Why Is Insurance Going Up

The insurance industry is a crucial component of modern society, offering financial protection and risk management to individuals and businesses alike. However, it is not uncommon for policyholders to notice an upward trend in their insurance premiums over time. Understanding the factors that contribute to rising insurance costs can help individuals make informed decisions about their coverage and navigate the complex world of insurance with greater insight.

The Complex Nature of Insurance Premium Increases

Insurance premium hikes are influenced by a multitude of factors, each playing a unique role in the overall pricing strategy. From natural disasters to economic fluctuations, these factors can significantly impact the cost of insurance, making it essential for policyholders to grasp the underlying dynamics.

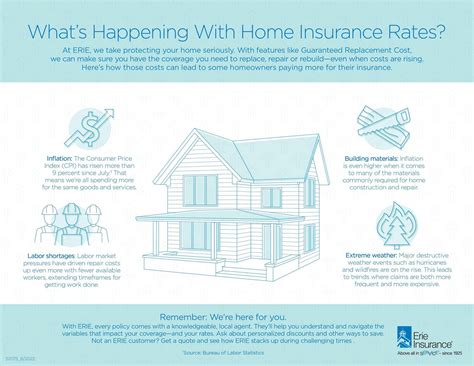

Natural Disasters and Catastrophic Events

One of the primary reasons for insurance premium increases is the occurrence of natural disasters and catastrophic events. These incidents, such as hurricanes, wildfires, or earthquakes, can result in extensive damage and substantial claims. Insurance companies must ensure they have adequate funds to cover these claims, leading to an increase in premiums to offset potential losses.

| Disaster Type | Average Cost per Claim |

|---|---|

| Hurricane | $50,000 |

| Wildfire | $35,000 |

| Earthquake | $120,000 |

For instance, the devastating Hurricane Katrina, which struck the Gulf Coast in 2005, resulted in over $41 billion in insurance claims. Such events not only impact the affected regions but can also lead to increased premiums for policyholders across the country as insurance companies aim to replenish their reserves.

Rising Medical Costs and Health Insurance

In the realm of health insurance, rising medical costs are a significant driver of premium increases. As healthcare expenses continue to soar, insurance providers must adjust their premiums to ensure they can cover the increasing costs of medical treatments and procedures. This is particularly evident in countries like the United States, where the cost of healthcare has been rising at an alarming rate, impacting the affordability of insurance coverage.

| Year | Average Annual Health Insurance Premium (Individual) |

|---|---|

| 2010 | $5,040 |

| 2020 | $7,536 |

The Kaiser Family Foundation reports that the average annual premium for an individual health insurance plan in the United States has increased by over 50% in the last decade. This rise is attributed to factors such as new medical technologies, prescription drug costs, and an aging population, all of which contribute to higher healthcare expenses.

Economic Factors and Inflation

Economic conditions and inflation also play a significant role in insurance premium adjustments. During periods of high inflation, the cost of goods and services rises, including the expenses associated with insurance claims. Insurance companies must adapt their premiums to account for these increased costs to maintain their financial stability.

Moreover, economic downturns can lead to higher unemployment rates, resulting in a greater demand for insurance coverage. This increased demand can put pressure on insurance providers to raise premiums to manage the risk associated with a larger pool of policyholders.

Changing Regulatory Landscape

Insurance premiums are also influenced by the ever-evolving regulatory environment. Governments and regulatory bodies frequently update insurance laws and guidelines, often with the aim of protecting consumers. While these changes are necessary, they can also impact the cost of insurance.

For example, new regulations may require insurance companies to offer more comprehensive coverage or provide additional benefits, which can increase their operational costs. These added expenses are often passed on to policyholders in the form of higher premiums.

Increased Claims Frequency and Severity

The frequency and severity of insurance claims can significantly impact premium rates. When insurance companies experience a surge in claims, whether due to increased accidents, fraud, or other factors, they may need to adjust premiums to ensure they can cover these losses.

For instance, in the automotive insurance industry, a rise in distracted driving incidents and the resulting accidents can lead to an increase in claims. Insurance providers must then raise premiums to account for the higher risk and potential losses associated with these claims.

Competitive Market Dynamics

The insurance market is highly competitive, with numerous providers vying for customers. In such a landscape, insurance companies must carefully balance their premiums to remain competitive while ensuring their financial health. This delicate balance can sometimes lead to premium increases as companies strive to maintain profitability.

Additionally, the entry of new players into the market can disrupt established pricing structures, potentially leading to premium hikes as companies adjust their strategies to remain viable.

Aging Population and Long-Term Care

In countries with an aging population, the demand for long-term care insurance is on the rise. As individuals live longer, the need for extended care and support increases, putting pressure on insurance providers to offer suitable coverage. This rising demand often translates into higher premiums to ensure adequate resources are available for long-term care services.

The Future of Insurance: Navigating Rising Costs

As we look ahead, the insurance industry is likely to face ongoing challenges related to rising costs. With the increasing frequency and severity of natural disasters, the continuous rise in medical expenses, and the evolving regulatory landscape, insurance providers must adapt their strategies to remain viable.

Policyholders, too, have a role to play in managing insurance costs. By staying informed about the factors influencing premium hikes and adopting risk-mitigating behaviors, individuals can help reduce the frequency and severity of claims, potentially leading to more stable insurance rates over time.

Ultimately, the insurance industry must strike a delicate balance between providing adequate coverage and ensuring the financial sustainability of their operations. This balance is crucial not only for the health of the industry but also for the protection and peace of mind of policyholders worldwide.

Frequently Asked Questions

Why do insurance companies raise premiums so frequently?

+Insurance companies base their premium rates on a variety of factors, including claims experience, regulatory changes, and economic conditions. When these factors change, it can trigger a need for premium adjustments to ensure the company can continue providing coverage. Frequent premium reviews help insurance providers stay financially stable and able to pay out claims when needed.

Can I negotiate my insurance premiums?

+While it’s generally not possible to negotiate premiums directly, there are strategies you can employ to potentially reduce your insurance costs. These include comparing quotes from multiple providers, bundling your insurance policies, maintaining a good credit score, and exploring discounts for safety features or loyalty programs. However, keep in mind that insurance premiums are primarily based on statistical risk assessments, so room for negotiation may be limited.

What can I do to mitigate rising insurance costs?

+To help mitigate rising insurance costs, consider adopting risk-reducing behaviors. For instance, in auto insurance, drive safely and avoid accidents to maintain a clean driving record. In home insurance, take proactive measures to prevent damage, such as regular home maintenance and installing safety features. Additionally, staying informed about your coverage options and shopping around periodically can help you identify the most cost-effective insurance plan for your needs.