving the necessary care promptly.

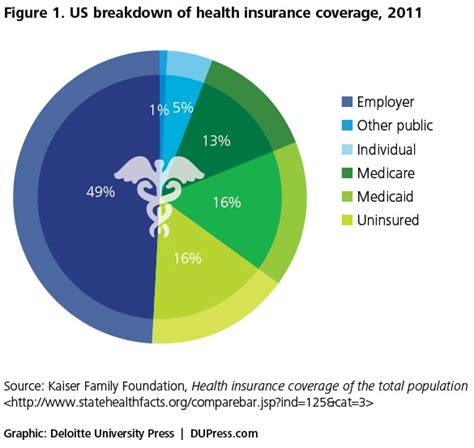

Performance Analysis and Comparative Insights

United Healthcare’s private insurance plans consistently rank among the top choices for individuals and families seeking comprehensive healthcare coverage. Their strong financial stability, as evidenced by high ratings from leading insurance rating agencies, provides policyholders with added assurance.

When compared to other major insurance providers, United Healthcare’s plans often offer a competitive edge in terms of network size, coverage flexibility, and technological integration. Additionally, their emphasis on preventive care and wellness initiatives sets them apart, reflecting a commitment to long-term health management rather than solely focusing on reactive medical treatments.

Future Implications and Industry Trends

As the healthcare industry continues to evolve, United Healthcare’s commitment to innovation and technological advancement positions them well for the future. Their focus on digital health solutions and telemedicine options is expected to become increasingly integral to the insurance landscape, offering policyholders greater convenience and accessibility.

Furthermore, United Healthcare’s ongoing investments in preventive care initiatives and wellness programs are likely to yield positive outcomes in terms of overall population health and reduced healthcare costs. This proactive approach to healthcare aligns with the industry’s shifting focus towards value-based care and population health management.

Conclusion: A Comprehensive and Customizable Approach

United Healthcare’s private insurance plans offer a compelling blend of comprehensive coverage, customization options, and innovative technological integration. By prioritizing preventive care and leveraging technology, they provide policyholders with a modern and personalized insurance experience. Whether it’s for families seeking peace of mind, individuals valuing flexibility, or seniors enhancing their existing coverage, United Healthcare’s private insurance plans stand as a trusted and reliable choice in the healthcare insurance market.

How do United Healthcare’s private insurance plans compare in terms of cost and coverage compared to other providers?

+

United Healthcare’s private insurance plans offer competitive pricing and comprehensive coverage. While specific costs can vary based on factors like location, age, and coverage preferences, their plans are often considered affordable and provide excellent value for the level of coverage offered. In terms of coverage, United Healthcare’s plans are designed to be customizable, allowing policyholders to choose the level of coverage they need, which can help keep costs manageable.

What are some of the key factors to consider when choosing a United Healthcare private insurance plan?

+

When selecting a United Healthcare private insurance plan, it’s essential to consider your specific healthcare needs and preferences. Key factors to consider include the plan’s coverage for your regular healthcare providers and specialists, the level of coverage for preventive care services, the network size and accessibility of healthcare facilities, and any additional benefits or perks that align with your priorities. Additionally, reviewing the plan’s cost-sharing structure, including deductibles, copayments, and out-of-pocket maximums, is crucial to ensure the plan aligns with your budget.

How can policyholders maximize the benefits of their United Healthcare private insurance plan?

+

Policyholders can maximize the benefits of their United Healthcare private insurance plan by actively engaging with their healthcare and staying informed about their coverage. This includes regularly reviewing the plan’s coverage details, understanding the network of providers and facilities covered, and utilizing the plan’s preventive care services to maintain good health. Additionally, policyholders can benefit from leveraging United Healthcare’s digital tools and resources, such as their online platforms and mobile apps, to manage their healthcare needs efficiently and conveniently.