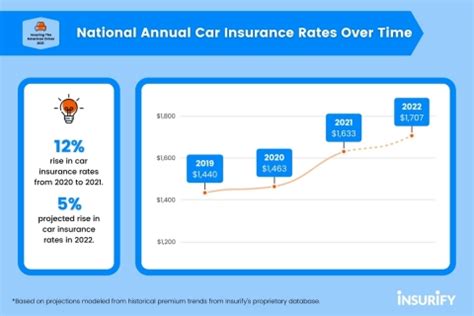

Car Insurance Rate Increase

Understanding the factors that contribute to car insurance rate increases is crucial for both policyholders and insurers alike. These rate adjustments, often an inevitable part of the insurance landscape, can significantly impact a driver's financial planning and insurance coverage choices. In this comprehensive article, we delve into the intricate details of why car insurance rates increase, exploring the underlying causes, the methods insurers employ to determine these changes, and the strategies consumers can adopt to mitigate the impact.

The Complex Dynamics of Car Insurance Rate Increases

The insurance industry operates on a delicate balance of risk assessment and actuarial science. When it comes to car insurance rate increases, a multitude of factors come into play, each influencing the final premium calculation. From individual driving records to broader industry trends, these elements collectively shape the insurance landscape, often leading to rate adjustments.

Personal Factors: The Impact of Driving Behavior

One of the primary drivers of car insurance rate increases is the personal behavior of the policyholder. Insurers carefully evaluate a driver’s history, taking into account factors such as:

- Accidents and Claims: Past accidents, regardless of fault, can signal an increased risk for insurers. A history of multiple claims suggests a higher likelihood of future incidents, prompting insurers to adjust rates accordingly.

- Moving Violations: Speeding tickets, DUI convictions, and other moving violations are red flags for insurers. These indicate a disregard for traffic laws and can lead to significant rate hikes.

- License Status: A suspended or revoked license is a major concern for insurers. It often signifies a pattern of irresponsible behavior and can result in higher insurance premiums.

- Credit Score: Surprisingly, an individual’s credit score can influence their insurance rates. Insurers use credit-based insurance scores as a predictor of risk, with lower scores often leading to higher premiums.

Demographic and Geographical Factors

Beyond individual behavior, demographic and geographical factors play a significant role in car insurance rate calculations. These include:

- Age and Gender: Younger drivers, particularly males, are statistically more likely to be involved in accidents. This demographic profile often results in higher insurance rates for this group.

- Location: The area where a policyholder lives and drives can impact their insurance rates. Urban areas with higher traffic density and crime rates often see increased premiums. Similarly, regions with severe weather conditions may also experience rate adjustments.

Vehicle-Specific Factors

The type of vehicle insured is another crucial factor in rate calculations. Insurers consider:

- Vehicle Make and Model: Certain vehicles, especially high-performance cars, are more prone to accidents and theft. Insurers take this into account when determining rates.

- Vehicle Age: Older vehicles may have lower repair costs, but they also tend to have lower safety ratings and may lack modern safety features. This can lead to varying insurance rates.

- Vehicle Usage: The purpose for which a vehicle is used can impact rates. For instance, a car primarily used for business purposes may face higher rates due to increased mileage and potential risk.

Industry Trends and External Factors

Car insurance rates are not solely influenced by individual factors. Industry-wide trends and external factors also play a significant role:

- Claims Frequency and Severity: An increase in the number and cost of insurance claims across the industry can prompt insurers to raise rates to maintain profitability.

- Economic Conditions: Inflation and economic downturns can impact the cost of repairs and medical expenses, leading to higher insurance premiums.

- Regulatory Changes: Government regulations and legal reforms can affect the insurance landscape. For instance, changes in no-fault insurance laws can impact premium structures.

- Competitive Landscape: The insurance market is highly competitive. Insurers may adjust rates to remain competitive or to respond to the pricing strategies of their rivals.

Rate Adjustment Methods: A Behind-the-Scenes Look

Insurers employ sophisticated actuarial and statistical methods to determine car insurance rate increases. These processes are designed to accurately assess risk and ensure the financial stability of the insurance company. Here’s a glimpse into the methodologies:

- Actuarial Analysis: Actuaries play a pivotal role in insurance rate determination. They use mathematical and statistical models to predict future losses and set appropriate premiums. This involves analyzing historical data, understanding industry trends, and assessing the risk profile of policyholders.

- Experience Rating: This method adjusts rates based on an individual policyholder’s claims experience. Policyholders with a history of frequent or costly claims may see their rates increase, while those with a clean record may enjoy lower premiums.

- Loss Ratio Analysis: Insurers closely monitor their loss ratios, which represent the ratio of incurred losses to earned premiums. If the loss ratio exceeds a certain threshold, insurers may need to increase rates to maintain solvency.

- Risk Pooling: Insurers group policyholders with similar risk profiles into risk pools. This allows for more accurate rate setting and ensures that policyholders with lower risk subsidize those with higher risk, creating a fairer premium structure.

Mitigating Rate Increases: Strategies for Policyholders

While car insurance rate increases are often inevitable, policyholders have several strategies at their disposal to minimize the impact and potentially reduce their premiums:

- Safe Driving Practices: Maintaining a clean driving record is crucial. Avoid accidents, reduce speeding, and practice defensive driving to keep your insurance rates as low as possible.

- Choose the Right Coverage: Evaluate your insurance needs and choose the coverage that suits your circumstances. Opting for higher deductibles can lower your premium, but ensure you can afford the out-of-pocket expense in case of a claim.

- Bundle Policies: Consider bundling your car insurance with other policies, such as home or life insurance. Many insurers offer discounts for multiple policy purchases.

- Shop Around: Insurance rates can vary significantly between providers. Compare quotes from multiple insurers to find the best deal for your specific situation.

- Understand Your Policy: Familiarize yourself with your insurance policy. Know what’s covered and what’s not to avoid surprises. Review your policy annually to ensure it aligns with your changing needs and circumstances.

The Future of Car Insurance Rates: A Data-Driven Perspective

The insurance industry is undergoing a transformative phase, driven by advancements in technology and data analytics. This shift is expected to have a significant impact on how car insurance rates are determined in the future:

- Telematics and Usage-Based Insurance: Telematics devices and smartphone apps are increasingly being used to monitor driving behavior in real-time. This data can be used to offer personalized insurance rates based on actual driving habits, rewarding safe drivers with lower premiums.

- Big Data Analytics: Insurers are leveraging vast amounts of data to improve risk assessment. By analyzing large datasets, insurers can identify patterns and trends, leading to more accurate and fair premium calculations.

- Artificial Intelligence (AI) and Machine Learning: AI technologies are being employed to automate and enhance various aspects of the insurance process, including rate determination. Machine learning algorithms can analyze complex data and make predictions, helping insurers set more precise premiums.

- Predictive Modeling: Advanced predictive modeling techniques are enabling insurers to forecast future claims more accurately. This can lead to more efficient rate setting and better risk management.

Conclusion: Navigating the Complex World of Car Insurance Rates

Car insurance rate increases are a complex and multifaceted issue, influenced by a multitude of factors. While these rate adjustments can be challenging for policyholders, understanding the underlying causes and employing strategic approaches can help mitigate their impact. The insurance industry’s ongoing transformation, driven by technology and data, promises a future where car insurance rates are more personalized, accurate, and fair.

As we navigate the ever-evolving landscape of car insurance, staying informed and proactive is key. By staying abreast of industry trends and adopting safe driving practices, policyholders can ensure they're getting the best value for their insurance premiums.

FAQ

How often do car insurance rates increase?

+

Car insurance rates can increase annually or more frequently, depending on various factors such as personal driving behavior, demographic changes, and industry trends. Some insurers may also adjust rates mid-policy term if significant changes occur.

Can I negotiate my car insurance rates?

+

While insurance rates are primarily determined by actuarial calculations, you can still negotiate with your insurer. Review your policy annually, discuss your needs and circumstances, and inquire about potential discounts or rate adjustments. Building a strong relationship with your insurer can sometimes lead to favorable terms.

What can I do to lower my car insurance rates if they increase?

+

If your car insurance rates increase, consider these strategies: improve your driving record by avoiding accidents and violations, shop around for better rates, bundle your policies to take advantage of multi-policy discounts, and increase your deductibles to reduce your premium. Additionally, maintain a good credit score, as it can positively impact your insurance rates.

Are there any government regulations that impact car insurance rates?

+

Yes, government regulations play a significant role in the insurance industry. Laws regarding minimum coverage requirements, no-fault insurance, and rate regulation can directly impact car insurance rates. Stay informed about these regulations in your state to understand their potential influence on your premiums.