Automobile Insurance Coverage

Automobile insurance is a vital aspect of modern life, offering protection and financial security to vehicle owners and drivers. This comprehensive guide aims to delve into the intricate world of automobile insurance coverage, providing an in-depth analysis of the various aspects that shape this essential industry.

Understanding Automobile Insurance

Automobile insurance, often referred to as car insurance, is a contract between an individual (the policyholder) and an insurance provider. This contract ensures that the insurer will provide financial protection against physical damage, bodily injury, or liability resulting from vehicle accidents, theft, or other defined events. It serves as a safeguard for both the policyholder and others involved in an incident, offering peace of mind and a means to recover losses.

The history of automobile insurance traces back to the early 20th century when the increasing popularity of motor vehicles led to a rise in accidents and related legal complexities. To address these challenges, the concept of insurance evolved, providing a structured mechanism to manage risks and liabilities associated with automotive travel.

Key Components of Automobile Insurance

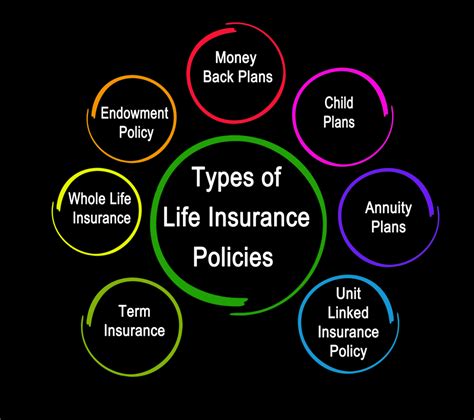

Automobile insurance policies are intricate documents that encompass various components, each designed to address specific risks and scenarios. These include:

- Liability Coverage: This covers bodily injury and property damage caused to others in an accident for which the policyholder is at fault. It protects the policyholder from potential lawsuits and financial liabilities.

- Collision Coverage: Collision coverage provides protection for the policyholder’s vehicle in the event of an accident, regardless of fault. It covers repair or replacement costs, subject to the policy’s terms and conditions.

- Comprehensive Coverage: Comprehensive coverage extends beyond collision accidents, providing protection against theft, vandalism, natural disasters, and other non-collision-related incidents. It ensures the policyholder is not left bearing the entire financial burden of such occurrences.

- Personal Injury Protection (PIP): PIP, also known as no-fault insurance, covers medical expenses and lost wages for the policyholder and their passengers, regardless of fault in an accident. It ensures prompt access to medical care and financial support during recovery.

- Uninsured/Underinsured Motorist Coverage: This coverage protects the policyholder when involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages. It ensures the policyholder is not left financially responsible for another driver’s lack of coverage.

Factors Influencing Automobile Insurance Rates

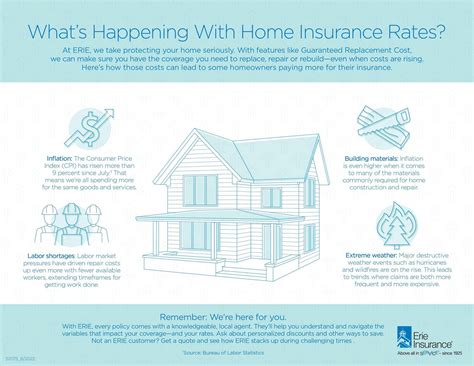

Automobile insurance rates are not uniform and vary significantly based on numerous factors. Understanding these factors is crucial for policyholders to make informed decisions and potentially negotiate better rates.

Risk Assessment and Pricing

Insurance providers employ sophisticated risk assessment models to determine insurance rates. These models consider a wide range of factors, including:

- Vehicle Type and Usage: Different vehicles have varying insurance rates based on factors like make, model, age, and usage. High-performance vehicles or those commonly involved in accidents typically have higher insurance premiums.

- Driver Profile: The driver’s age, gender, driving record, and years of driving experience significantly influence insurance rates. Younger drivers, especially males, are often considered higher risk and thus face higher premiums.

- Location and Mileage: The policyholder’s residential location and annual mileage are crucial factors. Areas with higher accident rates or theft incidences generally have higher insurance costs. Additionally, higher mileage may indicate a greater risk of accidents or vehicle wear and tear.

- Credit History: Surprisingly, credit scores play a role in insurance pricing. Many insurance providers consider credit history as an indicator of responsibility, with lower credit scores often resulting in higher premiums.

Discounts and Savings Opportunities

Insurance providers offer a range of discounts to attract customers and incentivize safer driving behaviors. These discounts can significantly reduce insurance premiums and are worth exploring.

- Safe Driver Discounts: Insurance companies reward drivers with clean records, offering discounts for accident-free driving. Some providers even use telematics devices to monitor driving behavior, rewarding safe practices with lower rates.

- Multi-Policy Discounts: Bundling multiple insurance policies, such as auto and home insurance, often results in substantial discounts. Insurance providers appreciate the loyalty and convenience of having multiple policies under one roof.

- Membership and Affiliation Discounts: Belonging to certain professional organizations, alumni associations, or even specific employer groups can unlock exclusive insurance discounts. It’s worth exploring such affiliations for potential savings.

- Advanced Training Discounts: Completing advanced driving courses or safety training programs can lead to insurance discounts. These courses promote safer driving practices and reduce the likelihood of accidents.

Claims Process and Settlement

Understanding the claims process is essential for policyholders to navigate the system effectively and ensure timely settlements. The process can vary slightly between insurance providers, but the core steps remain consistent.

Reporting and Documentation

In the event of an accident or incident, the policyholder must promptly report the claim to their insurance provider. This involves providing detailed information about the incident, including the date, time, location, and any relevant witnesses. It’s crucial to document the scene with photographs and gather contact information from involved parties.

The insurance provider will then assign a claims adjuster to investigate the incident and assess the damages. The adjuster may request additional documentation, such as police reports, medical records, or repair estimates, to support the claim.

Assessment and Settlement

The claims adjuster will evaluate the claim based on the policy’s terms and conditions. This involves assessing the extent of damages, determining fault (if applicable), and calculating the value of the claim. The adjuster will consider factors like the vehicle’s age, condition, and market value to determine the appropriate settlement amount.

Once the assessment is complete, the insurance provider will offer a settlement proposal to the policyholder. If the policyholder accepts the offer, the provider will process the payment, typically via check or direct deposit. If the policyholder disagrees with the settlement amount, they can negotiate or seek further evaluation, although this may prolong the process.

Future Trends and Innovations

The automobile insurance industry is undergoing significant transformations, driven by technological advancements and changing consumer expectations. These trends are shaping the future of automobile insurance coverage.

Telematics and Usage-Based Insurance

Telematics devices, which monitor driving behavior and transmit data to insurance providers, are gaining popularity. These devices provide real-time insights into driving habits, allowing insurance companies to offer usage-based insurance policies. Policyholders with safe driving records can benefit from lower premiums, while those with riskier behaviors may face higher rates.

Artificial Intelligence and Claims Processing

Artificial Intelligence (AI) is revolutionizing claims processing, streamlining the assessment and settlement process. AI-powered systems can analyze vast amounts of data, including photos and videos, to accurately assess damages and determine settlement amounts. This technology enhances efficiency and reduces the potential for human error, benefiting both policyholders and insurance providers.

Blockchain and Smart Contracts

Blockchain technology, with its secure and transparent nature, is poised to transform the insurance industry. Smart contracts, self-executing contracts with predefined rules, can automate various insurance processes, including claims management and policy administration. This technology ensures faster, more secure transactions, reducing administrative burdens and potential disputes.

Connected Cars and Data Analytics

The rise of connected cars, equipped with advanced sensors and communication technologies, is generating vast amounts of data. Insurance providers are leveraging this data to gain deeper insights into driving behaviors and vehicle performance. By analyzing this data, insurers can offer more personalized policies and improve risk assessment, ultimately benefiting policyholders with more accurate and tailored coverage.

How often should I review my automobile insurance policy?

+It’s advisable to review your policy annually, especially after significant life events like marriage, purchasing a new vehicle, or relocating. Regular reviews ensure your coverage remains adequate and aligned with your current needs.

What should I do if I’m involved in an accident?

+Stay calm and ensure the safety of all involved. Exchange contact and insurance information with the other party. Document the scene with photographs and gather witness statements if possible. Promptly report the accident to your insurance provider and provide all relevant details.

Can I negotiate my automobile insurance rates?

+Yes, negotiation is possible, especially if you have a clean driving record or multiple policies with the same provider. Shop around for quotes and discuss your options with your insurance agent to potentially secure a better rate.