Auto Insurance Usa

The world of auto insurance in the United States is vast and complex, offering a wide range of coverage options and varying requirements across different states. With a multitude of insurance providers, understanding the intricacies of this system is crucial for drivers to make informed decisions and secure the best protection for their vehicles. This comprehensive guide aims to delve into the specifics of auto insurance in the US, covering key aspects such as types of coverage, cost factors, and strategies for obtaining the most suitable and affordable policy.

Understanding Auto Insurance Coverage in the US

Auto insurance is a legal requirement for all vehicle owners in the United States. It provides financial protection against physical damage, bodily injury, and other liabilities resulting from traffic accidents, natural disasters, or other mishaps on the road. The coverage options and requirements vary from state to state, with some states implementing a no-fault system, while others follow a tort system.

Liability Coverage

Liability insurance is the most basic form of auto insurance, and it’s mandatory in every US state. This coverage protects the policyholder against financial losses if they’re found legally responsible for causing bodily injury or property damage to others in an accident. It typically includes bodily injury liability and property damage liability components.

For instance, let’s say you’re driving and accidentally collide with another vehicle, causing injuries to the other driver and damage to their car. In this scenario, your liability insurance would cover the costs of the other driver’s medical bills and the repairs to their vehicle, up to the limits specified in your policy.

Comprehensive and Collision Coverage

While liability insurance is mandatory, comprehensive and collision coverage are optional. However, if you’re financing or leasing your vehicle, your lender may require you to carry these additional types of insurance.

- Comprehensive Coverage: This protects against damage caused by incidents other than collisions, such as theft, vandalism, natural disasters, or damage caused by animals. For example, if your car is damaged in a hailstorm, comprehensive coverage would help cover the repair costs.

- Collision Coverage: As the name suggests, this coverage applies to accidents involving your vehicle colliding with another vehicle or object. It covers the repair or replacement costs of your own vehicle, regardless of who’s at fault. So, if you were to hit a deer on the road, collision coverage would assist with the repairs.

Personal Injury Protection (PIP) and Medical Payments Coverage

PIP and Medical Payments coverage, often referred to as No-Fault Insurance, provide coverage for medical expenses and lost wages for you and your passengers, regardless of who’s at fault in an accident. These coverages are typically mandatory in no-fault states.

In states that follow a tort system, where fault is determined, PIP and Medical Payments coverage may still be available as optional add-ons to your policy.

Uninsured and Underinsured Motorist Coverage

This coverage comes into play when you’re involved in an accident with a driver who either doesn’t have insurance or doesn’t have enough insurance to cover the damages. It can help cover your medical bills, lost wages, and other related expenses in such scenarios.

Factors Affecting Auto Insurance Costs

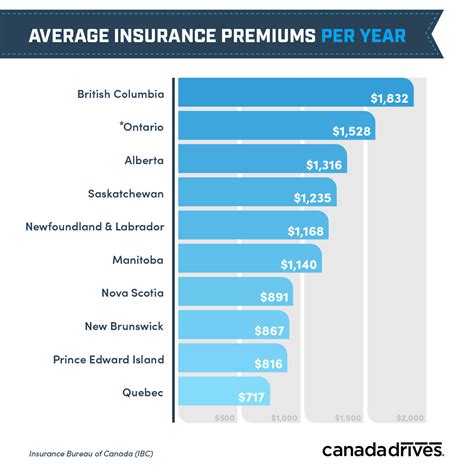

The cost of auto insurance can vary significantly from one driver to another and from one state to another. Several factors influence the premiums you pay for your auto insurance policy.

Driver’s Profile

Your driving history, age, gender, and marital status are key factors that insurance companies consider when determining your premiums. For instance, younger drivers, especially those under 25, often pay higher premiums due to their higher risk profile. Similarly, drivers with a history of accidents or traffic violations may also face higher insurance costs.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can impact your insurance rates. Sports cars and luxury vehicles, for example, generally cost more to insure due to their higher repair costs and theft risks. Additionally, if you use your vehicle for business purposes or frequently drive long distances, your insurance premiums may be higher.

Location

Where you live and where you typically drive your vehicle can affect your insurance rates. Insurance companies consider factors like the crime rate, traffic density, and the average cost of living in your area. For example, if you live in an urban area with high traffic volume and a higher risk of accidents, your insurance premiums are likely to be higher.

Coverage and Deductibles

The type and amount of coverage you choose, as well as your deductible, play a significant role in determining your insurance costs. Comprehensive and collision coverage, while optional, can significantly increase your premiums. On the other hand, choosing a higher deductible (the amount you pay out-of-pocket before your insurance kicks in) can lower your premiums.

Tips for Getting the Best Auto Insurance Rates

Navigating the world of auto insurance can be challenging, but with the right strategies, you can find the best coverage at the most affordable rates.

Shop Around

Auto insurance rates can vary widely between different insurance companies. It’s important to compare quotes from multiple providers to ensure you’re getting the best deal. Online comparison tools and insurance brokers can be valuable resources for this.

Bundle Your Policies

Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance, or auto and life insurance. By combining your policies, you can often save money on your overall insurance costs.

Take Advantage of Discounts

Insurance companies often provide discounts for various reasons. Some common discounts include safe driving records, loyalty discounts for long-term customers, and discounts for taking defensive driving courses. You may also be eligible for discounts if you have certain safety features in your vehicle, such as anti-theft devices or advanced driver-assistance systems.

Maintain a Good Driving Record

Your driving history is a major factor in determining your insurance rates. Maintaining a clean driving record, free from accidents and traffic violations, can help keep your premiums low. Even a single traffic violation or accident can lead to a significant increase in your insurance costs.

Consider Higher Deductibles

Opting for a higher deductible can reduce your insurance premiums. However, it’s important to choose a deductible amount that you’re comfortable paying out-of-pocket in the event of a claim. A higher deductible is a good option if you’re a cautious driver and don’t anticipate making frequent claims.

Review Your Coverage Regularly

Your insurance needs may change over time. It’s important to review your coverage annually to ensure you have the right amount of protection and to take advantage of any changes in your circumstances that could lead to lower premiums, such as a clean driving record or a new safety feature in your vehicle.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protects against financial losses caused to others in an accident. |

| Comprehensive Coverage | Covers non-collision incidents like theft, natural disasters, and vandalism. |

| Collision Coverage | Covers damage to your vehicle in a collision, regardless of fault. |

| Personal Injury Protection (PIP) | Provides coverage for medical expenses and lost wages for you and your passengers. |

| Uninsured/Underinsured Motorist Coverage | Protects you if involved in an accident with an uninsured or underinsured driver. |

Frequently Asked Questions

What is the average cost of auto insurance in the US?

+The average cost of auto insurance in the US varies significantly depending on factors like location, driver’s profile, and coverage. As of [most recent data available], the national average for auto insurance premiums is around 1,674 annually. However, this can range from as low as 500 to over $3,000, based on individual circumstances.

Are there any ways to lower my auto insurance premiums?

+Yes, there are several strategies to reduce your auto insurance premiums. These include shopping around for quotes, bundling your insurance policies, maintaining a clean driving record, opting for a higher deductible, and taking advantage of discounts for safe driving or vehicle safety features. Regularly reviewing your coverage and making necessary adjustments can also help keep costs down.

What happens if I’m involved in an accident with an uninsured driver?

+If you’re involved in an accident with an uninsured driver, your uninsured motorist coverage (if you have it) will kick in to help cover your damages and injuries. This coverage is designed to protect you in situations where the at-fault driver doesn’t have insurance or doesn’t have enough insurance to cover the costs.

How often should I review my auto insurance policy?

+It’s recommended to review your auto insurance policy at least once a year, or whenever there’s a significant change in your circumstances (e.g., buying a new car, moving to a new location, getting married, or adding a teen driver to your policy). Regular reviews ensure that your coverage remains adequate and that you’re not paying for unnecessary features.