What Is The Income Limit For Marketplace Insurance 2024

The Marketplace Income Limits for 2024 play a crucial role in determining eligibility for subsidized health insurance plans offered through the Health Insurance Marketplace, as established by the Affordable Care Act (ACA). These limits, often referred to as Modified Adjusted Gross Income (MAGI), serve as a financial threshold that varies based on household size and is critical for individuals and families seeking affordable healthcare coverage.

Understanding Marketplace Income Limits

The Marketplace Income Limits for 2024 are a key component of the Affordable Care Act, shaping the accessibility of health insurance for millions of Americans. These limits, which are updated annually, determine who qualifies for financial assistance in the form of premium tax credits and cost-sharing reductions when purchasing health insurance plans through the Health Insurance Marketplace.

Here's a comprehensive breakdown of the Marketplace Income Limits for 2024 and their implications:

Household Size and Income Limits

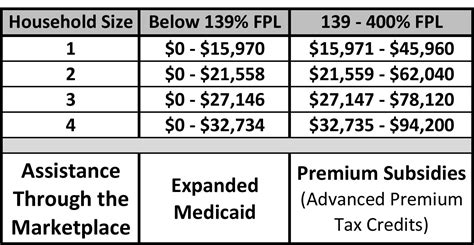

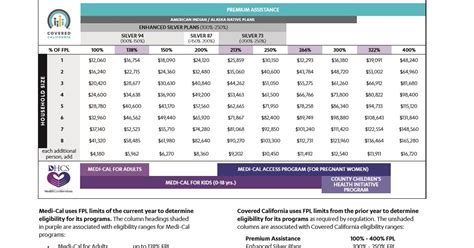

The Marketplace Income Limits are determined based on household size, with each additional person in the household increasing the income threshold. This means that a larger family can earn more and still qualify for assistance. The limits are set as a percentage of the Federal Poverty Level (FPL), which is adjusted annually.

| Household Size | Income Limit as % of FPL |

|---|---|

| 1 Person | 400% |

| 2 People | 450% |

| 3 People | 500% |

| 4+ People | 550% |

For instance, in 2024, a single individual with an income up to $54,760 (400% of the FPL) may be eligible for premium tax credits. For a family of four, the income limit is $128,800 (550% of the FPL).

Income Eligibility and Subsidies

If your income falls within the Marketplace Income Limits, you may qualify for financial assistance. The amount of assistance depends on your income and the cost of available plans in your area. Here's a simplified breakdown:

- Income below 138% of FPL: You may qualify for Medicaid or the Children's Health Insurance Program (CHIP).

- Income between 138% and 400% of FPL: You are eligible for premium tax credits and cost-sharing reductions, reducing your out-of-pocket costs for healthcare.

- Income above 400% of FPL: You are not eligible for premium tax credits but may still purchase health insurance plans through the Marketplace.

Income Verification and Recalculations

To ensure accuracy, the Marketplace may verify your income during the application process and throughout the year. If your income changes, you should report it to the Marketplace to avoid overpayment or underpayment of subsidies. Income fluctuations can impact your eligibility and the amount of assistance you receive.

Special Enrollment Periods and Income Changes

The Affordable Care Act allows for Special Enrollment Periods (SEPs) outside of the annual Open Enrollment period. If you experience a qualifying life event, such as a change in income, you may be eligible for a SEP to update your coverage and subsidies.

Income-Based Assistance for Different Plans

The level of income-based assistance can vary depending on the type of health insurance plan you choose. Bronze, Silver, Gold, and Platinum plans offer different levels of coverage and premium costs, and your income affects the amount of subsidy you receive for each plan type.

Real-World Examples and Case Studies

Let's explore some real-world scenarios to better understand how the Marketplace Income Limits impact eligibility and subsidy amounts:

Case Study 1: Single Individual

Sarah, a 30-year-old single individual, has an annual income of $45,000. With this income, she falls within the Marketplace Income Limits for 2024 and is eligible for premium tax credits. Based on her income, she could receive a subsidy of approximately $1,200 per year, reducing her monthly premium for a Silver plan.

Case Study 2: Family of Four

The Johnson family, consisting of two parents and two children, has a combined annual income of $100,000. Given their household size, they are above the Marketplace Income Limit for a family of four, which is $128,800 in 2024. As a result, they are not eligible for premium tax credits, but they can still purchase health insurance plans through the Marketplace.

Case Study 3: Income Fluctuation

Imagine John, who recently started a new job with a higher salary. His income increased from $50,000 to $65,000 annually. While he was eligible for premium tax credits before, his increased income now places him above the Marketplace Income Limit for a single individual. John should report this income change to the Marketplace to ensure he is not overpaying for subsidies.

Implications for Health Insurance Coverage

The Marketplace Income Limits have significant implications for individuals and families seeking affordable health insurance coverage. Here's a deeper look at these implications:

Ensuring Accessibility

The Marketplace Income Limits ensure that low- and moderate-income individuals and families can access affordable health insurance. By providing premium tax credits and cost-sharing reductions, the Marketplace makes healthcare more accessible and reduces the financial burden of healthcare costs.

Income-Based Subsidies and Plan Selection

Income plays a critical role in determining the level of subsidy an individual or family receives. Those with lower incomes may qualify for more substantial subsidies, making higher-tier plans (Gold or Platinum) more affordable. Understanding your income and the corresponding subsidies can help you choose a plan that best suits your healthcare needs and budget.

Avoiding Penalties and Overpayments

By accurately reporting income and staying within the Marketplace Income Limits, individuals can avoid overpayment of subsidies or penalties for non-compliance. It's essential to keep the Marketplace informed of any income changes to ensure you receive the correct level of assistance.

Impact on Healthcare Utilization

The Marketplace Income Limits and the resulting subsidies can encourage individuals and families to seek necessary healthcare services. With reduced out-of-pocket costs, individuals may be more likely to access preventative care, routine check-ups, and specialized treatments, leading to improved overall health outcomes.

Future Outlook and Policy Considerations

As we look ahead to 2024 and beyond, it's important to consider the evolving landscape of healthcare policy and its potential impact on Marketplace Income Limits:

Policy Updates and Changes

Healthcare policy is subject to ongoing changes and updates. The Affordable Care Act and related policies may be amended, expanded, or replaced, which could impact the Marketplace Income Limits and the eligibility criteria for subsidized health insurance.

Income Threshold Adjustments

The Marketplace Income Limits are typically adjusted annually to account for inflation and changes in the cost of living. These adjustments ensure that the limits remain relevant and accessible to those who need assistance. However, significant economic shifts or policy decisions could lead to more substantial adjustments in the future.

Expanding Eligibility and Subsidies

There is ongoing debate and advocacy for expanding eligibility criteria and increasing subsidies for health insurance. Some proposals suggest raising the Marketplace Income Limits to cover a larger portion of the population or providing more generous subsidies to make healthcare more affordable for those with higher incomes.

Addressing Income Inequality

Income inequality remains a significant issue, and the Marketplace Income Limits play a role in addressing this challenge. By providing financial assistance to low- and moderate-income individuals, the Marketplace aims to reduce healthcare disparities and ensure that everyone has access to quality healthcare, regardless of their financial situation.

Conclusion

The Marketplace Income Limits for 2024 are a critical aspect of the Affordable Care Act, shaping the accessibility and affordability of health insurance for millions of Americans. By understanding these limits and their implications, individuals and families can make informed decisions about their healthcare coverage and take advantage of the available subsidies to reduce their out-of-pocket costs.

As we navigate the complexities of healthcare policy and the ongoing evolution of the Affordable Care Act, staying informed and proactive about income-based eligibility and subsidies is essential for ensuring access to quality healthcare.

Frequently Asked Questions

How often are the Marketplace Income Limits updated?

+The Marketplace Income Limits are typically updated annually to account for inflation and changes in the cost of living. These updates ensure that the limits remain relevant and accessible to those who need assistance.

<div class="faq-item">

<div class="faq-question">

<h3>Can my income affect my eligibility for other government programs?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, your income can impact your eligibility for various government programs, including Medicaid, the Children's Health Insurance Program (CHIP), and other social services. It's important to consider the income guidelines for each program separately.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if my income changes during the year?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If your income changes during the year, you should report the change to the Marketplace as soon as possible. This ensures that you receive the correct level of assistance and avoids any overpayment or underpayment of subsidies.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any income verification requirements for the Marketplace?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, the Marketplace may verify your income during the application process and throughout the year. It's important to provide accurate and up-to-date income information to ensure eligibility and the correct level of assistance.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I qualify for Marketplace subsidies if I already have health insurance through my employer?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If you have health insurance through your employer, you may still be eligible for Marketplace subsidies if your employer's plan is considered unaffordable or does not meet minimum coverage requirements. It's best to review your specific situation with a healthcare professional or a qualified insurance advisor.</p>

</div>

</div>

</div>