Car Insurance Lowest Rate

In the world of automotive insurance, finding the lowest rate can be a challenging yet rewarding endeavor. With countless providers and policies available, it's crucial to understand the factors that influence these rates and the strategies to secure the best deal. This comprehensive guide will delve into the intricacies of obtaining the lowest car insurance rates, offering a detailed analysis of the process, backed by real-world examples and industry insights.

Understanding Car Insurance Rates

Car insurance rates are not standardized across the industry. They vary significantly based on a multitude of factors, making it essential to comprehend these influences to negotiate the best possible deal.

Key Factors Affecting Insurance Rates

- Driver’s Profile: Age, gender, driving history, and credit score play a pivotal role in determining insurance rates. For instance, young drivers often face higher premiums due to their perceived risk, while a clean driving record and a good credit score can work in your favor.

- Vehicle Type: The make, model, and age of your vehicle impact insurance costs. Sports cars and luxury vehicles, known for their higher repair costs, typically attract higher premiums. On the other hand, economy cars and sedans are often more affordable to insure.

- Coverage Options: The level of coverage you choose affects your premium. Comprehensive and collision coverage provide broader protection but cost more, while liability-only coverage is more affordable but offers limited protection.

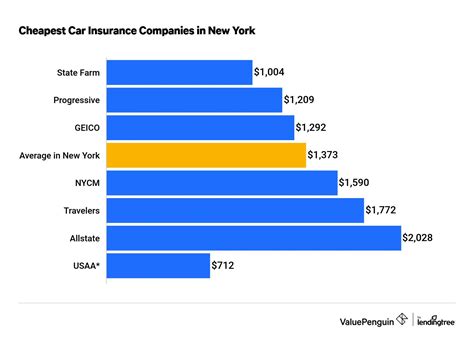

- Location: Insurance rates vary significantly based on your geographic location. Urban areas with higher crime rates and traffic congestion often see higher premiums.

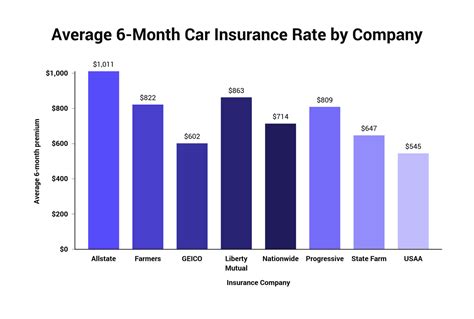

- Insurance Company: Different insurance providers offer varying rates for similar coverage. It’s crucial to shop around and compare quotes to find the best deal.

The Impact of Discounts and Bundling

Insurance companies offer a range of discounts to incentivize customers. These discounts can significantly reduce your premium and are often an effective strategy to obtain lower rates. Some common discounts include:

- Safe Driver Discount: Awarded to drivers with a clean driving record, free of accidents and traffic violations.

- Multi-Policy Discount: Offered when you bundle your car insurance with other policies, such as home or renters insurance.

- Payment Method Discount: Provided when you choose to pay your premium in full or via certain payment methods like automatic bank withdrawals.

- Loyalty Discount: Awarded to long-term customers who have maintained their policy with the same insurer.

- Low Mileage Discount: Given to drivers who drive fewer miles annually, typically less than 7,500 miles.

Shopping for the Best Car Insurance Rates

To secure the lowest car insurance rates, a systematic approach is necessary. Here’s a step-by-step guide to help you navigate the process effectively.

Assess Your Coverage Needs

Before shopping for insurance, understand your coverage requirements. Consider the value of your vehicle, your personal financial situation, and your risk tolerance. While comprehensive coverage provides the most protection, it’s not always necessary, especially for older vehicles. Opting for liability-only coverage can be a cost-effective choice if you’re comfortable with the associated risks.

Compare Quotes from Multiple Insurers

Obtaining multiple quotes is crucial to finding the best rate. Online quote comparison tools can provide a quick and easy way to compare rates from various insurers. However, be sure to provide accurate and detailed information to ensure an apples-to-apples comparison. Additionally, contact insurers directly to discuss your options and inquire about potential discounts.

| Insurance Company | Average Annual Premium |

|---|---|

| State Farm | $1,200 |

| Geico | $1,150 |

| Progressive | $1,350 |

| Allstate | $1,400 |

| Esurance | $1,250 |

Negotiate and Bundle Policies

Don’t be afraid to negotiate with insurers. Explain your coverage needs and budget, and inquire about potential discounts. Bundling your car insurance with other policies, such as home or renters insurance, can lead to significant savings. Many insurers offer multi-policy discounts, so it’s worth exploring this option.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach where your premium is based on your actual driving behavior. Insurers monitor your driving habits, such as miles driven, time of day, and driving style, to determine your premium. This can be an excellent option for low-mileage drivers or those with a safe driving record.

Review Your Policy Regularly

Car insurance rates can fluctuate over time, so it’s essential to review your policy annually. Factors like changes in your driving record, vehicle upgrades, or relocating to a new area can impact your premium. Regularly comparing rates and updating your policy can ensure you’re always getting the best deal.

Future Trends and Implications

The car insurance industry is evolving rapidly, driven by technological advancements and changing consumer preferences. Here’s a glimpse into the future and its potential impact on insurance rates.

Autonomous Vehicles and Safety Features

The rise of autonomous vehicles and advanced safety features is expected to significantly reduce accident rates. This could lead to lower insurance premiums as the risk of accidents diminishes. However, the initial cost of insuring autonomous vehicles may be higher due to the complex technology involved.

Telematics and Data-Driven Insurance

Telematics, the use of technology to collect and transmit vehicle data, is transforming the insurance industry. With real-time data on driving behavior, insurers can offer more precise premiums based on individual risk profiles. This trend could benefit safe drivers with the potential for significant savings.

Digital Transformation and Direct-to-Consumer Models

The digital revolution is simplifying the insurance shopping experience, with many insurers now offering online quote tools and policy management platforms. This shift towards a direct-to-consumer model can result in lower operating costs for insurers, potentially translating to more competitive rates for consumers.

The Impact of Climate Change

Climate change is expected to influence insurance rates, particularly in regions prone to natural disasters. As extreme weather events become more frequent, insurers may adjust their rates to account for increased risk. This highlights the importance of being proactive in choosing an insurer that offers competitive rates while maintaining financial stability.

Conclusion

Securing the lowest car insurance rate requires a combination of understanding the factors that influence premiums, shopping around, and negotiating effectively. With the ever-evolving insurance landscape, staying informed about the latest trends and advancements can ensure you’re always getting the best value for your money. By following the strategies outlined in this guide, you can navigate the insurance market with confidence and find the coverage that suits your needs and budget.

How often should I review my car insurance policy to ensure I’m getting the best rate?

+

It’s recommended to review your policy annually, especially after any significant life events or changes in your driving habits. This ensures you’re always getting the most competitive rate.

Are there any hidden costs associated with car insurance quotes?

+

Some insurers may charge administrative fees or add-on costs, so it’s essential to review the fine print carefully before finalizing your policy.

What is the average cost of car insurance per month in the United States?

+

The average cost of car insurance in the U.S. varies greatly by state and can range from 50 to 200 per month, with an overall average of around $100 per month.

Can I switch car insurance companies mid-policy if I find a better rate?

+

Yes, you can switch insurance companies at any time. However, be mindful of any cancellation fees or penalties that may apply with your current insurer.