Cash Value In Life Insurance

Cash value in life insurance is a key feature that adds flexibility and financial benefits to policyholders. This article aims to provide an in-depth exploration of cash value, shedding light on its advantages, functionality, and potential impact on your financial planning. Understanding cash value is crucial for anyone considering or already possessing a life insurance policy, as it can be a valuable tool for achieving financial goals and securing your future.

Understanding Cash Value

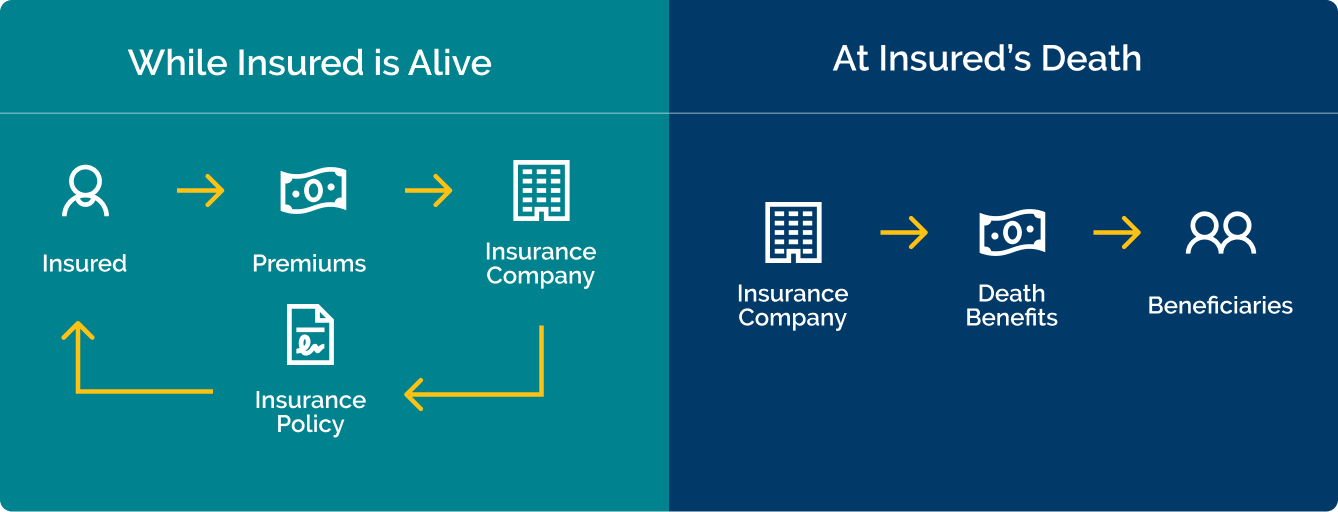

Cash value in life insurance refers to the portion of the policy’s premiums that accumulates over time and can be accessed by the policyholder. Unlike term life insurance, which typically does not offer cash value, permanent life insurance policies, such as whole life, universal life, and variable life insurance, are designed with this feature in mind.

The cash value component acts as a savings element within the policy, allowing policyholders to build a cash reserve that can be utilized during their lifetime. This reserve grows through regular premium payments and investment returns, providing a financial safety net that can be tapped into for various purposes.

How Cash Value Works

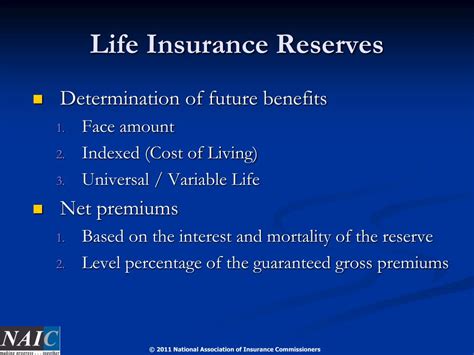

When you purchase a permanent life insurance policy with a cash value component, a portion of your premium payments is allocated towards building this cash reserve. This amount, known as the cost of insurance (COI), covers the insurance company’s expenses and the cost of providing the death benefit. The remaining portion of your premium goes towards investing in the cash value account.

The insurance company invests the cash value funds in a variety of assets, such as stocks, bonds, and money market instruments. The returns from these investments contribute to the growth of the cash value over time. The rate of return can vary depending on the type of policy and the performance of the investments.

| Policy Type | Cash Value Growth |

|---|---|

| Whole Life | Fixed rate of return |

| Universal Life | Varies based on market performance |

| Variable Life | Depends on investment choices |

As the cash value grows, policyholders can access this accumulated wealth through various means, such as:

- Policy Loans: Policyholders can borrow against the cash value, using it as collateral. The loan can be repaid with interest, and if left unpaid, it may reduce the death benefit.

- Withdrawal: Cash value can be withdrawn, providing a source of funds during financial emergencies or for specific goals.

- Reduced Paid-Up Insurance: Policyholders can use the cash value to reduce or eliminate future premium payments, maintaining a smaller death benefit.

- Surrendering the Policy: In some cases, policyholders can surrender the policy, receiving the full cash value amount.

Advantages of Cash Value

Cash value in life insurance offers a range of benefits that can significantly impact your financial planning and security:

Financial Flexibility

One of the primary advantages of cash value is the flexibility it provides. Policyholders can access their accumulated funds through loans or withdrawals, allowing them to address unexpected expenses or take advantage of investment opportunities. This financial flexibility can be especially valuable during challenging economic times or when unexpected costs arise.

Supplemental Income

Cash value can serve as a supplemental income source, particularly during retirement. Policyholders can utilize the cash value to fund their retirement plans, providing a reliable source of income to cover living expenses or pursue other financial goals.

Estate Planning

The cash value component can be an essential tool for estate planning. By utilizing the cash value to pay for final expenses, policyholders can ensure their loved ones receive the full death benefit without incurring additional financial burdens.

Tax Advantages

Cash value life insurance offers tax advantages, as policy loans and withdrawals are generally tax-free, up to the amount of premiums paid. This can provide significant tax savings, especially when compared to other investment options.

Performance Analysis

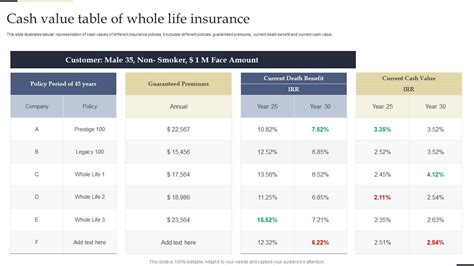

The performance of cash value life insurance policies can vary depending on the type of policy and the investment options available. Here’s a closer look at the performance of different cash value policies:

Whole Life Insurance

Whole life insurance policies offer a fixed rate of return on the cash value. This means that policyholders can expect a steady and predictable growth rate, providing a stable financial foundation. The fixed rate of return makes whole life insurance an attractive option for conservative investors who prioritize stability over high returns.

Universal Life Insurance

Universal life insurance policies provide more flexibility in terms of investment options. Policyholders can choose how their cash value is invested, allowing for potential higher returns. However, the performance of universal life insurance depends on market conditions and the chosen investment strategy. While it can offer higher growth potential, it also carries a higher level of risk.

Variable Life Insurance

Variable life insurance policies allow policyholders to invest their cash value in a range of investment options, including stocks, bonds, and mutual funds. The growth of the cash value is directly tied to the performance of these investments. While variable life insurance can offer the potential for higher returns, it also carries a higher level of risk, as the cash value can decrease if the investments perform poorly.

Real-World Examples

Let’s explore a few real-world scenarios to illustrate the impact of cash value in life insurance:

Scenario 1: Emergency Fund

John, a 40-year-old professional, has a whole life insurance policy with a cash value of $50,000. When faced with a sudden medical emergency, he decides to borrow against his cash value to cover the costs. The loan provides him with the necessary funds to address the emergency without disrupting his long-term financial plans.

Scenario 2: Retirement Planning

Sarah, a 55-year-old retiree, has been diligently building the cash value in her universal life insurance policy over the years. As she enters retirement, she begins to withdraw from her cash value to supplement her retirement income, ensuring a comfortable and secure financial future.

Scenario 3: Estate Planning

Michael, a successful businessman, has a variable life insurance policy with a substantial cash value. As part of his estate planning, he uses his cash value to pay for his final expenses, ensuring that his beneficiaries receive the full death benefit without any financial burden.

Expert Insights

Cash value in life insurance offers a unique opportunity to combine financial protection with long-term savings. It allows policyholders to build wealth while also providing a safety net for their loved ones. However, it’s important to carefully consider your financial goals and risk tolerance when choosing a cash value life insurance policy.

Future Implications

The cash value component of life insurance is likely to remain a significant aspect of permanent life insurance policies. As more individuals seek financial flexibility and long-term savings options, cash value life insurance can provide a valuable solution. Additionally, with the increasing complexity of financial planning, cash value life insurance may become an even more appealing option for those seeking comprehensive financial protection and wealth accumulation.

FAQ

Can I access the cash value at any time?

+

Yes, you can access the cash value through policy loans, withdrawals, or reduced paid-up insurance options. However, it’s important to consider the potential impact on your death benefit and overall financial plan.

Are there any tax implications when accessing the cash value?

+

Policy loans and withdrawals are generally tax-free up to the amount of premiums paid. However, if the cash value exceeds the premiums paid, the excess amount may be subject to taxes. It’s advisable to consult with a tax professional for specific advice.

Can I invest the cash value myself?

+

No, the insurance company manages the investment of the cash value. However, with certain policies like universal life insurance, you may have some control over the investment strategy, allowing for potential customization based on your risk tolerance and financial goals.