Ga Department Of Insurance

Welcome to an in-depth exploration of the Georgia Department of Insurance (DOI), an essential governmental body that plays a pivotal role in regulating and overseeing the insurance industry within the state of Georgia. This article will delve into the department's structure, functions, and its impact on both insurance providers and consumers, providing a comprehensive understanding of its operations and significance.

Understanding the Georgia Department of Insurance

The Georgia Department of Insurance is a state agency responsible for the supervision, regulation, and control of insurance activities within Georgia. Established to protect consumers and ensure the stability and integrity of the insurance market, the DOI’s mandate extends across various insurance sectors, including life, health, property, and casualty insurance.

With a comprehensive range of responsibilities, the DOI serves as the guardian of insurance standards, consumer rights, and industry practices. It achieves this through a combination of licensing and regulatory processes, market conduct examinations, consumer education initiatives, and enforcement actions when necessary. By upholding high standards, the department contributes to the overall financial health and stability of the insurance industry in Georgia.

Mission and Vision

The mission of the Georgia Department of Insurance is to protect consumers, foster market stability, and promote fair competition within the insurance industry. Through rigorous oversight and enforcement of insurance laws and regulations, the DOI aims to ensure that insurance companies operate ethically and consumers receive the coverage and services they are entitled to.

In alignment with its mission, the vision of the DOI is to establish Georgia as a leader in insurance regulation, characterized by a robust and innovative insurance market that is responsive to the needs of consumers and businesses alike. By adopting a proactive approach to regulation and collaboration with industry stakeholders, the department strives to create an environment where consumers have access to a wide range of insurance products and services, delivered by stable and financially sound insurers.

Key Functions and Responsibilities

The Georgia Department of Insurance undertakes a diverse array of functions and responsibilities to fulfill its mission and vision. These include:

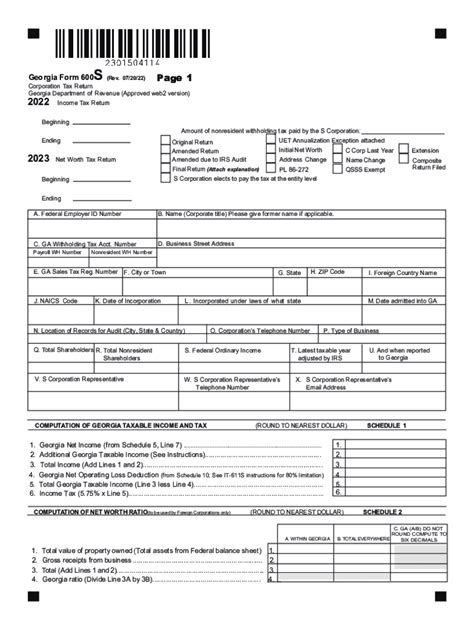

- Licensing and Appointments: The DOI is responsible for licensing insurance companies, agencies, and professionals operating in Georgia. This process ensures that all entities meet the necessary requirements and adhere to ethical standards.

- Market Conduct Examinations: Regular market conduct examinations are conducted to assess insurance companies' compliance with laws and regulations. These examinations cover areas such as financial solvency, consumer complaints, and market behavior.

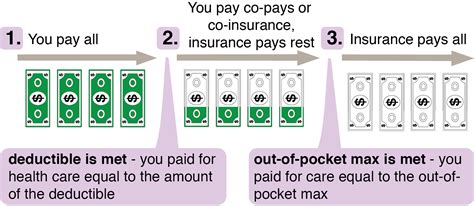

- Consumer Protection: A key focus of the DOI is consumer protection. It educates consumers about their rights and provides assistance in resolving insurance-related disputes. The department also investigates and takes action against companies or individuals engaging in fraudulent or unfair practices.

- Rate and Form Filings: Insurance companies are required to file their rates and policy forms with the DOI for approval. The department reviews these filings to ensure they are in compliance with state laws and do not discriminate against specific groups or individuals.

- Fraud Prevention and Investigation: The DOI plays a crucial role in preventing and investigating insurance fraud. It works closely with law enforcement agencies to identify and prosecute fraudulent activities, thereby protecting consumers and the insurance industry.

- Education and Outreach: Through various initiatives, the DOI provides education and outreach programs to inform consumers about insurance products, their rights, and how to make informed choices. These programs aim to empower consumers and enhance their understanding of the insurance landscape.

- Industry Oversight and Monitoring: The department continuously monitors the insurance industry to identify emerging trends, potential risks, and areas of concern. This proactive approach enables the DOI to take timely action and ensure the stability of the insurance market.

Regulatory Framework

The regulatory framework of the Georgia Department of Insurance is grounded in a set of principles that guide its operations and decision-making processes. These principles include:

- Consumer Protection: The DOI places a strong emphasis on protecting the interests and rights of insurance consumers. This involves ensuring that consumers have access to a wide range of insurance products, understanding their coverage, and being treated fairly by insurance companies.

- Market Stability: Maintaining the stability and integrity of the insurance market is a key priority. The department works to prevent market disruptions, promote sound financial practices, and ensure the long-term viability of insurance companies.

- Fair Competition: A competitive insurance market benefits both consumers and businesses. The DOI encourages fair competition by enforcing anti-trust laws and preventing practices that may hinder competition, such as price fixing or market manipulation.

- Financial Solvency: Insurance companies are required to maintain adequate financial reserves to meet their obligations. The DOI oversees this aspect to ensure that insurers can pay valid claims and remain solvent.

- Compliance and Enforcement: The department enforces insurance laws and regulations through a combination of education, guidance, and, when necessary, enforcement actions. This includes imposing fines, issuing cease-and-desist orders, and revoking licenses for non-compliance.

Impact on Insurance Industry and Consumers

The Georgia Department of Insurance’s regulatory activities have a profound impact on both the insurance industry and consumers. For insurance providers, the DOI’s oversight ensures a level playing field and promotes fair competition. By enforcing laws and regulations, the department helps maintain the financial stability of the industry and protects against fraudulent practices.

For consumers, the DOI's role is equally significant. It provides a layer of protection against unscrupulous practices and ensures that insurance products are affordable, accessible, and meet the needs of diverse populations. Through its educational initiatives and consumer assistance programs, the department empowers individuals to make informed choices and understand their rights.

The DOI's consumer protection efforts extend to addressing complaints and disputes. It investigates consumer grievances, mediates disputes between consumers and insurance companies, and takes action against companies that engage in unfair or deceptive practices. This ensures that consumers receive the coverage and services they are entitled to and have a mechanism for resolving insurance-related issues.

Industry Partnerships and Collaboration

The Georgia Department of Insurance recognizes the importance of collaboration and partnerships with various industry stakeholders. By working closely with insurance companies, agents, and brokers, the DOI gains valuable insights into industry practices and challenges. This collaborative approach allows the department to develop regulations and initiatives that are practical, effective, and aligned with the needs of the industry.

The DOI also engages with consumer advocacy groups and other regulatory bodies to share best practices and coordinate efforts in addressing cross-cutting issues. Through these partnerships, the department strengthens its ability to protect consumers, promote fair competition, and maintain the stability of the insurance market.

Future Outlook and Continuous Improvement

The Georgia Department of Insurance is committed to continuous improvement and adaptation to meet the evolving needs of the insurance industry and consumers. As the insurance landscape changes, the department is dedicated to staying at the forefront of regulatory practices and technological advancements.

The DOI actively engages in ongoing training and development programs for its staff to enhance their skills and knowledge. This ensures that the department remains well-equipped to address emerging issues, such as cyber risks, digital insurance products, and the increasing complexity of the insurance marketplace.

In addition, the department conducts regular reviews of its processes and procedures to identify areas for improvement. By soliciting feedback from industry stakeholders and consumers, the DOI can refine its regulatory approach and ensure that its practices remain effective and relevant.

Digital Transformation and Innovation

Recognizing the importance of technology in the insurance industry, the Georgia Department of Insurance is embracing digital transformation and innovation. The department is exploring ways to leverage technology to enhance its regulatory processes, improve consumer experiences, and streamline interactions with insurance companies.

For example, the DOI is developing online platforms and mobile applications to provide consumers with easy access to insurance information, policy comparisons, and complaint resolution processes. These digital initiatives aim to improve efficiency, reduce paperwork, and enhance transparency in insurance transactions.

Furthermore, the department is exploring the use of advanced technologies, such as artificial intelligence and blockchain, to enhance its regulatory capabilities. These technologies can assist in fraud detection, streamline regulatory reporting, and improve the overall efficiency of the department's operations.

Conclusion

The Georgia Department of Insurance plays a critical role in safeguarding the interests of insurance consumers and promoting a stable, competitive, and ethical insurance market. Through its comprehensive regulatory framework, consumer protection initiatives, and industry collaboration, the DOI ensures that insurance providers operate with integrity and consumers have access to the coverage and services they need.

As the insurance industry continues to evolve, the Georgia Department of Insurance remains dedicated to staying ahead of the curve. By embracing digital transformation, fostering partnerships, and continuously improving its practices, the DOI is well-positioned to meet the challenges and opportunities of the future, ensuring the long-term viability and success of the insurance industry in Georgia.

What is the role of the Georgia Department of Insurance in licensing insurance professionals?

+The Georgia Department of Insurance is responsible for licensing insurance professionals, such as agents and brokers, to ensure they meet the necessary qualifications and adhere to ethical standards. The licensing process involves background checks, education requirements, and examinations to ensure professionals have the knowledge and skills to serve consumers effectively.

How does the DOI handle consumer complaints and disputes?

+The DOI has a dedicated Consumer Services Division that handles consumer complaints and disputes. It investigates complaints, mediates disputes, and takes appropriate action against insurance companies or professionals found to be in violation of regulations. The department provides a fair and impartial process for resolving insurance-related issues.

What are the key challenges faced by the Georgia Department of Insurance in regulating the insurance industry?

+The Georgia Department of Insurance faces various challenges, including keeping pace with technological advancements, adapting to changing consumer needs and preferences, and addressing emerging risks such as cyber threats and climate change. Additionally, ensuring fair access to insurance coverage for all populations is an ongoing challenge.