Car Comparison Insurance

Choosing the right car insurance is a crucial decision that can significantly impact your financial well-being and peace of mind. With countless insurance providers offering various policies, it's essential to make an informed choice. This comprehensive guide will help you navigate the world of car insurance, comparing key factors to find the best coverage for your needs. By the end of this article, you'll have the tools and knowledge to confidently select an insurance plan that provides excellent coverage at a competitive price.

Understanding Car Insurance Policies

Car insurance is a contract between you and an insurance provider. In exchange for regular payments, known as premiums, the insurer promises to financially protect you in the event of an accident, theft, or other covered incidents. Policies can vary widely, offering different levels of coverage, deductibles, and optional add-ons. Understanding these variations is key to making an informed decision.

Types of Car Insurance Coverage

Car insurance policies primarily fall into three categories: liability, collision, and comprehensive. Liability coverage is the most basic and legally required in most states. It covers the cost of damages and injuries you cause to others in an accident. Collision coverage, on the other hand, pays for repairs to your vehicle after an accident, regardless of fault. Comprehensive coverage protects against non-collision incidents like theft, vandalism, or natural disasters.

| Coverage Type | Description |

|---|---|

| Liability | Covers damages and injuries to others |

| Collision | Pays for repairs to your vehicle after an accident |

| Comprehensive | Protects against non-collision incidents |

Additional Coverage Options

Beyond the basic coverages, many insurers offer additional options to tailor your policy to your specific needs. These may include:

- Uninsured/Underinsured Motorist Coverage: Protects you if you're involved in an accident with a driver who has no or insufficient insurance.

- Medical Payments Coverage: Covers medical expenses for you and your passengers after an accident, regardless of fault.

- Personal Injury Protection (PIP): Provides broader medical and disability coverage, including lost wages and funeral expenses.

- Rental Car Reimbursement: Covers the cost of renting a vehicle while yours is being repaired.

- Gap Insurance: Covers the difference between what your insurance pays and what you still owe on your car loan if your vehicle is a total loss.

Comparing Insurance Providers

With so many insurance companies in the market, it’s essential to compare policies to find the best fit for your needs. Here are some key factors to consider when evaluating providers:

Financial Stability and Reputation

A financially stable insurance company is crucial to ensure they can fulfill their obligations in the event of a claim. Check ratings from independent agencies like AM Best, Moody’s, or Standard & Poor’s to assess the company’s financial health. Additionally, research online reviews and customer satisfaction surveys to gauge the provider’s reputation and customer service.

Coverage Options and Customization

Different insurers offer varying coverage options and customization capabilities. Some may specialize in certain types of coverage, like classic car insurance or coverage for high-risk drivers. Assess your specific needs and ensure the provider offers the coverage options that align with them.

Discounts and Savings

Many insurers offer discounts to reduce the cost of premiums. Common discounts include those for safe driving records, bundling multiple policies, installing anti-theft devices, and completing defensive driving courses. Compare the types and amounts of discounts offered by different providers to find the most cost-effective option.

Claims Process and Customer Service

The claims process and customer service are critical aspects of any insurance policy. Research how the provider handles claims, including the speed of response, ease of the process, and customer satisfaction. Check online reviews and ratings to gauge the provider’s customer service reputation.

Technology and Digital Tools

In today’s digital age, many insurers offer online and mobile tools to manage policies, file claims, and communicate with the company. Consider the provider’s technological offerings and how they can simplify the insurance process for you.

Network of Repair Shops and Rental Car Partners

Some insurance companies have preferred networks of repair shops and rental car partners. Assess whether the provider’s network includes reputable shops and rental companies in your area. This can impact the convenience and quality of your experience if you need to use these services.

Comparing Policy Features and Benefits

Beyond the provider, it’s essential to compare the specific features and benefits of the policies themselves. Here’s what to look for:

Coverage Limits and Deductibles

Coverage limits refer to the maximum amount the insurer will pay for a covered loss. Higher limits typically provide better protection but also result in higher premiums. Deductibles are the amount you pay out of pocket before the insurance coverage kicks in. Higher deductibles can lower your premium, so consider your financial situation and risk tolerance when choosing deductibles.

Policy Add-ons and Customization

As mentioned earlier, many insurers offer additional coverages to tailor your policy. Assess which add-ons are available and how they can enhance your protection. Consider your specific needs and the value of your vehicle when choosing add-ons.

Policy Terms and Conditions

Read the fine print of the policy to understand the terms and conditions. This includes understanding what’s covered and what’s excluded, as well as any limitations or restrictions on coverage. Pay attention to policy exclusions, as they can significantly impact your coverage in certain situations.

Renewal and Cancellation Policies

Understand the insurer’s policies regarding renewals and cancellations. Some providers may automatically renew your policy, while others may require action on your part. Additionally, check the terms for canceling a policy and any associated fees.

The Impact of Your Driving Record

Your driving record plays a significant role in determining your insurance rates. Insurers use this information to assess your risk level and set your premium. A clean driving record with no accidents or violations typically results in lower rates. However, even a single traffic violation or accident can increase your rates significantly.

Improving Your Driving Record

If you have a less-than-perfect driving record, there are steps you can take to improve your situation. Consider taking a defensive driving course, which can help you become a safer driver and may even qualify you for a discount with some insurers. Additionally, maintaining a clean driving record over time can lead to lower rates as insurers see you as a lower risk.

The Cost of Car Insurance

The cost of car insurance, or the premium, is a key factor in your decision-making process. Premiums can vary widely depending on several factors, including your driving record, the type of vehicle you drive, your location, and the coverage options you choose.

Factors Affecting Car Insurance Premiums

Here are some of the key factors that influence the cost of your car insurance:

- Driving Record: As mentioned, your driving history is a significant factor in determining your premium. A clean record typically results in lower rates, while accidents and violations can increase them.

- Vehicle Type: The make, model, and year of your vehicle can impact your premium. Sports cars and luxury vehicles often have higher premiums due to their higher repair costs and theft rates.

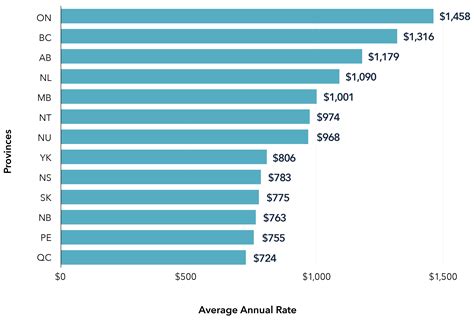

- Location: Where you live and drive your vehicle can affect your premium. Urban areas with higher population densities and traffic congestion often have higher rates due to increased accident risks.

- Coverage Options: The more coverage you choose, the higher your premium is likely to be. However, this provides greater protection in the event of an accident or other covered incident.

- Deductibles: Higher deductibles can lower your premium, but they also mean you'll pay more out of pocket if you need to file a claim.

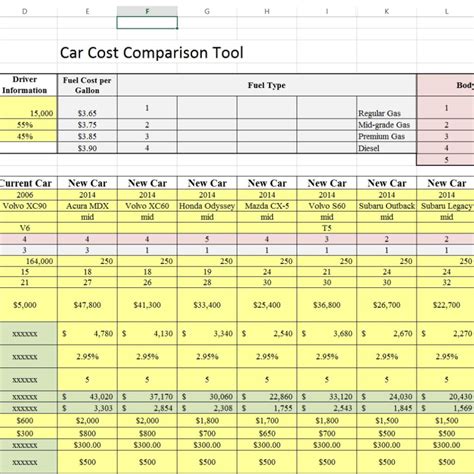

Shopping Around for the Best Rate

To find the best rate for your car insurance, it’s essential to shop around and compare quotes from multiple providers. Use online comparison tools or work with an insurance broker who can provide quotes from several companies. By comparing rates, you can ensure you’re getting the best value for your money.

Making an Informed Decision

Comparing car insurance policies and providers can be a complex process, but it’s a crucial step in ensuring you have the right coverage at a fair price. By understanding the different types of coverage, comparing providers and policies, and considering the impact of your driving record and cost factors, you can make an informed decision that meets your needs and budget.

Additional Resources

For further guidance and support in your car insurance journey, consider the following resources:

- State Insurance Departments: Many states have insurance departments that offer consumer guides and resources to help you understand your rights and responsibilities as a policyholder.

- Insurance Brokers: Working with an insurance broker can provide valuable expertise and guidance in finding the right policy for your needs. Brokers can often access multiple insurance companies and provide quotes and advice.

- Online Resources: There are numerous online resources, including blogs, forums, and comparison websites, that can provide additional insights and guidance on car insurance.

What is the difference between liability, collision, and comprehensive coverage?

+Liability coverage is the most basic and covers damages and injuries you cause to others. Collision coverage pays for repairs to your vehicle after an accident, regardless of fault. Comprehensive coverage protects against non-collision incidents like theft, vandalism, or natural disasters.

How do I improve my driving record to lower my insurance rates?

+Consider taking a defensive driving course, which can help you become a safer driver and may even qualify you for a discount with some insurers. Additionally, maintaining a clean driving record over time can lead to lower rates as insurers see you as a lower risk.

What factors affect the cost of car insurance premiums?

+Your driving record, vehicle type, location, coverage options, and deductibles all impact the cost of your car insurance premiums. Shopping around and comparing quotes from multiple providers is essential to finding the best rate.