Best Short Term Insurance Coverage

Short-term insurance is a flexible and cost-effective solution for individuals and businesses seeking temporary coverage to protect their assets and livelihoods. Unlike long-term policies, short-term insurance provides coverage for a defined period, typically ranging from a few months to a year, offering tailored protection during specific life stages or business operations. This article explores the benefits, types, and considerations of short-term insurance, highlighting its role as a vital component of a comprehensive risk management strategy.

Understanding Short-Term Insurance

Short-term insurance, also known as temporary or limited-term insurance, is designed to provide coverage for a specified period, addressing immediate insurance needs. These policies are particularly beneficial for individuals experiencing life transitions, such as job changes, career breaks, or periods of financial uncertainty. For businesses, short-term insurance can bridge coverage gaps during project-specific operations or when transitioning between long-term policies.

Key Benefits of Short-Term Insurance

- Flexibility: Short-term insurance policies offer customizable coverage, allowing individuals and businesses to select the duration and level of protection that suits their current needs.

- Cost-Effectiveness: With shorter coverage periods, these policies are generally more affordable than long-term alternatives, making insurance accessible to a broader range of consumers.

- Quick Coverage: Many short-term insurance plans provide immediate coverage, ensuring protection is in place as soon as the policy is activated.

- Tailored Solutions: Policies can be tailored to specific risks, providing targeted protection for unique situations or projects.

Types of Short-Term Insurance

Short-term insurance is available for a wide range of coverage needs, including:

- Health Insurance: Short-term health insurance plans offer temporary medical coverage, often at a lower cost than traditional health insurance. These policies are ideal for individuals between jobs, students, or those facing a coverage gap.

- Travel Insurance: Designed for travelers, short-term travel insurance provides coverage for medical emergencies, trip cancellations, lost luggage, and other travel-related risks.

- Auto Insurance: Short-term auto insurance is perfect for individuals borrowing or renting a vehicle, offering liability and collision coverage for a specified period.

- Business Insurance: Businesses can secure short-term coverage for specific projects, events, or periods of heightened risk, such as product launches or seasonal operations.

- Homeowner’s Insurance: Short-term homeowner’s insurance provides coverage for individuals between homes or during home renovations, protecting against property damage and liability risks.

Factors to Consider When Choosing Short-Term Insurance

When selecting a short-term insurance policy, several factors should be taken into account to ensure the coverage meets your specific needs:

Coverage Duration

Determine the length of coverage required. Short-term insurance policies typically range from 30 days to 12 months, with some providers offering customizable durations.

Coverage Limits

Review the policy’s coverage limits, ensuring they align with your potential risks and liabilities. Consider the value of your assets, the potential cost of medical treatment, or the financial impact of a business disruption.

Policy Exclusions

Carefully read the policy’s exclusions to understand what risks are not covered. Some common exclusions include pre-existing conditions, certain high-risk activities, or specific types of damage.

Renewability and Conversion Options

Inquire about the policy’s renewability and conversion options. Some short-term insurance policies can be renewed, while others offer the option to convert to a long-term policy, ensuring continuous coverage without the need for a new application.

Provider Reputation and Financial Stability

Research the insurance provider’s reputation and financial stability. Ensure the company has a strong track record of paying claims promptly and has the financial resources to provide coverage during the policy period.

Additional Benefits and Services

Look for policies that offer additional benefits or services, such as 24⁄7 customer support, emergency assistance, or access to a network of preferred providers.

Case Study: Short-Term Insurance for Freelancers

Consider the example of Sarah, a freelance graphic designer. With a fluctuating income and irregular work schedule, Sarah’s insurance needs are unique. She opts for short-term health insurance during periods of lower income, ensuring she has coverage when it matters most. Additionally, Sarah purchases short-term liability insurance for specific client projects, protecting her business during high-risk operations.

Future Trends in Short-Term Insurance

The short-term insurance market is evolving to meet the changing needs of consumers and businesses. Here are some key trends to watch:

Digital Transformation

Insurance providers are embracing digital technologies to streamline the short-term insurance process. From online applications and instant policy issuance to digital claim submission and tracking, the industry is becoming more efficient and customer-centric.

Personalized Coverage

Short-term insurance policies are becoming increasingly customizable, allowing individuals and businesses to select coverage options that align with their specific needs and risk profiles. This shift towards personalized coverage ensures that policies are not only affordable but also provide comprehensive protection.

Integration with Technology

Short-term insurance is integrating with emerging technologies, such as IoT devices and AI-powered risk assessment tools. These innovations enable more accurate risk profiling, real-time monitoring of insured assets, and proactive claim prevention.

Collaborative Insurance Models

Collaborative insurance models, such as peer-to-peer insurance and parametric insurance, are gaining traction in the short-term insurance space. These models leverage community networks and shared risk pools to offer more affordable and accessible coverage options.

Conclusion

Short-term insurance is a valuable tool for individuals and businesses seeking flexible, cost-effective coverage during specific life stages or operational periods. By understanding the benefits, types, and considerations of short-term insurance, consumers can make informed decisions to protect their assets and livelihoods. As the industry continues to innovate, short-term insurance is poised to become an even more integral component of comprehensive risk management strategies.

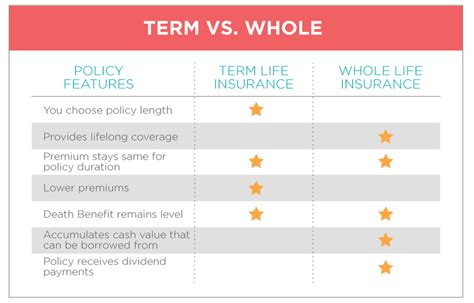

What are the key differences between short-term and long-term insurance policies?

+Short-term insurance policies are designed for temporary coverage, typically lasting from a few months to a year, and offer flexible, customizable protection. In contrast, long-term insurance policies, such as life insurance or traditional health insurance, are intended for lifelong or extended coverage and often come with fixed terms and conditions.

How can I determine the right coverage limits for my short-term insurance policy?

+Assessing your specific risks and potential liabilities is crucial when determining coverage limits. Consider the value of your assets, the cost of potential medical treatment, or the financial impact of a business disruption. Consulting with an insurance professional can help you tailor your coverage limits to your unique needs.

Are short-term insurance policies renewable, and what are the benefits of renewal?

+Many short-term insurance policies offer the option to renew, allowing you to extend your coverage for an additional period. Renewal ensures continuous protection without the need for a new application, which can be especially beneficial if your insurance needs remain consistent over time.

What are some common exclusions in short-term insurance policies, and how can I ensure I have adequate coverage?

+Common exclusions in short-term insurance policies may include pre-existing conditions, high-risk activities, or specific types of damage. To ensure adequate coverage, carefully review the policy’s exclusions and consider purchasing additional endorsements or riders to address specific risks that are not covered by the base policy.

How do I choose a reputable short-term insurance provider?

+When selecting a short-term insurance provider, consider their reputation, financial stability, and track record of paying claims promptly. Look for providers with positive customer reviews and a history of strong financial performance. Additionally, seek recommendations from trusted sources, such as industry experts or financial advisors.