International Medical Insurance Travel

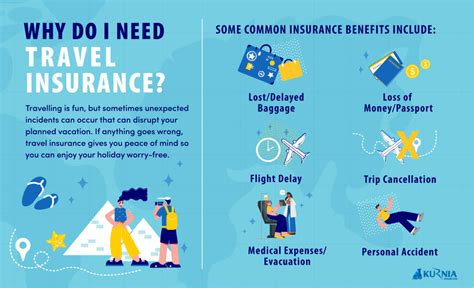

Traveling to new and exciting destinations is an adventure that many people dream of. However, when it comes to international travel, especially for extended periods or to remote locations, ensuring your health and well-being becomes a top priority. This is where international medical insurance steps in as a vital consideration for any traveler.

International medical insurance is a specialized form of health coverage designed to cater to the unique needs of individuals traveling or living abroad. It provides comprehensive protection against unforeseen medical emergencies and offers peace of mind during your travels. In this comprehensive guide, we will delve into the world of international medical insurance, exploring its features, benefits, and how it can make a significant difference in your travel experiences.

Understanding International Medical Insurance

International medical insurance is a customized insurance plan tailored for individuals who venture beyond their home country’s borders. It offers a wide range of coverage options to address the diverse needs of travelers, expatriates, and even those participating in international study programs or volunteering abroad.

Unlike traditional health insurance plans, international medical insurance is designed to be flexible and adaptable to the dynamic nature of travel. It takes into account the varying healthcare systems, costs, and medical facilities available in different countries, ensuring that you receive the necessary medical attention, regardless of where your travels take you.

Key Features of International Medical Insurance

International medical insurance offers a comprehensive set of features to cater to the unique requirements of travelers. Here are some key aspects to consider:

- Worldwide Coverage: One of the primary advantages of international medical insurance is its global coverage. Whether you're hiking in the Swiss Alps, exploring the rainforests of Costa Rica, or simply relaxing on a beach in Thailand, your insurance plan will provide coverage for medical emergencies and unforeseen illnesses.

- Emergency Medical Evacuation: In the event of a serious medical emergency, international medical insurance often includes coverage for emergency medical evacuation. This means that if you require specialized treatment that is not available locally, the insurance provider will arrange and cover the costs of transporting you to the nearest suitable medical facility.

- Repatriation Benefits: International medical insurance plans often include repatriation benefits, which cover the costs of returning your remains to your home country in the unfortunate event of your passing while abroad. This sensitive and important aspect of travel insurance provides much-needed support during difficult times.

- Travel Assistance Services: Many international medical insurance providers offer 24/7 travel assistance services. These services can help with a wide range of travel-related issues, including lost luggage, passport replacement, legal assistance, and even emergency cash transfer in case of financial emergencies.

- Prescription Medication: Depending on your plan, international medical insurance may cover the cost of prescription medications required during your travels. This is particularly beneficial for individuals with pre-existing conditions who rely on specific medications to manage their health.

- Pre-Existing Condition Coverage: Some international medical insurance plans offer coverage for pre-existing medical conditions. This is a valuable feature for travelers with known health issues, as it ensures that their conditions are not excluded from the insurance coverage.

The Benefits of International Medical Insurance

International medical insurance provides a multitude of benefits that enhance your travel experiences and ensure your well-being. Here are some key advantages to consider:

Peace of Mind

Traveling to unfamiliar destinations can be exciting, but it also comes with inherent risks and uncertainties. With international medical insurance, you can travel with peace of mind, knowing that you have access to quality medical care should the need arise. This sense of security allows you to fully immerse yourself in your travels without constant worry about unforeseen medical emergencies.

Cost-Effective Medical Care

Healthcare costs can vary significantly from one country to another. In some destinations, medical expenses can be exorbitant, especially for emergency treatments or specialized procedures. International medical insurance ensures that you receive quality medical care without the financial burden. By covering a wide range of medical expenses, including hospital stays, doctor visits, and diagnostic tests, the insurance plan helps you manage your healthcare costs effectively.

Comprehensive Coverage

International medical insurance plans are designed to offer comprehensive coverage, addressing a wide array of potential medical scenarios. From minor injuries and illnesses to more serious conditions, your insurance plan will have you covered. This level of protection ensures that you receive the necessary medical attention promptly, without having to navigate the complexities of foreign healthcare systems or worry about financial constraints.

Assistance with Language Barriers

Language barriers can be a significant challenge when seeking medical care abroad. International medical insurance providers often offer assistance in overcoming these barriers. They may provide translation services or facilitate communication with local healthcare providers, ensuring that you receive the right medical attention, even if you don’t speak the local language fluently.

Flexible Plan Options

One of the greatest advantages of international medical insurance is its flexibility. Insurance providers offer a range of plan options to cater to different travel durations, destinations, and personal preferences. Whether you’re planning a short-term trip or an extended stay abroad, there’s an insurance plan that aligns with your needs. This flexibility ensures that you can choose a plan that fits your budget and provides the coverage you require.

Performance Analysis and Real-World Examples

International medical insurance has proven its worth in countless real-world scenarios. Let’s explore a few examples that highlight the impact and effectiveness of this specialized insurance coverage.

Case Study: Emergency Medical Evacuation

Imagine a solo traveler embarking on an adventurous hike in the mountains of Nepal. During the hike, they suffer a severe injury that requires immediate medical attention. Without international medical insurance, the traveler would face significant challenges in accessing specialized treatment in a remote location. However, with the right insurance plan, the traveler can benefit from emergency medical evacuation, ensuring they receive the necessary care promptly and safely.

Case Study: Managing Pre-Existing Conditions

Consider an individual with a pre-existing heart condition who plans to travel to Europe for an extended period. Without insurance coverage, managing their condition while abroad could be challenging and costly. However, with international medical insurance that includes pre-existing condition coverage, they can have peace of mind knowing that their condition is covered. The insurance plan provides access to local healthcare professionals who can monitor their condition and ensure they receive the necessary medications and treatments.

Case Study: Travel Assistance Services

A family on a vacation to a foreign country experiences a sudden illness that requires immediate medical attention. With international medical insurance, they can access 24⁄7 travel assistance services. These services provide language interpretation, help locate the nearest medical facility, and even arrange for emergency transportation if needed. The insurance plan ensures that the family receives the necessary support and guidance during this stressful situation.

| Insurance Provider | Coverage Highlights |

|---|---|

| Company A | Worldwide coverage, emergency evacuation, and repatriation benefits. Offers flexible plan options for short-term and long-term travelers. |

| Company B | Specializes in providing insurance for expatriates. Includes comprehensive coverage for pre-existing conditions and access to a global network of medical providers. |

| Company C | Known for its innovative travel assistance services. Offers real-time tracking and assistance during medical emergencies, ensuring prompt response and support. |

Future Implications and Industry Insights

The international medical insurance industry continues to evolve, adapting to the changing needs of travelers and the global healthcare landscape. Here are some key trends and insights to consider:

Digitalization and Telemedicine

The rise of digitalization and telemedicine has had a significant impact on the insurance industry. Many international medical insurance providers now offer telemedicine services, allowing travelers to consult with healthcare professionals remotely. This innovation enhances accessibility to medical advice and can be particularly beneficial for travelers in remote areas or those with non-emergency medical concerns.

Focus on Preventive Care

There is a growing emphasis on preventive care within the international medical insurance industry. Insurance providers are recognizing the importance of proactive health management and are incorporating features such as wellness programs, health coaching, and access to online health resources. By promoting preventive care, insurance companies aim to reduce the incidence of costly medical emergencies and encourage travelers to take a more proactive approach to their health.

Tailored Plans for Specific Travel Types

Insurance providers are increasingly offering specialized plans tailored to specific types of travel. For example, there are insurance plans designed for adventure travelers, covering activities such as rock climbing, scuba diving, and skiing. These plans often include higher limits for adventure-related injuries and provide coverage for specialized equipment rental or purchase. Similarly, insurance plans for business travelers may offer additional benefits such as higher coverage limits for business-related injuries and access to executive-level medical facilities.

Integration with Travel Apps and Platforms

The integration of international medical insurance with travel apps and platforms is becoming more prevalent. Travelers can now easily access their insurance policies, file claims, and seek medical assistance through user-friendly apps. This integration streamlines the insurance experience, making it more convenient and accessible for travelers on the go.

Expanded Network of Healthcare Providers

Insurance providers are continuously expanding their networks of healthcare providers worldwide. This expansion ensures that travelers have access to a diverse range of medical facilities and specialists, regardless of their location. By partnering with reputable healthcare institutions, insurance companies can provide their policyholders with quality medical care, even in remote or less developed areas.

Enhanced Security and Fraud Prevention

With the increasing sophistication of fraud and identity theft, international medical insurance providers are implementing advanced security measures to protect their policyholders. This includes the use of blockchain technology, biometric authentication, and enhanced data encryption to safeguard personal and medical information. By prioritizing security, insurance companies aim to provide a safe and secure environment for travelers to access their insurance benefits.

FAQs

What is the difference between international medical insurance and traditional health insurance?

+International medical insurance is specifically designed for individuals traveling or living abroad. It offers global coverage, emergency evacuation benefits, and other travel-related services. Traditional health insurance, on the other hand, is typically limited to a specific country or region and may not provide coverage for medical emergencies outside of that area.

How do I choose the right international medical insurance plan for my travels?

+When selecting an international medical insurance plan, consider factors such as your travel duration, destinations, and any specific medical needs you may have. Compare different providers and plans to find one that offers the coverage and benefits that align with your travel requirements. Don’t hesitate to reach out to insurance providers for personalized advice and guidance.

Can I get international medical insurance if I have a pre-existing medical condition?

+Yes, many international medical insurance plans offer coverage for pre-existing conditions. However, it’s important to disclose any pre-existing conditions when applying for insurance. Some plans may have specific requirements or exclusions for certain conditions, so it’s essential to carefully review the policy details before purchasing.

What happens if I need medical attention while abroad and my insurance plan is not accepted at the local hospital?

+In such cases, it’s crucial to contact your insurance provider’s emergency assistance services as soon as possible. They can guide you through the process and facilitate payment or reimbursement for the medical services you receive. Most insurance providers have established networks of preferred medical facilities, but in some cases, they may still cover your treatment at non-network hospitals.

Are there any age restrictions for purchasing international medical insurance?

+Age restrictions can vary depending on the insurance provider and the specific plan. Some plans may have upper age limits, while others may offer coverage for individuals of all ages. It’s recommended to check with the insurance provider directly to understand their age-related requirements and any potential age-based exclusions or limitations.

International medical insurance is an essential consideration for anyone embarking on international travels. It provides a safety net, ensuring that you receive the necessary medical care and support, regardless of your destination. With its comprehensive coverage, emergency assistance services, and flexible plan options, international medical insurance offers peace of mind and enhances the overall travel experience. As the industry continues to evolve, travelers can look forward to even more innovative and tailored insurance solutions, making their journeys safer and more enjoyable.