Errors Omissions Insurance

Errors and Omissions (E&O) insurance is a critical safeguard for professionals in various industries, providing coverage for legal expenses and potential compensation in cases where their work or advice leads to a client's financial loss. This specialized insurance policy is often overlooked, yet it plays a pivotal role in risk management and business sustainability.

In today's complex business landscape, where even the smallest oversight can lead to costly legal battles, understanding the nuances of E&O insurance is paramount. This article aims to delve deep into the world of Errors and Omissions insurance, exploring its importance, coverage, and the key considerations professionals need to make when acquiring this essential protection.

Understanding Errors and Omissions Insurance

Errors and Omissions insurance, often referred to as Professional Liability insurance, is a tailored coverage designed to protect professionals from claims arising from their work performance or advice. Unlike general liability insurance, which covers bodily injury or property damage, E&O insurance specifically addresses financial losses caused by a professional’s error, oversight, or omission.

The policy provides a safety net for professionals in a wide range of fields, including but not limited to: lawyers, consultants, real estate agents, architects, engineers, financial advisors, and IT professionals. These professionals, despite their expertise, can make mistakes that result in significant financial repercussions for their clients. E&O insurance steps in to mitigate the financial risks associated with these errors.

Key Features of E&O Insurance

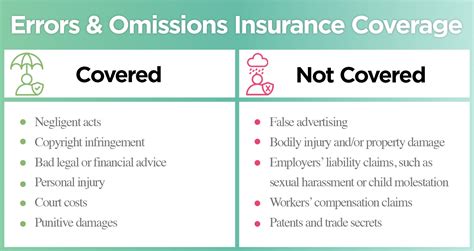

E&O insurance policies are known for their comprehensive coverage, which typically includes:

- Defense Costs: The insurance company covers the legal expenses, including attorney fees and court costs, incurred in defending against a claim, regardless of the outcome.

- Compensation for Client Losses: If the court rules against the insured professional, the policy provides compensation to the client for their financial losses.

- Retroactive Coverage: Many E&O policies offer retroactive coverage, meaning they can cover claims arising from work performed before the policy was in place.

- Additional Expenses: Some policies may cover additional expenses, such as the cost of hiring experts or conducting investigations, incurred during the claim process.

- Crisis Management: Advanced policies might even offer crisis management support to help the insured professional manage the reputational impact of a claim.

The Importance of E&O Insurance

The significance of Errors and Omissions insurance cannot be overstated. In today’s litigious society, professionals face an ever-increasing risk of being sued for their work, even if the error was unintentional. A single lawsuit can lead to substantial financial losses, not just in legal fees but also in potential compensation to the client.

Moreover, the reputational damage that can result from a lawsuit can be catastrophic. Even if the professional is ultimately found not liable, the process of defending themselves can be time-consuming, stressful, and detrimental to their business relationships and reputation.

Real-World Scenarios

Consider the following scenarios where E&O insurance could prove invaluable:

- Legal Advisors: A lawyer provides advice on a complex contract, but an oversight in the contract's wording leads to a financial loss for their client. E&O insurance would cover the legal costs and any compensation due to the client.

- Financial Advisors: An investment advisor recommends a high-risk strategy that results in significant losses for their client. E&O insurance would step in to manage the legal and financial implications.

- IT Consultants: A software bug, inadvertently introduced by an IT consultant, causes a system failure at a client's company, leading to downtime and lost revenue. E&O insurance would help cover the client's losses.

Coverage and Policy Considerations

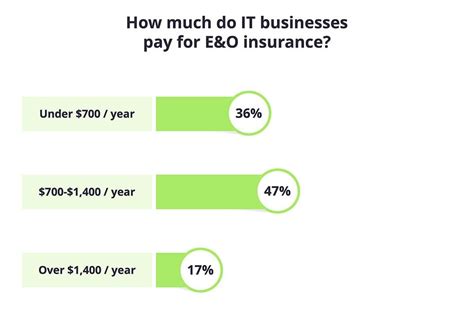

When acquiring E&O insurance, professionals need to carefully consider their specific needs and the potential risks associated with their profession.

Policy Limits and Deductibles

E&O policies typically have limits, which specify the maximum amount the insurer will pay for a single claim or all claims over the policy period. Professionals should choose limits that align with the potential risks and losses their work could cause. Additionally, policies often have deductibles, which the insured professional must pay before the insurance coverage kicks in.

| Policy Limit | Deductible |

|---|---|

| $1,000,000 per claim | $5,000 per claim |

Exclusions and Extensions

E&O policies often have specific exclusions, detailing situations where the policy will not provide coverage. For instance, many policies exclude intentional acts, criminal acts, or claims arising from intellectual property disputes. Professionals should carefully review these exclusions to ensure they understand the limitations of their coverage.

On the other hand, some policies offer extensions that provide additional coverage for specific risks. For instance, a professional might opt for an extension to cover regulatory investigations or cyber liability.

Claims-Made vs. Occurrence Policies

E&O policies can be structured as either claims-made or occurrence-based policies. Claims-made policies cover claims made during the policy period, regardless of when the incident occurred. In contrast, occurrence policies cover incidents that occur during the policy period, even if the claim is made after the policy has ended.

The choice between these two types of policies depends on the professional's specific needs and preferences. Claims-made policies are often more cost-effective but require continuous coverage to ensure ongoing protection. Occurrence policies, while potentially more expensive, provide longer-term coverage, even if the professional decides to switch insurers.

The Process of Filing an E&O Claim

In the unfortunate event that a professional needs to file an E&O claim, they should be aware of the process involved.

Reporting a Claim

The first step is to promptly report the claim to the insurance company. Many policies require immediate notification to ensure coverage. The professional should provide a detailed account of the incident, including any relevant documentation.

Investigation and Resolution

Once the claim is reported, the insurance company will initiate an investigation. This may involve gathering additional information from the professional, the client, and potentially other parties involved. The insurer will then work towards resolving the claim, either by providing a defense or by negotiating a settlement with the claimant.

Role of an Insurance Broker

An insurance broker can play a crucial role in the claims process. They can assist the professional in understanding their coverage, navigating the claims process, and advocating on their behalf with the insurance company. Brokers often have extensive experience in handling E&O claims and can provide valuable guidance.

Future Implications and Industry Trends

The landscape of Errors and Omissions insurance is evolving, influenced by emerging risks and changing industry standards.

Increasing Professional Liability

As industries become more specialized and regulated, the potential for professional liability increases. For instance, with the rise of digital technologies, professionals in fields like IT and data analytics face new risks related to data privacy and cybersecurity.

The Rise of Cyber Insurance

The increasing prevalence of cyber threats has led to a surge in demand for cyber insurance policies. These policies often include coverage for errors and omissions related to cyber incidents, such as data breaches or system failures. Professionals in various fields should consider the benefits of cyber insurance as part of their E&O coverage.

Regulatory and Legal Changes

Changes in regulations and legal standards can impact the coverage provided by E&O insurance. Professionals need to stay informed about these changes to ensure their policies remain compliant and adequate. For instance, recent privacy laws, such as GDPR in Europe, have significant implications for professionals handling personal data.

Conclusion: A Necessary Protection

Errors and Omissions insurance is an indispensable tool for professionals to manage the risks inherent in their work. It provides a vital safety net, ensuring that a single mistake does not lead to financial ruin or irreparable reputational damage.

As the business environment becomes more complex and competitive, professionals should prioritize acquiring adequate E&O coverage. By understanding the nuances of this insurance, they can make informed decisions to protect their business, their clients, and their own financial well-being.

What is the typical duration of an E&O policy?

+Most E&O policies are written for a one-year term, but they can be renewed annually. It’s important to ensure continuous coverage to maintain protection over time.

How soon after a claim is reported does the insurance company respond?

+Insurance companies typically respond promptly to claims, often within a few days. However, the investigation and resolution process can take several weeks or even months, depending on the complexity of the claim.

Can E&O insurance cover criminal acts or intentional misconduct?

+No, E&O insurance typically excludes coverage for criminal acts or intentional misconduct. These types of actions are considered outside the scope of professional services and are not covered by standard E&O policies.