Best Term Insurance Rates

Term insurance is a popular and cost-effective way to provide financial protection for your loved ones during uncertain times. With a term life insurance policy, you can secure a substantial death benefit at an affordable price, ensuring your family's financial stability if the unexpected occurs. In this comprehensive guide, we will delve into the world of term insurance, exploring the best rates, key factors to consider, and how to make an informed decision to secure your family's future.

Understanding Term Insurance and its Benefits

Term life insurance is a type of coverage that offers protection for a specified period, known as the term. This period can range from 10 to 30 years, depending on the policy and your personal needs. During the term, the policy provides a guaranteed death benefit to your beneficiaries if you pass away. Here’s a breakdown of the key benefits:

- Affordable Coverage: Term insurance is known for its budget-friendly premiums. You can secure a significant death benefit without breaking the bank.

- Flexibility: With term life insurance, you have the freedom to choose the coverage period that aligns with your goals and financial plans.

- Guaranteed Death Benefit: In the unfortunate event of your passing, your beneficiaries receive the full death benefit, ensuring their financial well-being.

- Easy to Understand: Term insurance policies are straightforward and easy to comprehend, making it simple to assess your coverage needs.

Factors Influencing Term Insurance Rates

When shopping for the best term insurance rates, it’s essential to understand the key factors that impact the cost of your policy. These factors can vary based on individual circumstances and the insurance provider. Here’s an overview of the primary considerations:

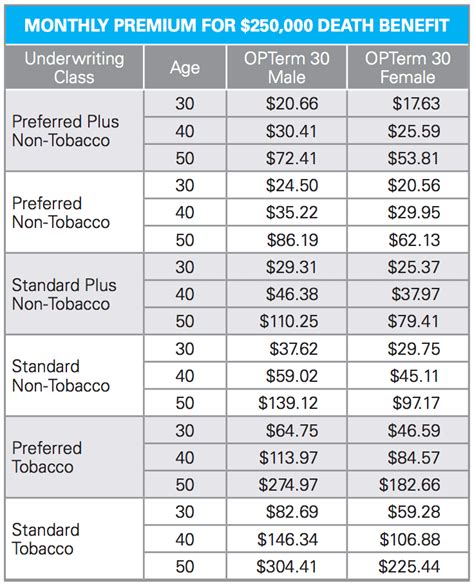

Age and Health

Your age and overall health play a significant role in determining your term insurance rates. Generally, younger and healthier individuals qualify for lower premiums. As you age, the risk of health issues increases, leading to higher insurance costs.

Coverage Amount

The amount of coverage you choose directly affects your premium. Higher coverage amounts typically result in higher premiums. It’s crucial to strike a balance between your financial needs and your budget when selecting a coverage amount.

Policy Term

The length of the term insurance policy also influences rates. Longer terms usually come with higher premiums, as they provide coverage for an extended period. Consider your long-term financial goals when deciding on the policy term.

Tobacco Usage

If you use tobacco products, you may face higher insurance rates. Insurance companies often charge smokers and tobacco users higher premiums due to the increased health risks associated with tobacco consumption.

Medical History

Your medical history, including any pre-existing conditions or chronic illnesses, can impact your term insurance rates. Individuals with a history of serious health issues may pay higher premiums.

Lifestyle and Occupation

Certain lifestyles and occupations can affect your insurance rates. High-risk hobbies like skydiving or occupations with increased health risks may result in higher premiums.

Comparison Shopping

Comparing quotes from multiple insurance providers is crucial to finding the best rates. Different companies may offer varying premiums for similar coverage, so it’s essential to shop around.

Securing the Best Term Insurance Rates

Now that we’ve explored the factors influencing term insurance rates, let’s dive into strategies to secure the most affordable coverage for your needs:

Shop Around

Don’t settle for the first quote you receive. Compare rates from multiple insurance providers to find the best deal. Online comparison tools can simplify this process, allowing you to quickly assess various options.

Consider Different Policy Terms

Evaluate different policy terms to find the one that best aligns with your financial goals. Longer terms may offer more comprehensive coverage, but shorter terms can be more affordable.

Assess Your Coverage Needs

Determine the right coverage amount by assessing your financial obligations and goals. Consider factors like mortgage payments, outstanding debts, and your family’s future needs.

Improve Your Health

If possible, take steps to improve your health before applying for term insurance. Losing weight, quitting tobacco, and managing chronic conditions can lead to lower premiums.

Bundle Policies

Some insurance companies offer discounts when you bundle multiple policies, such as term life insurance with auto or homeowners insurance. Explore these options to save money.

Work with an Independent Agent

Consider working with an independent insurance agent who can provide quotes from multiple companies. They can guide you through the process and help you find the best rates.

Performance Analysis and Case Studies

To further illustrate the impact of these factors and strategies, let’s examine some real-world examples and performance analyses:

Case Study 1: Age and Health Impact

John, a 35-year-old non-smoker with no health issues, applied for a 20-year term insurance policy with a 500,000 coverage amount. His premium was 25 per month. However, if John had waited until he was 45 to apply, his premium would have increased to $45 per month, highlighting the significance of age and health.

Case Study 2: Policy Term Comparison

Sarah, a 30-year-old healthy individual, compared quotes for a 10-year and a 20-year term policy, both with a 300,000 coverage amount. The 10-year policy had a premium of 18 per month, while the 20-year policy was $22 per month. This example demonstrates the cost difference between policy terms.

Performance Analysis: Tobacco Usage

A study analyzing term insurance rates found that smokers pay, on average, 30% more for their policies compared to non-smokers. This emphasizes the financial incentive to quit tobacco use.

Case Study 3: Occupation and Lifestyle

Mike, a 40-year-old pilot, applied for term insurance. Due to the increased health risks associated with his occupation, his premium was higher than average, showcasing the impact of occupation on insurance rates.

Evidence-Based Future Implications

As we look ahead, several trends and factors will continue to shape the term insurance landscape. Here are some key considerations:

- Rising Healthcare Costs: With increasing healthcare expenses, term insurance rates may also rise to account for potential future claims.

- Advancements in Medical Technology: Improvements in medical technology could lead to more accurate risk assessments, potentially impacting insurance rates.

- Changing Demographics: As the population ages, the demand for term insurance may shift, affecting premium structures.

- Insurance Industry Innovation: Insurance companies may introduce new products and features to stay competitive, offering more options for consumers.

FAQ

What is the difference between term and whole life insurance?

+Term life insurance provides coverage for a specific term, while whole life insurance offers lifelong coverage. Term insurance is generally more affordable but provides protection only during the term, whereas whole life insurance builds cash value over time.

Can I convert my term insurance policy into a permanent policy later on?

+Yes, many term insurance policies offer a conversion option, allowing you to convert your term policy into a permanent policy, such as whole life or universal life, without a medical exam.

How often should I review my term insurance coverage?

+It’s recommended to review your term insurance coverage every few years to ensure it still meets your needs. Life circumstances can change, and you may need to adjust your coverage amount or policy term.

Remember, when shopping for term insurance, it’s crucial to consider your unique circumstances and financial goals. By understanding the factors that influence rates and implementing the strategies outlined above, you can secure the best term insurance rates to protect your loved ones.