Online Home Insurance Quotation

Securing the right home insurance coverage is an essential step in protecting your biggest asset and ensuring peace of mind. With the convenience of online platforms, obtaining a home insurance quote has become a streamlined process, allowing homeowners to quickly assess their options and make informed decisions. In this comprehensive guide, we delve into the world of online home insurance quotations, exploring the factors that influence quotes, the benefits of digital quotes, and how to navigate the process to find the best coverage for your unique needs.

Understanding the Factors That Impact Your Home Insurance Quote

When requesting an online home insurance quote, several factors come into play, each influencing the final quotation you receive. Here’s an in-depth look at these key considerations:

Location, Location, Location

The geographical location of your home plays a significant role in determining your insurance quote. Different regions have varying risks, from natural disasters like hurricanes and wildfires to crime rates and proximity to emergency services. Insurance providers assess these risks to tailor quotes accordingly. For instance, areas prone to natural disasters may have higher premiums to account for the increased likelihood of claims.

| Region | Average Annual Premium |

|---|---|

| Coastal Areas | $2,500 |

| Urban Centers | $1,800 |

| Suburban Areas | $1,500 |

It's crucial to understand that while you can't change your home's location, being aware of the associated risks allows you to prepare and potentially mitigate some of these factors. For example, installing storm shutters in hurricane-prone areas or investing in home security systems can not only enhance your safety but also positively impact your insurance quote.

The Age and Condition of Your Home

The age of your home and its overall condition are vital aspects that insurance providers evaluate when generating quotes. Older homes, especially those built before modern safety standards, may require more extensive coverage due to potential risks associated with outdated wiring, plumbing, or structural integrity. On the other hand, newer homes often benefit from modern construction techniques and materials, which can lead to more affordable insurance quotes.

| Home Age | Average Premium Adjustment |

|---|---|

| Built before 1960 | +10% |

| Built between 1960-1990 | +5% |

| Built after 1990 | –5% |

Regular maintenance and updates to your home can also influence your insurance quote. Well-maintained homes with recent renovations or upgrades often receive more favorable quotes, as they pose fewer risks and may have enhanced safety features.

Your Home’s Size and Construction Materials

The size of your home, measured in square footage, directly affects the scope of coverage required and, consequently, your insurance quote. Larger homes generally require more extensive coverage, as they may have more rooms, windows, and potential risks. Similarly, the construction materials used in your home’s build can impact your quote. For example, homes built with fire-resistant materials may enjoy lower premiums compared to those with more combustible materials.

| Construction Material | Premium Impact |

|---|---|

| Brick | –3% |

| Concrete | –5% |

| Wood | +2% |

Consider the unique features of your home when evaluating these factors. For instance, a home with a finished basement may require additional coverage for potential flood or water damage risks, while a home with a swimming pool may face higher liability coverage needs.

Your Personal Claim History

Your past insurance claim history is a significant factor in determining your home insurance quote. Insurance providers carefully review this information to assess your potential risk level. If you’ve made multiple claims in the past, especially for costly or frequent incidents, it may reflect negatively on your quote. Conversely, a clean claim history can lead to more favorable rates, as it demonstrates a lower risk profile.

| Claim History | Average Premium Adjustment |

|---|---|

| Multiple Claims | +15% |

| Single Claim | +5% |

| No Claims | –5% |

It's important to note that while your claim history is a critical factor, it's not the sole determinant of your insurance quote. Other factors, such as your home's location and condition, also play significant roles.

The Advantages of Obtaining an Online Home Insurance Quote

In today’s digital age, obtaining an online home insurance quote offers numerous benefits and conveniences. Here’s a closer look at why this approach is increasingly popular among homeowners:

Convenience and Speed

One of the most significant advantages of online home insurance quotes is the convenience and speed they offer. With just a few clicks, you can access multiple insurance providers and compare their offerings from the comfort of your home. This process eliminates the need for in-person meetings or lengthy phone calls, saving you valuable time and effort.

Wide Range of Options

Online platforms provide a vast array of insurance options, allowing you to explore various providers and their unique coverage offerings. Whether you’re seeking comprehensive coverage, specialized add-ons, or affordable premiums, the online marketplace offers a diverse range of choices to suit your specific needs.

Personalized Quotes

Online quotation tools are designed to provide personalized quotes based on your unique circumstances. By inputting detailed information about your home, location, and coverage preferences, these tools generate tailored quotes that reflect your specific requirements. This level of personalization ensures you receive accurate and relevant information, helping you make informed decisions.

Comparison and Cost Savings

The ability to compare multiple quotes side by side is a powerful advantage of online quotation platforms. By evaluating different providers and their offerings, you can identify the most competitive rates and potentially save money on your home insurance. This comparison process empowers you to negotiate with providers and secure the best value for your insurance needs.

Educational Resources

Many online insurance platforms offer educational resources and articles to help you better understand the home insurance landscape. These resources can provide valuable insights into different coverage options, common pitfalls to avoid, and tips for optimizing your insurance portfolio. By leveraging these educational tools, you can make more confident decisions and ensure you’re adequately protected.

Easy Policy Management

Once you’ve obtained your online home insurance quote and selected a provider, many platforms offer convenient policy management tools. These tools allow you to make policy changes, pay premiums, and access your insurance documents from a centralized digital platform. This level of convenience ensures you can easily manage your insurance coverage without the hassle of physical paperwork.

Navigating the Online Home Insurance Quotation Process

Now that we’ve explored the factors influencing your home insurance quote and the advantages of online quotations, let’s delve into the step-by-step process of obtaining an accurate and beneficial quote.

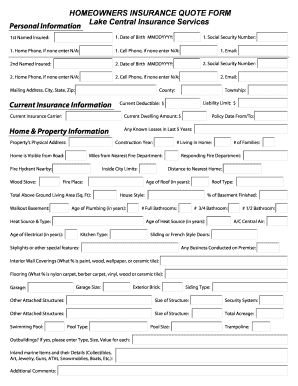

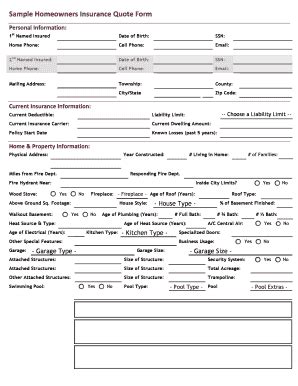

Step 1: Prepare Your Information

Before beginning the quotation process, gather the necessary information about your home and your insurance needs. This includes details such as your home’s address, construction materials, square footage, and any unique features or potential risks. Additionally, have your current insurance policy (if applicable) readily available to compare coverages and premiums.

Step 2: Choose Reputable Online Platforms

Select reputable online insurance platforms or comparison websites to obtain your quotes. Look for platforms with a solid track record, positive user reviews, and a wide range of insurance provider partnerships. These platforms should offer secure and user-friendly interfaces to ensure a seamless quotation experience.

Step 3: Input Your Details

On the chosen platform, enter your home’s details, including its location, construction, and any additional features or risks. Be as accurate and detailed as possible to ensure you receive relevant and accurate quotes. Some platforms may also request information about your personal circumstances, such as your age, occupation, and any past insurance claims.

Step 4: Compare Quotes

Once you’ve submitted your information, the platform will generate quotes from various insurance providers. Take the time to carefully review and compare these quotes, considering factors such as coverage limits, deductibles, and any additional benefits or exclusions. Ensure you understand the fine print and don’t solely focus on the lowest premium.

Step 5: Evaluate Coverage Options

Beyond the premium, evaluate the coverage options provided in each quote. Assess whether the coverage limits are sufficient for your needs and whether any additional coverage options, such as flood or earthquake insurance, are necessary given your location and circumstances. Remember, choosing the right coverage is more important than selecting the lowest premium.

Step 6: Contact Insurance Providers

If you have questions or require clarification about a specific quote, don’t hesitate to reach out to the insurance provider. Many providers offer dedicated customer support channels, allowing you to discuss your concerns and gain a better understanding of their coverage and policies.

Step 7: Finalize Your Selection

After thorough evaluation and comparison, select the insurance provider and policy that best align with your needs and budget. Finalize the application process by providing any additional required information and paying the initial premium. Congratulations! You’ve successfully obtained an online home insurance quote and are now one step closer to securing comprehensive coverage for your home.

Conclusion: Empowering Homeowners with Knowledge

Obtaining an online home insurance quote is a powerful tool for homeowners seeking to protect their assets and financial well-being. By understanding the factors that influence quotes and leveraging the advantages of digital platforms, you can make informed decisions and secure the best coverage for your unique circumstances. Remember, your home is a valuable investment, and the right insurance coverage is essential to safeguarding it.

Frequently Asked Questions

How do I know if my home insurance quote is accurate?

+

To ensure accuracy, carefully review the quote details, including coverage limits, deductibles, and any exclusions. Compare it with your current policy (if applicable) and seek clarification from the insurance provider if needed. Accuracy depends on the information you provide, so be as detailed as possible during the quotation process.

Can I negotiate my home insurance quote?

+

Yes, you can negotiate your home insurance quote, especially if you’re a loyal customer or have a clean claim history. Contact the insurance provider and discuss your concerns, highlighting your commitment to the company and any relevant factors that may impact your risk profile. Negotiation can lead to better rates or additional coverage benefits.

What happens if I need to make changes to my home insurance policy after obtaining a quote?

+

If you need to make changes to your home insurance policy after obtaining a quote, simply contact your insurance provider and discuss the necessary adjustments. They will guide you through the process, potentially requiring additional information or forms to finalize the changes. It’s important to keep your policy up-to-date to ensure adequate coverage.

How often should I review and update my home insurance coverage?

+

It’s recommended to review your home insurance coverage annually or whenever significant changes occur in your home or personal circumstances. This ensures your coverage remains adequate and aligned with your needs. Regular reviews help you stay informed and make necessary adjustments to protect your home effectively.

Are there any additional coverage options I should consider for my home insurance policy?

+

Depending on your location and circumstances, you may want to consider additional coverage options such as flood insurance, earthquake coverage, or personal liability insurance. These add-ons provide extra protection for specific risks, ensuring you’re fully prepared for various scenarios. Consult with your insurance provider to determine the best coverage for your needs.