Average Monthly Life Insurance Cost

Life insurance is an essential financial tool that provides a safety net for your loved ones in the event of your untimely passing. With a myriad of policy types and coverage options available, understanding the average monthly cost of life insurance is crucial for individuals seeking to secure their families' financial future.

Exploring the Average Monthly Life Insurance Cost

The average monthly life insurance cost can vary significantly based on numerous factors, including the policy type, coverage amount, and the insured’s age, health, and lifestyle. As such, it is essential to explore these factors in detail to gain a comprehensive understanding of the costs associated with life insurance.

Policy Types and Their Impact on Cost

Life insurance policies can be broadly categorized into two main types: term life insurance and permanent life insurance. Each type has distinct features and cost structures.

Term Life Insurance

Term life insurance is the most common and affordable type of life insurance. It provides coverage for a specific period, typically ranging from 10 to 30 years. During the term, the insured pays a fixed premium, and the policy pays out a predetermined death benefit if the insured passes away within the term.

The average monthly cost for term life insurance can range from 15 to 100 or more, depending on the coverage amount and the insured’s age and health. For example, a healthy 30-year-old male might pay around 15 per month for a 250,000 term life insurance policy, while a 50-year-old male with health issues could pay upwards of $100 per month for the same coverage.

Term life insurance is ideal for individuals seeking temporary coverage to protect their families during specific life stages, such as raising children or paying off a mortgage.

Permanent Life Insurance

Permanent life insurance, on the other hand, provides lifelong coverage and accumulates cash value over time. There are several types of permanent life insurance, including whole life, universal life, and variable life insurance.

The average monthly cost for permanent life insurance is generally higher than term life insurance. Whole life insurance, for instance, can cost between 50 and 500 per month, depending on the coverage amount and the insured’s age and health. Universal life insurance and variable life insurance policies can have even higher monthly costs, as they offer more flexibility and investment options.

Permanent life insurance is suitable for individuals seeking long-term coverage and those interested in building cash value over time, which can be used for various financial goals, such as retirement planning or leaving a legacy.

Coverage Amount and Its Influence on Cost

The coverage amount, or the death benefit, is a significant factor influencing the cost of life insurance. In general, the higher the coverage amount, the higher the monthly premium.

For instance, a term life insurance policy with a 500,000 coverage amount may cost twice as much as a policy with a 250,000 coverage amount, all other factors being equal. Similarly, a permanent life insurance policy with a 1,000,000 coverage amount will typically have a higher monthly premium than a policy with a 500,000 coverage amount.

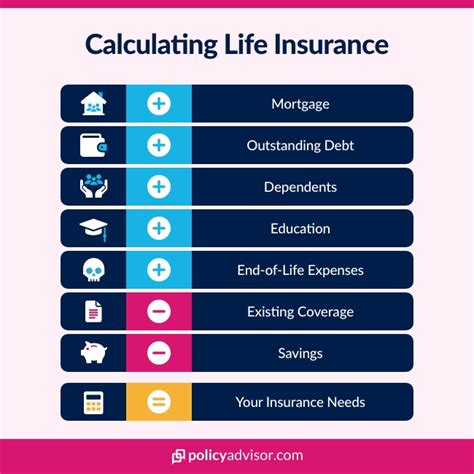

When determining the appropriate coverage amount, it is essential to consider your financial obligations and the needs of your loved ones. Factors such as outstanding debts, mortgage payments, children’s education expenses, and funeral costs should be taken into account to ensure sufficient coverage.

Age, Health, and Lifestyle: Key Factors in Determining Cost

The insured’s age, health, and lifestyle are critical factors in determining the cost of life insurance. Insurance companies assess these factors to gauge the risk associated with insuring an individual.

Age

In general, younger individuals tend to pay lower premiums for life insurance. This is because younger individuals are statistically less likely to pass away during the term of the policy, making them a lower risk for insurance companies. As individuals age, the risk increases, and so do the premiums.

For instance, a 25-year-old might pay around 10 per month for a 250,000 term life insurance policy, while a 65-year-old with the same coverage amount could pay upwards of $50 per month.

Health

An individual’s health plays a significant role in determining life insurance costs. Insurance companies assess an individual’s health through medical examinations, health questionnaires, and sometimes even genetic testing. Pre-existing health conditions, such as high blood pressure, diabetes, or a history of heart disease, can increase the cost of life insurance.

For example, an individual with a healthy lifestyle and no pre-existing conditions might pay a lower premium for a life insurance policy compared to someone with multiple health issues. The insurance company may require the latter individual to undergo a medical exam to assess their risk level accurately.

Lifestyle

Lifestyle factors, such as smoking, hazardous occupations, or high-risk hobbies, can also impact the cost of life insurance. Insurance companies consider these factors when assessing the risk associated with insuring an individual.

For instance, a smoker may pay a significantly higher premium for life insurance compared to a non-smoker, as smoking is a known risk factor for various health conditions. Similarly, individuals engaged in hazardous occupations, such as firefighting or construction work, may also face higher premiums due to the increased risk of injury or death.

Other Factors Influencing Cost

In addition to the factors mentioned above, several other elements can influence the average monthly life insurance cost.

One such factor is the insurance company itself. Different insurance companies may have varying pricing structures, policy features, and underwriting guidelines. It is essential to shop around and compare policies from multiple companies to find the best coverage at the most affordable price.

Additionally, the state or region where the policy is issued can also impact the cost. Some states have higher average insurance costs due to various factors, such as higher medical costs or a higher prevalence of certain health conditions.

The policy’s riders or additional benefits can also increase the monthly premium. Riders, such as accelerated death benefits, waiver of premium, or long-term care coverage, can enhance the policy’s benefits but come at an additional cost.

Understanding Average Monthly Costs Through Real-World Examples

To provide a clearer understanding of the average monthly life insurance cost, let’s explore some real-world examples.

Example 1: Term Life Insurance for a Young Professional

Consider a 30-year-old male non-smoker with no pre-existing health conditions. He seeks a 500,000 term life insurance policy for a 20-year term. Based on his age, health, and the coverage amount, he might expect to pay an average monthly premium of around 25 to $35.

This example highlights the affordability of term life insurance for young, healthy individuals. By securing a policy early in life, individuals can lock in a lower premium and provide significant financial protection for their loved ones at a reasonable cost.

Example 2: Permanent Life Insurance for a Family Provider

Imagine a 40-year-old female with a family to support. She seeks a whole life insurance policy with a 1,000,000 coverage amount to provide long-term financial security for her family. Given her age and the coverage amount, she might expect to pay an average monthly premium of around 200 to $300.

This example illustrates the higher cost associated with permanent life insurance, particularly for individuals seeking substantial coverage amounts. Permanent life insurance provides lifelong coverage and the potential for cash value accumulation, making it an attractive option for those seeking long-term financial planning.

Example 3: Life Insurance for a High-Risk Individual

Suppose a 55-year-old male smoker with a history of heart disease seeks a 250,000 term life insurance policy. Due to his age, smoking habit, and pre-existing health condition, he may face significant challenges in obtaining coverage. If he is able to secure a policy, he might expect to pay an average monthly premium of 200 or more.

This example demonstrates the impact of health and lifestyle factors on life insurance costs. High-risk individuals may face higher premiums or even be denied coverage altogether. It is essential for such individuals to explore their options carefully and consider alternative insurance products or lifestyle changes to improve their eligibility and affordability.

Analyzing Performance and Future Implications

The life insurance industry has experienced steady growth over the years, with increasing awareness of the importance of financial protection among individuals and families. The average monthly cost of life insurance has also seen fluctuations, influenced by various economic and social factors.

In recent years, the COVID-19 pandemic has had a significant impact on the life insurance industry. The increased awareness of mortality and the importance of financial preparedness has led to a surge in life insurance policy applications. This heightened demand has, in turn, influenced the average monthly cost of life insurance, with some companies adjusting their premiums to account for the increased risk.

Looking ahead, the life insurance industry is expected to continue its growth trajectory, driven by increasing life expectancies, changing family dynamics, and the rising importance of financial planning. As more individuals recognize the need for life insurance, the industry is likely to see further innovation in policy offerings, making it more accessible and affordable for a broader range of individuals.

Furthermore, advancements in technology and data analytics are expected to play a significant role in shaping the future of life insurance. Insurance companies are increasingly leveraging digital tools and data-driven insights to streamline their underwriting processes and offer more tailored coverage options. This shift towards digital transformation is expected to enhance the efficiency and accuracy of risk assessment, ultimately benefiting both insurance companies and policyholders.

| Policy Type | Average Monthly Cost |

|---|---|

| Term Life Insurance | $15 to $100 or more |

| Whole Life Insurance | $50 to $500 or more |

| Universal Life Insurance | Varies based on coverage and investment options |

| Variable Life Insurance | Varies based on coverage and investment options |

What is the difference between term and permanent life insurance, and which one is better for me?

+

Term life insurance provides coverage for a specific period, typically 10 to 30 years, and is ideal for individuals seeking temporary coverage. Permanent life insurance, on the other hand, offers lifelong coverage and accumulates cash value over time. The choice between the two depends on your specific needs and financial goals. If you’re looking for long-term financial planning and cash value accumulation, permanent life insurance may be a better option. However, if you seek temporary coverage to protect your family during specific life stages, term life insurance is more affordable and suitable.

How do health and lifestyle factors impact life insurance costs?

+

Health and lifestyle factors significantly impact life insurance costs. Insurance companies assess these factors to gauge the risk associated with insuring an individual. Pre-existing health conditions, such as high blood pressure or diabetes, can increase premiums. Additionally, lifestyle factors like smoking or engaging in hazardous occupations can also lead to higher costs. It’s essential to disclose all relevant health and lifestyle information to ensure accurate risk assessment and avoid potential issues with your policy.

Can I reduce the cost of my life insurance policy?

+

Yes, there are several strategies to potentially reduce the cost of your life insurance policy. First, consider the coverage amount and whether it aligns with your financial obligations and family’s needs. Opting for a lower coverage amount can reduce your premium. Additionally, maintaining a healthy lifestyle, quitting smoking, and managing pre-existing health conditions can improve your overall health profile and potentially lead to lower premiums. Shopping around and comparing policies from multiple companies can also help you find the most affordable option.