Automobile Insurance Comparison

In today's fast-paced world, ensuring the safety and security of our vehicles is paramount. Automobile insurance plays a crucial role in providing financial protection and peace of mind to vehicle owners. With numerous insurance providers offering a wide range of coverage options, it can be daunting to navigate the complex landscape of automotive insurance. This comprehensive guide aims to shed light on the essential aspects of automobile insurance, empowering you to make informed decisions and choose the coverage that best suits your needs.

Understanding Automobile Insurance: A Comprehensive Overview

Automobile insurance, often referred to as car insurance, is a contractual agreement between an insurance provider and a vehicle owner. This agreement outlines the coverage terms, including the types of risks covered, the limits of coverage, and the associated costs. By understanding the different components of automobile insurance, you can tailor your policy to match your specific requirements.

Key Components of Automobile Insurance

Automobile insurance policies typically encompass the following fundamental elements:

- Liability Coverage: This aspect of insurance covers the costs associated with bodily injury and property damage claims made against you. It provides financial protection if you are found legally responsible for an accident.

- Comprehensive Coverage: Comprehensive insurance offers protection against non-collision incidents, such as theft, vandalism, natural disasters, or damage caused by animals. It provides a safety net for unforeseen events beyond your control.

- Collision Coverage: As the name suggests, collision insurance covers the repair or replacement costs of your vehicle if it’s involved in a collision, regardless of fault. This coverage is essential for safeguarding your vehicle’s value.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you in the event of an accident with a driver who has no insurance or insufficient insurance to cover the damages. It ensures you’re not left financially burdened in such situations.

- Personal Injury Protection (PIP) or Medical Payments: PIP or Medical Payments coverage provides financial assistance for medical expenses incurred by you or your passengers in an accident, regardless of fault.

- Rental Car Reimbursement: Some policies include rental car reimbursement, covering the cost of a rental vehicle if your car is being repaired or is declared a total loss due to an insured event.

Factors Influencing Automobile Insurance Premiums

The cost of automobile insurance, known as the premium, can vary significantly based on several factors. Understanding these factors can help you negotiate better rates and make informed choices.

- Driver’s Profile: Your age, gender, driving history, and credit score are significant factors. Younger drivers, especially males, often face higher premiums due to their perceived riskier driving behavior. A clean driving record and a good credit score can lead to more favorable rates.

- Vehicle Type: The make, model, and year of your vehicle play a crucial role. Sports cars and luxury vehicles typically attract higher premiums due to their higher repair costs and potential for theft. Additionally, vehicles with advanced safety features may qualify for discounts.

- Location: The area where you live and work can impact your insurance rates. Urban areas often have higher premiums due to increased traffic congestion and the higher likelihood of accidents and theft. Rural areas, on the other hand, may offer lower rates.

- Coverage Level: The level of coverage you choose directly influences your premium. Opting for higher coverage limits and adding optional coverages will result in a higher premium, while choosing basic coverage may keep costs down.

- Deductibles: Deductibles are the amount you agree to pay out-of-pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, as it reduces the financial burden on the insurance provider.

Comparing Automobile Insurance: A Step-by-Step Guide

Comparing automobile insurance policies is essential to finding the best value and coverage for your needs. Here’s a step-by-step process to help you navigate this task effectively:

Step 1: Identify Your Coverage Needs

Before comparing policies, assess your specific coverage requirements. Consider the following:

- Do you primarily drive in urban or rural areas?

- How often do you drive, and for what purposes (commuting, leisure, work)?

- What is the value of your vehicle, and how important is it to you to have comprehensive and collision coverage?

- Do you have any specific concerns, such as frequent road trips or potential exposure to natural disasters?

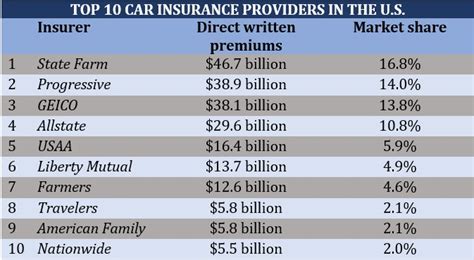

Step 2: Research Insurance Providers

Start by researching reputable insurance providers in your area. Consider their financial stability, customer satisfaction ratings, and the range of coverage options they offer. Online reviews and ratings can provide valuable insights into the provider’s reliability and customer service.

Step 3: Request Quotes

Contact the insurance providers you’ve shortlisted and request quotes. Ensure you provide accurate and detailed information about your driving history, vehicle details, and desired coverage levels. Compare the quotes based on the following criteria:

- Premium Cost: Compare the annual premiums, but also consider the breakdown of costs for different coverage levels.

- Coverage Limits: Ensure the policies offer adequate coverage limits for liability, comprehensive, and collision coverage.

- Optional Coverages: Assess whether the policies include optional coverages you may require, such as rental car reimbursement or roadside assistance.

- Discounts: Look for providers offering discounts for safe driving, multiple policies, or other eligibility criteria.

Step 4: Analyze Policy Details

Beyond the premium and coverage limits, delve into the fine print of the policies. Pay attention to the following aspects:

- Deductibles: Compare the deductibles for different coverage types. Higher deductibles can lower premiums but may require a larger out-of-pocket expense in the event of a claim.

- Claim Settlement Process: Understand the provider’s claim settlement process, including how quickly they respond to claims and their reputation for fair settlements.

- Policy Exclusions: Be aware of any exclusions or limitations in the policies. Some providers may exclude certain types of claims or limit coverage in specific situations.

- Customer Service: Assess the provider’s customer service reputation. Consider factors like response times, accessibility, and the availability of online resources and tools.

Step 5: Consider Add-Ons and Personalized Options

Many insurance providers offer add-ons or personalized coverage options to cater to specific needs. These may include coverage for custom parts, gap insurance, or coverage for specific events like racing or off-roading. Evaluate whether these options align with your requirements and budget.

Step 6: Negotiate and Choose

Once you’ve thoroughly analyzed the policies, negotiate with the providers to secure the best deal. Don’t hesitate to ask for discounts or to discuss any concerns you may have. Finally, choose the policy that offers the best combination of coverage, cost, and customer satisfaction.

The Future of Automobile Insurance: Technological Advancements and Their Impact

The automobile insurance industry is undergoing significant transformation, driven by technological advancements. These innovations are reshaping the way insurance is priced, delivered, and experienced by customers. Here’s a glimpse into the future of automobile insurance and its implications.

Telematics and Usage-Based Insurance (UBI)

Telematics and UBI are revolutionizing the way insurance providers assess risk and price policies. Telematics devices installed in vehicles collect real-time data on driving behavior, including speed, acceleration, and braking patterns. This data is then used to calculate personalized insurance rates based on an individual’s driving habits.

UBI policies offer discounts to drivers who exhibit safe driving behavior, incentivizing responsible driving and potentially lowering premiums for cautious drivers. This technology also allows insurance providers to identify high-risk drivers more accurately, leading to fairer pricing for all policyholders.

Artificial Intelligence and Data Analytics

Artificial Intelligence (AI) and advanced data analytics are enhancing the efficiency and accuracy of insurance processes. AI-powered systems can quickly analyze vast amounts of data, including historical claims data, vehicle repair costs, and customer feedback, to identify trends and patterns.

This technology enables insurance providers to make more informed decisions when pricing policies and managing risks. It also streamlines the claim settlement process, reducing processing times and enhancing customer satisfaction.

Connected Car Technology

The rise of connected car technology is transforming the driving experience and, subsequently, the insurance industry. Connected cars, equipped with advanced sensors and communication systems, can transmit real-time data to insurance providers, enabling them to monitor vehicle performance and driving behavior.

This data can be used to offer personalized insurance rates, provide early warnings for potential mechanical issues, and even offer proactive maintenance suggestions. Connected car technology also enhances safety features, reducing the likelihood of accidents and potentially lowering insurance costs for drivers.

Blockchain and Smart Contracts

Blockchain technology, combined with smart contracts, has the potential to revolutionize the insurance industry by enhancing transparency, security, and efficiency. Smart contracts are self-executing contracts with the terms of the agreement directly written into code.

In the context of automobile insurance, smart contracts can automate various processes, including policy issuance, claim processing, and premium payments. This technology reduces the need for manual intervention, minimizes the risk of fraud, and provides a secure and tamper-proof record of transactions.

Implications for the Future

The technological advancements outlined above are set to have a profound impact on the automobile insurance industry. Here are some key implications to consider:

- Personalized Insurance: With the advent of telematics and UBI, insurance policies can be tailored to individual driving behavior, offering fairer rates based on actual risk rather than broad demographics.

- Enhanced Customer Experience: AI-powered systems and connected car technology can provide real-time assistance and personalized recommendations, enhancing the overall customer experience and satisfaction.

- Reduced Fraud and Improved Security: Blockchain technology and smart contracts can minimize fraud and enhance data security, ensuring a more secure and transparent insurance ecosystem.

- Faster Claim Settlements: Advanced data analytics and AI can streamline the claim settlement process, reducing processing times and providing quicker financial relief to policyholders.

Conclusion: Navigating the Complex World of Automobile Insurance

Automobile insurance is a complex but essential aspect of vehicle ownership. By understanding the key components of insurance policies, the factors influencing premiums, and the latest technological advancements, you can make informed decisions and choose the coverage that best suits your needs and budget.

As the industry continues to evolve, staying abreast of these changes will empower you to maximize the benefits of automobile insurance while minimizing potential risks. Remember, the right insurance policy is not just a financial safeguard but also a reflection of your commitment to safety and responsibility on the road.

FAQ

How often should I review my automobile insurance policy?

+It’s recommended to review your insurance policy annually or whenever there’s a significant change in your circumstances, such as a new vehicle purchase, a move to a different location, or a change in your marital status. Regular reviews ensure your coverage remains adequate and up-to-date.

What factors can lead to an increase in my automobile insurance premium?

+Several factors can contribute to an increase in your premium, including a history of accidents or traffic violations, a change in your vehicle’s value, or an increase in the overall cost of insurance in your area. It’s important to regularly monitor your policy and make adjustments as necessary.

Can I negotiate my automobile insurance premium?

+Absolutely! Insurance providers often offer discounts for safe driving, loyalty, or bundling multiple policies. Don’t hesitate to negotiate with your provider to secure the best rates. Additionally, comparing quotes from multiple providers can help you find more competitive rates.

What should I do if I’m involved in an automobile accident?

+If you’re involved in an accident, the first step is to ensure the safety of all individuals involved. Call the police to report the accident and exchange information with the other driver(s). Notify your insurance provider as soon as possible and provide them with a detailed report of the incident. Cooperate with the claims process and follow any instructions provided by your insurer.