Best Dental Insurance For Braces

Dental insurance plans that cover orthodontic treatments like braces can be a game-changer for those seeking affordable options to straighten their teeth. With the rising costs of orthodontic care, having a comprehensive dental insurance policy can make a significant difference in your overall dental health journey. In this comprehensive guide, we will explore the best dental insurance options for individuals seeking coverage for braces, providing you with valuable insights to make an informed decision.

Understanding Dental Insurance for Braces

Dental insurance plans offer a range of benefits, and one of the most sought-after is orthodontic coverage. Braces, or orthodontic treatments, are often necessary to correct misaligned teeth and improve both aesthetics and overall oral health. However, the cost of braces can be substantial, making insurance coverage a crucial aspect to consider.

When evaluating dental insurance plans for braces, it's essential to understand the following key factors:

- Coverage Limits: Different plans have varying coverage limits for orthodontic treatments. Some may offer full coverage, while others provide partial coverage or have annual maximum limits.

- Waiting Periods: Most dental insurance policies have a waiting period before you can initiate orthodontic treatment. This waiting period ensures that individuals don't sign up solely for braces coverage.

- Age Restrictions: Some insurance providers set age limits for orthodontic coverage. It's crucial to check these restrictions, especially if you're an adult seeking braces.

- Treatment Types: Dental insurance plans may cover different types of braces, including traditional metal braces, ceramic braces, or even clear aligners like Invisalign.

- Network Providers: Dental insurance often works with a network of preferred providers. It's beneficial to choose a plan that includes orthodontists in your area who accept your insurance.

Top Dental Insurance Providers for Braces

Here’s a list of some of the leading dental insurance providers that offer comprehensive coverage for braces:

1. Delta Dental

Delta Dental is one of the most extensive dental insurance networks in the United States. They offer a range of plans, many of which provide orthodontic coverage. Delta Dental’s plans often cover a significant portion of the cost of braces, making them a popular choice for families and individuals seeking affordable orthodontic care.

Key Features:

- Comprehensive Coverage: Delta Dental plans typically cover a wide range of orthodontic treatments, including braces, clear aligners, and retainers.

- Network of Providers: With a vast network, finding an in-network orthodontist near you is often straightforward.

- Flexible Payment Options: Delta Dental offers various payment plans to suit different budgets.

2. MetLife Dental

MetLife Dental provides a comprehensive suite of dental insurance plans, including coverage for orthodontic treatments. Their plans are known for their flexibility and affordability, making them a great option for those seeking braces coverage.

Key Features:

- Customizable Plans: MetLife allows you to tailor your dental insurance plan to your specific needs, including orthodontic coverage.

- Quick Claims Processing: MetLife is known for its efficient claims processing, ensuring you receive reimbursements promptly.

- Discounted Rates: MetLife often offers discounted rates for additional orthodontic treatments beyond the initial coverage.

3. Cigna Dental

Cigna Dental is another prominent player in the dental insurance industry, offering a variety of plans that include orthodontic benefits. Their plans are designed to cater to different age groups and provide comprehensive coverage for braces.

Key Features:

- Age-Specific Plans: Cigna offers plans specifically tailored for children, teens, and adults, ensuring appropriate coverage for braces at different life stages.

- Orthodontic Consultation Coverage: Some Cigna plans cover the cost of initial orthodontic consultations, helping you assess your treatment options.

- Network Discounts: By staying within the Cigna network, you can often access discounted rates for orthodontic procedures.

4. Aetna Dental

Aetna Dental provides a wide range of dental insurance plans, and many of their options include orthodontic coverage. Aetna is known for its extensive network and comprehensive benefits, making it a reliable choice for those seeking braces insurance.

Key Features:

- Orthodontic Specialist Network: Aetna has a dedicated network of orthodontic specialists, ensuring you have access to highly skilled professionals.

- Flexible Deductibles: Aetna offers plans with flexible deductibles, allowing you to choose a plan that suits your financial situation.

- Orthodontic Emergency Coverage: Some Aetna plans provide coverage for orthodontic emergencies, ensuring you receive timely care when needed.

5. United Concordia Dental

United Concordia Dental offers a range of dental insurance plans, and their orthodontic coverage is highly regarded. They provide comprehensive benefits and a user-friendly claims process, making them a top choice for those seeking braces insurance.

Key Features:

- Clear Orthodontic Benefits: United Concordia's plans clearly outline orthodontic coverage, making it easy to understand your benefits.

- No Age Restrictions: Unlike some providers, United Concordia doesn't impose age restrictions on orthodontic coverage, making it suitable for all age groups.

- Convenient Online Claims: United Concordia offers a user-friendly online platform for submitting and tracking claims.

Factors to Consider When Choosing Dental Insurance for Braces

When selecting a dental insurance plan for braces, it's crucial to consider the following factors:

- Cost of the Plan: Evaluate the premium and out-of-pocket costs associated with the plan. Consider your budget and the long-term financial commitment.

- Coverage Limits: Understand the coverage limits for orthodontic treatments. Ensure the plan covers the type of braces you prefer and provides adequate coverage.

- Waiting Periods: Be aware of any waiting periods before you can initiate orthodontic treatment. Plan accordingly to avoid delays.

- Network Providers: Check if your preferred orthodontist is within the insurance network. If not, consider the out-of-network benefits and potential additional costs.

- Additional Benefits: Look for plans that offer additional benefits, such as coverage for retainers, emergency orthodontic care, or discounts on orthodontic treatments.

Performance Analysis and Future Implications

The dental insurance market is highly competitive, and providers are constantly evolving their plans to meet the growing demand for orthodontic coverage. As more individuals seek affordable options for braces, insurance providers are expected to enhance their benefits and network partnerships.

In the future, we may see insurance companies offering more specialized plans tailored to orthodontic needs. This could include plans with dedicated orthodontic coverage limits, reduced waiting periods, and expanded network access to top orthodontic specialists. Additionally, with the rising popularity of clear aligners, insurance providers may start offering coverage for these discreet and convenient orthodontic solutions.

It's important to stay informed about the latest developments in dental insurance to ensure you choose a plan that aligns with your orthodontic goals and budget. Regularly reviewing and comparing plans can help you make the most informed decision when it comes to securing coverage for braces.

Conclusion

Securing dental insurance coverage for braces is a wise decision to ensure your oral health and confidence. With the right insurance plan, you can access affordable orthodontic treatments and achieve the smile you’ve always wanted. Remember to carefully evaluate the coverage limits, network providers, and additional benefits offered by each plan to make an informed choice.

By understanding the key factors and exploring the top dental insurance providers, you're well on your way to finding the best coverage for your braces journey. Don't hesitate to reach out to insurance providers or seek advice from dental professionals to ensure you make the right decision for your unique needs.

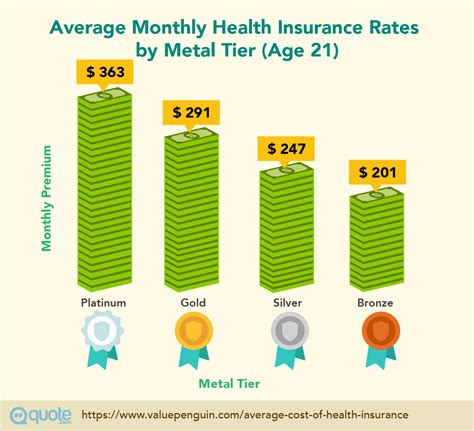

How much does dental insurance for braces typically cost?

+

The cost of dental insurance for braces can vary depending on the plan and provider. On average, you can expect to pay between 30 and 50 per month for a basic plan with orthodontic coverage. However, the premium can increase based on the level of coverage and your location.

Are there any age restrictions for orthodontic coverage in dental insurance plans?

+

Yes, some dental insurance plans have age restrictions for orthodontic coverage. Typically, these restrictions are in place to ensure that individuals receive orthodontic treatment during the most effective age range, which is often between 7 and 14 years old. However, many plans also offer coverage for adults seeking braces.

What type of braces does dental insurance typically cover?

+

Dental insurance plans usually cover a range of braces, including traditional metal braces, ceramic braces, and clear aligners like Invisalign. However, the level of coverage may vary, and some plans may have specific restrictions or require additional fees for certain types of braces.

Can I use my dental insurance for braces if I already have them installed?

+

Most dental insurance plans with orthodontic coverage are designed to provide benefits for the initial installation of braces. However, some plans may also offer coverage for adjustments, repairs, and retainers. It’s essential to review your specific plan’s coverage details to understand what is included.