Car Insurance Lowest

In the vast landscape of insurance options, finding the cheapest car insurance can be a challenging endeavor. It requires a meticulous exploration of various factors and an understanding of the intricate dynamics that influence insurance costs. This article aims to navigate you through the process of securing the most affordable car insurance, considering individual needs and circumstances.

Understanding the Fundamentals of Car Insurance Costs

The journey to identifying the cheapest car insurance begins with a grasp of the fundamental factors that influence insurance premiums. These factors, ranging from personal demographics to vehicle specifics, play a pivotal role in determining the overall cost of coverage.

Demographic Factors

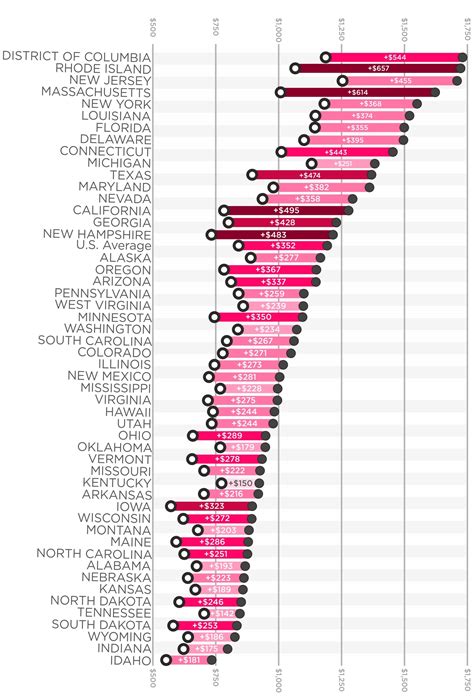

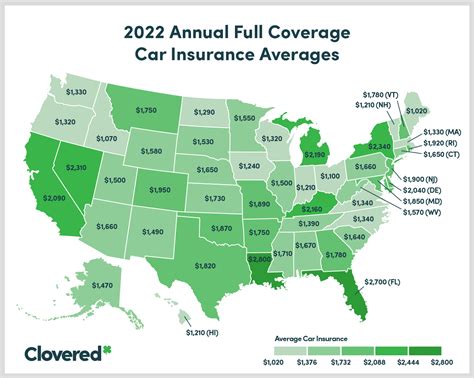

Your personal information, including age, gender, marital status, and location, significantly impacts insurance rates. For instance, younger drivers, particularly males, are often considered higher risk, leading to elevated insurance premiums. Similarly, residing in an area with a higher crime rate or frequent accidents can result in increased insurance costs.

| Demographic Factor | Impact on Insurance Rates |

|---|---|

| Age | Younger drivers often pay more due to higher risk. |

| Gender | Statistically, males tend to have higher premiums. |

| Marital Status | Married individuals may benefit from lower rates. |

| Location | Crime rates and accident frequency can affect premiums. |

Vehicle-Specific Factors

The type of vehicle you drive and its usage significantly impact insurance costs. High-performance cars or those with expensive repair costs typically attract higher premiums. Additionally, the primary use of your vehicle, whether for personal, business, or pleasure, can influence insurance rates.

| Vehicle Factor | Impact on Insurance Rates |

|---|---|

| Vehicle Type | Sports cars or luxury vehicles often have higher premiums. |

| Vehicle Usage | Business or pleasure use may impact premium rates. |

| Safety Features | Vehicles with advanced safety features can reduce premiums. |

Strategies to Secure the Lowest Car Insurance Rates

Now that we’ve explored the foundational elements, let’s delve into practical strategies to secure the lowest car insurance rates tailored to your specific needs and circumstances.

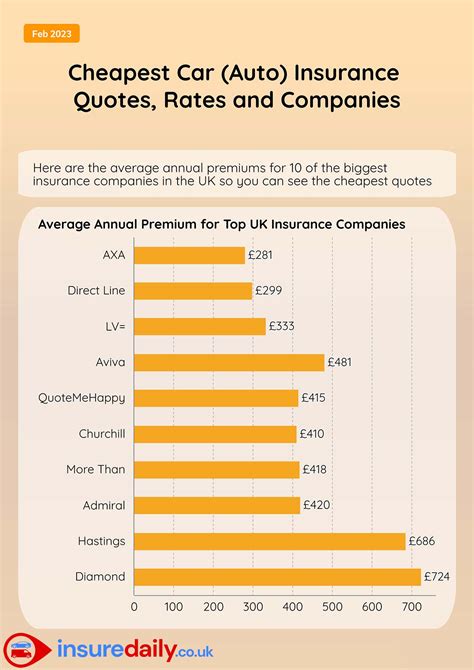

Shop Around and Compare Quotes

One of the most effective ways to find the cheapest car insurance is to explore multiple options. Obtain quotes from various insurance providers to compare prices and coverage. Online quote comparison tools can be particularly useful for this purpose.

Consider Bundling Policies

If you have multiple insurance needs, such as home and auto insurance, consider bundling them with the same provider. Many insurance companies offer discounts when you bundle multiple policies, resulting in significant savings.

Explore Discounts and Rewards

Insurance providers often offer a range of discounts and rewards to attract and retain customers. These can include safe driving discounts, loyalty rewards, or discounts for completing defensive driving courses. Be sure to inquire about available discounts and take advantage of those applicable to your situation.

Adjust Coverage Levels

Review your insurance coverage regularly and ensure it aligns with your needs. If your vehicle is older or has low market value, you may consider reducing your coverage levels, such as opting for liability-only coverage instead of comprehensive coverage. This can result in substantial savings.

Maintain a Clean Driving Record

A clean driving record is a significant factor in determining insurance premiums. Avoid traffic violations and accidents to keep your insurance costs low. Additionally, consider enrolling in safe driving programs, as some insurance companies offer discounts for completing such courses.

Choose a Higher Deductible

Increasing your deductible, the amount you pay out-of-pocket before your insurance coverage kicks in, can lead to reduced insurance premiums. However, it’s essential to choose a deductible amount that you can comfortably afford in the event of an accident or claim.

Review and Negotiate Regularly

Insurance rates can fluctuate, and it’s beneficial to review your policy and shop around for better rates annually. Additionally, don’t hesitate to negotiate with your insurance provider. They may be willing to match or beat competitor rates to retain your business.

Real-World Examples: Lowest Car Insurance Stories

Let’s delve into some real-world scenarios where individuals have successfully secured the lowest car insurance rates, showcasing the effectiveness of the strategies outlined above.

John’s Story: Bundling for Savings

John, a 35-year-old professional, recently purchased a new home and was in the market for both home and auto insurance. By bundling his policies with a reputable insurance provider, he was able to secure significant savings. The provider offered a 20% discount on his auto insurance when bundled with his home insurance, resulting in a substantial reduction in his overall insurance costs.

Sarah’s Story: Adjusting Coverage for Cost-Effectiveness

Sarah, a 22-year-old student, had been paying high insurance premiums for her sports car. Upon reviewing her coverage, she realized that her vehicle’s market value had significantly decreased over the years. By adjusting her coverage to liability-only and removing comprehensive coverage, she achieved a remarkable 40% reduction in her insurance premiums, making her insurance more cost-effective.

Michael’s Story: Safe Driving Rewards

Michael, a 45-year-old family man, had a long-standing relationship with his insurance provider. Over the years, he maintained a pristine driving record and consistently enrolled in safe driving programs. As a result, his insurance provider rewarded his loyalty and safe driving habits with a 15% discount on his auto insurance, a testament to the power of safe driving practices.

Future Implications and Industry Insights

As the insurance industry continues to evolve, it’s essential to stay informed about emerging trends and potential changes that could impact car insurance rates. Here are some key insights and predictions for the future of car insurance:

Technology’s Impact

Advancements in technology, such as telematics and usage-based insurance, are transforming the insurance landscape. Telematics devices installed in vehicles can track driving behavior, offering real-time data on driving habits. This data-driven approach allows insurance providers to offer more tailored and potentially cheaper insurance rates based on individual driving patterns.

Regulatory Changes

Changes in insurance regulations can significantly impact car insurance rates. For instance, adjustments in state laws regarding minimum liability limits or the introduction of new insurance products can lead to fluctuations in insurance costs. Staying informed about potential regulatory changes is crucial for understanding how they might affect your insurance premiums.

Industry Competition

The insurance industry is highly competitive, and providers are constantly seeking ways to attract and retain customers. This competition can drive down insurance costs as providers offer competitive rates and innovative products. Monitoring industry trends and staying informed about new offerings can help you take advantage of these competitive dynamics.

Data-Driven Insurance

The insurance industry is increasingly leveraging data analytics to assess risk and set premiums. This data-driven approach allows providers to make more accurate predictions about potential claims, leading to more precise pricing. As a result, insurance providers can offer more tailored and potentially cheaper insurance options based on individual risk profiles.

Conclusion: Securing the Cheapest Car Insurance

Finding the cheapest car insurance requires a thoughtful approach that considers various factors and strategies. By understanding the fundamentals of car insurance costs, exploring multiple options, and employing effective strategies, you can secure the most affordable coverage tailored to your needs. Remember, the insurance landscape is dynamic, and staying informed about industry trends and potential changes is essential for making informed decisions about your car insurance.

How often should I review my car insurance policy for potential savings?

+It’s recommended to review your car insurance policy annually to ensure you’re getting the best rates. Insurance providers may offer new discounts or promotions, and market conditions can change, affecting your premiums.

Are there any downsides to increasing my deductible to lower my premiums?

+While increasing your deductible can lower your premiums, it’s important to consider your financial situation. A higher deductible means you’ll have to pay more out-of-pocket in the event of a claim. Ensure you choose a deductible amount that you can comfortably afford.

Can I negotiate my car insurance rates with my provider?

+Absolutely! Negotiating your car insurance rates is a common practice. Many insurance providers are open to discussions and may offer better rates to retain your business. Highlight your loyalty, safe driving record, or any unique circumstances that could influence your premiums.