Insurance Life

Life insurance is an essential financial tool that provides peace of mind and security to individuals and their families. In today's dynamic world, the life insurance industry is undergoing significant transformations, offering a wide range of options and benefits to policyholders. This comprehensive guide aims to delve into the intricacies of modern life insurance, exploring its various facets, benefits, and the considerations one should make when navigating this critical aspect of financial planning.

Understanding Life Insurance: More Than Just a Policy

At its core, life insurance serves as a financial safety net, offering protection and stability to policyholders and their beneficiaries. It is a contract between an individual and an insurance company, where the insurer promises to pay a specified sum of money to the beneficiary upon the insured’s death. However, the scope of life insurance has expanded far beyond this basic definition.

Today's life insurance policies are sophisticated financial instruments designed to cater to a diverse range of needs. They provide not just a death benefit, but also offer features like cash value accumulation, tax benefits, and the flexibility to adapt to changing life circumstances. These policies can be tailored to individual needs, making them an essential component of a well-rounded financial plan.

The Importance of Life Insurance in Modern Times

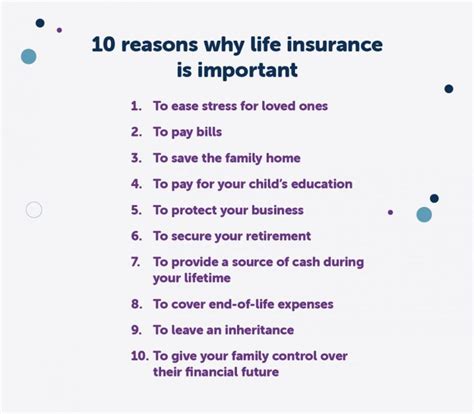

In an era marked by economic uncertainties and changing family dynamics, life insurance has become increasingly crucial. It ensures financial security for families in the event of an untimely demise, providing funds for funeral expenses, outstanding debts, and daily living costs. Moreover, life insurance policies can serve as a vital tool for estate planning, helping to ensure a smooth transition of assets to heirs.

Beyond the immediate financial protection, life insurance can also offer long-term benefits. Certain policies, such as permanent life insurance, provide a cash value component that grows over time, offering policyholders a form of savings or investment. This cash value can be used to pay premiums, fund retirement, or cover unexpected expenses.

| Policy Type | Key Benefits |

|---|---|

| Term Life Insurance | Affordable, temporary coverage with a specified duration. Ideal for covering specific needs like mortgage payments or children's education. |

| Permanent Life Insurance | Offers lifelong coverage with a cash value component that grows tax-deferred. Suitable for long-term financial planning and wealth accumulation. |

| Whole Life Insurance | Provides guaranteed death benefits and cash value growth. Offers a stable, predictable option for long-term financial security. |

| Universal Life Insurance | Flexible policy with adjustable premiums and death benefits. Allows policyholders to customize their coverage and cash value accumulation. |

Key Considerations When Choosing a Life Insurance Policy

Selecting the right life insurance policy involves careful consideration of various factors. Here are some critical aspects to keep in mind:

Assessing Your Needs

Before purchasing a life insurance policy, it’s essential to assess your specific needs. Consider your financial obligations, such as mortgage payments, outstanding debts, and your family’s future financial goals. Determine the amount of coverage required to ensure your loved ones are financially secure in the event of your untimely demise.

Understanding Policy Types

Life insurance policies come in various types, each designed to cater to different needs. Term life insurance offers temporary coverage for a specified period, often at a lower cost. Permanent life insurance, on the other hand, provides lifelong coverage with a cash value component, making it a suitable choice for long-term financial planning. Understanding these policy types is crucial in selecting the right fit for your needs.

Policy Riders and Add-ons

Many life insurance policies offer additional riders or add-ons that can enhance your coverage. These may include options like accelerated death benefits for terminal illnesses, waiver of premium in case of disability, or child riders that provide a small death benefit for your children. These add-ons can significantly increase the value of your policy, so it’s worth exploring them during your selection process.

The Role of Premiums

Premiums are the regular payments you make to maintain your life insurance policy. The cost of premiums can vary based on factors like your age, health status, lifestyle, and the type of policy you choose. It’s essential to consider the long-term affordability of premiums when selecting a policy. While a lower premium might be appealing, ensure that the policy offers adequate coverage and flexibility to meet your future needs.

Maximizing the Benefits of Your Life Insurance Policy

Once you’ve chosen a life insurance policy, it’s essential to understand how to maximize its benefits. Here are some strategies to consider:

Regular Policy Reviews

Life circumstances can change rapidly, and it’s essential to review your life insurance policy regularly. As your family grows, your financial obligations change, or your career advances, your insurance needs may also evolve. Regular policy reviews ensure that your coverage remains adequate and aligned with your current and future financial goals.

Utilizing Policy Riders and Add-ons

As mentioned earlier, policy riders and add-ons can significantly enhance your coverage. Depending on your specific needs, you might consider adding riders like waiver of premium, which waives your premium payments in case of disability, or accelerated death benefits, which provide a portion of your death benefit if you’re diagnosed with a terminal illness.

Exploring Policy Loans and Withdrawals

Some life insurance policies, particularly permanent life insurance, offer the option of policy loans or withdrawals. These features allow you to access the cash value of your policy, which can be beneficial in emergencies or to fund major life events. However, it’s essential to understand the implications of these actions, as they may impact your policy’s cash value and death benefit.

Estate Planning and Beneficiary Designation

Life insurance plays a crucial role in estate planning. By naming beneficiaries for your policy, you can ensure that your death benefit is distributed according to your wishes. It’s essential to review and update your beneficiary designations regularly, especially after significant life events like marriage, divorce, or the birth of a child. This ensures that your wishes are respected and your loved ones receive the financial support they need.

The Future of Life Insurance: Industry Trends and Innovations

The life insurance industry is continually evolving, driven by technological advancements, changing consumer needs, and regulatory reforms. Here are some key trends and innovations shaping the future of life insurance:

Digital Transformation

The digital age has brought about significant changes in how insurance products are marketed, sold, and serviced. Insurers are increasingly leveraging digital technologies to enhance the customer experience, streamline processes, and improve operational efficiency. From online policy applications and digital claim submissions to AI-powered chatbots for customer support, the industry is embracing digital transformation to meet the evolving needs of policyholders.

Personalized Insurance Solutions

Insureds today demand personalized insurance solutions that cater to their unique needs and circumstances. Insurers are responding by offering customized policies and add-ons that provide flexibility and tailored coverage. This shift towards personalized insurance reflects the industry’s focus on delivering value-added services and meeting the diverse needs of an increasingly discerning consumer base.

Data Analytics and Underwriting

Advanced data analytics and machine learning algorithms are transforming the underwriting process. Insurers are now able to analyze vast amounts of data to assess risk more accurately and efficiently. This enhanced risk assessment capability enables insurers to offer more precise pricing, improve claim management, and develop innovative products that better meet the needs of policyholders. The use of data analytics is also helping to identify new opportunities and develop more effective marketing strategies.

Blockchain and Smart Contracts

Blockchain technology and smart contracts are poised to revolutionize the insurance industry. By providing a secure, transparent, and tamper-proof platform for recording and managing insurance policies, blockchain technology can streamline the entire insurance lifecycle, from policy issuance to claim settlement. Smart contracts, which automatically trigger actions based on predefined conditions, can further enhance efficiency and reduce the need for manual intervention, making the insurance process faster and more cost-effective.

Insurtech Partnerships

Insurtech startups are bringing innovative technologies and business models to the insurance industry. Traditional insurers are recognizing the value of partnering with these startups to enhance their digital capabilities, improve customer engagement, and develop new products and services. These partnerships are driving industry innovation, helping insurers stay competitive in a rapidly changing market, and delivering better value to policyholders.

Conclusion: Navigating the Complexities of Life Insurance

Life insurance is a critical component of financial planning, offering protection, stability, and peace of mind to policyholders and their beneficiaries. As the industry continues to evolve, staying informed about the various policy options, benefits, and trends is essential. By understanding the intricacies of life insurance and making informed choices, individuals can ensure they have the coverage they need to protect their loved ones and achieve their financial goals.

This comprehensive guide has explored the key aspects of life insurance, from understanding policy types and benefits to maximizing policy value and staying abreast of industry trends. By leveraging this knowledge, individuals can navigate the complexities of life insurance with confidence, securing their financial future and that of their families.

What is the primary purpose of life insurance?

+Life insurance is primarily designed to provide financial protection and security to policyholders and their beneficiaries. In the event of the insured’s death, the policy pays out a specified sum of money to the beneficiary, ensuring they can cover funeral expenses, pay off debts, and maintain their standard of living.

How do I choose the right life insurance policy for my needs?

+When choosing a life insurance policy, consider your current and future financial needs. Assess your obligations, such as mortgage payments, outstanding debts, and future goals. Term life insurance might be suitable for temporary coverage, while permanent life insurance offers lifelong protection and financial flexibility. It’s also essential to evaluate the policy’s premiums, benefits, and add-ons to ensure it aligns with your needs.

Can I access the cash value of my life insurance policy during my lifetime?

+Yes, many life insurance policies, particularly permanent life insurance, offer the option of policy loans or withdrawals. This allows you to access the cash value of your policy, which can be beneficial in emergencies or to fund major life events. However, it’s important to understand the implications of these actions, as they may impact your policy’s cash value and death benefit.

How often should I review my life insurance policy?

+It’s recommended to review your life insurance policy regularly, ideally once a year or whenever there’s a significant change in your life circumstances. This ensures your coverage remains adequate and aligned with your current and future financial goals. Reviewing your policy also allows you to explore new add-ons or riders that might enhance your coverage.