Insurance Compare Websites

In today's digital age, insurance compare websites have emerged as powerful tools for consumers seeking the best deals and coverage options. These platforms offer a convenient way to compare various insurance policies, helping individuals and businesses make informed decisions. With a vast array of insurance products available, from auto and home insurance to health and life coverage, these websites play a crucial role in simplifying the complex world of insurance.

Revolutionizing the Insurance Industry

The rise of insurance compare websites has revolutionized the traditional insurance landscape. By providing an online marketplace, these platforms have disrupted the industry, empowering consumers with the ability to research, compare, and choose insurance plans with ease. No longer are individuals limited to a single provider or agent; insurance compare websites open up a world of options, fostering competition and driving down prices.

The impact of these websites extends beyond price comparisons. They offer a wealth of information, from policy details and coverage limits to customer reviews and ratings. This transparency allows consumers to make choices based on their specific needs and preferences, ensuring they receive the right coverage at the right price.

Key Features and Benefits

Insurance compare websites boast a range of features that enhance the user experience and simplify the insurance shopping process. Here are some notable aspects:

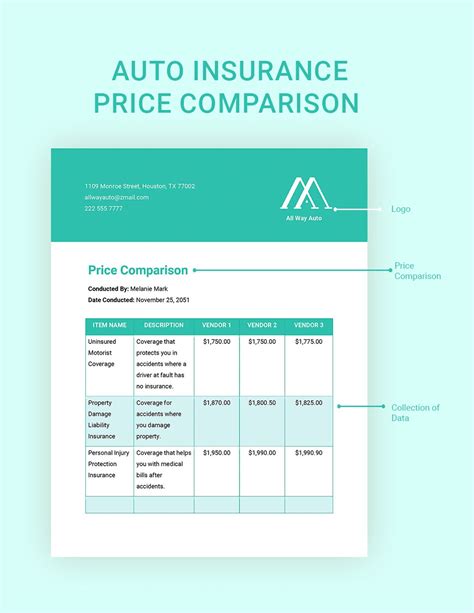

- Comprehensive Policy Comparison: These websites aggregate policies from multiple providers, allowing users to compare coverage, premiums, and features side by side. This comprehensive comparison ensures consumers find the best fit for their needs.

- Real-Time Quotes: Users can instantly obtain quotes for various insurance types, receiving accurate and up-to-date information. This real-time feature saves time and effort, especially when shopping for multiple policies.

- Customizable Search Filters: Advanced search filters enable users to tailor their search based on specific criteria, such as coverage limits, deductibles, and provider ratings. This customization ensures a more precise and relevant set of results.

- Customer Reviews and Ratings: Many insurance compare websites feature customer reviews and ratings, providing valuable insights into the experiences of policyholders. This social aspect helps users gauge the reputation and reliability of insurance providers.

- Expert Advice and Resources: Some platforms offer educational resources, articles, and guides to help users understand insurance jargon and make informed decisions. This additional layer of support ensures consumers are well-informed about their choices.

| Insurance Type | Average Savings |

|---|---|

| Auto Insurance | $400 annually |

| Home Insurance | $250 annually |

| Health Insurance | Varies based on plan |

| Life Insurance | Up to 20% on premiums |

The Future of Insurance Shopping

As technology advances and consumer expectations evolve, insurance compare websites are poised to become even more sophisticated and user-friendly. Here’s a glimpse into the future:

Artificial Intelligence and Personalization

AI-powered algorithms will play a pivotal role in enhancing the insurance comparison experience. These algorithms can analyze user data, preferences, and historical trends to provide personalized recommendations. By understanding individual needs and risk profiles, AI can suggest the most suitable policies, ensuring a more tailored and efficient shopping journey.

Enhanced Data Security and Privacy

With the increasing importance of data privacy, insurance compare websites will prioritize secure data handling. Advanced encryption protocols and robust security measures will protect user information, building trust and confidence among consumers. Additionally, websites may adopt privacy-focused features, such as allowing users to selectively share their data with providers, further empowering individuals to control their digital footprint.

Integration of Emerging Technologies

The integration of emerging technologies, such as blockchain and IoT (Internet of Things), will transform the insurance landscape. Blockchain technology can enhance data integrity and streamline claim processes, while IoT devices can provide real-time data for more accurate risk assessments. These technologies will enable insurance compare websites to offer innovative solutions and more precise pricing models.

Seamless Digital Experiences

Insurance compare websites will continue to prioritize user experience, offering seamless and intuitive interfaces. With the rise of mobile devices, platforms will optimize for mobile-first interactions, ensuring a smooth and efficient shopping journey regardless of the device. Additionally, voice-assisted search and augmented reality may play a role in providing interactive and immersive experiences.

Expanded Global Reach

As the world becomes more interconnected, insurance compare websites will expand their reach globally. By partnering with international providers and offering multilingual support, these platforms will cater to a diverse range of consumers, breaking down geographical barriers and providing access to a wider array of insurance options.

Conclusion: Empowering Consumers

Insurance compare websites have transformed the way consumers shop for insurance, offering a convenient, transparent, and empowering experience. With their extensive features, real-time quotes, and personalized recommendations, these platforms have become essential tools for anyone seeking the best insurance coverage. As the industry continues to evolve, insurance compare websites will remain at the forefront, driving innovation and putting the power of choice directly into the hands of consumers.

How do insurance compare websites work?

+Insurance compare websites aggregate data from various insurance providers, allowing users to input their preferences and receive tailored quotes and policy comparisons. These platforms simplify the process by presenting options side by side, making it easier to find the best fit.

Are insurance compare websites free to use?

+Yes, insurance compare websites are typically free for users. They generate revenue through commissions from insurance providers when users purchase policies through their platforms.

How accurate are the quotes provided by these websites?

+Quotes provided by insurance compare websites are generally accurate, as they are based on the information users provide. However, it’s important to note that final premiums may vary slightly during the application process, as providers may require additional details or perform further assessments.

Can I trust the customer reviews on insurance compare websites?

+Customer reviews on insurance compare websites can provide valuable insights, but it’s important to exercise caution. Look for patterns in the reviews and consider multiple sources to get a well-rounded understanding of a provider’s reputation. Additionally, some websites have measures in place to ensure the authenticity of reviews.