Good Cheap Car Insurance

Finding affordable and reliable car insurance can be a challenging task, especially when you're on a budget. The cost of car insurance varies significantly depending on numerous factors, including your location, driving history, the make and model of your vehicle, and the coverage you require. However, with careful research and an understanding of the market, it is possible to secure good car insurance at a reasonable price. This comprehensive guide will delve into the world of car insurance, offering insights and strategies to help you find the best coverage at the most affordable rates.

Understanding Car Insurance and Its Costs

Car insurance is a legal requirement in most countries, designed to provide financial protection in the event of an accident or other vehicle-related incidents. It covers a range of potential risks, including damage to your vehicle, injuries sustained by yourself or others, and property damage caused by your vehicle. The cost of car insurance is influenced by various factors, and understanding these can help you make informed choices when selecting a policy.

Factors Affecting Car Insurance Rates

The cost of car insurance is determined by a multitude of factors, some of which are within your control, while others are not. Here are some of the key influences on car insurance rates:

- Location: Insurance rates can vary significantly between different states, counties, and even zip codes. This is because the likelihood of accidents and the cost of car repairs can differ greatly depending on the area.

- Age and Gender: Generally, younger drivers, especially males, are considered higher risk and therefore pay more for insurance. However, this gap tends to narrow with age, and older drivers may also face higher premiums due to increased health risks.

- Driving History: Your record of accidents, traffic violations, and claims can greatly impact your insurance rates. A clean driving history can lead to significant discounts, while multiple accidents or violations can cause your premiums to soar.

- Vehicle Type: The make, model, and year of your vehicle play a role in insurance costs. Sporty cars or luxury vehicles are often more expensive to insure due to their higher repair costs and increased likelihood of theft.

- Coverage Type and Limits: The type of coverage you choose and the limits you set for each type of coverage will directly affect your insurance premiums. Comprehensive and collision coverage, for instance, can add significantly to your costs.

- Deductibles: Choosing a higher deductible (the amount you pay out of pocket before your insurance kicks in) can lower your monthly premiums, but it also means you’ll have to pay more if you ever need to file a claim.

- Credit History: In many states, insurers are allowed to use your credit score as a factor in determining your insurance rates. Generally, those with higher credit scores are seen as lower risk and therefore receive lower premiums.

Understanding these factors can help you make strategic choices when selecting car insurance. For instance, you might consider a higher deductible to lower your monthly payments, or opt for a less sporty vehicle to reduce repair costs and insurance premiums.

Tips for Finding Affordable Car Insurance

Now that we’ve established the key factors influencing car insurance rates, let’s explore some strategies to help you find affordable coverage.

Shop Around and Compare Quotes

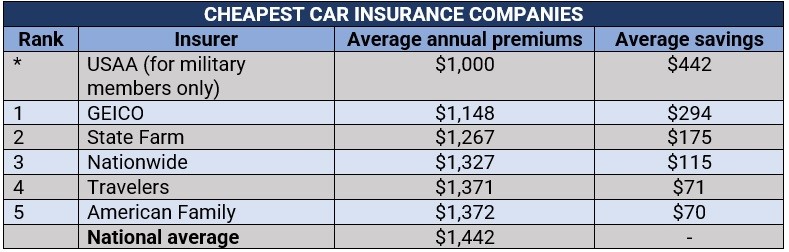

The car insurance market is highly competitive, with numerous providers offering a range of policies and prices. Shopping around and comparing quotes from different insurers is crucial to finding the best deal. Online comparison tools can be particularly useful for this, allowing you to quickly and easily compare policies and prices from multiple providers.

When comparing quotes, pay attention to more than just the price. Ensure you're comparing policies with similar coverage limits and deductibles to ensure you're getting a true comparison. Also, consider the reputation and financial stability of the insurance company. While a low price might be tempting, you want to ensure the company will be able to pay out your claim if needed.

Choose the Right Coverage

Car insurance policies typically offer a range of coverage options, and not all of them are necessary for every driver. Understanding your specific needs and choosing the right coverage can help you keep costs down while ensuring you have adequate protection.

- Liability Coverage: This is the most basic and legally required type of coverage. It covers the cost of damages you cause to others' vehicles or property. While it's essential to have, you can often find ways to lower the cost, such as by increasing your deductible or choosing a higher liability limit.

- Collision and Comprehensive Coverage: These optional coverages are highly recommended, especially if you have a loan on your vehicle. Collision coverage pays for repairs to your vehicle after an accident, while comprehensive coverage covers damages from non-accident events like theft, vandalism, or natural disasters. However, if you have an older vehicle that's paid off, you might consider dropping these coverages to save on premiums.

- Additional Coverages: Some insurers offer additional coverages, such as rental car reimbursement or roadside assistance. While these can be useful, they often come at a cost, so consider whether you really need them before adding them to your policy.

Take Advantage of Discounts

Insurance companies offer a variety of discounts that can significantly reduce your premiums. Some common discounts include:

- Multi-Policy Discounts: Many insurers offer discounts if you bundle your car insurance with other policies, such as home or renters insurance.

- Safe Driver Discounts: Maintaining a clean driving record for a certain period of time can earn you a safe driver discount.

- Loyalty Discounts: Staying with the same insurer for multiple years can result in loyalty discounts.

- Good Student Discounts: Many insurers offer discounts to students who maintain a certain GPA.

- Low Mileage Discounts: If you drive fewer miles than average, you might be eligible for a low mileage discount.

- Safety Feature Discounts: Certain safety features on your vehicle, such as anti-theft devices or advanced driver-assistance systems, can earn you a discount.

Be sure to ask your insurance provider about any discounts you might qualify for. It's also a good idea to review your policy and available discounts annually to ensure you're taking advantage of all applicable savings.

Improve Your Driving Record

Your driving record is a significant factor in determining your insurance rates. A clean driving record can lead to substantial savings, while multiple accidents or violations can cause your premiums to skyrocket. To improve your driving record and potentially lower your insurance costs:

- Avoid speeding and other traffic violations.

- Complete a defensive driving course to improve your skills and potentially earn a discount.

- If you’ve had an accident or violation, take steps to improve your driving habits and ensure it doesn’t happen again.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, is a type of policy where your premiums are based on how, when, and how much you drive. This can be a great option for low-mileage drivers or those with a history of safe driving. By tracking your driving habits, insurers can offer more personalized rates.

Maintain a Good Credit Score

In many states, insurers are allowed to use your credit score as a factor in determining your insurance rates. Generally, those with higher credit scores are seen as lower risk and therefore receive lower premiums. So, maintaining a good credit score can help you secure more affordable car insurance.

Understanding Your Policy and Coverage

Once you’ve found a policy that suits your needs and budget, it’s important to understand exactly what you’re covered for. Car insurance policies can be complex, and it’s easy to overlook important details. Here’s a breakdown of some key aspects of your policy that you should understand:

Coverage Limits

Your policy will have specific limits for each type of coverage. For example, your liability coverage might have limits of 100,000 for bodily injury per person, 300,000 for bodily injury per accident, and $50,000 for property damage. These limits are the maximum amounts your insurer will pay out for each type of claim. It’s important to ensure these limits are sufficient to cover potential damages, as you’ll be responsible for any costs above these limits.

Deductibles

Your deductible is the amount you must pay out of pocket before your insurance coverage kicks in. For instance, if you have a 500 deductible and are involved in an accident that causes 3,000 worth of damage to your vehicle, you’ll pay the first 500, and your insurance will cover the remaining 2,500. Choosing a higher deductible can lower your monthly premiums, but it means you’ll have to pay more if you ever need to file a claim.

Exclusions and Limitations

Every policy has exclusions and limitations, which are situations or types of damage that are not covered by your insurance. For example, normal wear and tear on your vehicle is typically not covered. It’s important to review these exclusions carefully to understand what you’re not covered for, so you can plan accordingly or consider adding additional coverage if necessary.

Claim Process and Deductible Reimbursement

Understanding how to file a claim and what to expect is crucial. Most insurers have a straightforward process, but it’s a good idea to familiarize yourself with it beforehand. Additionally, some insurers offer deductible reimbursement programs, which can help offset the cost of your deductible if you’re involved in an accident that’s not your fault. These programs can be a valuable addition to your policy, especially if you have a high deductible.

Making Informed Choices for Your Car Insurance

Finding good, cheap car insurance requires a combination of understanding the market, knowing your needs, and making strategic choices. By researching and comparing policies, choosing the right coverage, taking advantage of discounts, and maintaining a good driving record, you can secure affordable car insurance without compromising on quality.

Remember, car insurance is a vital part of your financial protection, and it's important to ensure you have adequate coverage. While it's tempting to choose the cheapest option, make sure you're not sacrificing essential coverage in the process. With the right knowledge and approach, you can find a balance between cost and coverage that suits your needs perfectly.

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the U.S. varies greatly depending on the state and individual factors. As of 2023, the national average cost of car insurance is around 1,674 per year, or approximately 139 per month. However, rates can range from as low as 500 to over 3,000 per year depending on various factors such as age, gender, driving record, location, and the type of vehicle insured.

Are there any government programs or initiatives to help lower car insurance costs for certain individuals or groups?

+Yes, there are government programs and initiatives in place to help certain individuals or groups with their car insurance costs. For example, some states offer low-cost auto insurance programs for low-income individuals or those who meet specific criteria. Additionally, some insurers participate in state-sponsored initiatives to provide discounted rates to certain groups, such as seniors or veterans. It’s worth researching these programs and reaching out to your state’s insurance department or local insurers to see if you’re eligible.

How can I lower my car insurance premiums if I have a poor driving record or have made multiple claims in the past?

+If you have a poor driving record or have made multiple claims in the past, your car insurance premiums are likely to be higher. However, there are still strategies you can employ to lower your costs. First, consider increasing your deductible. A higher deductible means you’ll pay more out of pocket if you have a claim, but it can also lead to lower premiums. Additionally, maintain a clean driving record going forward and avoid any further accidents or violations. Over time, as your record improves, your premiums should decrease. Finally, shop around and compare quotes from multiple insurers to find the best rate for your situation.