Compare Auto Insurance Costs

In the realm of personal finance, understanding the factors that influence auto insurance costs is essential for making informed decisions. This article delves into the intricacies of auto insurance, exploring the key variables that impact premiums and providing a comprehensive comparison to empower consumers in their financial choices.

The Complexity of Auto Insurance Costs

Auto insurance, a mandatory financial protection for vehicle owners, is a complex landscape with premiums varying significantly across individuals and regions. This variability arises from a multitude of factors, each contributing to the overall cost of coverage.

Key Factors Influencing Auto Insurance Premiums

The cost of auto insurance is determined by a combination of personal, vehicle, and environmental factors. Here’s a breakdown of the primary considerations:

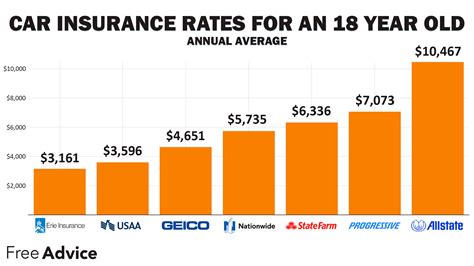

- Driver Profile: Personal characteristics such as age, gender, driving record, and credit score play a significant role. Younger drivers, especially males, often face higher premiums due to their perceived higher risk. Additionally, a history of accidents or traffic violations can lead to increased costs.

- Vehicle Type: The make, model, and year of your vehicle impact insurance rates. Sports cars and luxury vehicles, for instance, are generally more expensive to insure due to their higher repair costs and susceptibility to theft.

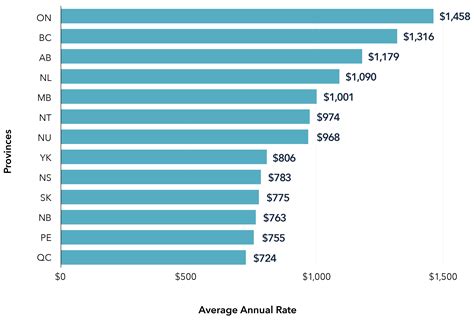

- Location: The region where you reside and drive has a substantial influence on insurance costs. Urban areas with higher population density and a greater incidence of accidents and thefts typically result in higher premiums. Similarly, states with stricter insurance regulations may have elevated rates.

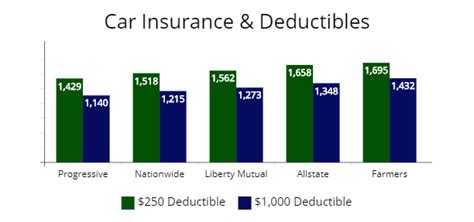

- Coverage Type and Limits: The type and extent of coverage you choose also affect your premium. Comprehensive coverage, which includes protection against theft, vandalism, and natural disasters, often incurs higher costs. Conversely, basic liability coverage, which only covers damage to other vehicles, may be more affordable.

- Driving Behavior: Your driving behavior, as monitored through telematics or usage-based insurance programs, can impact your premium. Safe driving habits, such as maintaining a steady speed and avoiding sudden braking, may lead to discounts or reduced premiums.

| Factor | Impact on Premium |

|---|---|

| Driver Age | Younger drivers face higher premiums due to perceived risk. |

| Vehicle Type | Sports cars and luxury vehicles often have higher insurance costs. |

| Location | Urban areas and states with strict regulations may have higher rates. |

| Coverage Type | Comprehensive coverage incurs higher costs than basic liability. |

| Driving Behavior | Safe driving habits may lead to discounts or reduced premiums. |

Comparing Auto Insurance Costs: A Comprehensive Analysis

When comparing auto insurance costs, it’s essential to consider a range of providers and policies to find the most suitable and cost-effective coverage for your needs. Here’s a detailed comparison to guide your decision-making process:

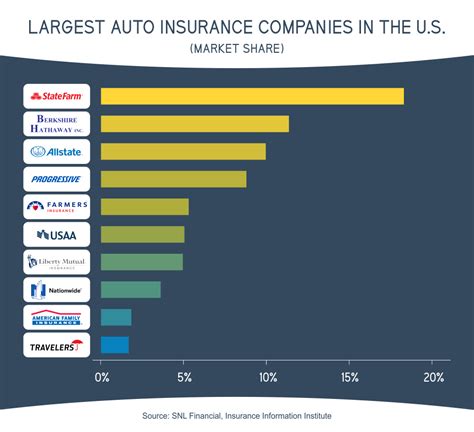

National vs. Regional Carriers

The auto insurance market is dominated by both national and regional carriers, each offering unique advantages and disadvantages. National carriers, with their extensive reach, often provide broader coverage options and more extensive customer support networks. However, they may not always offer the most competitive rates in specific regions.

On the other hand, regional carriers, which operate within a limited geographic area, can offer more tailored coverage and localized expertise. They may have a better understanding of the unique risks and regulations in their operating region, potentially resulting in more affordable premiums. However, their coverage options may be more limited, and their customer support may not be as extensive as national carriers.

Price Comparison Tools and Quotes

Utilizing online price comparison tools and requesting quotes from multiple insurers are invaluable steps in the comparison process. These tools allow you to input your specific details and receive customized quotes from various providers, enabling an apples-to-apples comparison of premiums and coverage.

When obtaining quotes, ensure you provide accurate and detailed information to receive precise estimates. Consider factors such as your driving history, vehicle details, and desired coverage limits. By comparing multiple quotes, you can identify the insurer offering the most competitive rates for your unique circumstances.

Discounts and Bundle Opportunities

Many auto insurance providers offer discounts and bundle options to incentivize customers and reduce costs. Common discounts include those for safe driving, multiple vehicles, and policy bundling (combining auto insurance with other types of insurance, such as home or renters insurance). These discounts can significantly reduce your overall premium, so it’s worthwhile to explore the various discount options available with each insurer.

Additionally, bundling your auto insurance with other policies can result in substantial savings. By combining multiple policies with a single insurer, you may qualify for multi-policy discounts, streamlining your insurance management and potentially lowering your overall insurance costs.

Customer Satisfaction and Claims Experience

Beyond cost considerations, evaluating customer satisfaction and claims experience is crucial. A highly rated insurer with a strong track record of customer satisfaction and efficient claims handling can provide peace of mind and ensure a positive experience should you need to make a claim.

Review customer reviews and ratings on trusted platforms to gauge an insurer’s reputation. Additionally, consider factors such as response time, claims processing efficiency, and customer support accessibility. By choosing an insurer with a positive claims experience, you can ensure that your coverage not only offers the best value but also provides reliable support when you need it most.

Future Implications and Trends in Auto Insurance

The auto insurance landscape is evolving, influenced by technological advancements and changing consumer preferences. As the industry adapts, several trends are shaping the future of auto insurance and its costs:

- Telematics and Usage-Based Insurance: The increasing adoption of telematics and usage-based insurance programs is revolutionizing the way premiums are calculated. These programs monitor driving behavior in real-time, rewarding safe drivers with lower premiums. This shift towards a more personalized and data-driven approach is expected to continue, offering greater transparency and cost savings for responsible drivers.

- Digital Transformation: The digital transformation of the insurance industry is streamlining processes and enhancing customer experiences. Online platforms and mobile apps are making it easier for consumers to compare policies, obtain quotes, and manage their insurance needs. This digital shift is likely to continue, further empowering consumers to make informed choices and potentially driving down costs through increased competition and efficiency.

- Autonomous Vehicles and Safety Innovations: The emergence of autonomous vehicles and advanced safety features is poised to impact auto insurance costs. As these technologies become more prevalent, they are expected to reduce accident rates and associated claims, potentially leading to lower premiums. Additionally, the collection of real-time vehicle data may enable more precise risk assessment and personalized coverage options.

Conclusion: Empowering Informed Choices

Understanding the factors influencing auto insurance costs and conducting a thorough comparison of providers and policies are essential steps in making informed financial decisions. By considering personal and vehicle-specific factors, exploring a range of insurers, and leveraging online tools, consumers can find the most suitable and cost-effective auto insurance coverage.

As the auto insurance landscape continues to evolve, staying abreast of emerging trends and innovations will be crucial for consumers. Embracing digital platforms, adopting safe driving practices, and staying informed about industry developments will empower individuals to navigate the complex world of auto insurance, ensuring they obtain the best value and protection for their unique circumstances.

What is the average cost of auto insurance in the United States?

+The average cost of auto insurance in the U.S. varies significantly by state and can range from a few hundred to several thousand dollars annually. Factors such as location, driving record, and vehicle type play a significant role in determining the average premium.

How can I reduce my auto insurance costs?

+To reduce auto insurance costs, consider shopping around for quotes from multiple insurers, maintaining a clean driving record, opting for higher deductibles, and exploring discounts for safe driving or policy bundling. Additionally, ensuring your vehicle is equipped with advanced safety features may lead to lower premiums.

Are there any regional variations in auto insurance costs?

+Yes, auto insurance costs can vary significantly by region. Urban areas with higher population density and accident rates often have higher premiums. Additionally, states with stricter insurance regulations or a higher incidence of natural disasters may also result in elevated insurance costs.