What Auto Insurance Do I Need

Choosing the right auto insurance is a crucial step to protect your financial well-being and ensure peace of mind while driving. With a multitude of options available, it's essential to understand your specific needs and the various coverage types to make an informed decision. This comprehensive guide will delve into the world of auto insurance, offering expert insights and practical advice to help you navigate this complex landscape.

Understanding Your Auto Insurance Needs

Your auto insurance requirements are unique and depend on several factors, including your personal circumstances, the value of your vehicle, and the laws in your state. Here's a breakdown of the key considerations:

Liability Coverage

Liability insurance is the cornerstone of any auto insurance policy. It covers the costs if you're at fault in an accident, including bodily injury and property damage to others. Every state has minimum liability requirements, but these limits might not be sufficient to cover all expenses in a severe accident. It's recommended to consider higher liability limits to provide better protection.

| State | Minimum Liability Requirements |

|---|---|

| California | 15/30/5 |

| Texas | 30/60/25 |

| New York | 25/50/10 |

Collision and Comprehensive Coverage

Collision coverage pays for damages to your vehicle if you're in an accident, regardless of fault. Comprehensive coverage, on the other hand, covers damages caused by events other than collisions, such as theft, vandalism, or natural disasters. These coverages are optional but are highly recommended, especially if your vehicle is still being financed or leased.

Personal Injury Protection (PIP) and Medical Payments Coverage

PIP and medical payments coverage provide financial support for medical expenses and lost wages if you or your passengers are injured in an accident. PIP is mandatory in some states, while medical payments coverage is optional. These coverages can help alleviate the financial burden of medical bills and lost income.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you're involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages. It's an important consideration, given that not all drivers carry adequate insurance. Uninsured/underinsured motorist coverage can help ensure you're not left with unpaid medical bills or other expenses.

Assessing Your Risk and Coverage Options

Understanding your risk profile is crucial when selecting auto insurance. Factors such as your driving history, the age and value of your vehicle, and the area where you live can all impact your insurance needs and costs. Here's a deeper dive into these considerations:

Risk Factors

- Driving History: A clean driving record can lead to lower insurance premiums. Conversely, a history of accidents or violations may result in higher rates. It's essential to maintain a safe driving record to keep your insurance costs down.

- Vehicle Age and Value: Older vehicles may require less comprehensive coverage, as their value decreases over time. However, if your vehicle is still being financed or leased, collision and comprehensive coverage are generally necessary.

- Location: The area where you live and drive can impact your insurance rates. Urban areas with higher population densities and traffic may have more accidents and thefts, leading to higher insurance costs. Rural areas, on the other hand, may offer lower rates.

Coverage Options and Customization

Auto insurance policies can be customized to fit your specific needs. Here are some additional coverage options to consider:

- Rental Car Reimbursement: This coverage can help cover the cost of renting a vehicle if your insured car is in the shop for repairs.

- Gap Insurance: If you're leasing or financing your vehicle, gap insurance can cover the difference between what your insurance pays and the remaining balance on your lease or loan if your car is totaled.

- Custom Parts and Equipment Coverage: If you've made significant upgrades or modifications to your vehicle, this coverage can ensure that these additions are protected in the event of an accident or theft.

Comparing Insurance Providers and Policies

With numerous insurance providers offering a wide range of policies, it's essential to compare options to find the best coverage and value. Here are some tips to help you navigate the process:

Research and Comparison

- Use online tools and resources to research and compare insurance providers and their policies. Look for reviews and ratings to get an idea of the provider's reputation and customer satisfaction.

- Consider the financial stability and ratings of the insurance companies you're evaluating. A financially stable company can provide more assurance that they'll be able to pay out claims.

- Examine the policy details, including coverage limits, deductibles, and any exclusions or limitations. Ensure you understand what's covered and what's not.

Get Multiple Quotes

Obtain quotes from several insurance providers to compare prices and coverage options. Remember that the cheapest policy might not always offer the best value. Consider factors like the provider's claims process, customer service, and reputation when making your decision.

Consider Bundling and Discounts

Many insurance providers offer discounts for bundling multiple policies (such as auto and home insurance) or for certain qualifications like safe driving, good student status, or senior citizen status. Ask about available discounts and consider how they might impact your overall insurance costs.

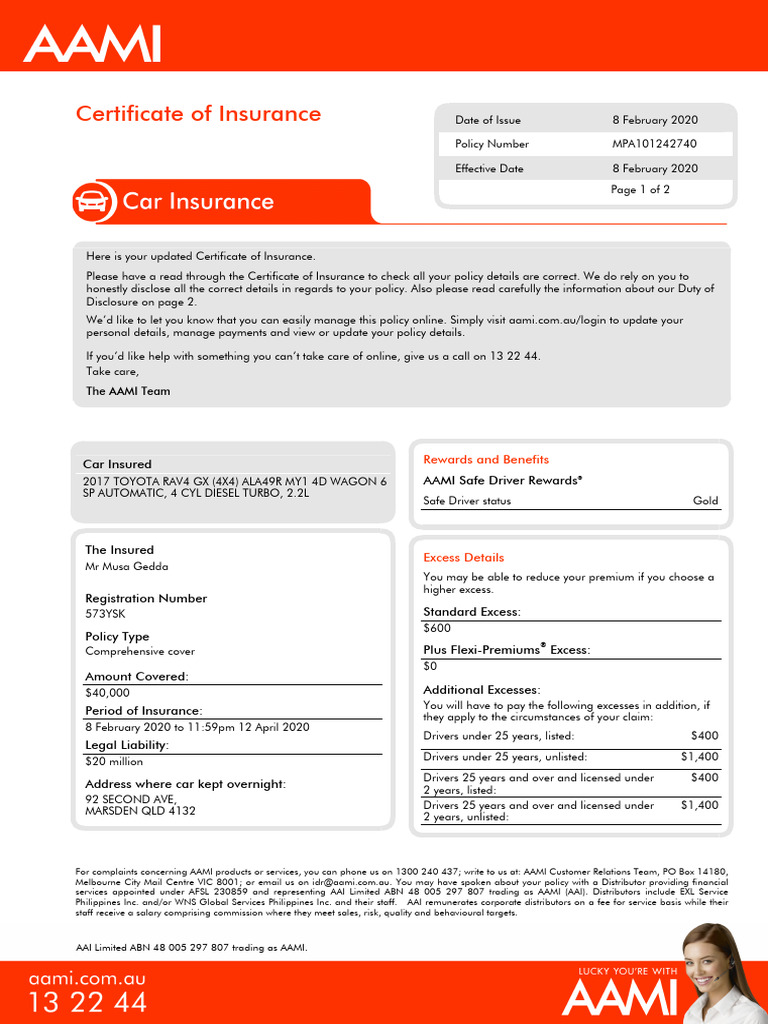

Understanding the Claims Process

In the event of an accident or other covered incident, understanding the claims process is essential. Here's a step-by-step guide to help you navigate this process:

Reporting the Claim

- Contact your insurance provider as soon as possible after an accident or incident. Provide them with all the necessary details, including the date, time, location, and any relevant photos or documentation.

- If you're involved in an accident, exchange information with the other driver(s) involved, including their insurance details.

- Keep a record of all communications with your insurance provider and any other parties involved in the claim.

The Claims Adjustment Process

An insurance adjuster will investigate your claim and determine the extent of the damages. They may request additional information or documentation to support your claim. It's essential to cooperate fully with the adjuster to ensure a smooth claims process.

Settling the Claim

Once the adjuster has completed their investigation, they'll make a determination on your claim and offer a settlement. If you agree with the settlement amount, you can proceed with the repairs or other necessary actions. If you disagree with the settlement, you have the right to negotiate or appeal the decision.

Maintaining Your Auto Insurance Coverage

Once you've selected your auto insurance policy, it's important to maintain it to ensure continuous protection. Here are some tips to keep in mind:

Regularly Review Your Policy

Your insurance needs may change over time. Review your policy annually or whenever there's a significant change in your life, such as buying a new vehicle, moving to a new location, or getting married. This ensures that your coverage remains adequate and up-to-date.

Keep Your Driving Record Clean

A clean driving record can lead to lower insurance premiums. Avoid accidents and violations to maintain a good record. If you do have an accident or violation, be sure to disclose it to your insurance provider to ensure your coverage isn't impacted.

Stay Informed and Up-to-Date

Keep yourself informed about changes in auto insurance laws and regulations in your state. Stay up-to-date with your insurance provider's policies and procedures, and don't hesitate to reach out to your agent or customer service with any questions or concerns.

FAQ

What is the difference between liability, collision, and comprehensive coverage?

+

Liability coverage is mandatory and covers damages you cause to others. Collision coverage is optional and covers damages to your own vehicle in an accident, regardless of fault. Comprehensive coverage is also optional and covers damages to your vehicle from non-collision events like theft, vandalism, or natural disasters.

How do I choose the right insurance provider?

+

Research and compare multiple providers based on their reputation, financial stability, policy offerings, and customer service. Consider factors like claims handling, discounts, and overall value when making your decision.

Can I switch insurance providers after purchasing a policy?

+

Yes, you can switch insurance providers at any time. However, it’s important to ensure that your new policy is in effect before canceling your old one to avoid a lapse in coverage.

What happens if I’m involved in an accident with an uninsured driver?

+

If you have uninsured motorist coverage, your insurance provider will cover the damages up to the limits of your policy. This coverage protects you when the at-fault driver has no insurance or insufficient coverage.