Affordable Insurance For Car

When it comes to protecting your vehicle and managing your finances, finding affordable car insurance is a top priority for many drivers. In today's market, there are numerous options available, each offering unique features and pricing structures. Understanding the factors that influence insurance rates and knowing how to navigate the complex world of automotive insurance can help you secure the best coverage at the most reasonable cost.

This comprehensive guide aims to provide you with the knowledge and tools to make informed decisions about your car insurance, ensuring you get the best value for your money. We'll delve into the various aspects that impact insurance costs, explore different policy options, and offer strategies to reduce your premiums without compromising on coverage.

Understanding Car Insurance and Its Importance

Car insurance is a vital financial tool that provides protection against the unpredictable events that can occur on the road. From accidents and theft to natural disasters and vandalism, insurance offers a safety net to help you cover the costs of repairs, medical expenses, and legal liabilities. Having adequate insurance coverage is not just a smart financial decision but also a legal requirement in most regions.

The primary goal of car insurance is to provide financial security in the face of unexpected circumstances. Whether you're involved in a minor fender bender or a more serious collision, insurance can help you manage the financial fallout. Additionally, insurance can protect you against lawsuits and other legal issues that may arise from an accident.

However, with the wide range of insurance providers and policies available, choosing the right coverage can be daunting. It's crucial to understand the different types of insurance, the factors that influence rates, and how to assess your specific needs to make an informed decision.

Types of Car Insurance Coverage

Car insurance policies generally fall into two main categories: liability coverage and comprehensive coverage. Liability coverage is mandatory in most states and protects you against claims for bodily injury or property damage that result from an accident you cause. It covers the other party’s medical bills, vehicle repairs, and any legal fees if a lawsuit is filed against you.

Comprehensive coverage, on the other hand, is optional but highly recommended. It provides protection for events beyond your control, such as theft, vandalism, natural disasters, and damage caused by hitting an animal. Comprehensive coverage typically also includes glass coverage, which can be particularly useful given the cost of repairing or replacing windshields and windows.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Covers claims for bodily injury and property damage caused by the policyholder. |

| Comprehensive Coverage | Protects against non-collision events like theft, vandalism, and natural disasters. |

Factors Influencing Car Insurance Rates

The cost of car insurance can vary significantly depending on a range of factors. Understanding these influences can help you anticipate and manage your insurance expenses more effectively.

Vehicle-Related Factors

The type of vehicle you drive plays a significant role in determining your insurance rates. Insurance companies consider factors such as the make, model, and age of your car, as well as its safety and theft ratings. Vehicles that are more expensive to repair or that have a higher likelihood of being stolen will generally result in higher insurance premiums.

Additionally, the purpose for which you use your vehicle can impact your rates. If you primarily use your car for commuting to work or running errands, your insurance will likely be lower than if you frequently drive for business purposes or use your vehicle for recreational activities like off-roading.

Driver-Related Factors

Your driving record and personal history are key considerations for insurance companies. A clean driving record with no accidents or traffic violations will typically result in lower insurance rates. Conversely, if you have a history of accidents or moving violations, your insurance premiums are likely to be higher.

Your age and gender can also affect your insurance rates. Statistically, younger drivers and males tend to be associated with higher risk and may pay more for insurance. However, this is not a universal rule, and other factors can influence rates more significantly.

Location-Related Factors

The area where you live and drive your vehicle can significantly impact your insurance rates. Insurance companies consider factors such as the local crime rate, traffic density, and weather conditions when determining rates. Areas with high rates of car theft or frequent severe weather events may have higher insurance costs.

Other Influencing Factors

Several other factors can influence your insurance rates, including:

- Credit History: Many insurance companies use your credit score as a factor in determining your insurance rates. A higher credit score may result in lower premiums.

- Marital Status: Married individuals may be considered lower-risk and thus may pay lower insurance rates.

- Educational Attainment: Some insurance companies offer discounts to policyholders with higher educational qualifications.

- Discounts and Bundling: Many insurance companies offer discounts for various reasons, such as safe driving, bundling policies, or installing safety features in your vehicle.

Tips for Getting Affordable Car Insurance

While insurance rates are influenced by various factors, there are strategies you can employ to find affordable coverage that suits your needs.

Shop Around and Compare Quotes

Insurance rates can vary significantly between providers, so it’s essential to shop around and compare quotes. Online comparison tools can be a great way to quickly get estimates from multiple insurers. However, it’s important to ensure you’re comparing apples to apples by considering factors like coverage limits, deductibles, and any applicable discounts.

Understand Your Coverage Needs

Different drivers have different insurance needs. Consider your specific circumstances and the level of coverage you require. If you have an older vehicle, you may not need comprehensive coverage, which can significantly reduce your insurance costs. On the other hand, if you have a newer or more expensive car, comprehensive coverage is generally recommended.

Consider Higher Deductibles

Increasing your deductible (the amount you pay out of pocket before your insurance coverage kicks in) can result in lower premiums. This strategy works best if you’re a safe driver and have the financial means to cover a higher deductible in the event of an accident or other covered incident.

Take Advantage of Discounts

Insurance companies offer a variety of discounts that can significantly reduce your premiums. These may include safe driver discounts, multi-policy discounts (for bundling your car insurance with other types of insurance), and discounts for safety features like anti-theft devices or advanced driver assistance systems.

Maintain a Good Driving Record

One of the most effective ways to keep your insurance rates low is to maintain a clean driving record. Avoid traffic violations and prevent accidents by practicing defensive driving techniques. Remember, a single speeding ticket or minor accident can significantly increase your insurance rates.

Understanding Policy Terms and Conditions

When selecting a car insurance policy, it’s crucial to thoroughly understand the terms and conditions. Read the policy document carefully to ensure you know exactly what is and isn’t covered, and what your responsibilities are in the event of a claim. Pay attention to the coverage limits, deductibles, and any exclusions or limitations that may apply.

It's also important to understand the process for filing a claim and what you can expect in terms of settlement. Some insurance companies may have a reputation for slow claim processing or low settlement amounts, so be sure to research these aspects before choosing a provider.

Future Trends in Car Insurance

The car insurance industry is constantly evolving, and several trends are shaping the future of automotive insurance.

Telematics and Usage-Based Insurance

Telematics technology, which tracks and analyzes driving behavior, is gaining popularity. Usage-based insurance policies use telematics data to offer personalized premiums based on how, when, and where you drive. This technology can benefit safe drivers by offering lower premiums, but it also means that your insurance rates may be more closely tied to your actual driving habits.

Increased Use of AI and Machine Learning

Artificial intelligence and machine learning are being used more frequently in the insurance industry. These technologies can analyze vast amounts of data to predict and assess risk more accurately. This can lead to more precise insurance pricing and improved claim handling processes.

The Rise of Electric Vehicles

As the adoption of electric vehicles (EVs) continues to grow, insurance providers are adapting their policies to accommodate this new segment of the market. EV insurance policies may differ from traditional car insurance, considering factors like the cost of EV repairs and the risk associated with high-voltage batteries.

Conclusion

Finding affordable car insurance that provides adequate coverage can be a complex task, but with the right knowledge and strategies, it’s achievable. By understanding the factors that influence insurance rates, shopping around for the best deals, and taking advantage of discounts, you can secure the protection you need at a price that fits your budget.

Stay informed about the latest trends in the insurance industry, and don't hesitate to seek professional advice when needed. Your car insurance is an essential component of your financial plan, so make sure you're getting the best value for your money.

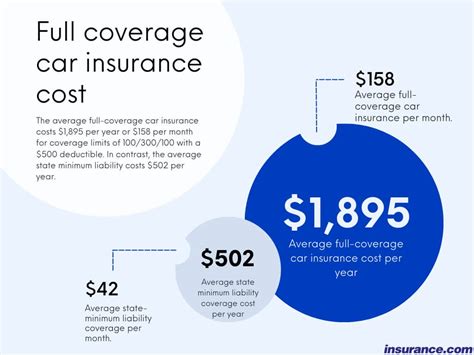

What is the average cost of car insurance in the US?

+The average cost of car insurance in the US varies significantly depending on factors such as location, driving record, and the type of vehicle insured. According to recent data, the national average for car insurance premiums is around 1,674 per year, or approximately 139 per month. However, rates can range from as low as 500 to over 3,000 annually depending on individual circumstances.

How can I reduce my car insurance premiums?

+There are several strategies to reduce your car insurance premiums. These include shopping around for the best rates, increasing your deductible, maintaining a clean driving record, taking advantage of discounts (such as safe driver discounts or bundling policies), and considering usage-based insurance if you’re a safe and low-mileage driver.

What factors determine my car insurance rates?

+Car insurance rates are determined by a variety of factors, including your driving record, the type of vehicle you drive, your location, your age and gender, your credit history, and the coverage limits you choose. Insurance companies use these factors to assess the level of risk you pose and set your premiums accordingly.

Do I need comprehensive coverage for my car insurance?

+Comprehensive coverage is generally recommended, especially for newer or more expensive vehicles. It provides protection against events beyond your control, such as theft, vandalism, and natural disasters. While it’s optional, comprehensive coverage can offer peace of mind and financial protection in the event of unforeseen circumstances.

How often should I review my car insurance policy?

+It’s a good idea to review your car insurance policy annually or whenever your circumstances change significantly. This allows you to ensure that your coverage still meets your needs and that you’re not overpaying for unnecessary coverage. Additionally, regular reviews can help you take advantage of any new discounts or policy enhancements offered by your insurer.