Rideshare Auto Insurance

In today's fast-paced world, ridesharing services have become an integral part of our daily commute, offering convenience and flexibility to both riders and drivers alike. As the popularity of ridesharing platforms continues to soar, it's crucial to understand the intricacies of insurance coverage for rideshare drivers, especially in the context of auto insurance.

Rideshare auto insurance is a specialized form of coverage designed to protect drivers who utilize their vehicles for ridesharing purposes. It addresses the unique challenges and risks associated with this evolving industry, ensuring drivers have the necessary protection during the various phases of their ridesharing journeys.

Understanding the Ridesharing Journey

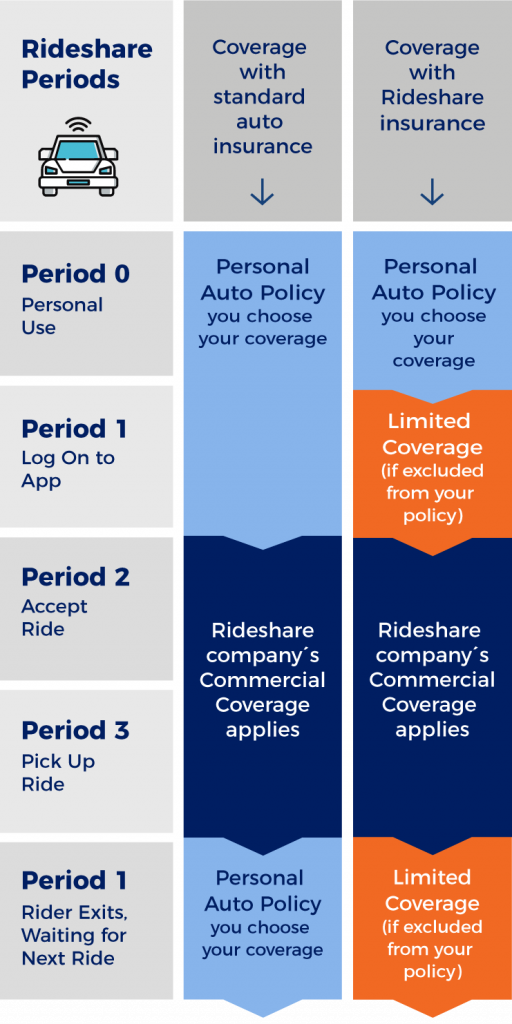

To grasp the importance of rideshare auto insurance, it’s essential to first understand the different stages of a typical ridesharing trip.

Phase 1: Offline and Personal Use

When a rideshare driver is offline and using their vehicle for personal purposes, their personal auto insurance policy typically provides coverage. This phase covers everyday driving activities, such as commuting to work, running errands, or taking a leisure drive.

| Coverage | Description |

|---|---|

| Liability | Covers injuries or damages caused to others. |

| Collision | Pays for repairs or replacement of the insured vehicle. |

| Comprehensive | Protects against non-collision incidents like theft or natural disasters. |

| Personal Injury Protection (PIP) | Provides medical coverage for the driver and passengers. |

Phase 2: Online and Available

Once a driver logs into the ridesharing app and becomes available for ride requests, their insurance coverage enters a unique phase. During this period, the driver’s personal auto insurance may provide limited coverage, often with reduced liability limits.

Phase 3: En Route to Pick Up a Rider

When a driver receives a ride request and is en route to pick up a passenger, their insurance coverage enters a critical phase. Many personal auto insurance policies may not provide adequate coverage during this period, leaving drivers vulnerable to potential gaps in protection.

This is where rideshare auto insurance steps in. It fills the coverage gap by offering comprehensive protection specifically tailored to the unique risks of this phase. Rideshare insurance policies typically include:

- Liability Coverage: Protects against bodily injury and property damage claims resulting from accidents.

- Uninsured/Underinsured Motorist Coverage: Provides protection if the at-fault driver lacks sufficient insurance coverage.

- Comprehensive and Collision Coverage: Covers damages to the driver's vehicle from accidents, theft, or other incidents.

- Medical Payments Coverage: Assists with medical expenses for the driver and passengers.

Benefits of Rideshare Auto Insurance

Rideshare auto insurance offers a range of advantages that ensure drivers are adequately protected throughout their ridesharing journeys.

Comprehensive Coverage

Rideshare auto insurance policies are designed to provide comprehensive coverage, addressing the specific risks associated with ridesharing. This includes coverage for accidents, vandalism, natural disasters, and even personal property damage while transporting passengers.

Gap Protection

One of the primary benefits of rideshare auto insurance is its ability to fill the coverage gaps left by personal auto insurance policies during the “en route to pick up” phase. By bridging this gap, rideshare insurance ensures drivers are protected throughout their entire ridesharing journey.

Flexibility and Convenience

Rideshare auto insurance policies often offer flexibility in terms of coverage options and pricing. Drivers can choose the level of coverage that best suits their needs and budget, ensuring they have the protection they require without unnecessary expenses.

Peace of Mind

With rideshare auto insurance, drivers can have peace of mind knowing they are adequately protected. This insurance provides reassurance that they can focus on their driving duties without worrying about potential financial burdens resulting from accidents or other incidents.

Rideshare Auto Insurance Options

There are two primary types of rideshare auto insurance options available to drivers:

Rideshare Endorsements

Many traditional auto insurance providers offer rideshare endorsements as an add-on to existing personal auto insurance policies. These endorsements typically provide coverage during the “online and available” and “en route to pick up” phases, filling the coverage gaps left by personal policies.

Dedicated Rideshare Insurance Policies

Dedicated rideshare insurance policies are specifically designed for rideshare drivers and offer comprehensive coverage throughout all phases of their ridesharing journeys. These policies are often more comprehensive and may include additional benefits such as roadside assistance and rental car coverage.

Comparative Analysis

When choosing between rideshare endorsements and dedicated rideshare insurance policies, it’s essential to consider the specific needs and requirements of the driver. Here’s a comparative analysis to help drivers make an informed decision:

| Criteria | Rideshare Endorsements | Dedicated Rideshare Policies |

|---|---|---|

| Coverage Scope | Provides coverage during "online and available" and "en route to pick up" phases. | Offers comprehensive coverage throughout all phases of ridesharing. |

| Flexibility | May be more flexible in terms of pricing and coverage options. | Provides specialized coverage tailored to ridesharing needs. |

| Cost | Often more affordable than dedicated policies. | May be more expensive but offer more comprehensive benefits. |

| Claim Process | Claims may be processed through the personal auto insurance provider. | Claims are typically handled by the dedicated rideshare insurance provider. |

Performance and Real-World Examples

Rideshare auto insurance has proven its effectiveness in numerous real-world scenarios. For instance, consider the case of a rideshare driver involved in an accident while en route to pick up a passenger. Without rideshare auto insurance, the driver would have faced significant financial burdens, including medical expenses, vehicle repairs, and potential legal fees.

With rideshare auto insurance in place, however, the driver's policy would have provided comprehensive coverage, covering medical expenses for the driver and passengers, repairing or replacing the vehicle, and offering legal assistance if needed. This real-world example highlights the critical role of rideshare auto insurance in protecting drivers and their passengers during ridesharing activities.

Future Implications and Industry Insights

As the ridesharing industry continues to evolve, the importance of rideshare auto insurance is likely to increase. With the growing number of rideshare drivers and passengers, the potential for accidents and incidents also rises. Therefore, having adequate insurance coverage will become even more crucial for drivers to mitigate financial risks and ensure a safe and secure ridesharing experience.

Furthermore, the ongoing advancements in technology and the integration of autonomous vehicles into the ridesharing ecosystem will present new challenges and opportunities for insurance providers. Insurance policies will need to adapt to cover potential risks associated with autonomous ridesharing, such as cybersecurity breaches and system failures.

In conclusion, rideshare auto insurance is a vital component of the ridesharing industry, providing essential protection for drivers and passengers alike. By understanding the different phases of a ridesharing journey and the unique coverage needs of each phase, drivers can make informed decisions about their insurance coverage. With the right rideshare auto insurance policy, drivers can focus on providing a safe and efficient ridesharing service without worrying about financial liabilities.

Is rideshare auto insurance mandatory for rideshare drivers?

+

While rideshare auto insurance is not mandatory in all jurisdictions, it is highly recommended for rideshare drivers to have adequate coverage. Personal auto insurance policies may not provide sufficient protection during ridesharing activities, leaving drivers vulnerable to financial risks.

Can I use my personal auto insurance for ridesharing?

+

Personal auto insurance policies may provide limited coverage during ridesharing activities, but they often have coverage gaps, especially during the “en route to pick up” phase. It’s important to review your personal policy and consider adding rideshare endorsements or obtaining a dedicated rideshare insurance policy for comprehensive coverage.

What should I look for when choosing rideshare auto insurance?

+

When choosing rideshare auto insurance, consider the coverage scope, flexibility, and cost. Look for policies that provide comprehensive coverage throughout all phases of ridesharing, offer customizable options to meet your specific needs, and fit within your budget. Additionally, research the reputation and financial stability of the insurance provider.

Are there any discounts available for rideshare auto insurance?

+

Yes, some insurance providers offer discounts for rideshare auto insurance policies. These discounts may be based on factors such as driving experience, safety records, and the number of rides completed. It’s worth inquiring about potential discounts when obtaining rideshare auto insurance.

How do I file a claim with rideshare auto insurance?

+

The claim process for rideshare auto insurance varies depending on the policy and insurance provider. Typically, you would need to contact your insurance provider and provide details of the incident. The insurer will then guide you through the claim process, which may involve completing claim forms, providing documentation, and cooperating with any investigations.