Purchase Protection Insurance

Purchase protection insurance, also known as PPI or buyer protection insurance, is a valuable financial tool designed to safeguard consumers against various risks and unforeseen circumstances associated with their purchases. In today's fast-paced world, where online shopping and e-commerce have become the norm, understanding the benefits and intricacies of purchase protection insurance is essential for informed consumers.

This comprehensive guide aims to delve into the world of purchase protection insurance, exploring its features, advantages, and real-world applications. By the end of this article, readers will have a thorough understanding of how PPI works, its potential benefits, and the critical role it plays in ensuring a secure and worry-free shopping experience.

Understanding Purchase Protection Insurance

Purchase protection insurance is a specialized form of coverage offered by various financial institutions, credit card companies, and insurance providers. It is designed to protect consumers against losses or damages incurred during the purchasing process, providing a safety net against unexpected events that could affect their purchases.

The concept of PPI revolves around offering consumers peace of mind by ensuring that, in the event of theft, loss, or damage to their recently purchased items, they will be financially reimbursed or receive other forms of assistance. This insurance coverage is particularly relevant in today's digital age, where online transactions and deliveries introduce additional risks.

Key Features of Purchase Protection Insurance

Purchase protection insurance typically covers a range of scenarios, including but not limited to:

- Theft and Robbery: In the unfortunate event of a theft or robbery, PPI can provide financial coverage for the stolen items, helping consumers recover the cost of their purchases.

- Loss and Misdelivery: If an item is lost during transit or misdelivered to the wrong address, purchase protection insurance can compensate the buyer for their loss.

- Damage and Defects: This coverage extends to situations where a purchased item arrives damaged or is found to be defective upon arrival. PPI ensures that consumers are not left bearing the cost of such issues.

- Extended Warranty: Some forms of PPI offer extended warranty coverage, providing additional protection beyond the standard manufacturer’s warranty period.

Additionally, purchase protection insurance often includes benefits such as:

- Replacement Services: In certain cases, PPI providers may offer to replace the lost or damaged item, ensuring a swift resolution to the issue.

- Purchase Price Protection: This feature guarantees that consumers will not overpay for an item. If the same product is found at a lower price elsewhere, the insurance will reimburse the difference.

- Identity Theft Protection: Many PPI policies include identity theft protection, which can assist consumers in recovering from financial losses due to identity theft.

| Scenario | Coverage |

|---|---|

| Theft and Robbery | Financial reimbursement for stolen items |

| Loss and Misdelivery | Compensation for lost or misdelivered items |

| Damage and Defects | Coverage for damaged or defective products |

| Extended Warranty | Additional warranty period beyond manufacturer's warranty |

How Purchase Protection Insurance Works

The process of claiming and receiving benefits under purchase protection insurance typically involves the following steps:

- Purchase with Eligible Payment Method: To be eligible for PPI coverage, consumers must make their purchases using an eligible payment method, such as a credit card or specific banking services.

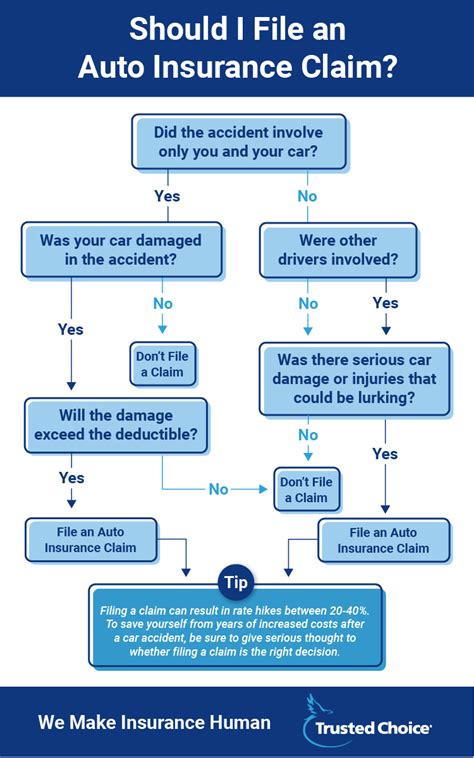

- Reporting the Incident: In the event of a loss, theft, damage, or other covered scenario, consumers must promptly report the incident to their PPI provider, providing detailed information about the purchase and the nature of the issue.

- Filing a Claim: After reporting the incident, consumers will need to file a formal claim with the PPI provider. This often involves submitting documentation, such as purchase receipts, police reports (in cases of theft), and any other relevant evidence.

- Assessment and Approval: The PPI provider will assess the claim, considering the terms and conditions of the insurance policy. If the claim is approved, the consumer will receive the appropriate compensation or assistance, as outlined in their policy.

It's important to note that the specific claims process and coverage details may vary depending on the provider and the type of purchase protection insurance purchased.

Real-World Scenarios and Benefits

Purchase protection insurance offers tangible benefits in various real-world scenarios. For instance, consider the following situations:

- Online Shopping: When purchasing electronics or other valuable items online, PPI can provide reassurance against potential delivery issues, such as theft or damage during transit.

- Travel and Vacation: During travels, PPI can cover the loss or theft of luggage and personal belongings, ensuring that travelers can focus on enjoying their trips without financial worries.

- High-Value Purchases: For big-ticket items like jewelry, artwork, or luxury goods, PPI can offer an extended warranty and protection against theft or damage, providing long-term peace of mind.

- Small Business Owners: Entrepreneurs and small business owners can benefit from PPI when purchasing equipment, inventory, or supplies, as it can help mitigate financial losses due to unforeseen circumstances.

Choosing the Right Purchase Protection Insurance

When selecting a purchase protection insurance policy, it’s crucial to consider the following factors to ensure the best coverage for your needs:

- Coverage Limits: Understand the maximum coverage amount offered by the policy. Ensure that it aligns with the value of the items you typically purchase.

- Eligibility and Exclusions: Carefully review the eligibility criteria and any exclusions listed in the policy. Certain items or situations may not be covered, so it’s essential to know what is and isn’t included.

- Claim Process and Response Time: Inquire about the claim process and the average response time for approvals. A timely and efficient claims process can be critical in resolving issues promptly.

- Additional Benefits: Explore the extra benefits offered by the policy, such as extended warranty coverage, purchase price protection, or identity theft protection. These features can add significant value to the insurance.

Comparing Providers

When comparing purchase protection insurance providers, consider the following:

- Reputation and Track Record: Research the provider’s reputation and customer feedback to ensure they have a solid track record of fair and efficient claim handling.

- Coverage Options: Compare the range of coverage options offered by different providers. Some may specialize in certain types of purchases or offer more comprehensive coverage for specific items.

- Cost and Premiums: Evaluate the cost of the insurance policy, including any additional fees or premiums. Ensure that the coverage and benefits provided are worth the investment.

- Customer Support: Assess the provider’s customer support services, including their accessibility, responsiveness, and availability.

Purchase Protection Insurance in Action

To illustrate the practical application of purchase protection insurance, let’s consider a real-life scenario:

Scenario: Sarah recently purchased a new laptop for her work, using her credit card with built-in purchase protection insurance. Unfortunately, the laptop was stolen from her car while she was at the gym. In this case, Sarah can file a claim with her credit card company, providing the necessary documentation, such as the purchase receipt and a police report. If the claim is approved, Sarah will receive financial reimbursement for the stolen laptop, allowing her to replace it without incurring a significant financial burden.

Future Trends and Innovations

As e-commerce and online shopping continue to evolve, purchase protection insurance is likely to adapt and innovate to meet the changing needs of consumers. Here are some potential future developments:

- Enhanced Digital Coverage: With the rise of digital purchases, PPI providers may offer more comprehensive coverage for digital goods, such as software, subscriptions, and online services.

- AI-Assisted Claims Processing: Artificial intelligence and machine learning technologies could streamline the claims process, making it faster and more efficient for consumers.

- Personalized Insurance Plans: Insurance providers may develop customized PPI plans based on individual consumer profiles and purchasing habits, offering tailored coverage and benefits.

- Integration with Smart Devices: As smart home devices become more prevalent, PPI could integrate with these devices to provide real-time protection and monitoring for high-value items.

Conclusion

Purchase protection insurance is a vital tool for consumers, offering a safety net against unforeseen circumstances and potential losses associated with their purchases. By understanding the features, benefits, and real-world applications of PPI, consumers can make informed decisions to protect their investments and enjoy a more secure shopping experience.

How much does purchase protection insurance typically cost?

+The cost of purchase protection insurance can vary depending on the provider and the type of coverage. Some credit cards offer PPI as a built-in benefit without additional fees, while others may charge a small percentage of the purchase amount as a premium. It’s essential to review the terms and conditions of the insurance policy to understand the associated costs.

Can I get purchase protection insurance for all my purchases?

+While PPI is widely available, there may be certain restrictions or exclusions. Some providers may have limitations on the types of items covered or the maximum coverage amount. It’s crucial to review the policy details to ensure that your specific purchases are eligible for protection.

What should I do if my purchase is lost, stolen, or damaged?

+In the event of a loss, theft, or damage, it’s important to act promptly. First, report the incident to the relevant authorities, such as the police in cases of theft. Then, contact your PPI provider and provide them with the necessary details and documentation. They will guide you through the claims process and assist you in resolving the issue.

Are there any alternatives to purchase protection insurance?

+Yes, there are alternative forms of protection, such as extended warranties offered by manufacturers or retailers. However, purchase protection insurance often provides more comprehensive coverage and can be more cost-effective for high-value or frequently purchased items. It’s essential to compare the options and choose the one that best suits your needs.