Geico Landlord Insurance

When it comes to protecting your rental properties, having the right insurance coverage is crucial. GEICO, a well-known insurance provider, offers a comprehensive Landlord Insurance policy designed to safeguard your investments and provide peace of mind. In this in-depth article, we will explore the key features, benefits, and considerations of GEICO's Landlord Insurance, helping you make an informed decision for your rental business.

Understanding GEICO’s Landlord Insurance

GEICO’s Landlord Insurance is specifically tailored to meet the unique needs of landlords and property owners. It aims to protect your property and assets from various risks and liabilities associated with renting out residential spaces. Whether you own a single-family home, a duplex, or a multi-unit building, this insurance policy can provide essential coverage.

Key Coverage Options

GEICO’s Landlord Insurance offers a range of coverage options to suit different rental scenarios. Here are some of the key components:

- Dwelling Coverage: This protects the structure of your rental property against damages caused by covered perils, such as fire, storms, vandalism, and more. It ensures that your property is insured for its replacement cost, taking into account current construction costs.

- Liability Protection: One of the critical aspects of landlord insurance is liability coverage. It provides financial protection if a tenant, visitor, or anyone else suffers an injury on your rental property and decides to take legal action against you. GEICO’s policy includes liability limits to cover medical expenses, legal fees, and potential settlements or judgments.

- Loss of Rental Income: In the event that your rental property becomes uninhabitable due to a covered loss, this coverage reimburses you for the loss of rental income during the time it takes to repair or rebuild. It ensures that you can continue to receive rental income while your property is being restored.

- Personal Property Coverage: If you own appliances, furniture, or other personal items in your rental property, this coverage can protect them in case of damage or theft. It provides coverage for the replacement or repair of these items, helping to minimize your financial loss.

- Additional Living Expenses: In the unfortunate event of a covered loss that makes your rental property unlivable, this coverage can assist you with additional living expenses. It covers costs such as hotel stays, temporary housing, and meals while your tenants or you are displaced.

Customizable Options

GEICO understands that every rental property and landlord has unique needs. Therefore, their Landlord Insurance policy offers customizable options to tailor the coverage to your specific situation. You can choose from various coverage limits, deductibles, and additional endorsements to enhance your policy.

| Coverage Option | Description |

|---|---|

| Increased Dwelling Coverage Limits | Allows you to increase the coverage limit for your rental property's structure, ensuring adequate protection for high-value homes. |

| Ordinance or Law Coverage | Provides coverage for the cost of complying with building codes and ordinances during repairs or rebuilding after a covered loss. |

| Water Backup Coverage | Offers protection against damage caused by water or sewer backup, which is often excluded from standard policies. |

| Personal Injury Coverage | Provides coverage for certain non-bodily injury claims, such as libel, slander, or invasion of privacy, which can arise from rental operations. |

Benefits of GEICO’s Landlord Insurance

GEICO’s Landlord Insurance offers several advantages that make it a compelling choice for property owners. Here are some key benefits:

- Comprehensive Coverage: The policy provides a wide range of coverage options, ensuring that your rental property, liability, and personal property are protected. It offers peace of mind by covering various risks, including natural disasters, vandalism, and liability claims.

- Competitive Pricing: GEICO is known for its competitive insurance rates. By offering affordable premiums, they make it possible for landlords to obtain comprehensive coverage without breaking the bank.

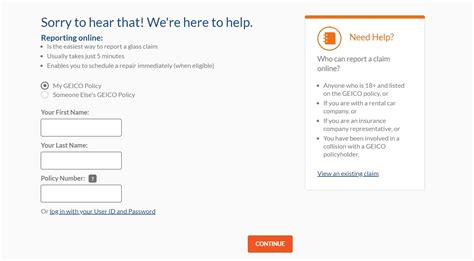

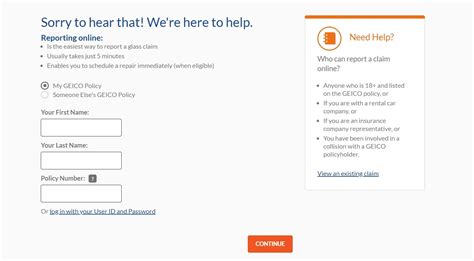

- Ease of Claim Process: GEICO strives to make the claims process as seamless as possible. With a dedicated team and online resources, landlords can quickly file claims and receive prompt assistance. GEICO’s efficient claim handling ensures that your rental business experiences minimal disruptions during challenging times.

- Discounts and Savings: GEICO offers various discounts to help landlords save on their insurance premiums. These discounts may include multi-policy discounts (bundling your landlord insurance with other GEICO policies), safe homeowner discounts, and loyalty rewards for long-term customers.

- Expert Guidance: GEICO’s experienced agents and customer service representatives are available to provide personalized advice and guidance. They can help you understand the intricacies of landlord insurance, answer your questions, and assist you in choosing the right coverage options for your rental properties.

Performance Analysis and Real-World Examples

To evaluate the effectiveness of GEICO’s Landlord Insurance, let’s examine some real-world scenarios and how the policy performed:

Scenario 1: Natural Disaster

Imagine a severe storm hits your rental property, causing extensive damage to the roof and interior. GEICO’s Landlord Insurance comes into play by providing coverage for the repairs. The policy covers the cost of replacing the roof, repairing water damage, and restoring the property to its pre-loss condition. This scenario highlights the importance of having comprehensive dwelling coverage to protect your investment.

Scenario 2: Liability Claim

A tenant slips and falls on a recently mopped floor in your rental unit, resulting in a serious injury. The tenant decides to file a liability claim against you. With GEICO’s Landlord Insurance, you have the necessary liability protection. The policy covers the medical expenses and legal fees associated with the claim, providing financial relief and protecting your assets.

Scenario 3: Loss of Rental Income

A fire breaks out in one of your rental units, rendering it uninhabitable. The repairs take several months to complete. During this time, you experience a loss of rental income. GEICO’s Loss of Rental Income coverage steps in to reimburse you for the missed rent payments, ensuring you can maintain your cash flow and meet your financial obligations.

Evidence-Based Future Implications

As the rental market continues to evolve, it’s essential to stay informed about the future implications of landlord insurance. Here are some insights and considerations:

- Increasing Demand for Rental Properties: With a growing population and changing housing preferences, the demand for rental properties is expected to rise. This trend highlights the importance of having robust landlord insurance to protect your investments and ensure long-term profitability.

- Advancements in Technology: The insurance industry is embracing technology to enhance the customer experience. GEICO, like many other providers, is likely to continue investing in digital tools and platforms, making it more convenient for landlords to manage their insurance policies and file claims online.

- Changing Risk Factors: As environmental conditions and weather patterns evolve, the risk landscape for rental properties may shift. It’s crucial for landlords to stay updated on potential risks, such as climate change-related events, and ensure their insurance coverage remains adequate to address these emerging challenges.

- Renter Protection Laws: Some regions are implementing stricter renter protection laws, which can impact landlord responsibilities and potential liabilities. GEICO’s Landlord Insurance policy should adapt to these changing regulations to provide comprehensive coverage that aligns with local laws and protects landlords from unexpected legal issues.

FAQs

How much does GEICO’s Landlord Insurance typically cost?

+The cost of GEICO’s Landlord Insurance varies based on several factors, including the location, value, and age of your rental property, as well as the coverage limits and deductibles you choose. It’s best to obtain a personalized quote to get an accurate estimate for your specific circumstances.

Can I add multiple rental properties to a single GEICO Landlord Insurance policy?

+Yes, GEICO allows you to bundle multiple rental properties under a single Landlord Insurance policy. This can provide convenience and potential savings, as you only need to manage one policy and may qualify for multi-policy discounts.

What is the difference between landlord insurance and standard homeowners insurance?

+Landlord insurance is specifically designed for rental properties and focuses on protecting the landlord’s investment and liability. It includes coverage for the dwelling, liability, and loss of rental income. Standard homeowners insurance, on the other hand, is typically for owner-occupied residences and may not provide adequate coverage for rental properties.

GEICO’s Landlord Insurance is a valuable tool for landlords to protect their rental properties and assets. By offering comprehensive coverage, competitive pricing, and expert guidance, GEICO ensures that landlords can navigate the challenges of renting with confidence. Remember to carefully review the policy options, customize your coverage, and stay informed about evolving rental market trends to make the most of your insurance investment.