Va Insurance For Family

Ensuring adequate insurance coverage for your family is a vital step towards securing their financial well-being and peace of mind. In the state of Virginia, there are various insurance options available to cater to the unique needs of families. From health insurance to protect against unexpected medical expenses to life insurance for long-term financial security, understanding the range of insurance products and their benefits is essential. This article aims to provide a comprehensive guide to VA insurance for families, covering everything from the different types of insurance to real-world examples and expert insights.

Understanding the Landscape: VA Insurance Options for Families

When it comes to insurance, Virginia offers a diverse range of options to cater to the varying needs of families. Here’s an overview of the key insurance types and their relevance to families:

Health Insurance: A Foundation for Well-Being

Health insurance is arguably the most critical type of insurance for families. In Virginia, health insurance plans can be obtained through the Affordable Care Act (ACA) marketplace or directly from insurance providers. These plans offer coverage for medical expenses, including doctor visits, hospital stays, prescription medications, and more. For families, having health insurance provides peace of mind, ensuring access to necessary medical care without the burden of excessive out-of-pocket costs.

Some key considerations for health insurance in Virginia include:

- Network Providers: Ensure that your preferred healthcare providers are within the insurance network to avoid higher costs.

- Plan Types: Choose between HMOs, PPOs, and POS plans, each with unique features and cost structures.

- Deductibles and Co-Pays: Understand the out-of-pocket costs associated with your plan, including deductibles, co-pays, and maximum out-of-pocket limits.

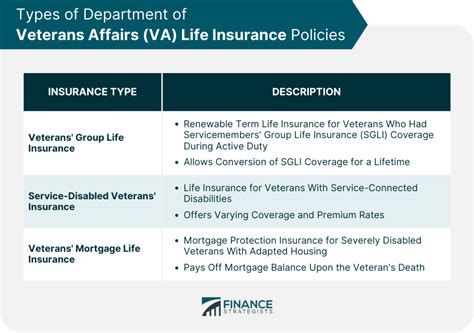

Life Insurance: Securing Your Family’s Future

Life insurance is an essential component of any family’s financial plan. It provides a safety net to ensure your family’s financial stability in the event of your untimely demise. In Virginia, life insurance is offered by various providers, including traditional insurance companies and online insurers. The two main types of life insurance are term life insurance and permanent life insurance, each with distinct features and benefits.

Consider the following when evaluating life insurance options:

- Coverage Amount: Determine the amount of coverage needed to meet your family’s financial needs, taking into account outstanding debts, future expenses, and income replacement.

- Term vs. Permanent: Decide between term life, which offers coverage for a specific period, and permanent life insurance, which provides lifelong coverage with additional cash value benefits.

- Rider Options: Explore rider options, such as accidental death benefits or waiver of premium, which can enhance your policy’s protection and benefits.

Auto Insurance: Protecting Your Family on the Road

Auto insurance is a legal requirement in Virginia and a necessary protection for families with vehicles. It provides financial coverage in the event of accidents, covering damages to your vehicle, injuries sustained, and liability for property damage or personal injuries to others.

Key aspects of auto insurance in Virginia include:

- Liability Coverage: This is the minimum requirement in Virginia, covering damages you cause to others.

- Collision and Comprehensive Coverage: These optional coverages provide protection for your vehicle, covering damages from accidents and non-accident-related incidents like theft or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient insurance.

Homeowners/Renters Insurance: Safeguarding Your Family’s Assets

Whether you own a home or rent, insurance is crucial to protect your family’s assets and provide liability coverage. Homeowners insurance covers the structure of your home and its contents, while renters insurance covers your personal belongings and provides liability protection.

Consider these factors when choosing homeowners or renters insurance:

- Dwelling Coverage: Ensure you have sufficient coverage to rebuild your home in the event of a total loss.

- Personal Property Coverage: Evaluate the value of your personal belongings and choose a policy that provides adequate coverage.

- Liability Coverage: This coverage is essential to protect you from lawsuits and medical payments if someone is injured on your property.

The Importance of Customized Insurance Solutions

Every family’s insurance needs are unique, influenced by factors such as health status, financial obligations, and lifestyle. That’s why it’s crucial to tailor your insurance portfolio to your specific circumstances. Here are some real-world examples to illustrate the importance of customized insurance solutions:

The Smith Family: A Case Study in Health Insurance

The Smith family, consisting of two parents and three children, opted for a PPO health insurance plan through the ACA marketplace. This plan allowed them to choose their preferred healthcare providers without referral requirements, providing flexibility and convenience. With one child requiring regular medical attention for a chronic condition, the Smith family benefited from the plan’s coverage of specialized care and prescription medications.

The Johnson Family: Life Insurance for Long-Term Security

The Johnson family, with two working parents and two young children, recognized the importance of life insurance for their financial security. They opted for a 20-year term life insurance policy with a coverage amount sufficient to pay off their mortgage and provide for their children’s education and living expenses until they reached adulthood. This policy offered them peace of mind, knowing their family’s future was financially secure even in the event of an untimely death.

The Davis Family: Auto and Home Insurance for Comprehensive Protection

The Davis family, with a teenage driver and a valuable home in a suburban neighborhood, tailored their insurance coverage to address their specific needs. They chose a comprehensive auto insurance policy with high liability limits and coverage for their teenage driver, recognizing the higher risk associated with young drivers. For their home, they opted for a homeowners insurance policy with adequate dwelling and personal property coverage, ensuring protection against natural disasters common in their area, such as hurricanes.

Expert Insights and Tips for VA Insurance

Navigating the world of insurance can be complex, but with the right guidance, you can make informed decisions to protect your family. Here are some expert insights and tips to enhance your VA insurance strategy:

Understanding Your Needs: A Holistic Approach

Assessing your insurance needs involves more than just calculating coverage amounts. It requires a holistic understanding of your family’s financial situation, health status, and lifestyle. Consider these factors:

- Financial Obligations: Evaluate your family’s financial commitments, including mortgages, loans, and other debts.

- Health Status: Consider the current and potential future health needs of your family members.

- Lifestyle and Risks: Assess your family’s lifestyle, including activities, hobbies, and travel habits, to identify potential risks and tailor your insurance coverage accordingly.

The Role of an Insurance Advisor

Engaging the services of a qualified insurance advisor can be invaluable in navigating the complex world of insurance. An advisor can provide personalized guidance, helping you understand your options and make informed decisions. They can also assist in reviewing and updating your insurance portfolio as your family’s needs evolve.

Regular Policy Reviews: Keeping Up with Life’s Changes

Life is dynamic, and your insurance needs may change over time. Regularly review your insurance policies to ensure they remain aligned with your current circumstances. Significant life events, such as marriage, divorce, the birth of a child, or a career change, can impact your insurance needs. Stay proactive in adjusting your coverage to reflect these changes.

The Power of Bundling

Bundling your insurance policies, such as auto and homeowners insurance, can often result in significant cost savings. Many insurance providers offer discounts when you bundle multiple policies with them. Additionally, bundling can simplify your insurance management, providing a single point of contact for all your insurance needs.

The Future of VA Insurance: Trends and Innovations

The insurance industry is constantly evolving, driven by technological advancements and changing consumer needs. Here’s a glimpse into the future of VA insurance and some of the trends shaping the industry:

Digital Transformation: Convenience and Accessibility

The digital age has brought about significant changes in the insurance landscape. Online insurance providers are gaining popularity, offering convenient and accessible insurance solutions. From comparing policies to purchasing coverage and filing claims, the entire insurance process is becoming increasingly digital, providing consumers with greater control and flexibility.

Personalized Insurance: Tailoring Coverage to Individual Needs

Insurance providers are leveraging data analytics and technology to offer more personalized insurance solutions. By analyzing individual risk factors and preferences, insurers can tailor policies to meet specific needs. This trend is particularly evident in the health insurance space, where personalized plans are emerging to address the unique health concerns of individuals and families.

Insurtech Innovations: Enhancing the Insurance Experience

Insurtech, the intersection of insurance and technology, is driving innovative solutions in the industry. From AI-powered chatbots for customer service to blockchain-based smart contracts for claims processing, insurtech is transforming the way insurance is delivered and experienced. These innovations are enhancing efficiency, reducing costs, and improving the overall customer experience.

Conclusion: Securing Your Family’s Future

In the complex world of insurance, making informed decisions is crucial to safeguarding your family’s financial well-being. By understanding the range of insurance options available in Virginia and tailoring your coverage to your unique needs, you can provide your family with the protection and peace of mind they deserve. Remember, insurance is an ongoing process, and regular reviews and updates are essential to keep pace with life’s changes.

How do I choose the right health insurance plan for my family in Virginia?

+When selecting a health insurance plan, consider your family’s healthcare needs, preferred providers, and budget. Evaluate different plan types (HMO, PPO, POS) and compare coverage, network providers, and out-of-pocket costs. Seek advice from insurance advisors or healthcare professionals to make an informed decision.

What are the benefits of term life insurance over permanent life insurance for families?

+Term life insurance offers a cost-effective way to provide financial protection for a specific period, typically suitable for families with short-term financial needs. Permanent life insurance, on the other hand, provides lifelong coverage with additional cash value benefits, making it a more comprehensive option for long-term financial planning.

How can I save money on my auto insurance premiums in Virginia?

+To reduce auto insurance costs, consider increasing your deductibles, opting for a higher coverage limit, and maintaining a clean driving record. You can also explore multi-policy discounts by bundling your auto insurance with other policies, such as homeowners or renters insurance.

What should I prioritize when choosing homeowners or renters insurance in Virginia?

+Prioritize adequate coverage for your home’s structure and personal belongings, as well as sufficient liability protection. Consider your family’s specific needs and the risks associated with your location, such as natural disasters or crime rates. Seek guidance from insurance professionals to ensure you have the right coverage.