How Much Is Rental Insurance

Rental insurance, also known as tenant insurance, is a vital aspect of protecting your belongings and ensuring peace of mind as a renter. While the cost of rental insurance can vary depending on several factors, understanding its importance and the coverage it provides can help you make an informed decision about securing your rental property and personal assets.

The Significance of Rental Insurance

Rental insurance serves as a safeguard for tenants, covering a wide range of potential risks and liabilities that may arise during the course of a tenancy. Here are some key reasons why investing in rental insurance is beneficial:

- Protection Against Loss or Damage: Rental insurance provides coverage for your personal belongings in the event of theft, fire, water damage, or other perils. This ensures that you can replace or repair your possessions without incurring significant financial burden.

- Liability Coverage: Tenants are often held responsible for any accidental damage caused to the rental property or injuries sustained by guests. Rental insurance offers liability protection, which can help cover legal fees and damages if a claim is made against you.

- Peace of Mind: Having rental insurance gives you peace of mind, knowing that you are protected from unexpected events. It allows you to focus on enjoying your rental experience without worrying about potential financial losses.

- Additional Living Expenses: In the event of a covered loss that makes your rental unit uninhabitable, rental insurance may provide coverage for temporary living expenses, such as hotel stays or additional rent costs.

- Personal Injury Protection: Some rental insurance policies also offer personal injury protection, covering medical expenses if a guest or visitor is injured on your rental property.

Factors Influencing Rental Insurance Costs

The cost of rental insurance can vary significantly based on several factors. It is important to understand these variables to estimate the price range for your specific situation.

Location and Property Type

The location of your rental property and its type (apartment, condo, house) play a crucial role in determining the cost of rental insurance. Insurance providers consider the risk associated with different areas and property types. For instance, a rental unit in an area prone to natural disasters or with a higher crime rate may attract higher insurance premiums.

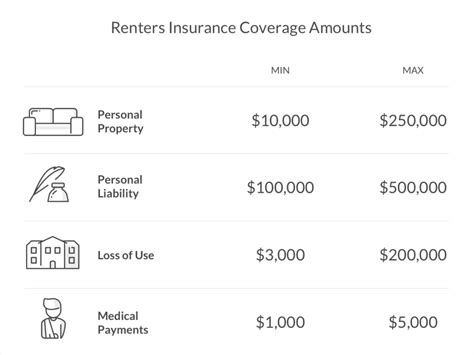

Coverage Amount and Deductible

The amount of coverage you choose directly impacts the cost of your rental insurance. Higher coverage limits will generally result in higher premiums. Additionally, the deductible, which is the amount you pay out of pocket before the insurance coverage kicks in, can also affect the overall cost. Opting for a higher deductible can lead to lower monthly premiums, but it means you’ll have to pay more in the event of a claim.

Policy Features and Add-Ons

Rental insurance policies come with various features and add-ons that can impact the cost. These may include coverage for specific items, such as jewelry or electronics, or additional benefits like identity theft protection or loss of use coverage. While these features enhance your protection, they may also increase the overall cost of your insurance.

Discounts and Bundling

Insurance providers often offer discounts for various reasons. You may be eligible for discounts if you have multiple policies with the same insurer (e.g., auto and rental insurance), have certain safety features in your rental unit, or maintain a good credit score. Bundling your insurance policies can lead to significant savings, so it’s worth exploring this option.

Actual Examples of Rental Insurance Costs

To give you a better understanding, here are some real-world examples of rental insurance costs based on different scenarios:

| Scenario | Coverage Amount | Deductible | Monthly Premium |

|---|---|---|---|

| Standard Apartment in a Low-Risk Area | $20,000 | $500 | $15 - $20 |

| Condo in an Urban Area with Higher Risk | $30,000 | $750 | $25 - $35 |

| Luxury Apartment with High-Value Items | $50,000 | $1,000 | $35 - $50 |

| House Rental with Additional Coverage | $40,000 | $800 | $40 - $60 |

Tips for Getting the Best Rental Insurance Rates

To ensure you get the most affordable rental insurance rates while still maintaining adequate coverage, consider the following tips:

- Shop Around: Compare quotes from multiple insurance providers to find the best rates and coverage options that suit your needs.

- Bundle Policies: If you have other insurance needs, such as auto or homeowners insurance, bundling them with your rental insurance can result in significant savings.

- Increase Your Deductible: Opting for a higher deductible can lower your monthly premiums, but be sure you can afford the out-of-pocket expense if a claim arises.

- Review Coverage Limits: Assess your belongings and determine the appropriate coverage limits to avoid over-insuring or under-insuring your possessions.

- Take Advantage of Discounts: Look for discounts based on factors like your age, occupation, or safety features in your rental unit. Insurance providers often offer discounts for smoke detectors, security systems, and other safety measures.

- Understand Exclusions: Carefully review the policy exclusions to ensure you're not overlooking any important coverage gaps.

Conclusion: The Value of Rental Insurance

Rental insurance is an essential investment for tenants, providing financial protection and peace of mind. By understanding the factors that influence insurance costs and taking advantage of available discounts, you can find a rental insurance policy that offers comprehensive coverage at an affordable price. Remember, the cost of rental insurance is typically much lower than the potential financial loss you could face without it.

How much is rental insurance for an average apartment?

+The average cost of rental insurance for an apartment can vary depending on factors like location, coverage amount, and deductible. Typically, you can expect to pay anywhere from 15 to 50 per month for rental insurance.

Does rental insurance cover my personal belongings?

+Yes, rental insurance typically covers your personal belongings against risks like theft, fire, and water damage. It provides financial protection to replace or repair your possessions if they are damaged or lost.

Can I get rental insurance if I have a low credit score?

+While a low credit score may impact the cost of your rental insurance, it does not necessarily prevent you from obtaining coverage. Some insurance providers offer rental insurance regardless of credit history, but you may face higher premiums.

What happens if I don’t have rental insurance and my belongings are stolen?

+If you don’t have rental insurance and your belongings are stolen, you will likely have to bear the financial burden of replacing or repairing them out of your own pocket. Rental insurance provides a safety net to protect your assets.

Are there any additional benefits to rental insurance?

+Yes, rental insurance often includes additional benefits such as liability coverage, which protects you from legal expenses if someone is injured on your rental property, and additional living expenses coverage, which provides financial assistance if your rental unit becomes uninhabitable due to a covered loss.