Insurance On A Camper

Insurance for your camper, whether it's a motorhome, caravan, or a converted van, is a crucial aspect of responsible ownership. It provides peace of mind and financial protection in case of accidents, theft, or other unforeseen events. With the rising popularity of campervan life and remote working, understanding the ins and outs of camper insurance has become increasingly important for adventurers and digital nomads alike. In this comprehensive guide, we'll delve into the world of camper insurance, exploring its various aspects, the coverage options available, and the key factors to consider when choosing the right policy for your unique needs.

Understanding Camper Insurance: More Than Just A Policy

Camper insurance is a specialized form of coverage tailored to the unique needs of campervan owners. It goes beyond the basic auto insurance, offering protection for the specific risks and challenges associated with living and traveling in a camper. Whether you’re a full-time campervan dweller or a weekend warrior, understanding the intricacies of camper insurance is essential to ensure you’re adequately protected.

The Basics: Covering Your Camper’s Essentials

At its core, camper insurance provides protection for the physical structure of your camper. This includes coverage for damage caused by accidents, such as collisions with other vehicles or objects, as well as damage from natural disasters like hail, storms, or even fires. Additionally, camper insurance typically covers theft of the vehicle and its contents, offering financial relief in case of such unfortunate events.

For instance, imagine you're parked at a remote campsite when a severe thunderstorm rolls in. Hailstones the size of golf balls pummel your camper, causing significant damage to the roof and windows. With comprehensive camper insurance, you can rest assured that the repairs will be covered, ensuring your vehicle is restored to its pre-storm condition.

Protecting Your Possessions: Contents Insurance

Camper insurance often extends beyond the vehicle itself to cover the contents within. This can include personal belongings, furniture, appliances, and any other items you keep inside your camper. In the event of theft, damage, or loss, contents insurance provides financial compensation to help replace or repair these items.

Consider a scenario where you leave your camper unattended for a few hours at a rest stop. Upon returning, you discover that someone has broken into your vehicle and stolen several valuable items, including your laptop, camera equipment, and camping gear. With contents insurance as part of your camper policy, you can file a claim to receive compensation for these losses, helping you get back on your feet and continue your adventures.

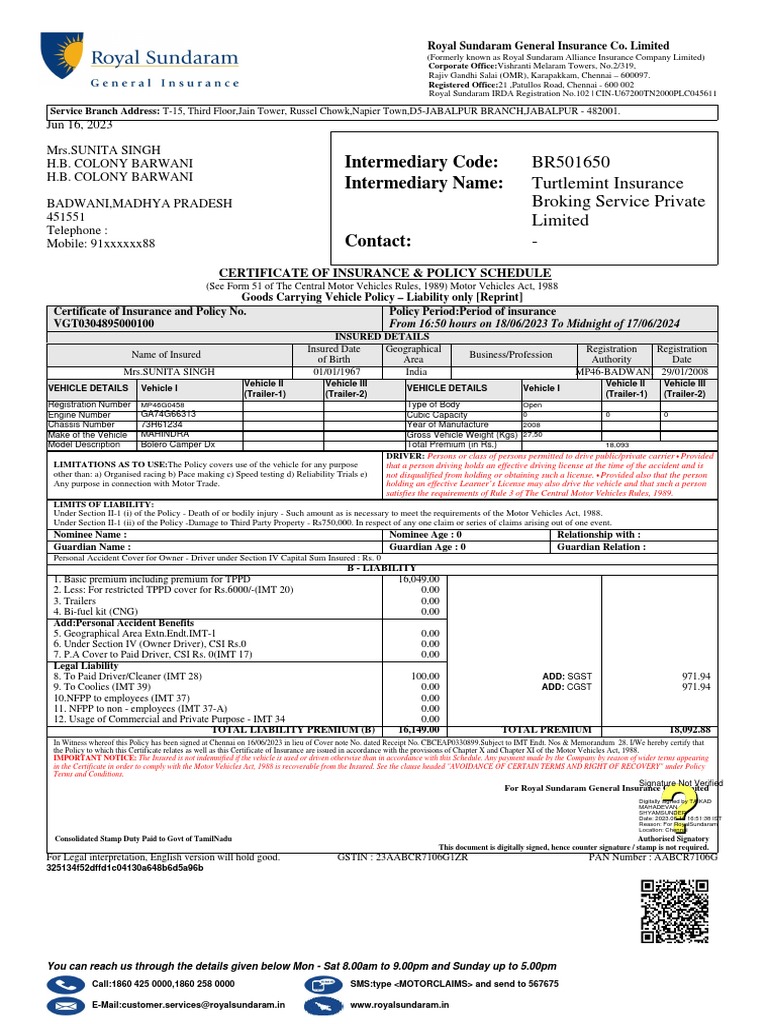

The Importance of Liability Coverage

Liability coverage is a critical component of camper insurance. It protects you financially in case you’re found legally responsible for causing damage or injury to others while operating your camper. This coverage can help cover medical expenses, property damage, and even legal fees if a lawsuit arises.

For example, imagine you're driving your camper along a narrow mountain road when an unexpected patch of ice causes you to lose control and collide with an oncoming vehicle. Liability insurance steps in to cover the costs associated with repairing the other driver's vehicle and any medical expenses they incur as a result of the accident. Without this coverage, you could be facing significant financial burdens and legal repercussions.

Choosing the Right Camper Insurance: Factors to Consider

When selecting a camper insurance policy, several key factors should be taken into account to ensure you’re getting the best coverage for your unique circumstances.

Understanding Your Risk Profile

Every campervan owner has a unique risk profile, influenced by factors such as the type of camper you own, how often you use it, and where you tend to travel. For instance, if you primarily stick to well-maintained campgrounds and rarely venture off the beaten path, your risk profile may be considered lower than that of an adventurer who frequently explores remote, rugged terrain.

Understanding your risk profile is essential when choosing insurance, as it helps determine the level of coverage you require. For those with a lower risk profile, a basic policy with standard coverage limits may suffice. On the other hand, high-risk profiles may benefit from additional coverage options, such as enhanced liability limits or specialized coverage for off-road adventures.

Assessing Your Needs: Comprehensive vs. Basic Coverage

Camper insurance policies come in various forms, ranging from comprehensive coverage that offers protection for a wide range of scenarios to more basic policies that focus on essential coverage. When assessing your needs, consider the value of your camper, the cost of potential repairs, and the likelihood of different types of incidents occurring.

If you own a luxury motorhome with high-end furnishings and appliances, a comprehensive policy that provides coverage for a broad range of scenarios, including accidents, theft, and natural disasters, may be the best option. On the other hand, if you have a more modestly priced camper that you use primarily for short trips, a basic policy that covers the essentials, such as collision and liability, may be more suitable.

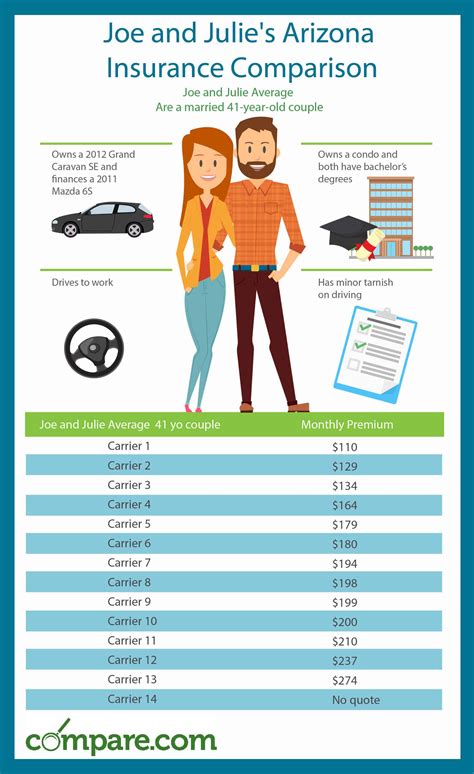

Comparing Insurance Providers: Reputation and Service

Choosing the right insurance provider is just as important as selecting the right policy. Research and compare different companies based on their reputation, customer service, and financial stability. Look for providers who specialize in camper insurance, as they are likely to have a deeper understanding of the unique needs and risks associated with this lifestyle.

Consider factors such as response times to claims, the ease of filing a claim, and the availability of 24/7 customer support. Reading reviews and testimonials from other campervan owners can also provide valuable insights into the quality of service offered by different insurance companies. Remember, in the event of an accident or emergency, you'll want a provider who is responsive, efficient, and reliable.

Customizing Your Policy: Additional Coverage Options

Standard camper insurance policies typically offer a range of coverage options, but it’s important to tailor your policy to your specific needs. Many insurance providers offer additional endorsements or riders that can enhance your coverage, providing protection for unique circumstances or valuable items.

For example, if you frequently tow a trailer or boat behind your camper, you may want to consider adding towing coverage to your policy. This ensures that you're protected in case of accidents or breakdowns while towing, providing peace of mind and financial assistance for any necessary repairs.

Additionally, if you have valuable electronics, jewelry, or other high-value items stored in your camper, you may want to explore personal property endorsements. These endorsements increase the coverage limits for specific items, ensuring that you're adequately protected in case of loss or damage.

The Bottom Line: Making Informed Decisions

Camper insurance is an essential component of responsible campervan ownership. By understanding the basics of camper insurance, assessing your unique needs, and choosing the right provider and policy, you can ensure that you’re adequately protected on your adventures. Remember, the right insurance policy can provide peace of mind, financial security, and the freedom to explore without worry.

So, whether you're hitting the open road for a weekend getaway or embarking on a long-term journey across the country, take the time to evaluate your insurance options and make informed decisions. Your campervan adventures await, and with the right coverage, you can focus on creating memories rather than worrying about potential pitfalls.

What is the average cost of camper insurance?

+The cost of camper insurance can vary widely depending on factors such as the type of camper, your location, driving history, and the level of coverage you choose. On average, you can expect to pay anywhere from 500 to 2,000 annually for a basic policy. However, it’s important to get multiple quotes to find the best coverage at the most competitive price.

Do I need camper insurance if my camper is already covered under my auto policy?

+While your auto policy may provide some coverage for your camper, it’s often limited and may not adequately protect your unique needs. Camper insurance is designed specifically for campers, offering more comprehensive coverage for the vehicle and its contents. It’s always best to consult with an insurance professional to ensure you have the right coverage in place.

What should I do if I’m involved in an accident while using my camper?

+In the event of an accident, it’s important to remain calm and follow these steps: first, ensure the safety of all individuals involved. Then, contact the police to file a report and exchange insurance information with the other party. Take photos of the accident scene and any visible damage. Finally, notify your insurance provider as soon as possible to begin the claims process.

Are there any discounts available for camper insurance?

+Yes, many insurance providers offer discounts for camper insurance. Common discounts include safe driver discounts, multi-policy discounts (if you bundle your camper insurance with other policies, such as auto or home insurance), and loyalty discounts for long-term customers. It’s always worth asking your insurance provider about available discounts to save on your premiums.