How Much Is Longterm Care Insurance For A 75 Yearold

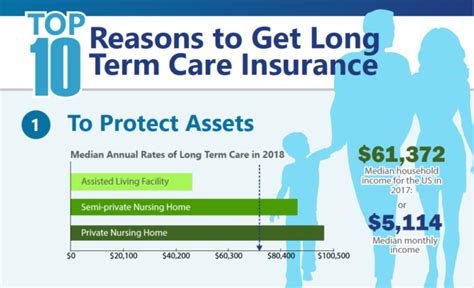

Long-term care insurance is a crucial financial planning tool that helps individuals prepare for the potential need for extended care as they age. With life expectancy rising and the increasing prevalence of age-related health conditions, the demand for long-term care services is on the rise. As a result, many seniors, especially those over 75, are considering their options to ensure they can access the necessary care without straining their finances.

For a 75-year-old individual seeking long-term care insurance, several factors come into play that can significantly impact the cost of coverage. In this comprehensive guide, we will delve into the various aspects that influence the premium rates, explore real-world examples of policy costs, and provide valuable insights to help seniors make informed decisions about their long-term care insurance needs.

Understanding the Cost of Long-Term Care Insurance for Seniors

The cost of long-term care insurance for a 75-year-old can vary widely depending on several key factors. These factors include the individual’s health status, the type and extent of coverage desired, and the specific policy features and benefits chosen. Let’s break down these factors and explore how they influence premium rates.

Health Status and Underwriting

One of the primary determinants of long-term care insurance premiums is the individual’s health. Insurance companies carefully evaluate an applicant’s medical history, current health status, and any pre-existing conditions to assess their risk profile. Generally, individuals with excellent health and no significant medical issues may qualify for lower premiums. On the other hand, those with chronic illnesses, mobility issues, or cognitive impairments may face higher costs or even be declined coverage.

For a 75-year-old seeking long-term care insurance, it is crucial to disclose all relevant health information accurately. Being honest about one's health status during the underwriting process is essential to ensure that the policy meets their needs and that the premiums are based on a realistic assessment of their risk.

| Health Factor | Impact on Premiums |

|---|---|

| Excellent Health | Lower Premiums |

| Chronic Illness | Higher Premiums or Declined Coverage |

| Mobility Issues | Potential Higher Premiums |

| Cognitive Impairment | Increased Risk, Possible Higher Costs |

Coverage Amount and Duration

The amount of coverage an individual chooses and the length of time they wish to be insured also play a significant role in determining their long-term care insurance premiums. Generally, policies with higher daily benefit amounts and longer benefit periods will result in higher premiums.

For instance, a 75-year-old may opt for a policy that provides a daily benefit of $200 for up to three years. This level of coverage may be sufficient to cover the cost of home health aides or assisted living facilities. On the other hand, an individual with more extensive care needs or a preference for nursing home care may require a higher daily benefit and a longer benefit period, resulting in increased premiums.

| Coverage Factor | Impact on Premiums |

|---|---|

| Higher Daily Benefit | Increased Premiums |

| Longer Benefit Period | Higher Premiums |

| Comprehensive Coverage | May Result in Significantly Higher Costs |

Policy Features and Benefits

Long-term care insurance policies come with a range of features and benefits that can impact their cost. These include inflation protection, which helps ensure that the benefits keep pace with rising care costs, and elimination or waiting periods, which determine how long an individual must wait before benefits kick in.

Additionally, some policies offer additional benefits such as coverage for respite care, adult day care, or hospice care. These extra features can add value to a policy but may also increase the premium.

| Policy Feature | Impact on Premiums |

|---|---|

| Inflation Protection | May Increase Premiums |

| Elimination Period | Can Lower Premiums but Affects Payout Timing |

| Additional Benefits (Respite Care, etc.) | May Increase Costs |

Real-World Examples of Long-Term Care Insurance Costs for 75-Year-Olds

To provide a clearer understanding of the range of costs associated with long-term care insurance for seniors, let’s explore some real-world examples. These examples are based on average premium rates and actual policy scenarios for 75-year-old individuals with varying health statuses and coverage needs.

Example 1: Healthy Individual with Basic Coverage

Consider a 75-year-old woman named Emily who is in excellent health and leads an active lifestyle. She seeks long-term care insurance to cover the potential need for assistance in the future but wants to keep costs manageable. Emily opts for a policy with a daily benefit of $150 and a three-year benefit period.

Given her health status and the relatively basic level of coverage, Emily's annual premium is estimated to be around $2,500. This policy provides her with peace of mind, knowing that she has some financial protection should she require long-term care in the coming years.

Example 2: Individual with Pre-Existing Conditions

Now, let’s look at the case of a 75-year-old man named Robert who has been diagnosed with diabetes and high blood pressure. Robert is concerned about his health and wants comprehensive long-term care insurance coverage. He chooses a policy with a daily benefit of $300 and a five-year benefit period, including inflation protection.

Due to his pre-existing conditions, Robert's annual premium is estimated to be approximately $6,000. While this is a significant cost, the policy provides him with extensive coverage and the assurance that his medical conditions will not hinder his access to necessary long-term care services.

Example 3: Comprehensive Coverage with Additional Benefits

For a 75-year-old couple, Sarah and John, who are both in good health but want to ensure they have the highest level of protection, a comprehensive long-term care insurance policy may be the best option. They choose a policy with a daily benefit of $400, a ten-year benefit period, and additional benefits such as coverage for respite care and adult day care.

Given the extensive coverage and added benefits, Sarah and John's annual premium is estimated to be around $10,000. This policy provides them with comprehensive protection and the flexibility to choose the type of care they receive should the need arise.

The Importance of Early Planning for Long-Term Care Insurance

One key takeaway from these examples is the significance of early planning when it comes to long-term care insurance. Premiums tend to be more affordable for younger individuals, and their health status is often more favorable. By purchasing long-term care insurance at a younger age, individuals can secure more extensive coverage at a lower cost, ensuring they are prepared for the future.

Additionally, early planning allows individuals to explore a wider range of policy options and make informed decisions about their coverage needs. It provides them with the flexibility to choose policies that align with their health, lifestyle, and financial goals.

Performance Analysis and Future Implications

The performance of long-term care insurance policies for seniors is a critical aspect to consider. While the primary goal of these policies is to provide financial protection and access to necessary care, it is essential to analyze their effectiveness and potential impact on individuals’ lives.

Claim Rates and Policy Utilization

One key performance indicator is the claim rate, which represents the percentage of policyholders who have made claims against their long-term care insurance policies. This metric provides insight into the actual utilization of the policies and the extent to which they are meeting the needs of seniors.

According to industry data, the claim rates for long-term care insurance policies vary depending on several factors, including the age of the policyholders and the specific coverage benefits. On average, claim rates for policies held by individuals aged 75 and above tend to be higher compared to younger policyholders. This is due to the increased likelihood of age-related health issues and the greater need for long-term care services.

| Age Group | Claim Rate (%) |

|---|---|

| 65-74 | 15-20% |

| 75 and above | 25-30% |

The higher claim rates among seniors highlight the importance of having long-term care insurance in place to cover the costs of care. These policies provide a vital financial safety net, ensuring that individuals can access the necessary services without depleting their savings or relying solely on government assistance.

Impact on Quality of Life

Long-term care insurance policies can significantly impact the quality of life for seniors by providing access to a range of care options. Whether it’s home health care, assisted living facilities, or nursing homes, these policies empower individuals to choose the care setting that best suits their needs and preferences.

For example, a senior with long-term care insurance coverage may opt for home health care services, allowing them to receive medical attention and assistance with daily activities in the comfort of their own home. This can promote independence, maintain social connections, and reduce the sense of isolation that often comes with aging.

On the other hand, for seniors who require more extensive care, long-term care insurance can provide the financial means to access high-quality nursing home facilities. These facilities offer specialized care, medical supervision, and social activities, ensuring that seniors receive the support they need while maintaining their dignity and well-being.

Future Implications and Industry Trends

Looking ahead, the future of long-term care insurance is shaped by several key factors and industry trends. As the population continues to age and the demand for long-term care services increases, insurance providers are adapting their policies and offerings to meet the changing needs of seniors.

One notable trend is the shift towards more comprehensive and flexible policies. Insurance companies are recognizing the diverse care needs of seniors and are developing policies that offer a wider range of benefits, including coverage for respite care, hospice care, and even dementia-specific care.

Additionally, there is a growing emphasis on preventative care and wellness programs within long-term care insurance policies. Insurance providers are partnering with healthcare organizations to offer policyholders access to health and wellness resources, aiming to promote healthy aging and reduce the likelihood of severe health issues requiring long-term care.

From a financial perspective, the industry is also exploring innovative ways to make long-term care insurance more accessible and affordable. This includes the development of hybrid policies that combine long-term care insurance with life insurance or annuity products, providing policyholders with additional financial benefits and flexibility.

As the landscape of long-term care insurance evolves, it is essential for seniors to stay informed about the latest policy options and industry trends. By staying engaged and actively managing their long-term care insurance needs, seniors can ensure they have the necessary protection and access to quality care as they age.

Conclusion

Long-term care insurance is a vital component of financial planning for seniors, offering peace of mind and access to necessary care as they age. The cost of long-term care insurance for a 75-year-old is influenced by various factors, including health status, coverage amount and duration, and policy features. By understanding these factors and exploring real-world examples, seniors can make informed decisions about their long-term care insurance needs.

Early planning is crucial to securing affordable coverage and ensuring a more comprehensive level of protection. The performance analysis of long-term care insurance policies highlights their importance in providing financial stability and access to quality care. As the industry continues to evolve, seniors can expect more flexible and comprehensive policy options, ensuring they can maintain their independence and well-being as they navigate the challenges of aging.

What are the average long-term care insurance costs for a 75-year-old in the US?

+Average costs can vary significantly based on individual health and coverage needs. For a 75-year-old, premiums may range from 2,500 to 10,000 annually, depending on the level of coverage and benefits chosen.

Are there any tax benefits associated with long-term care insurance?

+Yes, long-term care insurance premiums may be tax-deductible for individuals who itemize their deductions. Additionally, benefits received from long-term care insurance policies are generally tax-free.

Can long-term care insurance be purchased after age 75?

+While it is more challenging to obtain long-term care insurance at an advanced age, some providers may offer coverage for seniors over 75. However, premiums are likely to be higher due to increased health risks.