Medical Insurance Benefits

Medical insurance, also known as health insurance, is an essential financial safeguard that provides individuals and families with access to necessary healthcare services. In today's rapidly evolving healthcare landscape, understanding the benefits and intricacies of medical insurance is crucial. This comprehensive guide aims to delve into the world of medical insurance, exploring its significance, various types, coverage options, and the impact it has on individuals and society as a whole.

The Significance of Medical Insurance

In the face of rising healthcare costs, medical insurance serves as a vital financial protection measure. It ensures that individuals can access medical care without facing catastrophic financial burdens. By spreading the risk across a large population, insurance companies can provide coverage for a wide range of medical services, including hospital stays, doctor visits, prescription medications, and preventive care.

The primary goal of medical insurance is to promote access to quality healthcare and provide financial security. It enables individuals to seek timely medical attention, preventing minor health issues from escalating into major, costly complications. Additionally, medical insurance plays a pivotal role in fostering a healthier society by encouraging regular check-ups, vaccinations, and early disease detection.

Types of Medical Insurance

Medical insurance comes in various forms, each designed to cater to different needs and preferences. Understanding the different types of insurance is essential for making informed decisions about coverage.

Private Health Insurance

Private health insurance is a popular choice for individuals and families seeking comprehensive coverage. These plans are typically offered by private insurance companies and provide a wide range of benefits, including coverage for hospital stays, specialist consultations, diagnostic tests, and prescription medications. Private insurance plans often offer flexibility in terms of choosing healthcare providers and may include additional perks such as dental and vision coverage.

Group Health Insurance

Group health insurance plans are commonly provided by employers as a benefit to their employees. These plans offer a cost-effective way for companies to provide healthcare coverage to their workforce. Group insurance plans often have lower premiums compared to individual plans and may offer additional benefits such as discounted rates for family members or dependents. However, coverage options may be more limited, and individuals may need to consider additional coverage for specific needs.

Public Health Insurance

Public health insurance programs are government-funded initiatives designed to provide coverage to specific populations. These programs aim to ensure that vulnerable individuals and families have access to necessary healthcare services. Examples of public health insurance include Medicaid, which caters to low-income individuals and families, and Medicare, which provides coverage for individuals aged 65 and older or those with certain disabilities.

Coverage Options and Benefits

Medical insurance plans offer a multitude of coverage options and benefits, allowing individuals to tailor their coverage to their specific needs. Understanding these options is crucial for maximizing the value of insurance coverage.

Hospitalization and Surgical Coverage

Hospitalization coverage is a fundamental aspect of medical insurance. It provides financial protection in the event of a hospital stay, covering costs such as room and board, medical procedures, and specialist fees. Surgical coverage, a subset of hospitalization coverage, specifically caters to surgical procedures, ensuring individuals are protected from the high costs associated with surgeries.

Outpatient and Physician Services

Outpatient coverage is essential for individuals who require medical attention but do not need to be admitted to a hospital. This coverage includes doctor visits, diagnostic tests, and minor procedures performed in outpatient settings. Physician services coverage ensures that individuals have access to a network of healthcare professionals, providing a range of specialized medical services.

Prescription Drug Coverage

Prescription drug coverage is a vital component of medical insurance, especially for individuals with chronic conditions or those requiring long-term medication. This coverage ensures that individuals can access necessary medications at a reduced cost, making essential treatments more affordable. Insurance companies often have preferred drug lists and may offer discounts or incentives for using generic medications.

Preventive Care and Wellness Programs

Many medical insurance plans now emphasize the importance of preventive care and wellness. These plans offer coverage for a range of preventive services, including annual check-ups, screenings, vaccinations, and health education programs. By promoting preventive care, insurance companies aim to reduce the incidence of costly illnesses and encourage a healthier lifestyle.

Understanding Insurance Networks

Insurance networks refer to the healthcare providers, hospitals, and specialists that an insurance company has contracted with to provide services to its members. Understanding insurance networks is crucial for individuals to make informed decisions about their healthcare choices.

In-Network vs. Out-of-Network Providers

In-network providers are healthcare professionals and facilities that have an agreement with the insurance company to provide services at negotiated rates. Visiting in-network providers ensures that individuals receive discounted rates and their insurance coverage is honored. Out-of-network providers, on the other hand, do not have a contract with the insurance company, and individuals may face higher out-of-pocket costs when utilizing their services.

Network Size and Accessibility

The size and accessibility of an insurance network can significantly impact an individual’s healthcare experience. A larger network provides more options for choosing healthcare providers and may offer greater convenience in terms of location and availability. However, some insurance plans may have more limited networks, which can restrict access to certain specialists or facilities.

Network Tiering and Cost Sharing

Insurance companies may employ network tiering, which categorizes providers based on their negotiated rates. This can result in varying cost-sharing arrangements for individuals. For example, visiting a tier 1 provider may result in lower out-of-pocket costs compared to a tier 2 or 3 provider. Understanding network tiering is essential for managing healthcare expenses effectively.

Navigating Medical Insurance Claims

Filing medical insurance claims can be a complex process, but understanding the steps involved can help individuals navigate the system efficiently.

Understanding Claim Forms and Requirements

Insurance companies provide claim forms that outline the necessary information and documentation required to process a claim. These forms typically include details such as the date of service, provider information, diagnosis codes, and itemized charges. Understanding the specific requirements of each claim form is crucial for ensuring a smooth claims process.

Prior Authorization and Pre-Certification

Some medical services, especially specialized procedures or treatments, may require prior authorization or pre-certification from the insurance company. This process ensures that the requested service is covered under the individual’s plan and is deemed medically necessary. Failing to obtain prior authorization can result in denied claims or additional out-of-pocket expenses.

Appealing Denied Claims

Despite best efforts, insurance claims can sometimes be denied. Understanding the appeals process is essential for individuals to dispute denied claims. Insurance companies typically have a specific timeframe and process for appealing decisions. Individuals should carefully review the reasons for denial and gather supporting documentation to strengthen their appeal.

The Future of Medical Insurance

The landscape of medical insurance is constantly evolving, driven by technological advancements, changing healthcare regulations, and shifts in consumer preferences. As we look to the future, several trends and innovations are shaping the industry.

Telehealth and Virtual Care

The rise of telehealth and virtual care services has revolutionized the way healthcare is delivered. Insurance companies are increasingly covering virtual appointments, allowing individuals to access medical advice and consultations from the comfort of their homes. This trend is expected to continue, offering greater convenience and accessibility to healthcare services.

Value-Based Care and Accountable Care Organizations (ACOs)

Value-based care models are gaining traction in the healthcare industry. These models focus on delivering high-quality care while controlling costs. Accountable Care Organizations (ACOs) are groups of healthcare providers and insurers working together to coordinate patient care and improve outcomes. Insurance companies are increasingly partnering with ACOs to offer more efficient and cost-effective care, benefiting both patients and insurers.

Artificial Intelligence and Data Analytics

Artificial Intelligence (AI) and data analytics are transforming the insurance industry. These technologies enable insurance companies to analyze vast amounts of data, identify patterns, and make more accurate predictions about healthcare needs and costs. By leveraging AI, insurers can develop more personalized and targeted coverage options, enhancing the overall customer experience.

Consumer-Driven Health Plans

Consumer-driven health plans, such as Health Savings Accounts (HSAs) and Health Reimbursement Arrangements (HRAs), are gaining popularity. These plans give individuals more control over their healthcare spending and encourage a more proactive approach to managing their health. By offering tax advantages and flexible spending options, these plans empower individuals to make informed choices about their healthcare.

What is the difference between private and public health insurance?

+Private health insurance is typically offered by private insurance companies and provides comprehensive coverage options. It offers flexibility in choosing healthcare providers and may include additional benefits. On the other hand, public health insurance is government-funded and caters to specific populations, such as low-income individuals or the elderly. Public health insurance programs often have more limited coverage options but provide essential healthcare access to those who may not otherwise afford it.

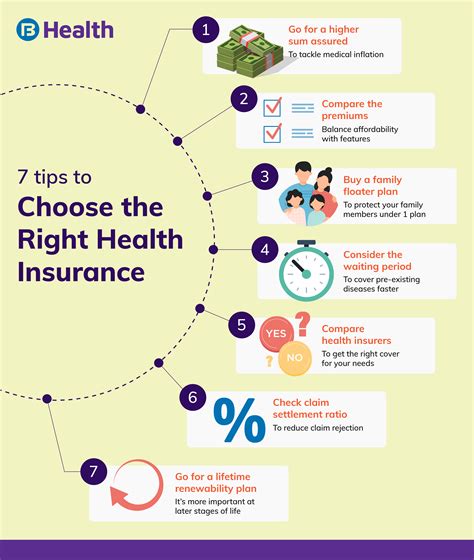

How do I choose the right medical insurance plan for my needs?

+Choosing the right medical insurance plan depends on various factors, including your healthcare needs, budget, and preferences. Consider the coverage options, network providers, and cost-sharing arrangements of different plans. Assess your medical history and anticipate any future healthcare needs. Compare premiums, deductibles, and out-of-pocket maximums to find a plan that aligns with your financial situation. It’s also beneficial to research customer reviews and seek advice from healthcare professionals or insurance brokers.

Can I switch my medical insurance plan during the year?

+Switching medical insurance plans during the year is typically possible under certain circumstances. Open Enrollment Periods, which occur annually, allow individuals to change their insurance plans without specific qualifying events. However, outside of these periods, individuals may need to experience a qualifying life event, such as marriage, divorce, or loss of job-based coverage, to switch plans. It’s important to review the specific rules and regulations of your insurance provider and state regulations to understand your options.

What is the role of insurance networks in medical insurance plans?

+Insurance networks play a crucial role in medical insurance plans by determining the healthcare providers and facilities that are covered under an individual’s plan. In-network providers have negotiated rates with the insurance company, ensuring discounted services for plan members. Visiting out-of-network providers may result in higher out-of-pocket costs. Understanding insurance networks is essential for individuals to make informed decisions about their healthcare choices and manage their expenses effectively.