How Does Motor Insurance Work

Motor insurance, also known as auto insurance or car insurance, is an essential financial safeguard for vehicle owners. It provides coverage for various risks and liabilities associated with owning and operating a motor vehicle. Understanding how motor insurance works is crucial for ensuring you have the right protection in place and knowing what to expect in different scenarios. In this comprehensive guide, we will delve into the world of motor insurance, covering its basics, key components, and how it operates in real-world situations.

Understanding Motor Insurance: The Basics

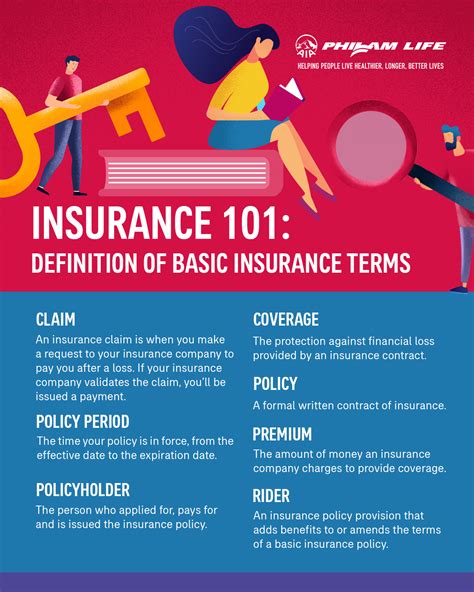

Motor insurance is a contract between an individual (the policyholder) and an insurance company. It involves the policyholder paying a premium to the insurer in exchange for financial protection against potential losses or damages resulting from using their vehicle.

Here are the fundamental aspects of motor insurance:

- Policy Coverage: Motor insurance policies typically offer a range of coverage options, including liability coverage, collision coverage, comprehensive coverage, and additional add-ons. Each type of coverage addresses different risks and scenarios.

- Premiums: Policyholders pay a premium, usually on a monthly or annual basis, to maintain their insurance coverage. The premium amount is influenced by factors such as the policyholder's driving history, the type of vehicle, and the level of coverage chosen.

- Deductibles: Deductibles are the amount the policyholder must pay out of pocket before the insurance coverage kicks in. Higher deductibles often result in lower premiums, as they indicate a willingness to share more of the financial risk.

- Policy Terms: Motor insurance policies have specific terms and conditions that outline the rights and responsibilities of both the insurer and the policyholder. These terms detail the coverage limits, exclusions, and any special conditions that apply.

Key Components of Motor Insurance

Motor insurance policies consist of several key components that determine the level of protection and the benefits provided. Let’s explore these components in detail:

Liability Coverage

Liability coverage is a fundamental aspect of motor insurance. It protects policyholders from financial losses arising from accidents or incidents where they are legally responsible. This coverage includes bodily injury liability and property damage liability.

- Bodily Injury Liability: This coverage provides compensation for injuries sustained by other individuals involved in an accident caused by the policyholder. It covers medical expenses, lost wages, and pain and suffering.

- Property Damage Liability: Property damage liability coverage pays for damages to other people's property, such as vehicles, structures, or personal belongings, resulting from an accident caused by the policyholder.

Collision Coverage

Collision coverage is designed to protect policyholders in the event of a collision with another vehicle or object. It covers the cost of repairing or replacing the insured vehicle, regardless of who is at fault.

- Repairs or Replacement: If the insured vehicle is damaged in a collision, collision coverage helps cover the costs of repairs. If the vehicle is deemed a total loss, collision coverage may provide funds to replace the vehicle.

- Fault Determination: Collision coverage typically applies regardless of fault. Even if the policyholder is not at fault, this coverage ensures they are not left with the financial burden of repairing their vehicle.

Comprehensive Coverage

Comprehensive coverage provides protection against a wide range of non-collision incidents, including theft, vandalism, natural disasters, and other unforeseen events.

- Vandalism and Theft: Comprehensive coverage compensates policyholders for damages resulting from acts of vandalism or theft of their vehicle. It covers repairs or replacement costs.

- Natural Disasters: This coverage extends to damages caused by natural disasters like hurricanes, floods, or wildfires. It can be crucial for policyholders living in areas prone to such events.

- Animal Strikes: Comprehensive coverage often includes protection for accidents involving animals, such as collisions with deer or other wildlife.

Additional Coverage Options

Motor insurance policies may offer various optional add-ons or endorsements to cater to specific needs and preferences. Here are a few common additional coverage options:

- Uninsured/Underinsured Motorist Coverage: This coverage protects policyholders in the event of an accident with an uninsured or underinsured driver. It provides compensation for medical expenses and property damage.

- Medical Payments Coverage: Medical payments coverage, often referred to as "MedPay," covers the medical expenses of the policyholder and their passengers, regardless of fault.

- Rental Car Coverage: Rental car coverage provides reimbursement for rental expenses if the insured vehicle is inoperable due to an insured incident.

- Gap Coverage: Gap coverage is especially valuable for individuals who lease or finance their vehicles. It covers the difference between the vehicle's actual cash value and the remaining loan or lease balance in the event of a total loss.

The Claims Process

When an insured incident occurs, policyholders must navigate the claims process to receive compensation. Here’s an overview of how the claims process typically unfolds:

- Reporting the Claim: Policyholders must promptly report the incident to their insurance company, providing detailed information about the accident, including the date, time, location, and any relevant details.

- Claim Investigation: The insurance company assigns a claims adjuster to investigate the claim. The adjuster may request additional information, such as police reports, photos, or witness statements, to determine liability and assess the extent of the damages.

- Determining Fault: In cases where fault is a factor, the claims adjuster will evaluate the evidence to determine who is at fault. This determination can impact the claim's outcome and the allocation of responsibility.

- Assessing Damages: The claims adjuster assesses the damages to the insured vehicle and any other involved parties. They may require the policyholder to obtain estimates or repair quotes from authorized repair facilities.

- Settlement Offer: Once the investigation is complete, the insurance company will extend a settlement offer to the policyholder. This offer will be based on the assessed damages and the terms of the policy.

- Acceptance or Dispute: Policyholders have the option to accept the settlement offer or dispute it if they believe it does not adequately cover the incurred losses. In such cases, further negotiations or mediation may be necessary.

- Payment Processing: Upon acceptance of the settlement offer, the insurance company processes the payment, either directly to the policyholder or to the repair facility, depending on the circumstances.

Real-World Scenarios and Case Studies

To illustrate how motor insurance operates in practice, let’s explore a few real-world scenarios and case studies:

Scenario 1: Collision with a Deer

Imagine a driver named Sarah who has a comprehensive motor insurance policy. While driving on a rural road, she unexpectedly collides with a deer. The impact causes significant damage to the front end of her vehicle.

Here's how the claims process unfolds in this scenario:

- Sarah promptly reports the accident to her insurance company, providing details such as the time and location.

- The insurance company assigns a claims adjuster to assess the damages. The adjuster requests photos of the vehicle and the accident scene.

- After reviewing the evidence, the adjuster determines that the collision was not Sarah's fault and that it resulted from an unforeseen animal strike.

- The adjuster arranges for an authorized repair facility to assess the damages and provide a repair estimate.

- Once the estimate is obtained, the insurance company extends a settlement offer to Sarah, covering the cost of repairs and a rental car for the duration of the repairs.

- Sarah accepts the settlement, and the insurance company processes the payment directly to the repair facility.

Scenario 2: Multi-Vehicle Accident

Consider a situation where a driver named David is involved in a multi-vehicle accident on a busy highway. David’s vehicle sustains damage, and he also sustains minor injuries.

Here's how the claims process proceeds:

- David reports the accident to his insurance company, providing details about the incident and any relevant information.

- The insurance company assigns a claims adjuster to investigate the claim. The adjuster requests police reports, witness statements, and photos of the accident scene.

- The adjuster determines that David was not at fault in the accident based on the available evidence.

- The adjuster assesses the damages to David's vehicle and arranges for an independent appraisal to determine the extent of the repairs needed.

- The insurance company extends a settlement offer to David, covering the cost of repairs to his vehicle, medical expenses for his injuries, and rental car coverage while his vehicle is being repaired.

- David accepts the settlement, and the insurance company processes the payments accordingly.

Scenario 3: Theft of a Luxury Vehicle

Imagine a policyholder named Emma who owns a high-end luxury vehicle. Unfortunately, her vehicle is stolen from a parking lot. She has comprehensive coverage as part of her motor insurance policy.

Here's how the claims process unfolds:

- Emma reports the theft to her insurance company, providing the necessary details and filing a police report.

- The insurance company's claims adjuster reviews the evidence, including the police report and any surveillance footage available.

- The adjuster determines that the theft was not Emma's fault and that her vehicle is likely a total loss.

- The adjuster obtains the vehicle's actual cash value from reputable sources and determines the replacement cost.

- The insurance company extends a settlement offer to Emma, covering the actual cash value of the vehicle, less the applicable deductible.

- Emma accepts the settlement, and the insurance company processes the payment to her bank account.

Conclusion: Navigating Motor Insurance with Confidence

Motor insurance is a complex yet crucial aspect of vehicle ownership. Understanding how it works, from the basic coverage options to the claims process, empowers policyholders to make informed decisions and navigate various scenarios with confidence.

By familiarizing yourself with the key components of motor insurance and staying up-to-date with your policy's terms and conditions, you can ensure that you have the appropriate coverage for your needs. Remember, choosing the right motor insurance policy and staying proactive in managing your coverage can provide invaluable peace of mind and financial protection on the road.

How do insurance companies determine fault in an accident?

+Insurance companies use various factors to determine fault, including police reports, witness statements, photos, and physical evidence. They analyze these elements to assess liability and allocate responsibility accordingly.

What happens if I’m involved in an accident with an uninsured driver?

+If you have uninsured/underinsured motorist coverage, your insurance company will compensate you for your losses, even if the other driver is uninsured. This coverage protects you in such situations.

Can I choose my own repair shop for collision repairs?

+In most cases, you have the right to choose your preferred repair shop. However, some insurance companies may have a network of preferred providers, offering discounts or additional benefits. Check your policy for specific guidelines.

What if I’m not satisfied with the insurance company’s settlement offer?

+If you disagree with the settlement offer, you can negotiate with the insurance company or seek independent advice. Mediation or arbitration may also be options to resolve disputes.