How Much Does Insurance Cost Per Month

Insurance costs can vary greatly depending on various factors, including the type of insurance, the coverage limits and deductibles chosen, the insured's age, location, and personal circumstances. Understanding the average monthly insurance costs for different policies can provide valuable insights for those seeking adequate protection while managing their financial obligations. In this comprehensive article, we will delve into the world of insurance costs, exploring the average monthly expenses for various types of insurance and uncovering the factors that influence these prices.

Understanding the Average Monthly Insurance Costs

When it comes to insurance, there is no one-size-fits-all solution, and the monthly costs can differ significantly based on individual needs and circumstances. Let’s explore the average monthly expenses for some common types of insurance policies.

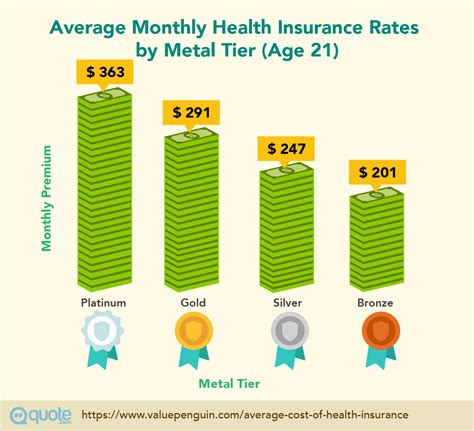

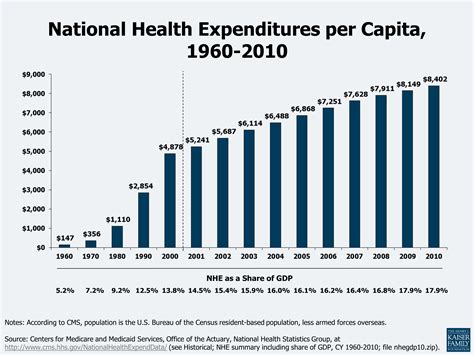

Health Insurance

Health insurance is arguably one of the most critical types of insurance coverage, especially in countries without universal healthcare. The average monthly cost of health insurance can vary greatly based on factors such as age, pre-existing conditions, and the level of coverage desired. According to recent data, the average monthly premium for an individual health insurance plan in the United States ranges from approximately 450 to 550, while family plans can cost upwards of $1,500 per month.

| Insurance Type | Average Monthly Cost (USD) |

|---|---|

| Individual Health Plan | $450 - $550 |

| Family Health Plan | $1,500+ |

It's important to note that these averages may not reflect the actual costs for everyone, as insurance premiums are personalized based on individual health assessments. Additionally, the Affordable Care Act (ACA) has introduced subsidies and tax credits to make health insurance more affordable for eligible individuals and families.

Auto Insurance

Auto insurance is a legal requirement in most countries and is essential for protecting drivers, passengers, and other road users. The average monthly cost of auto insurance varies significantly based on factors such as the driver’s age, driving history, location, and the type of vehicle insured. On average, drivers in the United States can expect to pay anywhere from 100 to 200 per month for basic liability coverage, while comprehensive plans with additional coverage can cost upwards of $300 per month.

| Auto Insurance Type | Average Monthly Cost (USD) |

|---|---|

| Basic Liability Coverage | $100 - $200 |

| Comprehensive Coverage | $300+ |

It's worth mentioning that insurance companies use complex algorithms to assess risk and determine premiums. Factors such as the driver's credit score, the number of miles driven annually, and even the car's safety features can influence the cost of auto insurance.

Homeowner’s Insurance

Homeowner’s insurance provides financial protection against damage to a home and its contents, as well as liability coverage for accidents that may occur on the property. The average monthly cost of homeowner’s insurance varies depending on the location, the value of the home, and the level of coverage chosen. In the United States, the average monthly premium for homeowner’s insurance ranges from 100 to 200, with higher-value homes and properties in high-risk areas commanding higher premiums.

| Homeowner's Insurance Type | Average Monthly Cost (USD) |

|---|---|

| Standard Homeowner's Insurance | $100 - $200 |

| High-Value Home Insurance | Varies |

It's important for homeowners to review their coverage annually to ensure it aligns with the current value of their home and possessions. Additionally, certain factors like installing security systems or making energy-efficient upgrades can potentially reduce insurance premiums.

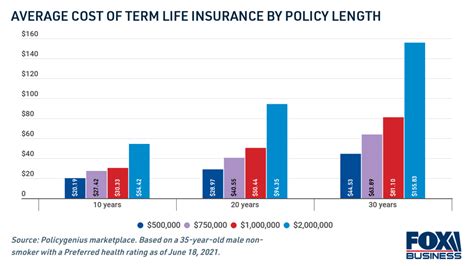

Life Insurance

Life insurance provides financial protection for loved ones in the event of the policyholder’s death. The average monthly cost of life insurance depends on various factors, including the policyholder’s age, health status, the amount of coverage desired, and the type of policy chosen. Term life insurance, which offers coverage for a specified period, tends to be more affordable compared to whole life insurance, which provides coverage for the policyholder’s entire life.

| Life Insurance Type | Average Monthly Cost (USD) |

|---|---|

| Term Life Insurance (20-year term) | $50 - $100 |

| Whole Life Insurance | Varies |

It's crucial to assess your financial needs and goals when considering life insurance. Factors such as outstanding debts, mortgage payments, and the financial well-being of dependents play a significant role in determining the appropriate level of coverage.

Other Types of Insurance

In addition to the aforementioned insurance types, there are numerous other policies available to address specific needs. These include:

- Renter's Insurance: Protects renters against property damage and liability claims, with average monthly premiums ranging from $15 to $30.

- Travel Insurance: Provides coverage for unexpected events during travel, such as trip cancellations, medical emergencies, and lost luggage. Average costs vary depending on the duration and destination of the trip.

- Pet Insurance: Covers veterinary expenses for pets, with monthly premiums ranging from $30 to $70 depending on the pet's age, breed, and coverage limits.

- Umbrella Insurance: Offers additional liability coverage beyond the limits of other policies, typically starting at $150 per month for $1 million in coverage.

- Business Insurance: Essential for protecting businesses against various risks, with costs varying based on the industry, size of the business, and coverage needs.

Factors Influencing Insurance Costs

Now that we’ve explored the average monthly costs for various insurance types, let’s delve into the factors that insurance companies consider when determining premiums.

Risk Assessment

Insurance companies assess risk to determine the likelihood of a claim being made. Higher-risk individuals or properties generally result in higher premiums. For example, younger drivers with less driving experience often pay higher auto insurance premiums due to the higher risk associated with their age group.

Coverage Limits and Deductibles

The level of coverage chosen can significantly impact insurance costs. Higher coverage limits generally result in higher premiums, as the insurance company assumes more financial responsibility. Additionally, the choice of deductibles can affect costs. Higher deductibles mean the policyholder bears more of the financial burden in the event of a claim, leading to lower premiums.

Location and Local Factors

The location of the insured property or individual can play a significant role in determining insurance costs. Areas prone to natural disasters, high crime rates, or dense traffic may have higher insurance premiums. For instance, homeowners in hurricane-prone regions may face higher insurance costs due to the increased risk of property damage.

Personal Circumstances

Insurance premiums can also be influenced by personal circumstances, such as age, gender, health status, and occupation. For instance, younger individuals may pay higher premiums for certain types of insurance due to their perceived higher risk profile. Additionally, certain occupations with higher injury risks may result in higher insurance costs.

Claim History

Insurance companies review an individual’s or business’s claim history to assess their risk profile. A history of frequent claims may result in higher premiums, as it indicates a higher likelihood of future claims. Maintaining a clean claim history can potentially lead to lower insurance costs over time.

Tips for Managing Insurance Costs

While insurance costs can be influenced by various factors, there are strategies individuals and businesses can employ to manage these expenses effectively.

Shop Around and Compare

Insurance premiums can vary significantly between companies, so it’s essential to shop around and compare quotes. Online insurance comparison tools can be valuable resources for quickly assessing different options and finding the best fit for your needs and budget.

Bundle Policies

Many insurance companies offer discounts when customers bundle multiple policies, such as auto and homeowner’s insurance. Bundling policies with the same insurer can often result in significant savings.

Understand Coverage Options

Reviewing and understanding the different coverage options available can help you make informed decisions. Balancing the level of coverage with your budget is crucial to ensure you’re not overinsured or underinsured.

Maintain a Good Credit Score

In many cases, insurance companies consider an individual’s credit score when determining premiums. Maintaining a good credit score can potentially lead to lower insurance costs, as it indicates a lower risk profile.

Review Policies Annually

Insurance needs can change over time, so it’s important to review your policies annually. This ensures that your coverage remains adequate and allows you to explore potential cost-saving opportunities.

Conclusion

Insurance costs can vary widely based on numerous factors, making it essential to understand the average monthly expenses for different types of insurance. By exploring the averages and delving into the factors that influence premiums, individuals and businesses can make informed decisions about their insurance coverage. Remember to shop around, understand your coverage options, and review your policies regularly to manage insurance costs effectively.

Can I negotiate insurance premiums with my provider?

+

While insurance premiums are typically based on standardized rates, there may be opportunities to negotiate with your provider. Some insurance companies offer discounts for loyal customers or may be willing to work with you to find a more affordable plan that meets your needs.

How often should I review my insurance policies?

+

It’s recommended to review your insurance policies at least once a year. This allows you to assess if your coverage is still adequate, make any necessary adjustments, and explore potential cost savings.

Are there any government programs that can help with insurance costs?

+

Yes, depending on your location and circumstances, there may be government programs or subsidies available to help with insurance costs. For example, the Affordable Care Act (ACA) in the United States provides tax credits and subsidies to make health insurance more affordable for eligible individuals and families.