Dental Insurance For Retirees

As individuals reach retirement age, ensuring access to quality healthcare becomes a paramount concern. Dental care, in particular, plays a vital role in maintaining overall health and well-being, making dental insurance an essential consideration for retirees. In this comprehensive guide, we will delve into the world of dental insurance options tailored for retirees, exploring the various plans, their benefits, and how they can help secure a healthy smile during the golden years.

Understanding the Need for Dental Insurance in Retirement

Retirees often face unique challenges when it comes to dental care. The cost of dental procedures can be significant, and without proper insurance coverage, these expenses can quickly become a financial burden. Additionally, retirement may bring changes in dental needs, such as the increased likelihood of developing age-related oral health issues like gum disease or tooth decay. Therefore, having adequate dental insurance is crucial to maintain optimal oral health and prevent potential complications.

Exploring Dental Insurance Options for Retirees

Retirees have several avenues to explore when it comes to dental insurance. Here are some of the most common options available:

Medicare Advantage Plans with Dental Coverage

Medicare Advantage plans, also known as Medicare Part C, offer an alternative to original Medicare. These plans are provided by private insurance companies and often include additional benefits beyond what traditional Medicare covers. Many Medicare Advantage plans include dental coverage, which can range from basic preventive care to more comprehensive procedures. It’s important to carefully review the specifics of each plan to understand the included dental benefits and any associated costs.

Medigap Policies with Dental Riders

Medigap, or Medicare Supplement Insurance, is designed to fill the gaps in original Medicare coverage. While Medigap policies primarily focus on medical expenses, some plans offer the option to add dental coverage through dental riders. These riders typically cover a limited range of dental services, such as cleanings and basic procedures. Retirees who wish to maintain their Medigap coverage while gaining access to dental benefits can consider adding a dental rider to their existing policy.

Stand-Alone Dental Insurance Plans

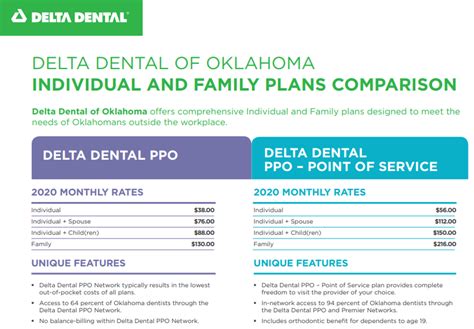

Retirees can also opt for stand-alone dental insurance plans, which are specifically designed to cover dental expenses. These plans are offered by various private insurance companies and provide a range of benefits tailored to meet the dental needs of retirees. Stand-alone dental plans often include coverage for preventive care, such as dental cleanings and check-ups, as well as more extensive procedures like fillings, root canals, and even orthodontic treatment. The level of coverage and associated costs can vary significantly between different providers and plan options.

Dental Discount Plans

For retirees seeking more affordable dental care options, dental discount plans can be a viable choice. These plans are not traditional insurance policies but rather membership programs that provide discounted rates on dental services. Members typically pay a monthly or annual fee and receive access to a network of participating dentists who offer reduced fees for various dental procedures. While dental discount plans do not provide actual insurance coverage, they can significantly lower the out-of-pocket costs for dental care, making them an attractive option for retirees on a fixed income.

Comparing Dental Insurance Plans for Retirees

When evaluating dental insurance options for retirement, it’s essential to compare different plans based on several key factors. Here’s a breakdown of what retirees should consider:

Coverage and Benefits

Review the scope of coverage offered by each plan. Pay close attention to the types of procedures covered, including preventive care, restorative treatments, and any specific limitations or exclusions. Understanding the benefits package will help retirees make informed decisions about their dental care needs.

Cost and Premiums

Consider the overall cost of the dental insurance plan, including the monthly premiums, deductibles, copayments, and any additional out-of-pocket expenses. Evaluate whether the plan’s cost aligns with your budget and financial goals for retirement. It’s important to strike a balance between comprehensive coverage and affordability.

Network of Dentists

Check if the dental insurance plan has a network of preferred providers. Being part of a network can provide access to a wider range of dentists and potentially lower costs. Retirees should assess whether the plan’s network includes dentists in their area who are conveniently located and have the expertise required for their specific dental needs.

Claim Process and Customer Service

Inquire about the claim process and customer service support offered by the insurance provider. Efficient claim processing and responsive customer service can make a significant difference in the overall experience with the dental insurance plan. Look for plans that have a proven track record of prompt claim handling and offer easy-to-reach customer support channels.

Maximizing Dental Insurance Benefits for Retirees

Once retirees have selected a dental insurance plan, it’s important to make the most of the benefits offered. Here are some tips to maximize the value of dental insurance coverage:

- Schedule Regular Check-Ups: Utilize your dental insurance to schedule regular dental check-ups and cleanings. Preventive care is often fully covered or offered at a significantly reduced cost, allowing you to maintain optimal oral health and catch potential issues early.

- Understand Coverage Limits: Familiarize yourself with the specific coverage limits and exclusions of your plan. This knowledge will help you plan for any additional costs that may arise for certain procedures or treatments.

- Explore Additional Benefits: Some dental insurance plans offer additional benefits such as discounts on dental products, vision care, or even hearing aids. Take advantage of these extra perks to further enhance your overall healthcare experience.

- Review Coverage Annually: As your dental needs may change over time, it's crucial to review your insurance coverage annually. This allows you to assess whether your current plan still aligns with your requirements and make any necessary adjustments.

The Future of Dental Insurance for Retirees

The landscape of dental insurance for retirees is continually evolving, with new trends and innovations shaping the industry. Here’s a glimpse into the future of dental insurance for this demographic:

Integration of Telehealth Services

Telehealth has gained prominence in recent years, and its integration into dental insurance plans is expected to grow. Retirees may soon have access to virtual consultations and remote dental care, offering convenience and ease of access to dental professionals without the need for in-person visits.

Focus on Preventive Care and Wellness

Dental insurance providers are increasingly recognizing the importance of preventive care and oral health education. Future plans may emphasize the value of regular check-ups, dental hygiene education, and early intervention to prevent more complex and costly dental issues. This shift towards preventive care aligns with the overall trend in healthcare towards wellness and disease prevention.

Customized Plans for Retirees

Insurance companies are likely to develop more tailored plans specifically designed to meet the unique dental needs of retirees. These plans may offer comprehensive coverage for common age-related dental issues, such as gum disease or tooth loss, while also providing access to specialized services like geriatric dental care.

Incentivizing Healthy Habits

In an effort to promote oral health and encourage healthy habits, dental insurance providers may introduce incentives and rewards for retirees who actively participate in preventive care and maintain good oral hygiene practices. These incentives could include reduced premiums, gift cards, or discounts on certain dental procedures.

Conclusion

Dental insurance is an essential component of a retiree’s healthcare plan, ensuring that they can maintain a healthy smile and address any dental concerns that may arise during their golden years. By exploring the various dental insurance options available, comparing plans based on coverage, cost, and network, and maximizing the benefits offered, retirees can make informed decisions to secure their oral health and overall well-being.

Frequently Asked Questions

Can I get dental insurance if I already have original Medicare coverage?

+Yes, retirees with original Medicare coverage can explore dental insurance options such as Medicare Advantage plans or stand-alone dental insurance plans to supplement their existing Medicare benefits.

Are there any age restrictions for dental insurance plans for retirees?

+Age restrictions for dental insurance plans can vary depending on the provider and the specific plan. However, many plans are designed to cater to the dental needs of retirees, ensuring accessibility regardless of age.

Can I switch my dental insurance plan after retirement?

+Yes, retirees have the flexibility to switch their dental insurance plans if they find a more suitable option that better meets their needs. It’s important to carefully review the enrollment periods and any associated costs or penalties for changing plans.