How Much Would Insurance Cost For A Small Business

For small business owners, understanding and managing expenses is crucial for success. One significant cost that often raises questions is insurance. The cost of insurance for a small business can vary greatly depending on several factors, and it's essential to have a comprehensive understanding of these variables to make informed decisions. This article aims to delve into the specifics of insurance costs for small businesses, offering a detailed analysis to help entrepreneurs navigate this crucial aspect of their financial planning.

Understanding the Variables in Insurance Costs for Small Businesses

When it comes to insurance, small businesses face a unique set of challenges and considerations. The cost of insurance is influenced by a multitude of factors, each playing a vital role in determining the final premium. By breaking down these variables, we can gain a clearer picture of the insurance landscape for small enterprises.

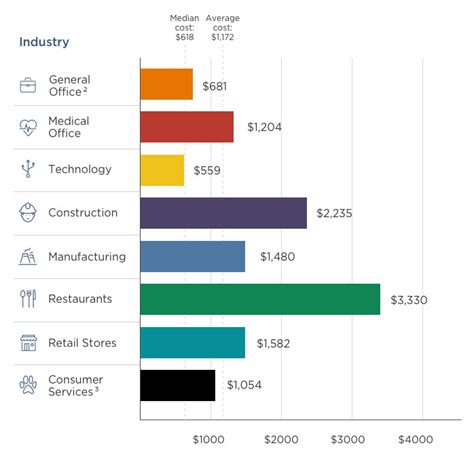

Business Type and Size

The nature and scale of your business are fundamental determinants of insurance costs. Different industries have varying levels of risk, and insurance providers consider these risks when calculating premiums. For instance, a construction business will likely face higher insurance costs due to the inherent risks associated with the industry, such as accidents and equipment damage. Similarly, the size of your business, measured by factors like revenue and number of employees, can also impact insurance rates. Larger businesses may benefit from economies of scale, potentially reducing their insurance costs per employee or operation.

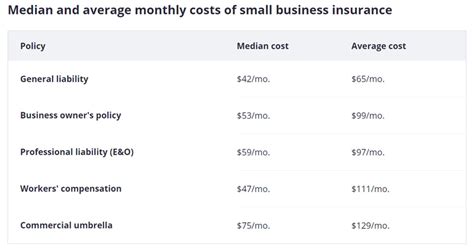

Coverage Requirements

The type and extent of coverage your business requires are significant factors in insurance costs. Small businesses often need a range of insurance policies to protect against various risks. Common types of insurance include general liability, professional liability (or errors and omissions), property insurance, workers’ compensation, and cyber liability insurance. Each policy serves a specific purpose, and the more comprehensive your coverage, the higher the premium is likely to be. It’s essential to carefully assess your business’s unique needs to ensure you have the right coverage without overspending on unnecessary policies.

Claims History and Risk Profile

Insurance providers carefully evaluate a business’s claims history and overall risk profile when determining premiums. A business with a history of frequent claims or a high-risk profile may face higher insurance costs. This is because insurance companies factor in the likelihood of future claims when setting rates. For example, if your business has had multiple employee injuries or property damage claims in the past, insurance providers may perceive your business as higher risk, leading to increased premiums. On the other hand, a business with a clean claims history and a low-risk profile may enjoy more competitive insurance rates.

Location and Operational Factors

The geographical location of your business and the specific operations it undertakes can significantly influence insurance costs. For instance, businesses located in areas prone to natural disasters like hurricanes or earthquakes may face higher insurance premiums to account for the increased risk of property damage. Similarly, if your business involves specialized operations or equipment, such as operating heavy machinery or handling hazardous materials, insurance costs may be higher due to the increased likelihood of accidents or damage.

| Business Type | Average Annual Premium |

|---|---|

| Construction | $15,000 - $30,000 |

| Retail | $5,000 - $15,000 |

| Professional Services | $3,000 - $10,000 |

| Manufacturing | $10,000 - $25,000 |

| E-commerce | $2,000 - $8,000 |

Strategies to Mitigate Insurance Costs for Small Businesses

While insurance costs are influenced by various factors, there are strategies small business owners can employ to potentially reduce their insurance expenses. These strategies involve a careful balance of coverage, risk management, and negotiation to achieve the best possible insurance rates.

Optimizing Coverage

One effective strategy is to carefully review and optimize your insurance coverage. This involves assessing your business’s unique risks and needs to ensure you have the right policies in place without paying for unnecessary coverage. By understanding the specific risks your business faces, you can tailor your insurance portfolio to provide adequate protection without overspending. For instance, if your business primarily operates online and doesn’t involve physical customer interactions, you may not require as extensive a general liability policy as a brick-and-mortar retail store.

Implementing Risk Management Measures

Taking proactive steps to mitigate risks can have a significant impact on insurance costs. Insurance providers often offer discounts or more competitive rates to businesses that demonstrate a commitment to risk management. This can include implementing safety protocols, investing in employee training, and utilizing technology to enhance safety measures. For example, a manufacturing business that installs advanced safety features on its machinery and provides comprehensive safety training to employees may be viewed as a lower-risk operation, leading to reduced insurance premiums.

Bundling Policies and Comparing Quotes

Bundling your insurance policies with a single provider can often lead to cost savings. Many insurance companies offer discounts when you purchase multiple policies from them. This strategy can be particularly effective for small businesses that require a range of insurance coverage, such as general liability, professional liability, and property insurance. Additionally, it’s crucial to compare quotes from multiple insurance providers to ensure you’re getting the best rates. Shopping around can help you identify the most competitive premiums and ensure you’re not overpaying for your insurance coverage.

Negotiating and Seeking Expert Advice

Negotiation is a powerful tool in the business world, and it can be effectively applied to insurance costs. When discussing premiums with insurance providers, it’s important to highlight the measures your business has taken to mitigate risks and reduce the likelihood of claims. By demonstrating your commitment to risk management and providing evidence of a clean claims history, you may be able to negotiate more favorable rates. Furthermore, seeking advice from insurance brokers or consultants who specialize in small business insurance can provide valuable insights and strategies to reduce costs while maintaining adequate coverage.

The Impact of Insurance Costs on Small Business Growth and Sustainability

Insurance costs are a significant consideration for small businesses, not only in terms of immediate financial outlays but also in their broader impact on business growth and sustainability. Understanding how insurance costs influence business operations and strategies is crucial for small business owners to make informed decisions and navigate the complex landscape of insurance.

Financial Planning and Budgeting

Insurance costs are a fixed expense that small businesses must budget for. The amount allocated for insurance can significantly impact a business’s financial health and growth prospects. Higher insurance premiums can eat into a business’s profits, potentially limiting its ability to invest in growth opportunities, hire new talent, or pursue innovative projects. As such, small business owners must carefully consider insurance costs when planning their finances and ensure they have sufficient reserves to cover these expenses without compromising other vital areas of the business.

Flexibility and Scalability

The cost of insurance can also influence a small business’s ability to scale and adapt to changing market conditions. Higher insurance costs may limit a business’s flexibility, making it more challenging to respond to market demands or seize new opportunities. For instance, a small business with high insurance premiums may struggle to expand its operations or enter new markets due to the increased financial burden. This lack of flexibility can hinder a business’s growth potential and limit its ability to compete effectively in the market.

Long-Term Sustainability and Risk Management

Insurance plays a critical role in the long-term sustainability of small businesses. By providing protection against various risks, insurance helps businesses mitigate potential financial losses and maintain stability. However, the cost of insurance must be balanced with the need for adequate coverage. Small businesses must carefully assess their risk exposure and ensure they have the right insurance policies in place to protect their operations. This delicate balance between cost and coverage is essential for long-term sustainability, as it allows businesses to manage risks effectively without incurring excessive insurance expenses.

Adapting to Changing Market Dynamics

The insurance landscape is not static, and small businesses must be prepared to adapt to changing market conditions. This includes keeping abreast of evolving insurance regulations, market trends, and new insurance products that may offer more competitive rates or tailored coverage. By staying informed and proactive, small businesses can ensure they are not paying more than necessary for insurance and can adapt their coverage as their business needs evolve. This adaptability is crucial for small businesses to remain competitive and resilient in a dynamic market environment.

How can I find the best insurance rates for my small business?

+To find the best insurance rates for your small business, it’s important to shop around and compare quotes from multiple providers. Additionally, consider bundling your policies with a single insurer to potentially save on premiums. Remember to review your coverage regularly and optimize it to ensure you’re not overpaying for unnecessary coverage.

Are there any government programs or incentives to help small businesses with insurance costs?

+Yes, some governments offer programs or incentives to support small businesses with their insurance costs. These may include tax deductions, grants, or subsidized insurance programs. It’s advisable to research and stay informed about such initiatives in your region to take advantage of any available support.

How can I reduce my insurance costs without compromising coverage?

+To reduce insurance costs without compromising coverage, focus on optimizing your policies by carefully reviewing your business’s unique risks and needs. Implement risk management measures to demonstrate your commitment to safety and consider bundling policies with a single provider. Additionally, negotiation and seeking expert advice can help you secure more favorable rates.